clearing up the confusion on the fairness index

24 views

Skip to first unread message

Roger Clough

Dec 17, 2012, 4:41:32 PM12/17/12

to everything-list

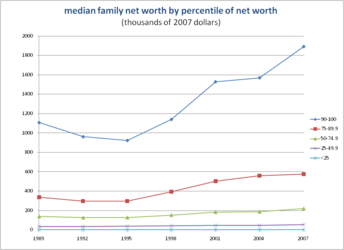

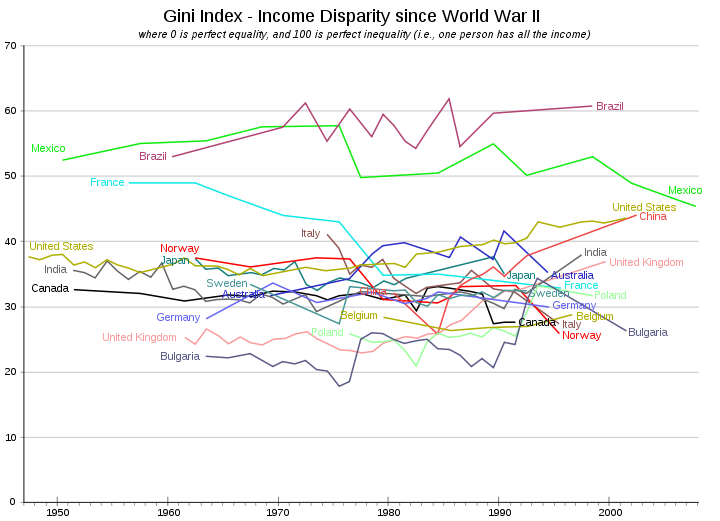

To try to clear up my mistaken interpretation of the gini

coefficient,

namely that USA inequality is not decreasing, it is actually

increasing,

I find that the per capita wealth is also

increasing, so

let's see what effect that will have.

Although the fairness index (gini coefficient)

has

grown linearly with time in the USA,

:

:

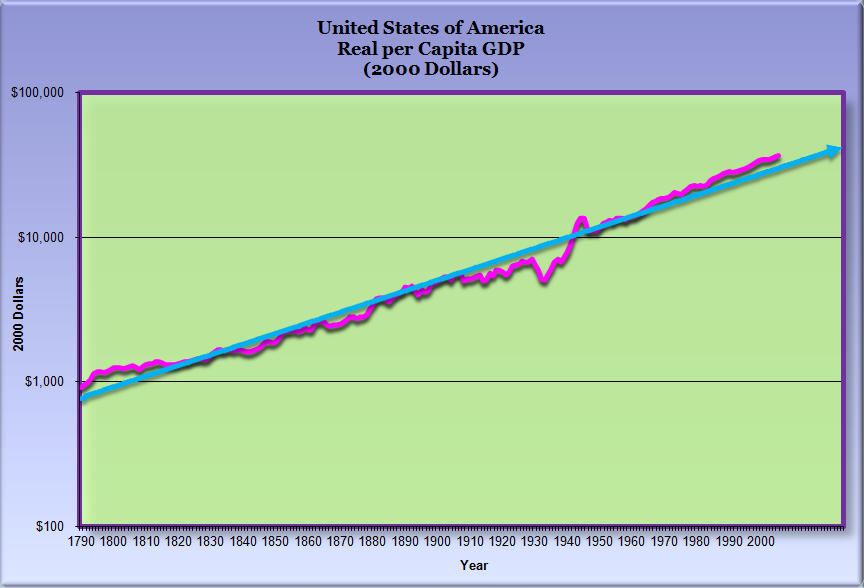

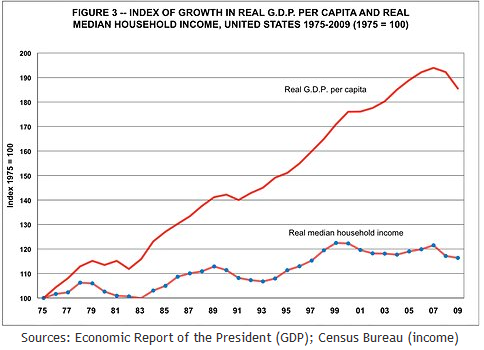

The real per capital wealth has also increased, but

exponentially:

(Real means inflation-adjusted)

:

By eyeball, it looks as though the real per person income GDP

increased over the range

of the time duration of the gini coefficient growth

by about 5/1.5 ~ 3.3 .. The gini

coefficient only increased from .4

to .47 or is about 1.17 times larger, or is essentially

constant in comparison with the

growth in real GDP by a factor of 3.3. So I would say

that

everybody- the poor as well as the wealthy-- is getting

appreciably richer, even

though there has been a minimal increase

in wealth inequality.

The growth rate is not within our control. The questiion then

is whether or

not the gini coefficient is in control of the growth rate. If

not, then

the debate on taxation ends there.

But if the gini coefficient can actually change the growth

rate, artificially lowering

the gini coefficient by increased taxation of the

rich (redistributing the income)

hurts the growth rate, so we all get

poorer. Actually, a lot poorer.

The data above shows that decreasing the gini coefficient a

small

amount will produce a much larger decrease in the per

capita GDP,

because the latter decreases exponentially

with a linear decrease in

the gini coefficient.

So, in either case, taxing the wealthy can do no

good.

Craig Weinberg

Dec 17, 2012, 5:11:57 PM12/17/12

to everyth...@googlegroups.com

On Monday, December 17, 2012 4:41:32 PM UTC-5, rclough wrote:

To try to clear up my mistaken interpretation of the gini coefficient,namely that USA inequality is not decreasing, it is actually increasing,I find that the per capita wealth is also increasing, solet's see what effect that will have.Although the fairness index (gini coefficient) hasgrown linearly with time in the USA,

:The real per capital wealth has also increased, but exponentially:(Real means inflation-adjusted):By eyeball, it looks as though the real per person income GDP increased over the rangeof the time duration of the gini coefficient growth by about 5/1.5 ~ 3.3 .. The ginicoefficient only increased from .4 to .47 or is about 1.17 times larger, or is essentiallyconstant in comparison with the growth in real GDP by a factor of 3.3. So I would say thateverybody- the poor as well as the wealthy-- is getting appreciably richer, eventhough there has been a minimal increase in wealth inequality.

No. It means the opposite. Even if the Gini doesn't increase at all it is still so high that any increase in GDP means that it will disproportionately benefit the rich - which is exactly what we have seen.

http://www.washingtonpost.com/blogs/wonkblog/post/in-2010-93-percent-of-income-gains-went-to-the-top-1-percent/2011/08/25/gIQA0qxhsR_blog.html

The growth rate is not within our control. The questiion then is whether ornot the gini coefficient is in control of the growth rate. If not, thenthe debate on taxation ends there.But if the gini coefficient can actually change the growth rate, artificially loweringthe gini coefficient by increased taxation of the rich (redistributing the income)hurts the growth rate, so we all get poorer.

No. Taxing the rich does not redistribute the income, it adjusts the expenses so that those who benefit disproportionately from the public resources pay their share for an educated labor force, policed cities, well maintained roads, bridges, ports, airports, the grotesquely hypertrophied military to enforce monopolistic trade policies worldwide, etc.

We all get poorer by letting the richest turn the entire country into indentured servants.

Actually, a lot poorer.The data above shows that decreasing the gini coefficient a smallamount will produce a much larger decrease in the per capita GDP,because the latter decreases exponentially with a linear decrease inthe gini coefficient.So, in either case, taxing the wealthy can do no good.

So first you were going to use the Gini as evidence that things are improving for the average person - now that you see it means just the opposite you try to claim that inflation actually makes the inequality somehow better.

The most prosperous times in US history correlate directly with the highest taxes on the rich. Your analysis is complete fiction. Maybe you're super rich, in which case I can understand why you would want to believe these fairy tales, and why you would want others to believe them also, but anyone who believes this and is not a multimillionaire is being played by highly paid propagandists.

Craig

Craig Weinberg

Dec 17, 2012, 5:36:38 PM12/17/12

to everyth...@googlegroups.com

How about this: Everyone gets their taxes cut in half, and then double that half is collected in addition but only by those whose total incomes increased and to the proportion that they increased from the previous year. Seems fair to me.

On Monday, December 17, 2012 4:41:32 PM UTC-5, rclough wrote:

On Monday, December 17, 2012 4:41:32 PM UTC-5, rclough wrote:

Stephen P. King

Dec 17, 2012, 8:02:12 PM12/17/12

to everyth...@googlegroups.com

On 12/17/2012 5:11 PM, Craig Weinberg wrote:

> Taxing the rich does not redistribute the income, it adjusts the

> expenses so that those who benefit disproportionately from the public

> resources pay their share for an educated labor force, policed cities,

> well maintained roads, bridges, ports, airports, the grotesquely

> hypertrophied military to enforce monopolistic trade policies

> worldwide, etc.

Hi Craig,

> Taxing the rich does not redistribute the income, it adjusts the

> expenses so that those who benefit disproportionately from the public

> resources pay their share for an educated labor force, policed cities,

> well maintained roads, bridges, ports, airports, the grotesquely

> hypertrophied military to enforce monopolistic trade policies

> worldwide, etc.

Could explain how it is that it is possible to "proportionally

benefit" from public resources? Are you saying that resources are the

natural property of the State and not of those willing to do the

investment of time and labor to exploit them?

By my logic, if the taxes of the public where taken from individual

people, then the public resources belong proportionately to those

individuals that paid the taxes. This means that if Fred paid more taxes

than Albert then the public resources belong that much more to Fred than

Albert. Simple math... How do you calculate "benefit"?

I don't understand the collectivization of people into equivalence

classes. Numbers are equivalence classes, not people! I am trying to

understand your thesis, not saying your wrong. ;-)

--

Onward!

Stephen

Stephen P. King

Dec 17, 2012, 8:03:25 PM12/17/12

to everyth...@googlegroups.com

On 12/17/2012 5:11 PM, Craig Weinberg wrote:

>

>

> We all get poorer by letting the richest turn the entire country into

> indentured servants.

So, the people that are actually paying taxes are not the

> indentured servants.

indentured servants of those that are not actually paying taxes?

--

Onward!

Stephen

Stephen P. King

Dec 17, 2012, 8:04:59 PM12/17/12

to everyth...@googlegroups.com

On 12/17/2012 5:11 PM, Craig Weinberg wrote:

> So first you were going to use the Gini as evidence that things are

> improving for the average person - now that you see it means just the

> opposite you try to claim that inflation actually makes the inequality

> somehow better.

Wrong. Inflation was factored for by using 2000 dollars in the graph.

> improving for the average person - now that you see it means just the

> opposite you try to claim that inflation actually makes the inequality

> somehow better.

--

Onward!

Stephen

Stephen P. King

Dec 17, 2012, 8:12:38 PM12/17/12

to everyth...@googlegroups.com

On 12/17/2012 5:36 PM, Craig Weinberg wrote:

> How about this: Everyone gets their taxes cut in half, and then double

> that half is collected in addition but only by those whose total

> incomes increased and to the proportion that they increased from the

> previous year. Seems fair to me.

How about this: We go back in history and look at all public policy

> How about this: Everyone gets their taxes cut in half, and then double

> that half is collected in addition but only by those whose total

> incomes increased and to the proportion that they increased from the

> previous year. Seems fair to me.

and pick out the ones that can be proven to increase both the pool of

available jobs and tax revenue to implement. Can we stop tinkering

blindly with peoples lives? Look at what worked for cities and states

and what failed.

Have you seen Detroit lately! Don't do that kinda shit!

--

Onward!

Stephen

meekerdb

Dec 17, 2012, 8:13:12 PM12/17/12

to everyth...@googlegroups.com

On 12/17/2012 1:41 PM, Roger Clough wrote:

But if the gini coefficient can actually change the growth rate, artificially loweringthe gini coefficient by increased taxation of the rich (redistributing the income)hurts the growth rate, so we all get poorer.

A Reaganomics myth. It wasn't true in the 1950's and it isn't true now. Where's your data.

Brent

Roger Clough

Dec 18, 2012, 10:05:49 AM12/18/12

to everything-list

Hi Craig Weinberg

More liberal misrepresentation of the truth.

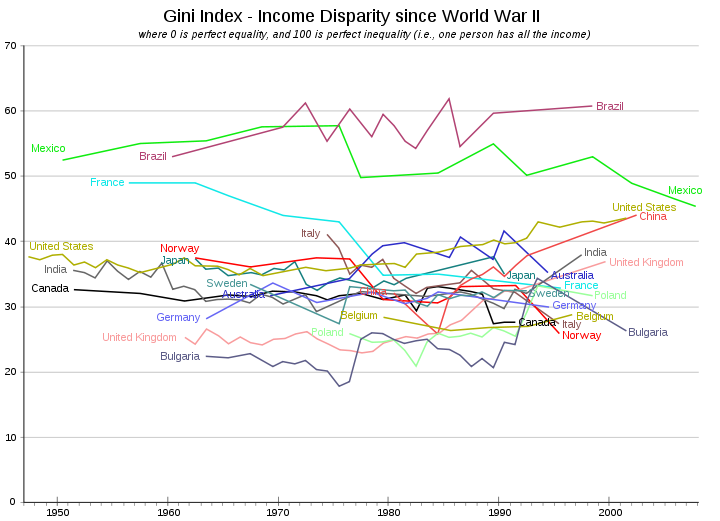

The

gini for the USA is about average for the world.

See wikimedia (I think) plot below:

[Roger Clough], [rcl...@verizon.net]

12/18/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----From: Craig WeinbergReceiver: everything-listTime: 2012-12-17, 17:11:57Subject: Re: clearing up the confusion on the fairness index

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To view this discussion on the web visit https://groups.google.com/d/msg/everything-list/-/3Itob5VZ3QEJ.

To post to this group, send email to everyth...@googlegroups.com.

To unsubscribe from this group, send email to everything-li...@googlegroups.com.

For more options, visit this group at http://groups.google.com/group/everything-list?hl=en.

Roger Clough

Dec 18, 2012, 11:15:26 AM12/18/12

to everything-list

Hi meekerdb

I should have said real per person income instead of growth rate,

but they are in the same ball park:

I subsequently found, in a followup email,

that although the gini factor shows inequality

in the USA to becoming greater, the effect

over the last 40 years (gini up by a factor

of 1.17) is small in comparison to the

inflation-adjusted GDP per person (up by a

factor of 3.3) and inflation-adjusted per person

income (up by a factor of about 2.5).

So, taking the least figure, while the gini

increased by 17%, the income increased by

about 250%, or greater than ten times the

increase in gamma. So we're all doing much better.

that although the gini factor shows inequality

in the USA to becoming greater, the effect

over the last 40 years (gini up by a factor

of 1.17) is small in comparison to the

inflation-adjusted GDP per person (up by a

factor of 3.3) and inflation-adjusted per person

income (up by a factor of about 2.5).

So, taking the least figure, while the gini

increased by 17%, the income increased by

about 250%, or greater than ten times the

increase in gamma. So we're all doing much better.

[Roger Clough], [rcl...@verizon.net]

12/18/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: meekerdbReceiver: everything-listTime: 2012-12-17, 20:13:12

Subject: Re: clearing up the confusion on the fairness index

meekerdb

Dec 18, 2012, 2:23:12 PM12/18/12

to everyth...@googlegroups.com

On 12/18/2012 7:05 AM, Roger Clough wrote:

Hi Craig WeinbergMore liberal misrepresentation of the truth. Thegini for the USA is about average for the world.

But it's above the average, and the individual values, for the OECD AND it's been steadily increasing since 1980 - when Ray-gun was elected.

Brent

Hal Ruhl

Dec 18, 2012, 3:53:17 PM12/18/12

to Everything List

Craig Weinberg

Dec 18, 2012, 4:40:35 PM12/18/12

to everyth...@googlegroups.com

On Monday, December 17, 2012 8:02:12 PM UTC-5, Stephen Paul King wrote:

On 12/17/2012 5:11 PM, Craig Weinberg wrote:

> Taxing the rich does not redistribute the income, it adjusts the

> expenses so that those who benefit disproportionately from the public

> resources pay their share for an educated labor force, policed cities,

> well maintained roads, bridges, ports, airports, the grotesquely

> hypertrophied military to enforce monopolistic trade policies

> worldwide, etc.

Hi Craig,

Could explain how it is that it is possible to "proportionally

benefit" from public resources? Are you saying that resources are the

natural property of the State and not of those willing to do the

investment of time and labor to exploit them?

In a democracy, they are the natural property of the taxpayers who pay for their construction and maintenance. The Port of Los Angeles is not the property of Onassis Shipping or whatever. If they are making hand over fist and bring in a dozen more tankers a week - who pays for the extra staffing of that? Who pays for the construction on the port to be upgraded. This is how corporations remain so profitable - privatize profit and socialize cost.

By my logic, if the taxes of the public where taken from individual

people, then the public resources belong proportionately to those

individuals that paid the taxes. This means that if Fred paid more taxes

than Albert then the public resources belong that much more to Fred than

Albert. Simple math... How do you calculate "benefit"?

It's easy to calculate benefit - you look at the books. You see how much more money a corporation is making and how much more costs are incurred by the government to underwrite that volume of gains.

I don't understand the collectivization of people into equivalence

classes. Numbers are equivalence classes, not people! I am trying to

understand your thesis, not saying your wrong. ;-)

I'm open to being wrong, I just need to be pointed in the direction of a reason why that might be the case.

Craig

--

Onward!

Stephen

Stephen P. King

Dec 18, 2012, 5:04:28 PM12/18/12

to everyth...@googlegroups.com

On 12/18/2012 4:40 PM, Craig Weinberg

wrote:

On Monday, December 17, 2012 8:02:12 PM UTC-5, Stephen Paul King wrote:On 12/17/2012 5:11 PM, Craig Weinberg wrote:

> Taxing the rich does not redistribute the income, it adjusts the

> expenses so that those who benefit disproportionately from the public

> resources pay their share for an educated labor force, policed cities,

> well maintained roads, bridges, ports, airports, the grotesquely

> hypertrophied military to enforce monopolistic trade policies

> worldwide, etc.

Hi Craig,

Could explain how it is that it is possible to "proportionally

benefit" from public resources? Are you saying that resources are the

natural property of the State and not of those willing to do the

investment of time and labor to exploit them?

In a democracy, they are the natural property of the taxpayers who pay for their construction and maintenance. The Port of Los Angeles is not the property of Onassis Shipping or whatever. If they are making hand over fist and bring in a dozen more tankers a week - who pays for the extra staffing of that? Who pays for the construction on the port to be upgraded. This is how corporations remain so profitable - privatize profit and socialize cost.

Hi Craig,

We are getting somewhere, but we need to stop and define some terms so we don't just confuse things. What exactly is the definition of "privatize profit and socialize cost" that we can agree upon? "Privatizing profits" seems to mean, in the context of your frame, the funneling of profits into the pockets of a few persons, perhaps undeservedly. "Socializing costs" seems to imply the spreading of costs to arbitrary many people, perhaps undeservedly.

So the key idea, if my interpretation is correct, hinges on the definition of "deservedly" and its opposite, "undeservedly". This seems to point to an idea of "fairness" that remains undefined. DO you care to define a canonical measure of fairness?

We are getting somewhere, but we need to stop and define some terms so we don't just confuse things. What exactly is the definition of "privatize profit and socialize cost" that we can agree upon? "Privatizing profits" seems to mean, in the context of your frame, the funneling of profits into the pockets of a few persons, perhaps undeservedly. "Socializing costs" seems to imply the spreading of costs to arbitrary many people, perhaps undeservedly.

So the key idea, if my interpretation is correct, hinges on the definition of "deservedly" and its opposite, "undeservedly". This seems to point to an idea of "fairness" that remains undefined. DO you care to define a canonical measure of fairness?

By my logic, if the taxes of the public where taken from individual

people, then the public resources belong proportionately to those

individuals that paid the taxes. This means that if Fred paid more taxes

than Albert then the public resources belong that much more to Fred than

Albert. Simple math... How do you calculate "benefit"?

It's easy to calculate benefit - you look at the books. You see how much more money a corporation is making and how much more costs are incurred by the government to underwrite that volume of gains.

We need to compare apples to apples here. Governements are only

bound, in their cost, by their ability to collect taxes, levies,

fees, etc. and can do so with the force of law. Private citizens, or

any collective thereof cannot use force unless allowed by the

government to do so, so their ability to recoup costs will always be

some smaller than the quantity that the government can collect. No?

Another way we can look at this is to consider the concept of efficiency. Governments have fewer reasons to consider the efficiency. When you can legally print money out of thin air, the need for efficiency vanishes completely. Private citizens, nor their collectives, can do no such thing!

Another way we can look at this is to consider the concept of efficiency. Governments have fewer reasons to consider the efficiency. When you can legally print money out of thin air, the need for efficiency vanishes completely. Private citizens, nor their collectives, can do no such thing!

I don't understand the collectivization of people into equivalence

classes. Numbers are equivalence classes, not people! I am trying to

understand your thesis, not saying your wrong. ;-)

I'm open to being wrong, I just need to be pointed in the direction of a reason why that might be the case.

What would be a clear indicator of "Craig being wrong"? You keep

shifting the argument frame around. Could you address the questions

I asked here now directly?

1) What is fairness?

2) Why does government not do at least what is it supposed to do? Enforce its own laws equally.

1) What is fairness?

2) Why does government not do at least what is it supposed to do? Enforce its own laws equally.

-- Onward! Stephen

Roger Clough

Dec 19, 2012, 9:59:20 AM12/19/12

to everything-list

Hi Craig Weinberg

What is wrong with making profits ?

[Roger Clough], [rcl...@verizon.net]

12/19/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: Craig WeinbergReceiver: everything-list

Time: 2012-12-18, 16:40:35

Subject: Re: clearing up the confusion on the fairness index

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To view this discussion on the web visit https://groups.google.com/d/msg/everything-list/-/fGZL2V5pd3EJ.

Roger Clough

Dec 19, 2012, 10:07:45 AM12/19/12

to everything-list

Hi Hal Ruhl

Nothing new there. Indeed there is inequality in income

in this country, but it's about average to other countries

around the world (see below):

Besides that, because of growth of the economy,

at least until Obama destroyed it, everybody was

getting substantially inflation-adjusted,

richer--poor and wealthy alike.

[Roger Clough], [rcl...@verizon.net]

12/19/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: Hal RuhlReceiver: Everything ListTime: 2012-12-18, 15:53:17

Subject: Re: clearing up the confusion on the fairness index

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To post to this group, send email to everyth...@googlegroups.com.

To unsubscribe from this group, send email to everything-list+unsub...@googlegroups.com.

Roger Clough

Dec 19, 2012, 11:25:38 AM12/19/12

to everything-list

Hi meekerdb

But while the gini index increases linearly with time,

the individual wealth of each american

(at least before Obama) increases exponentially

with time.

[Roger Clough], [rcl...@verizon.net]

12/19/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: meekerdbReceiver: everything-listTime: 2012-12-18, 14:23:12

Subject: Re: clearing up the confusion on the fairness index

Richard Ruquist

Dec 19, 2012, 11:43:55 AM12/19/12

to everyth...@googlegroups.com

Hi Roger,

Show me the exponential data.

Richard

Show me the exponential data.

Richard

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

Craig Weinberg

Dec 19, 2012, 12:43:48 PM12/19/12

to everyth...@googlegroups.com

On Tuesday, December 18, 2012 5:04:28 PM UTC-5, Stephen Paul King wrote:

On 12/18/2012 4:40 PM, Craig Weinberg wrote:

Hi Craig,

On Monday, December 17, 2012 8:02:12 PM UTC-5, Stephen Paul King wrote:On 12/17/2012 5:11 PM, Craig Weinberg wrote:

> Taxing the rich does not redistribute the income, it adjusts the

> expenses so that those who benefit disproportionately from the public

> resources pay their share for an educated labor force, policed cities,

> well maintained roads, bridges, ports, airports, the grotesquely

> hypertrophied military to enforce monopolistic trade policies

> worldwide, etc.

Hi Craig,

Could explain how it is that it is possible to "proportionally

benefit" from public resources? Are you saying that resources are the

natural property of the State and not of those willing to do the

investment of time and labor to exploit them?

In a democracy, they are the natural property of the taxpayers who pay for their construction and maintenance. The Port of Los Angeles is not the property of Onassis Shipping or whatever. If they are making hand over fist and bring in a dozen more tankers a week - who pays for the extra staffing of that? Who pays for the construction on the port to be upgraded. This is how corporations remain so profitable - privatize profit and socialize cost.

We are getting somewhere, but we need to stop and define some terms so we don't just confuse things. What exactly is the definition of "privatize profit and socialize cost" that we can agree upon?

Let's use a real life example instead. http://en.wikipedia.org/wiki/1954_Guatemalan_coup_d%27%C3%A9tat

"The 1954 Guatemalan coup d’état (18–27 June 1954) was the CIA covert operation that deposed President Jacobo Árbenz Guzmán (1950–54), with Operation PBSUCCESS — paramilitary invasion by an anti-Communist “army of liberation”. In the early 1950s, the politically liberal, elected Árbenz Government had effected the socio-economics of Decree 900 (27 June 1952), the national agrarian-reform expropriation, for peasant use and ownership, of unused prime-farmlands that Guatemalan and multinational corporations had set aside as reserved business assets. The Decree 900 land reform especially threatened the agricultural monopoly of the United Fruit Company (UFC), the American multinational corporation that owned 42 per cent of the arable land of Guatemala; which landholdings either had been bought by, or been ceded to, the UFC by the military dictatorships who preceded the Árbenz Government of Guatemala."

"Privatizing profits" seems to mean, in the context of your frame, the funneling of profits into the pockets of a few persons, perhaps undeservedly. "Socializing costs" seems to imply the spreading of costs to arbitrary many people, perhaps undeservedly.

It's not a concept which needs to be abstracted or generalized very much. In the above case, a corporate monopoly, benefits by profits based on the virtual slave labor of Guatemalan peasants under a military dictatorship. The giant corporation (renamed Chiquita) has friends in the CIA who use the power and wealth of the US to overthrow the democracy of Guatemala and restore the Banana Republic to its previous status as a corporate asset.

The costs of this are obvious in terms of the resources of the US used to depose a foreign government, but then there are innumerable less obvious costs to the people of the US and around the world. Labor is held at artificially low costs to UFC, and the costs in financial and real terms of quality of life of real people are billed to the societies of Central America, the West, and the world at large.

So the key idea, if my interpretation is correct, hinges on the definition of "deservedly" and its opposite, "undeservedly". This seems to point to an idea of "fairness" that remains undefined. DO you care to define a canonical measure of fairness?

You're trying to frame it into a 'social justice' talking point. A better frame is the obvious abuse of power. The reason you don't overthrow enslave people to make money on the bananas that grow in their country isn't because you don't deserve it, but because it is, how you say, the most evil thing that human beings can possibly do. It's like rounding up people who escaped Saddam's rape rooms and putting them back in there so you can keep raping them. When possible, atrocities should not be allowed to continue without trying to stop them. Is that unreasonable?

Of course, this is not some isolated example. This is the template for much of US Foreign Policy, from Iran to Vietnam, Iraq, Kuwait, etc. The corps are driving the bus, the gov is just the passenger with the credit card for the gas.

By my logic, if the taxes of the public where taken from individual

people, then the public resources belong proportionately to those

individuals that paid the taxes. This means that if Fred paid more taxes

than Albert then the public resources belong that much more to Fred than

Albert. Simple math... How do you calculate "benefit"?

It's easy to calculate benefit - you look at the books. You see how much more money a corporation is making and how much more costs are incurred by the government to underwrite that volume of gains.

We need to compare apples to apples here. Governements are only bound, in their cost, by their ability to collect taxes, levies, fees, etc. and can do so with the force of law. Private citizens, or any collective thereof cannot use force unless allowed by the government to do so, so their ability to recoup costs will always be some smaller than the quantity that the government can collect. No?

No. See above. Corporations are limited only in theory by government, otherwise they act with greater authority and less culpability than any government.

Another way we can look at this is to consider the concept of efficiency. Governments have fewer reasons to consider the efficiency. When you can legally print money out of thin air, the need for efficiency vanishes completely. Private citizens, nor their collectives, can do no such thing!

That's a mico-economic theory applied to a macro-geopolitical reality. The reality is that if I work for a company that can call in an air strike without any threat of exposure, the concept of efficiency is a non-starter. We are talking about *permanent global domination*, not debits and credits on a spreadsheet.

I don't understand the collectivization of people into equivalence

classes. Numbers are equivalence classes, not people! I am trying to

understand your thesis, not saying your wrong. ;-)

I'm open to being wrong, I just need to be pointed in the direction of a reason why that might be the case.

What would be a clear indicator of "Craig being wrong"? You keep shifting the argument frame around.

If there were some facts supporting the success of Trickle down economics, for one.

Could you address the questions I asked here now directly?

I always do.

1) What is fairness?

Fairness is a feeling of reciprocal satisfaction in a social context. It's a bit like bi-simulation - a feeling of equilibrium where someone feels that people representing different social positions within a particular ensemble of social conditions are being served in a way in which each position is reconciled with the other in a mutually satisfying and ethically sustainable way.

2) Why does government not do at least what is it supposed to do? Enforce its own laws equally.

Because the government pays its workers much less than corps pay them to subvert the interests of the people. Obviously?

Craig

-- Onward! Stephen

Roger Clough

Dec 19, 2012, 1:02:20 PM12/19/12

to everything-list

Hi Richard Ruquist

I already sent that out a few days ago, maybe

even yesterday. curve follows log (inflation-adjusted personal

income)

vs time I think back perhaps a century or more.

[Roger Clough], [rcl...@verizon.net]

12/19/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: Richard RuquistReceiver: everything-listTime: 2012-12-19, 11:43:55Subject: Re: Re: clearing up the confusion on the fairness index

> everything-list+unsub...@googlegroups.com.

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To post to this group, send email to everyth...@googlegroups.com.

To unsubscribe from this group, send email to everything-list+unsub...@googlegroups.com.

Stephen P. King

Dec 19, 2012, 1:28:54 PM12/19/12

to everyth...@googlegroups.com

On 12/19/2012 12:43 PM, Craig Weinberg

wrote:

On Tuesday, December 18, 2012 5:04:28 PM UTC-5, Stephen Paul King wrote:

On 12/18/2012 4:40 PM, Craig Weinberg wrote:

On Monday, December 17, 2012 8:02:12 PM UTC-5, Stephen Paul King wrote:

On 12/17/2012 5:11 PM, Craig Weinberg wrote:

> Taxing the rich does not redistribute the income, it adjusts the

> expenses so that those who benefit disproportionately from the public

> resources pay their share for an educated labor force, policed cities,

> well maintained roads, bridges, ports, airports, the grotesquely

> hypertrophied military to enforce monopolistic trade policies

> worldwide, etc.

Hi Craig,

� � �Could explain how it is that it is possible to "proportionally

benefit" from public resources? Are you saying that resources are the

natural property of the State and not of those willing to do the

investment of time and labor to exploit them?

In a democracy, they are the natural property of the taxpayers who pay for their construction and maintenance. The Port of Los Angeles is not the property of Onassis Shipping or whatever. If they are making hand over fist and bring in a dozen more tankers a week - who pays for the extra staffing of that? Who pays for the construction on the port to be upgraded. This is how corporations remain so profitable - privatize profit and socialize cost.

Hi Craig,

��� We are getting somewhere, but we need to stop and define some terms so we don't just confuse things. What exactly is the definition of "privatize profit and socialize cost" that we can agree upon?

Let's use a real life example instead. http://en.wikipedia.org/wiki/1954_Guatemalan_coup_d%27%C3%A9tat

"The 1954 Guatemalan coup d��tat (18�27 June 1954) was the CIA covert operation that deposed President Jacobo �rbenz Guzm�n (1950�54), with Operation PBSUCCESS � paramilitary invasion by an anti-Communist �army of liberation�. In the early 1950s, the politically liberal, elected �rbenz Government had effected the socio-economics of Decree 900 (27 June 1952), the national agrarian-reform expropriation, for peasant use and ownership, of unused prime-farmlands that Guatemalan and multinational corporations had set aside as reserved business assets. The Decree 900 land reform especially threatened the agricultural monopoly of the United Fruit Company (UFC), the American multinational corporation that owned 42 per cent of the arable land of Guatemala; which landholdings either had been bought by, or been ceded to, the UFC by the military dictatorships who preceded the �rbenz Government of Guatemala."�

"Privatizing profits" seems to mean, in the context of your frame, the funneling of profits into the pockets of a few persons, perhaps undeservedly. "Socializing costs" seems to imply the spreading of costs to arbitrary many people, perhaps undeservedly.

It's not a concept which needs to be abstracted or generalized very much. In the above case, a corporate monopoly, benefits by profits based on the virtual slave labor of Guatemalan peasants under a military dictatorship. The giant corporation (renamed Chiquita) has friends in the CIA who use the power and wealth of the US to overthrow the democracy of Guatemala and restore the Banana Republic to its previous status as a corporate asset.

The costs of this are obvious in terms of the resources of the US used to depose a foreign government, but then there are innumerable less obvious costs to the people of the US and around the world. Labor is held at artificially low costs to UFC, and the costs in financial and real terms of quality of life of real people are billed to the societies of Central America, the West, and the world at large.

Dear Craig,

��� Would you agree that none of this activity would be possible without the intervention of and implicit involvement of government? The key point here is that only government has the legal right to use force. Corporations do not have that right unless allowed so by a government. My thesis is that governments are inherently dangerous because of their default monopoly on the *legal* use of force. Any use of force by an individual person, bussiness agent or corporate activity is illegitimate unless condoned by government. This, IMHO, obviates all a priori claims of of criminality against corporations and thus the argument by Progressives is shown to based on a false premise.

��� Would you agree that none of this activity would be possible without the intervention of and implicit involvement of government? The key point here is that only government has the legal right to use force. Corporations do not have that right unless allowed so by a government. My thesis is that governments are inherently dangerous because of their default monopoly on the *legal* use of force. Any use of force by an individual person, bussiness agent or corporate activity is illegitimate unless condoned by government. This, IMHO, obviates all a priori claims of of criminality against corporations and thus the argument by Progressives is shown to based on a false premise.

��� So the key idea, if my interpretation is correct, hinges on the definition of "deservedly" and its opposite, "undeservedly". This seems to point to an idea of "fairness" that remains undefined. DO you care to define a canonical measure of fairness?

You're trying to frame it into a 'social justice' talking point. A better frame is the obvious abuse of power. The reason you don't overthrow enslave people to make money on the bananas that grow in their country isn't because you don't deserve it, but because it is, how you say, the most evil thing that human beings can possibly do. It's like rounding up people who escaped Saddam's rape rooms and putting them back in there so you can keep raping them. When possible, atrocities should not be allowed to continue without trying to stop them. Is that unreasonable?

���

��� Abuse of power by who, exactly? No abuse is reasonable, IMHO. Of course illegitimacy does not de facto prevent abuses, but we do have the means to ameliorate such. I hope...

��� Abuse of power by who, exactly? No abuse is reasonable, IMHO. Of course illegitimacy does not de facto prevent abuses, but we do have the means to ameliorate such. I hope...

Of course, this is not some isolated example. This is the template for much of US Foreign Policy, from Iran to Vietnam, Iraq, Kuwait, etc. The corps are driving the bus, the gov is just the passenger with the credit card for the gas.

��� I understand. So the real question is: Why is this situation

allowed by "We The People" to continue? (rhettorical question, I

know...)

� � �By my logic, if the taxes of the public where taken from individual

people, then the public resources belong proportionately to those

individuals that paid the taxes. This means that if Fred paid more taxes

than Albert then the public resources belong that much more to Fred than

Albert. Simple math... How do you calculate "benefit"?

It's easy to calculate benefit - you look at the books. You see how much more money a corporation is making and how much more costs are incurred by the government to underwrite that volume of gains.

��� We need to compare apples to apples here. Governements are only bound, in their cost, by their ability to collect taxes, levies, fees, etc. and can do so with the force of law. Private citizens, or any collective thereof cannot use force unless allowed by the government to do so, so their ability to recoup costs will always be some smaller than the quantity that the government can collect. No?

No. See above. Corporations are limited only in theory by government, otherwise they act with greater authority and less culpability than any government.

��� This claim only has logical force if there does not exist a government that can act against the individual people that control said corporations. It� is, frankly, amusing to me that corporations are discussed by many as if they are some form of Gozilla or mythical monster with a mind of its own that no one can defeat or otherwise bring under control.

�

��� Another way we can look at this is to consider the concept of efficiency. Governments have fewer reasons to consider the efficiency. When you can legally print money out of thin air, the need for efficiency vanishes completely. Private citizens, nor their collectives, can do no such thing!

That's a mico-economic theory applied to a macro-geopolitical reality.

��� How so? You seem to not understand the basic principle of government legitimacy: its legal authority to use force.

The reality is that if I work for a company that can call in an air strike without any threat of exposure, the concept of efficiency is a non-starter.

��� That can only happen if a government cannot act legitimately

against that Behemoth of a company. Honestly, this is fantasy talk

"call in an air strike without any threat of exposure", as if!

We are talking about *permanent global domination*, not debits and credits on a spreadsheet.

��� Hegemony! OH! This cannot be taken seriously.

�

�

� � �I don't understand the collectivization of people into equivalence

classes. Numbers are equivalence classes, not people! I am trying to

understand your thesis, not saying your wrong. ;-)

I'm open to being wrong, I just need to be pointed in the direction of a reason why that might be the case.

��� What would be a clear indicator of "Craig being wrong"? You keep shifting the argument frame around.

If there were some facts supporting the success of Trickle down economics, for one.

��� That is difficult to show if one is required to produce a constantly shifting target of data! If you cannot understand the basic processes that are involved in an economy that relate to how cutting taxes and regulations leads to increasing revenue, then I don't have the time to teach you, sorry.� ;_(

�

Could you address the questions I asked here now directly?

I always do.

��� Well?

1) What is fairness?

Fairness is a feeling of reciprocal satisfaction in a social context. It's a bit like bi-simulation - a feeling of equilibrium where someone feels that people representing different social positions within a particular ensemble of social conditions are being served in a way in which each position is reconciled with the other in a mutually satisfying and ethically sustainable way.

��� Sound good, but can you see how it is inherently subjective and

thus it is impossible to be considered coherently as something that

can be defined objectively?

�

2) Why does government not do at least what is it supposed to do? Enforce its own laws equally.

Because the government pays its workers much less than corps pay them to subvert the interests of the people. Obviously?

��� Facts contradict you on that claim! Check out for your self the numbers of average total compensation for private v. government worker and then factor in the average job security.

-- Onward! Stephen

Bruno Marchal

Dec 19, 2012, 1:45:13 PM12/19/12

to everyth...@googlegroups.com

On 17 Dec 2012, at 22:41, Roger Clough wrote:

To try to clear up my mistaken interpretation of the gini coefficient,namely that USA inequality is not decreasing, it is actually increasing,I find that the per capita wealth is also increasing, solet's see what effect that will have.Although the fairness index (gini coefficient) hasgrown linearly with time in the USA,

:

<USA gini_index.jpg>

The real per capital wealth has also increased, but exponentially:(Real means inflation-adjusted):

<USA-per-capita-gdp-1790-2005.png>

By eyeball, it looks as though the real per person income GDP increased over the rangeof the time duration of the gini coefficient growth by about 5/1.5 ~ 3.3 .. The ginicoefficient only increased from .4 to .47 or is about 1.17 times larger, or is essentiallyconstant in comparison with the growth in real GDP by a factor of 3.3. So I would say thateverybody- the poor as well as the wealthy-- is getting appreciably richer, eventhough there has been a minimal increase in wealth inequality.The growth rate is not within our control. The questiion then is whether ornot the gini coefficient is in control of the growth rate. If not, thenthe debate on taxation ends there.But if the gini coefficient can actually change the growth rate, artificially loweringthe gini coefficient by increased taxation of the rich (redistributing the income)hurts the growth rate, so we all get poorer. Actually, a lot poorer.The data above shows that decreasing the gini coefficient a smallamount will produce a much larger decrease in the per capita GDP,because the latter decreases exponentially with a linear decrease inthe gini coefficient.So, in either case, taxing the wealthy can do no good.

I think you are right. But we have to defend the individuals against corporatism, clubism, clientelism, special interest, etc.

Money should not been used to make money based on lies. Press should be more diverse, and banks better regulated, etc. The powers should be better separated, and some domain should be out of the political, like religion and health, food, sports, etc.

As long as drugs are not legal, I will not trust a politician (unless he says so).

Being against drugs means being brainwashing, or being brainwashed, or both.

Bruno

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To post to this group, send email to everyth...@googlegroups.com.

To unsubscribe from this group, send email to everything-li...@googlegroups.com.

For more options, visit this group at http://groups.google.com/group/everything-list?hl=en.

Richard Ruquist

Dec 19, 2012, 2:11:31 PM12/19/12

to everyth...@googlegroups.com

Then you can easily provide a link to that data

>> everything-li...@googlegroups.com.

>> For more options, visit this group at

>> http://groups.google.com/group/everything-list?hl=en.

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> everything-li...@googlegroups.com.

>> http://groups.google.com/group/everything-list?hl=en.

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> For more options, visit this group at

> http://groups.google.com/group/everything-list?hl=en.

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> everything-li...@googlegroups.com.

> http://groups.google.com/group/everything-list?hl=en.

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

meekerdb

Dec 19, 2012, 2:16:22 PM12/19/12

to everyth...@googlegroups.com

On 12/19/2012 8:25 AM, Roger Clough wrote:

Hi meekerdbBut while the gini index increases linearly with time,the individual wealth of each american(at least before Obama) increases exponentiallywith time.

Why should the gini index, already the highest in the developed

world, increase at all. As wealth increases it should decrease if

anything. The wealth of average or median Americans has increased

much more slowly than the average:

You seem to think there is something wonderful that income increased exponentially while the gini increased only linearly. But that depends entirely on how you express the variables. Of course the gini didn't increase exponentially - it is bounded above at 100%. The above graph indicates a linear increase in GDP and a less than linear increase in median income.

Brent

You seem to think there is something wonderful that income increased exponentially while the gini increased only linearly. But that depends entirely on how you express the variables. Of course the gini didn't increase exponentially - it is bounded above at 100%. The above graph indicates a linear increase in GDP and a less than linear increase in median income.

Brent

[Roger Clough], [rcl...@verizon.net]12/19/2012"Forever is a long time, especially near the end." -Woody Allen----- Receiving the following content -----From: meekerdbReceiver: everything-listTime: 2012-12-18, 14:23:12Subject: Re: clearing up the confusion on the fairness index

On 12/18/2012 7:05 AM, Roger Clough wrote:Hi Craig WeinbergMore liberal misrepresentation of the truth. Thegini for the USA is about average for the world.

But it's above the average, and the individual values, for the OECD AND it's been steadily increasing since 1980 - when Ray-gun was elected.

Brent

No virus found in this message.

Checked by AVG - www.avg.com

Version: 2013.0.2805 / Virus Database: 2637/5969 - Release Date: 12/18/12

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

Stephen P. King

Dec 19, 2012, 2:20:53 PM12/19/12

to everyth...@googlegroups.com

On 12/19/2012 2:16 PM, meekerdb wrote:

On 12/19/2012 8:25 AM, Roger Clough wrote:Hi meekerdbBut while the gini index increases linearly with time,the individual wealth of each american(at least before Obama) increases exponentiallywith time.

Why should the gini index, already the highest in the developed world, increase at all. As wealth increases it should decrease if anything. The wealth of average or median Americans has increased much more slowly than the average:

You seem to think there is something wonderful that income increased exponentially while the gini increased only linearly. But that depends entirely on how you express the variables. Of course the gini didn't increase exponentially - it is bounded above at 100%. The above graph indicates a linear increase in GDP and a less than linear increase in median income.

Brent

Dear Brent and Friends,

Is there any indication of how much of that GDP number is actually built on sovereign and private debt?

Is there any indication of how much of that GDP number is actually built on sovereign and private debt?

-- Onward! Stephen

John Mikes

Dec 19, 2012, 3:18:06 PM12/19/12

to everyth...@googlegroups.com

I do not intend to 'clear up' on a nonexisting "fairness Index".

Democracy is an oxymoron: NO CHANCE the entire populace (demos) could exercise governance-power (cratos). There is a COMPROMISE in voting: what do I prefer to vote for from other goals I put temporarily to sleep - and who is the 'candidate' lying (=campaigning?) exactly towards THOSE chosen goals?

What makes a REPRESENTATIONAL RESPUBLIC in which the representants keep their promises as it seems fit. To recall them? very rare.

It is still better than an autocratic dictature, religious, financial, or political.

Now what is fair? an existing system produces values in different proportions to different role-players. It is definitely NOT FAIR what the ultra-wealthy pocket (- a question drawn here in a discussion group: who are the ultra-wealthy? with an instant reply: whoever has more them himself). Approaching fairness:

the values are used differently by diffeent segments of society, so should be the burden of contribution (tax etc.) factored upon the 'pocketed' (earned???) values to SUPPORT said beneficial values.

Low income local workers draw less from foreign relations,transportation,finance, banking, intricate law (legislation - enforcement) perspective research projects, and a host of other topics "rich segments" live on. So the latter should pick up a larger burden of the expenses than the former, in all fairness.

Low income local workers draw less from foreign relations,transportation,finance, banking, intricate law (legislation - enforcement) perspective research projects, and a host of other topics "rich segments" live on. So the latter should pick up a larger burden of the expenses than the former, in all fairness.

I don't even 'touch' the (moral) aspect of social conscientiousness.

John M

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

meekerdb

Dec 19, 2012, 4:08:05 PM12/19/12

to everyth...@googlegroups.com

How would you define 'built-on'? If I borrow money to start a

business and the money comes from a pool that Japanese and Germans

invested in does that mean my business is "built-on" private debt?

GDP is the value of what is produced.

Brent

Brent

Stephen P. King

Dec 19, 2012, 5:11:09 PM12/19/12

to everyth...@googlegroups.com

On 12/19/2012 4:08 PM, meekerdb wrote:

>> Is there any indication of how much of that GDP number is actually

>> built on sovereign and private debt?

>

> How would you define 'built-on'? If I borrow money to start a

> business and the money comes from a pool that Japanese and Germans

> invested in does that mean my business is "built-on" private debt?

> GDP is the value of what is produced.

Hi Brent,

>> Is there any indication of how much of that GDP number is actually

>> built on sovereign and private debt?

>

> How would you define 'built-on'? If I borrow money to start a

> business and the money comes from a pool that Japanese and Germans

> invested in does that mean my business is "built-on" private debt?

> GDP is the value of what is produced.

I am interested in how economic models evolve to adapt to new

economic processes. Consider how much money is made and lost in the

investement in speculative instruments, stocks, bonds, credit systems,

derivatives, etc. My question is considering such...

--

Onward!

Stephen

Roger Clough

Dec 20, 2012, 9:30:02 AM12/20/12

to everything-list

Hi Bruno Marchal

I really have called the gini coefficient the "unfairness index"

instead of the "fairness index", as the larger it is, the more

inequality.

I might not have gotten it backwards.

[Roger Clough], [rcl...@verizon.net]

12/20/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: Bruno MarchalReceiver: everything-listTime: 2012-12-19, 13:45:13

Subject: Re: clearing up the confusion on the fairness index

Roger Clough

Dec 20, 2012, 12:06:44 PM12/20/12

to everything-list

Hi meekerdb

I believe more in phenomenology than

what man can or should do.

[Roger Clough], [rcl...@verizon.net]

12/20/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----From: meekerdbReceiver: everything-list

Time: 2012-12-19, 14:16:22

Hal Ruhl

Dec 18, 2012, 2:50:39 PM12/18/12

to everyth...@googlegroups.com

Hi Roger :

Roger Clough

Dec 22, 2012, 6:35:11 AM12/22/12

to everything-list

Hi Hal Ruhl

Sure, wealth inequality has gotten linearly greater,

but the economy has grown much faster (exponentially),

so we are all getting richer, fairness or not.

The second link you gave proves my point.

The figure below was taken from your second link,

It shows that the median family wealth has increased

from 1200 to 1900 thousand inflation-adjusted dollars

(2007 dollars) from 1989 to 2007. You may have to bnring

up

http://en.wikipedia.org/wiki/Wealth_in_the_United_States

to see the details better.

12/22/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: Hal RuhlReceiver: everything-listTime: 2012-12-18, 14:50:39Subject: RE: Re: clearing up the confusion on the fairness index

meekerdb

Dec 22, 2012, 3:35:27 PM12/22/12

to everyth...@googlegroups.com

On 12/22/2012 3:35 AM, Roger Clough wrote:

Hi Hal RuhlSure, wealth inequality has gotten linearly greater,but the economy has grown much faster (exponentially),so we are all getting richer, fairness or not.

That only means *some* of us are getting richer, specifically those that are rich. The median income, corrected for inflation is essentially flat. And "exponential" doesn't mean "faster" no matter what the media think. It's simple mathematics that the gini isn't going to "grow exponentially" because it's a fraction and it's bounded by 1.0 above (complete inequality in which everything belongs to one person).

Brent

Roger Clough

Dec 24, 2012, 11:48:18 AM12/24/12

to everything-list

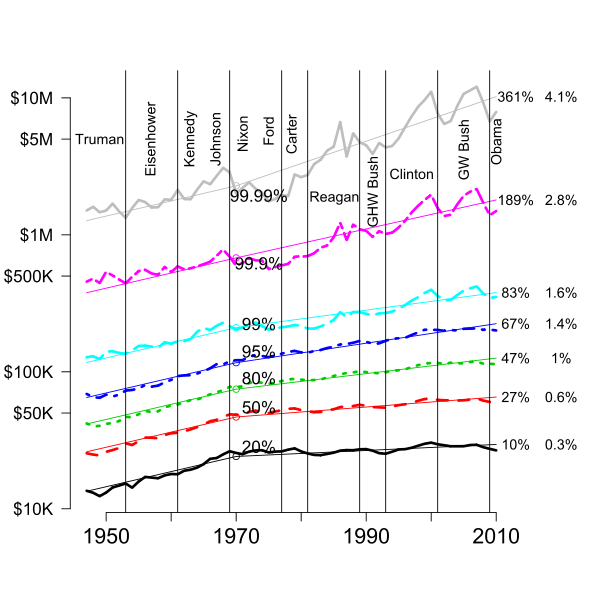

Hi meekerdb

This graph shows the income of the given percentiles from

1947 to 2010 in 2010 dollars. The 2 columns of numbers in the

right margin are the cumulative growth 1970-2010 and the

annual growth rate over that period. The vertical scale is

logarithmic, which makes constant percentage growth

appear as a straight line. From 1947 to 1970,

all percentiles grew at essentially the same rate; the light,

straight

lines for the different percentiles for those years all have

the same slope.

Since then, there has been substantial divergence, with

different percentiles of the income distribution growing at

different rates.

For the median American family, this gap is $39,000 per year

(just over $100 per day):

If the economic growth during this period had been broadly

shared

as it was from 1947 to 1970, the median household income would

have been $39,000 per year higher than it was in 2010. This

plot was

created by combining data from the US Census Bureau[48]

and the US Internal Revenue Service.[49]

There are systematic

differences between these two sources, but the

differences are small

relative to the scale of this plot.[50]

[Roger Clough], [rcl...@verizon.net]

12/24/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: meekerdbReceiver: everything-listTime: 2012-12-22, 15:35:27Subject: Re: clearing up the confusion on the fairness index

Richard Ruquist

Dec 24, 2012, 12:03:15 PM12/24/12

to everyth...@googlegroups.com

Interesting Roger,

According to these charts the richest people have always increased their wealth under democratic presidents whereas they have always decreased wealth under republican presidents except for the first half of Reagan, which seemed to be a continuation of their increased wealth under Carter. But the usual republican wealth decrease kicked in during Reagan's 2nd term and continued under Bush.

Same thing happened under Bush II. The increase was followed by an equal 2nd term decrease.

Conservatism, at least the republican brand, does not work for the very wealthy.

Richard

Richard

meekerdb

Dec 24, 2012, 2:56:25 PM12/24/12

to Barrett Meeker, Art Shaffman, Bill Stermer, Dan Foster, Gennifer home, Ed Gravlin, Hugh Kramer, Jim Wilkinson, Kirsten Meeker, Lara gmail, Mae Meeker, Marsha home, Mark Morgan, Mike Kory, Terry & Lucy home, Tom Blattel

I was not confused. I think a good argument can be made from simple

fairness; that income (and wealth) should be more evenly

distributed. But even this chart doesn't fully illustrate the

problem. If all those households simply spent their money on goods

and services and investments the inequality would be fairly benign.

But at the high end, there is so much disposable income available

that the very rich also spend it on influencing public policy (aka

buying legislation). To paraphrase Al Capone: You can get a lot

further with a vote and 10M$ than you can with a vote alone.

On 12/24/2012 8:48 AM, Roger wrote:

Hi meekerdbThis graph shows the income of the given percentiles from1947 to 2010 in 2010 dollars. The 2 columns of numbers in theright margin are the cumulative growth 1970-2010 and theannual growth rate over that period. The vertical scale islogarithmic, which makes constant percentage growthappear as a straight line. From 1947 to 1970,all percentiles grew at essentially the same rate; the light, straightlines for the different percentiles for those years all have the same slope.

Meaning that the gini didn't change.

Since then, there has been substantial divergence, withdifferent percentiles of the income distribution growing at different rates.For the median American family, this gap is $39,000 per year (just over $100 per day):If the economic growth during this period had been broadly sharedas it was from 1947 to 1970, the median household income wouldhave been $39,000 per year higher than it was in 2010.

Almost double what it is.

Brent

You can get further with a kind word and a gun than you can with a

kind word alone.

--- Al Capone

You can get further with a kind word and a gun than you can with a

kind word alone.

--- Al Capone

Roger Clough

Dec 25, 2012, 3:56:34 AM12/25/12

to everything-list

Hi Richard Ruquist

From what you say, also interesting is that democrats--those folks

who hate the rich--have made the rich richer.

[Roger Clough], [rcl...@verizon.net]

12/25/2012

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: Richard RuquistReceiver: everything-list

Time: 2012-12-24, 12:03:15Subject: Re: Re: clearing up the confusion on the fairness index

Interesting Roger,

According to these charts the richest people have always increased their

wealth under democratic presidents whereas they have always decreased

wealth under republican presidents except for the first half of Reagan,

which seemed to be a continuation of their increased wealth under Carter.

But the usual republican wealth decrease kicked in during Reagan's 2nd term

and continued under Bush.

Same thing happened under Bush II. The increase was followed by an equal

2nd term decrease.

Conservatism, at least the republican brand, does not work for the very

wealthy.

Richard

Richard

On Mon, Dec 24, 2012 at 11:48 AM, Roger Clough <rcl...@verizon.net> wrote:

> Hi meekerdb

>

> http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States

>

>

> This graph shows the income of the given percentiles from

> 1947 to 2010 in 2010 dollars. The 2 columns of numbers in the

> right margin are the cumulative growth 1970-2010 and the

> annual growth rate over that period. The vertical scale is

> logarithmic, which makes constant percentage growth

> appear as a straight line. From 1947 to 1970,

> all percentiles grew at essentially the same rate; the light, straight

> lines for the different percentiles for those years all have the same

> slope.

> Since then, there has been substantial divergence, with

> different percentiles of the income distribution growing at different

> rates.

> For the median American family, this gap is $39,000 per year (just over

> $100 per day):

> If the economic growth during this period had been broadly shared

> as it was from 1947 to 1970, the median household income would

> have been $39,000 per year higher than it was in 2010. This plot was

> created by combining data from the US Census Bureau[48]<http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States#cite_note-48>

> and the US Internal Revenue Service.[49]<http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States#cite_note-49>There are systematic

> differences between these two sources, but the differences are small

> relative to the scale of this plot.[50]<http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States#cite_note-50>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

>

> [Roger Clough], [rcl...@verizon.net] <rcl...@verizon.net]>

> 12/24/2012

> "Forever is a long time, especially near the end." -Woody Allen

>

>

> ----- Receiving the following content -----

> *From:* meekerdb <meek...@verizon.net>

> *Receiver:* everything-list <everyth...@googlegroups.com>

> *Time:* 2012-12-22, 15:35:27

> *Subject:* Re: clearing up the confusion on the fairness index

>

> On 12/22/2012 3:35 AM, Roger Clough wrote:

>

> Hi Hal Ruhl

>

> Sure, wealth inequality has gotten linearly greater,

> but the economy has grown much faster (exponentially),

> so we are all getting richer, fairness or not.

>

>

>

> That only means *some* of us are getting richer, specifically those that

> are rich. The median income, corrected for inflation is essentially flat.

> And "exponential" doesn't mean "faster" no matter what the media think.

> It's simple mathematics that the gini isn't going to "grow exponentially"

> because it's a fraction and it's bounded by 1.0 above (complete inequality

> in which everything belongs to one person).

>

> Brent

>

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> everything-list+unsub...@googlegroups.com.

> For more options, visit this group at

> http://groups.google.com/group/everything-list?hl=en.

>

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To post to this group, send email to everyth...@googlegroups.com.

To unsubscribe from this group, send email to everything-list+unsub...@googlegroups.com.

Roger Clough

Dec 25, 2012, 9:46:38 AM12/25/12

to everything-list

Hi meekerdb

Some economists argue that the wealthy invest their money,

creating capital for creating businesses, hiring workers,

and generally enriching the economy. (The poor don't

save money for others to use.)

So greed is good for the country.

Time: 2012-12-24, 14:56:25

Some economists argue that the wealthy invest their money,

creating capital for creating businesses, hiring workers,

and generally enriching the economy. (The poor don't

save money for others to use.)

So greed is good for the country.

"Forever is a long time, especially near the end." -Woody Allen

----- Receiving the following content -----

From: meekerdb

Receiver: Barrett Meeker,Art Shaffman,Bill Stermer,Dan Foster,Gennifer home,Ed Gravlin,Hugh Kramer,Jim Wilkinson,Kirsten Meeker,Lara gmail,Mae Meeker,Marsha home,Mark Morgan,Mike Kory,Terry & Lucy home,Tom Blattel

----- Receiving the following content -----

From: meekerdb

Time: 2012-12-24, 14:56:25

Subject: Re: clearing up the confusion on the fairness index

I was not confused. I think a good argument can be made from simple fairness; that income (and wealth) should be more evenly distributed. But even this chart doesn't fully illustrate the problem. If all those households simply spent their money on goods and services and investments the inequality would be fairly benign. But at the high end, there is so much disposable income available that the very rich also spend it on influencing public policy (aka buying legislation). To paraphrase Al Capone: You can get a lot further with a vote and 10M$ than you can with a vote alone.

On 12/24/2012 8:48 AM, Roger wrote:

Hi meekerdb

http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States

On 12/24/2012 8:48 AM, Roger wrote:

Hi meekerdb

http://en.wikipedia.org/wiki/Income_inequality_in_the_United_States

Platonist Guitar Cowboy

Dec 25, 2012, 2:43:55 PM12/25/12

to everyth...@googlegroups.com

Hi Roger,

I am convinced that this is off-topic but I'll change that by framing the current mediatized rhetoric of conservative Christians of the last 20 years in US as a TOE, or an epistemology within a TOE, so make that choice; and if you would indulge me you can read on.

Imho right versus left is a false framing of problems and priorities.

But if greed is universally good, then so are thieves driven by the same.

I doubt Christian god and especially his son's incarnation, whose birth is just being celebrated, would agree.

I do consider it fascinating how many people that label themselves "conservative" in the US also proclaim to be serious Christians.

From Bible:

But if anyone has the world's goods and sees his brother in need, yet closes his heart against him, how does God's love abide in him?

Matthew 19:21

Jesus said to him, “If you would be perfect, go, sell what you possess and give to the poor, and you will have treasure in heaven; and come, follow me.”

Mark 12: 41-44

And he sat down opposite the treasury and watched the people putting money into the offering box. Many rich people put in large sums. And a poor widow came and put in two small copper coins, which make a penny. And he called his disciples to him and said to them, “Truly, I say to you, this poor widow has put in more than all those who are contributing to the offering box. For they all contributed out of their abundance, but she out of her poverty has put in everything she had, all she had to live on.”

Luke 3: 10-11

And the crowds asked him, “What then shall we do?” And he answered them, “Whoever has two tunics is to share with him who has none, and whoever has food is to do likewise.”

Mathew 6: 24-25

“No one can serve two masters, for either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve God and money. “Therefore I tell you, do not be anxious about your life, what you will eat or what you will drink, nor about your body, what you will put on. Is not life more than food, and the body more than clothing?

I admit to not reading the Bible often enough to have deep insight on the Christian underpinnings of so much thought and rhetoric that circulates and influences western policy making and conceptions of ethics (What do cowboys read, huh?). But I will venture the bet, that the above quotes are not cherry picked and reflect somewhat accurately one significant aspect of Jesus' messages.

For me, the combination of these positions, does not bode well for TOE binding those two ways of thinking.

PGC

I am convinced that this is off-topic but I'll change that by framing the current mediatized rhetoric of conservative Christians of the last 20 years in US as a TOE, or an epistemology within a TOE, so make that choice; and if you would indulge me you can read on.

Imho right versus left is a false framing of problems and priorities.

But if greed is universally good, then so are thieves driven by the same.

I doubt Christian god and especially his son's incarnation, whose birth is just being celebrated, would agree.

I do consider it fascinating how many people that label themselves "conservative" in the US also proclaim to be serious Christians.

From Bible:

1 John 3:17

But if anyone has the world's goods and sees his brother in need, yet closes his heart against him, how does God's love abide in him?

Matthew 19:21

Jesus said to him, “If you would be perfect, go, sell what you possess and give to the poor, and you will have treasure in heaven; and come, follow me.”

Mark 12: 41-44

And he sat down opposite the treasury and watched the people putting money into the offering box. Many rich people put in large sums. And a poor widow came and put in two small copper coins, which make a penny. And he called his disciples to him and said to them, “Truly, I say to you, this poor widow has put in more than all those who are contributing to the offering box. For they all contributed out of their abundance, but she out of her poverty has put in everything she had, all she had to live on.”

Luke 3: 10-11

And the crowds asked him, “What then shall we do?” And he answered them, “Whoever has two tunics is to share with him who has none, and whoever has food is to do likewise.”

Mathew 6: 24-25

“No one can serve two masters, for either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve God and money. “Therefore I tell you, do not be anxious about your life, what you will eat or what you will drink, nor about your body, what you will put on. Is not life more than food, and the body more than clothing?

I admit to not reading the Bible often enough to have deep insight on the Christian underpinnings of so much thought and rhetoric that circulates and influences western policy making and conceptions of ethics (What do cowboys read, huh?). But I will venture the bet, that the above quotes are not cherry picked and reflect somewhat accurately one significant aspect of Jesus' messages.

For me, the combination of these positions, does not bode well for TOE binding those two ways of thinking.

PGC

--

You received this message because you are subscribed to the Google Groups "Everything List" group.

To post to this group, send email to everyth...@googlegroups.com.

To unsubscribe from this group, send email to everything-li...@googlegroups.com.

Richard Ruquist

Dec 25, 2012, 3:57:20 PM12/25/12

to everyth...@googlegroups.com

Indeed. Can you guess why?

>> everything-li...@googlegroups.com.

>> For more options, visit this group at

>> http://groups.google.com/group/everything-list?hl=en.

>>

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> everything-li...@googlegroups.com.

>> http://groups.google.com/group/everything-list?hl=en.

>>

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> For more options, visit this group at

> http://groups.google.com/group/everything-list?hl=en.

>

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

> everything-li...@googlegroups.com.

> http://groups.google.com/group/everything-list?hl=en.

>

>

> --

> You received this message because you are subscribed to the Google Groups

> "Everything List" group.

> To post to this group, send email to everyth...@googlegroups.com.

> To unsubscribe from this group, send email to

Roger Clough

Dec 26, 2012, 3:39:46 PM12/26/12

to everything-list

Hi Platonist Guitar Cowboy

I was trying to make a point with liberals,

to whom greed is essentially financial exploitation of another.

Making profits is greed to many of them.

My point is that that is what capitalism can involve,

although not always. The basis of capitalism is

enlightened self-interest. Enlightened in the

sense that the transaction will not backfire on you.

The understanding s that everybody profits if

the transaction is for their own interest.

They get the goods, you get the money.

[Roger Clough], [rcl...@verizon.net]

12/26/2012

"The one thing a woman looks for in a man is to be needed." - "Ethan

Frome", by Edith Wharton

----- Receiving the following content -----

From: Platonist Guitar CowboyReceiver: everything-listTime: 2012-12-25, 14:43:55Subject: Re: why greed is good.

Hi Roger,

I am convinced that this is off-topic but I'll change that by framing the current mediatized rhetoric of conservative Christians of the last 20 years in US as a TOE, or an epistemology within a TOE, so make that choice; and if you would indulge me you can read on.

Imho right versus left is a false framing of problems and priorities.

But if greed is universally good, then so are thieves driven by the same.

I doubt Christian god and especially his son's incarnation, whose birth is just being celebrated, would agree.

I do consider it fascinating how many people that label themselves "conservative" in the US also proclaim to be serious Christians.

From Bible:

1 John 3:17

But if anyone has the world's goods and sees his brother in need, yet closes his heart against him, how does God's love abide in him?

Matthew 19:21