[Economic Insights] NZ GDP - September 2015 quarter

2 views

Skip to first unread message

Bevan Graham

Dec 16, 2015, 9:50:58 PM12/16/15

to worldview...@googlegroups.com

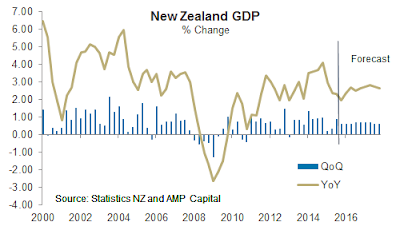

NZ GDP came in at a better-than-expected

0.9% in the September quarter (market consensus +0.8%, RBNZ +0.6%). Annual growth came in at +2.3% with annual

average holding up at a still impressive +2.9%.

The strong quarterly growth rate is part

solid underlying growth (which we think is running at around +0.6-0.7% per

quarter), part pay-back for the weak start to the calendar year and part higher

meat processing reflecting low dairy/high meat prices and impending drought. With all that going on its important not to

take the strength in the result, especially when compared to the RBNZ’s

forecast, at face value.

History has been revised up with annual

average growth for calendar 2014 revised up from +3.3% to +3.7%. That makes the lack of inflation over that

period even more surprising than it already was!!

The outlook remains for solid growth of

around 2.5-2.7% per annum over the next couple of years.

But with likely continued benign inflationary

pressures reflecting a near-term rise in the unemployment rate and soft

increases in unit labour costs, this result won’t change the RBNZ’s comfort

with interest rates now back to 2.5%.

The RBNZ has flagged they are now more than

likely on hold. The key risk to that

view is a period of drought in early 2016 that hits production hard. That makes the risk to interest rates still biased to the downside but that will remain dependent on the data…and the weather.

--

Posted By Bevan Graham to Economic Insights at 12/17/2015 03:50:00 PM

Reply all

Reply to author

Forward

0 new messages