[Economic Insights] US GDP - revisions imply lower productivity growth

1 view

Skip to first unread message

Bevan Graham

Jul 30, 2015, 6:13:50 PM7/30/15

to worldview...@googlegroups.com

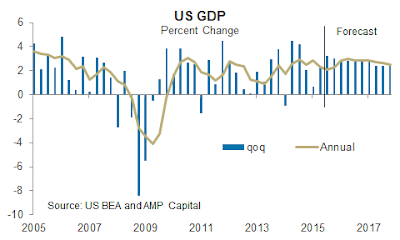

US real GDP bounced back to a solid +2.3% annual

pace in the second quarter of the year, proving that March quarter weakness was

largely temporary. The best part of the result was the +2.9%

increase in consumer spending but private sector investment was less exuberant

at +0.8%.

This release was also interesting in that it

incorporated annual benchmark revisions back to 2012. Of particular note was the upward revision in

March quarter growth from an annualised -0.2% to +0.6%. However on average the revisions knocked 0.2%

off annual growth over the period of the revisions.

With respect to the comments I made yesterday

about underwhelming productivity, these GDP revisions make the mystery a bit deeper

by lowering implied productivity growth.

Any immediate concerns about that for the Fed will be ameliorated by the

still subdued annual 1.3% increase in the core personal consumption expenditure

deflator, but it does reinforce that the time for the Fed to start the interest

rate normalisation process is nigh.

--

Posted By Bevan Graham to Economic Insights at 7/31/2015 10:13:00 AM

Reply all

Reply to author

Forward

0 new messages