[Economic Insights] Growth and monetary policy in Japan and the Eurozone

2 views

Skip to first unread message

Bevan Graham

Nov 16, 2015, 3:55:00 PM11/16/15

to worldview...@googlegroups.com

Third quarter growth was weaker than

expected in both Japan and the Eurozone.

Further monetary easing appears inevitable in both cases. This will, in turn, have implications for the

extent to which the Fed can take its foot of the monetary policy accelerator.

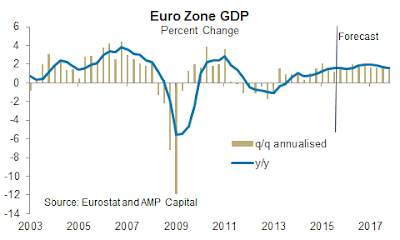

Eurozone GDP expanded 0.3% in the third

quarter of 2015, below the consensus expectation of +0.4%. Annual growth came in at +1.6%, up from +1.5%

in the second quarter. France and

Germany both posted growth of +0.3% over the quarter with Italy disappointing

at +0.2%. Spain continues to expand more

rapidly with a +0.8% increase over the quarter, though off a lower base.

Breakdowns of growth into its core demand

components are not yet available but partial data for the quarter suggest the

detail will show reasonably solid consumption growth offset by weakness in

capital spending and net exports.

We see little scope for growth to

accelerate from the current 1.6% annual pace in the near-term. As we’ve said all year, the likely pace of

growth is unlikely to prove sufficiently fast to put any sustained upward

pressure on inflation. While core

Eurozone inflation is off its lows, it remains stuck at around 1.0%, well shy

of the ECB’s 2.0% target.

ECB President Mario Draghi recently stated

that “signs of a sustained turnaround in core inflation have somewhat weakened”

and that the bank’s monetary policy stance will be re-evaluated at its December

meeting. That along with the downside

risks to growth in the Eurozone key trading partners seems to make further

easing a done deal.

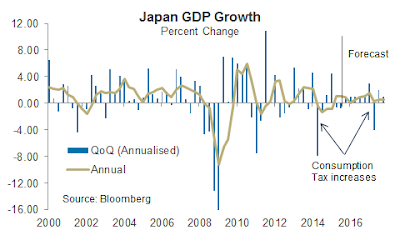

Turning to Japan, the economy entered its

second (technical) recession in 18 months.

The first came in the aftermath of the consumption tax increase last

year, making this more recent downturn more worrying in that it highlights the

fundamental weakness of the economy.

GDP contracted at an annualised rate of

-0.8% in the September quarter, well below the market consensus of -0.2%. The biggest disappointment was the drop in

capital spending which contracted at an annual rate of 5.0% over the

quarter. Strong capital spending growth observed

in the in the first quarter of the year has now been completely unwound. That’s inconsistent with recently upbeat capital

spending intentions from various business surveys with concerns about the

domestic economy and more recently China resulting in those intentions being

delayed.

Consumer spending was solid at an

annualised pace of +2.1% and net exports were positive, the first positive

contribution in three quarters. Weaker

inventories was the major downside surprise, although that provides some scope

for a recovery in production further down the track.

Looking ahead we think capital spending

will remain soft and exports appear likely to slow. Furthermore the positive impact from the last

supplementary budget is now beginning to fade.

That leaves consumer spending as the determining factor of the pace of

growth from here. So it seems inevitable

here too that the central bank will be forced to step up its monetary easing.

One of our “Themes for 2015” was the

emergence of divergent monetary policy settings amongst the G4, with the US and

the UK the first to tighten with more easing likely in the Euro zone and

Japan. While expectations of UK tightening

are now pushed out well into 2016, our base case is the Fed hikes in

December. That means we can stop

fretting about the timing of lift-off and start worrying about what really

matters – the pace and extent of the tightening – which we expect to be gradual. One of the key limiting factors on US interest

rate increases will be the strong likelihood of further easing in Europe and

Japan and upside implications for the USD.

--

Posted By Bevan Graham to Economic Insights at 11/17/2015 09:54:00 AM

Reply all

Reply to author

Forward

0 new messages