[Economic Insights] October jobs growth supports December "lift-off"

1 view

Skip to first unread message

Bevan Graham

Nov 8, 2015, 5:12:45 PM11/8/15

to worldview...@googlegroups.com

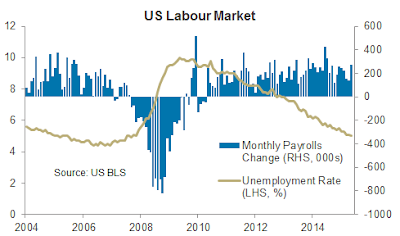

After a couple of soft months US jobs

growth bounced back with a vengeance in October. Non-farm payrolls rose +271k over the month,

well ahead of average market expectations of +180k. Adding

to the strength in the result the unemployment rate dipped lower to 5.0% and

wage growth blipped higher.

--

Posted By Bevan Graham to Economic Insights at 11/09/2015 11:12:00 AM

This result sees jobs growth back to a

solid upward trend, supporting our view that solid consumer spending will

continue to be the back-bone of above-trend GDP growth in the period ahead. That tips the scales further in favour of a December

“lift-off” for interest rates. Indeed

market-based probability of a hike in December now sits at 68%.

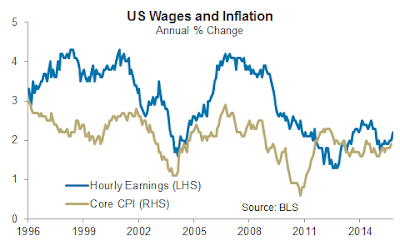

Average hourly earnings were up +0.4% in

the month for an annual increase of 2.5%.

The unemployment rate is now within the Fed’s central tendency for

full-employment and the broader U6 measure of labour market is slack is now at

9.8%, its lowest level in five-and-a-half years.

The Federal Open Market Committee will see

this for what it is – an unambiguously strong result. We know the Committee, either rightly or

wrongly, operates within a Phillips Curve framework. So a combination of diminished labour market

slack and rising wages will have them itching to tighten. Barring any data-disasters between now and

mid-December, a rate increase before Christmas is looking like a done deal.

--

Posted By Bevan Graham to Economic Insights at 11/09/2015 11:12:00 AM

Reply all

Reply to author

Forward

0 new messages