[Economic Insights] US jobs helps soothes concerns over global growth, but the Renminbi is key to stability

8 views

Skip to first unread message

Bevan Graham

Jan 10, 2016, 3:16:02 PM1/10/16

to worldview...@googlegroups.com

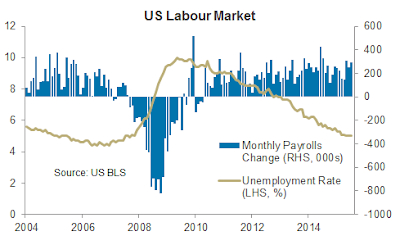

Strong US jobs growth in December went some towards settling share

markets towards the end of last week following a few days of general angsting

over global growth with a few geo-political concerns thrown in for good measure. But right now the immediate outlook for the Renminbi remains key to stability in markets.

Non-farm employment rose a better-than-solid +292k in December. Positive revisions of +50k to prior months

added to the positive story. Strength

was centered in the service sectors and construction, with the latter probably

helped by good weather.

The unemployment rate was unchanged at 5.0% as the participation rate

nudged higher to 62.6%. Average hourly

earnings were flat over the month but the annual rate rose to 2.5% as a negative

monthly decline in December 2014 fell out of the annual calculation. The reverse happens next month as a +0.6%

falls out in January. Looking through

the volatility annual wage growth seems to be consolidating at a level just

over 2%, which won’t be causing the Fed any sleepless nights.

This result reinforces our view of consumer rather than production-led

growth momentum in the US economy. Last

week’s weak ISM manufacturing survey confirmed the sector continues to grapple with

energy-related weakness, the higher US dollar and only modest global;

growth. We expect those factors will

continue to be a drag on US industrial production and capital spending for some

time.

So the US consumer remains key to our view of continued above trend GDP growth

in 2016. A combination of continued jobs

growth, increases in the average working week along with modest wage growth is

expected to lead to solid gains in aggregate labour income and consumer

spending.

But

right now global growth concerns remain centered on China. The latest fall in Chinese shares looks to

have been exaggerated and driven more by fears and regulatory issues around the

share market and currency rather than a renewed deterioration in economic

indicators.

While

the Caixin business conditions PMIs were weaker in the last week official PMIs

for December were stronger (see post below). Rather the main drivers were

worries about new share supply following the scheduled end to a ban on selling

by major shareholders, a new share market circuit breaker that commenced on

Monday which appears to have added to market volatility rather than calmed it

down and a continuing depreciation of the Renminbi.

Looking

at each of these: Chinese regulators have since announced a restrictive limit

on the size of stakes that major investors can sell; the circuit breaker has

now been suspended after the experience of the last week; and after a 6% plus

depreciation in the value of the RMB since July the PBoC is now likely to step

up efforts to try and stabilise it again much as it did through September and

October.

The

depreciation of the Renminbi is the key issue at present as its decline is

helping fuel upwards pressure on the US dollar, adding to weakness in oil and other

commodity prices and contributing to fears of some sort of emerging market crisis,

fears that we don’t share. As the week

ended we saw some stability return to the Chinese share market and currency but

it needs to be sustained.

--

Posted By Bevan Graham to Economic Insights at 1/11/2016 09:16:00 AM

Reply all

Reply to author

Forward

0 new messages