[Economic Insights] 9/07/2015 02:24:00 PM

1 view

Skip to first unread message

Bevan Graham

Sep 6, 2015, 10:24:44 PM9/6/15

to worldview...@googlegroups.com

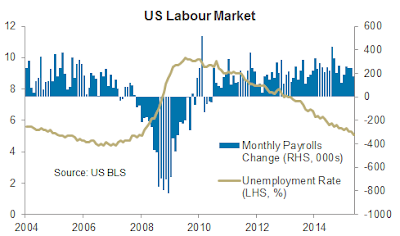

US August employment data was consistent with

“some further improvement” in the labour market. By itself that seems to meet the criteria for

“lift-off” for US interest rates in September, but it’s not that simple.

The only disappointment in the report was the

increase of 173k in non-farm payrolls which was below expectations of a +200k

result. But that disappointment is ameliorated

by the observation that the initial estimate of August payrolls often undershoots

the recent trend, only to benefit from upward revisions in subsequent months.

Everything else in the report pointed in the

right direction. June and July

employment growth was revised up by a combined 44k, jobs growth is increasingly

broad-based, hours worked remains consistent with above trend growth and the

average work week rose.

Average hourly earnings rose 0.3% in the

month although the annual rate of increase remains stuck at 2.2%. Most importantly the unemployment rate fell

to 5.1% - and is now bang on the mid-point of latest Fed estimate of longer run

unemployment (NAIRU). On its own this

data fits the bill for some further improvement in the labour market and supports

the case for “lift-off” in September.

That just leaves the Committee’s interpretation

of recent market volatility. As I said

last week, market volatility by itself should not delay the Fed. Indeed some volatility should be expected

whenever the Fed starts any rate hiking cycle, let alone the first hike in

nearly a decade.

But it’s a different matter if the Committee

views that volatility as indicative of factors that may impact the growth and

inflation outlook in the US. To the

extent that recent volatility has been due to concerns about growth in China,

this week’s release of the usual monthly plethora of Chinese activity data will

add further fuel to the debate. More on

that later in the week.

--

Posted By Bevan Graham to Economic Insights at 9/07/2015 02:24:00 PM

Reply all

Reply to author

Forward

0 new messages