[Economic Insights] GDP growth underwhelms in Japan and the Euro zone

2 views

Skip to first unread message

Bevan Graham

Aug 17, 2015, 12:19:21 AM8/17/15

to worldview...@googlegroups.com

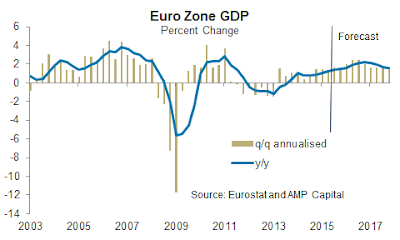

I’ve warned all year about not getting too

carried away with heightened expectation of growth in the Euro zone and Japan. That caution has been rewarded with

underwhelming June quarter growth for both.

Sure Japan beat expectations but only because the economy contracted

less than expected. And while the Euro

zone posted modest growth in the quarter, it and its three largest constituent

parts (Germany, France and Italy) all fell short of expectations.

At this stage we don’t have a breakdown of

Euro zone-wide growth but prior releases of retail sales suggests consumption

was a likely solid contributor to growth over the quarter and we expect exports

would have been OK for some, especially Germany. However indications from the respective

national statistical agencies are that business investment was weak in at least

France and Germany.

To be fair, annual growth of 1.2% for the

year to June is the strongest since September 2011, but it’s hardly shooting

the lights out. Easy monetary conditions

should continue to support a further cyclical upswing via the low exchange

rate, low interest rates while the TLTRO will continue to support stronger

credit growth.

The question for the ECB is whether growth

becomes strong enough to lift inflation from its current “unusually low” level,

let alone maintain it at close to their 2% target. Until they are of that view expect the

central bank to continue its program of sovereign bond purchases.

A contraction in Japan Q2 growth was widely

expected. Consumption was weak over the

quarter, despite better labour market data, and exports were weaker still. Capital expenditure also posted a small

negative (although this could yet be revised up and came after a solid Q1). The only positive surprise was inventories

which posted a small positive contribution where a negative had been expected

following the significant inventory build in the first quarter – but that will

simply serve to suppress future production.

Looking ahead we think consumption will look

a bit stronger next quarter while there are pluses (US) and minuses (China)

for exports. And stronger capex remains

a pre-condition for any sustained pick-up in growth. I’ve got a rebound to 2% growth penciled in

for Q3. The Bank of Japan lowered their

growth and inflation forecasts recently but they are likely still too

optimistic on both fronts making further monetary easing likely.

--

Posted By Bevan Graham to Economic Insights at 8/17/2015 04:19:00 PM

Reply all

Reply to author

Forward

0 new messages