[Economic Insights] RBNZ: To cut or not to cut

1 view

Skip to first unread message

Bevan Graham

Dec 6, 2015, 3:34:51 PM12/6/15

to worldview...@googlegroups.com

The RBNZ releases its December Monetary

Policy Statement (MPS) this Thursday with the big question being whether there

is another interest rate cut in the bag.

Our view is that having signalled another cut at the last MPS, there is

no compelling reason not to deliver.

Sure some of the growth indicators are

looking better. In particular both

business and consumer confidence appear to be on the mend after a mid-year

slump on over-inflated concern and hyperbole around the imminent demise of the

Chinese economy. At the same time dairy

prices have waxed and waned but appear to be trying to form a base at a level

that suggest the RBNZ will be able to revise up its forecast for the terms of

trade. And net migration inflows

continue to hit new record highs.

But it’s the labour market that I think

should still see the RBNZ deliver on an interest rate cut this week. Our views on monetary policy have evolved

with the labour market. As I’ve said

many time before the big surprise for me this cycle has been the extent to

which increased labour supply via net migration and a high participation rate

have conspired to keep wage increases and therefore domestic inflationary

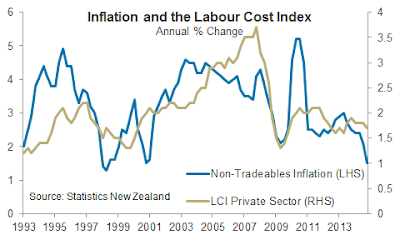

pressures in check. Non-tradeables

inflation was 1.5% in the year to September, a 14-year low. At the same time unit labour costs (as

measured by the private sector Labour Cost Index) are again ticking lower.

Headline inflation will rise over the next

few quarters as big declines in fuel prices drop out of the annual calculation

and as (at least some of) the recent decline in the exchange rate feeds through

into retail prices. But importantly,

while some of the growth indicators are looking better, we still expect the

unemployment rate to rise over the next few quarters. Outside some notable sectors (e.g. construction

in Auckland) we expect this to keep wages and underlying inflationary pressures

in check.

So in short – we see no compelling reason

for the RBNZ to back away from or even delay its already flagged interest rate

cut this week.

--

Posted By Bevan Graham to Economic Insights at 12/07/2015 09:34:00 AM

Reply all

Reply to author

Forward

0 new messages