[Economic Insights] Fed and ECB on divergent paths

0 views

Skip to first unread message

Bevan Graham

Nov 30, 2015, 3:50:46 PM11/30/15

to worldview...@googlegroups.com

Interest rate markets are now pricing in a

74% probability the US Federal Reserve starts the interest rate normalisation

process at its 15/16th December meeting. But before then the

European Central Bank is widely expected to step up its easing efforts in the

face of low growth and weak inflation expectations when it meets later this

week.

In comments reminiscent of his

game-changing 2012 do “whatever it takes” to save the Euro, ECB President Mario Draghi has committed the central bank

to do “what we must” to achieve its inflation target in the face of low

inflation expectations and growth that remains too low to put any significant

upward pressure on inflation.

Further action therefore appears

more than likely when the Governing Council meets on December 3rd. That could include one, some or all of:

cutting the already negative deposit rate, increasing the quantum of the

current asset purchase program or extending the duration of the program beyond

its scheduled finish of September next year.

The Euro is currently trading at

its lowest level in eight-months, indicative of market expectations of

meaningful action from the ECB this week.

The risk then is the Council reads too much into recent better data and

under-delivers. Our read of the data is

that it appears consistent with trend GDP growth, which we put at around 1.5%

per annum. The problem is the Euro zone

needs a decent burst of above trend growth to absorb the still significant

spare capacity across the region, the most obvious example of which is the

still-high unemployment rate of 10.8%.

Monetary policy can’t do that by itself.

After

delaying the start of the interest rate normalisation process in September,

markets are now pricing in a 74% chance of the Fed lifting interest rates off

zero at their December meeting. Only an

atrociously bad payrolls report this weekend appears likely to derail the Fed

from what will be their first interest rate hike in 9-years.

Markets

seem more comfortable with the prospects of higher interest rates now than they

were prior to the September meeting.

This is likely a combination of factors including the growing

understanding that interest rate increase are likely to be only gradual and

fears of a hard landing in China (and global growth) have receded. So the fact the Fed didn’t hike in September for

all the reasons they stated to some extent turns a December hike into a good

news story!

As

we have consistently argued it’s the pace of interest rate increase and the peak

(terminal rate) in rates that are more critical for markets than the timing of

the start of the process. Assuming the

Fed start to raise rates in December, we expect the Fed funds rate to be around

1.00-1.25% by December 2016. Furthermore

we expect the Fed will continue to lower its estimate of the neutral rate from the

current 3.75% towards our estimate of 3.0%.

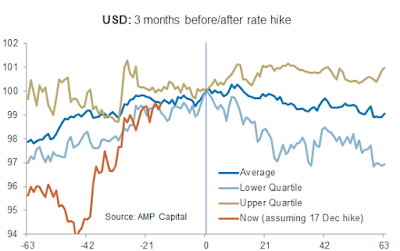

The path of the USD will be a critical part of the outlook for interest rates. History shows us that the exchange rate does most of its work in anticipation of higher interest rates – the classic case of “buy the rumour, sell the fact”. That said the fact that the Fed and the ECB (along with the BoJ and the PBoC, amongst others) are on divergent monetary policy paths will limit the extent to which the Fed can tighten.

--

Posted By Bevan Graham to Economic Insights at 12/01/2015 09:50:00 AM

Reply all

Reply to author

Forward

0 new messages