Fwd: CENTRAL GOVERNMENT EMPLOYEES NEWS

gr bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 1 Sep 2016 2:21 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

CENTRAL GOVERNMENT EMPLOYEES NEWS |

- AICPIN for July 2016 - Labour Bureau Press Release

- 7th Pay Commission Resolution Notified by Central Government

- Issues arisen consequent upon 7th CPC recommendations and Government decisions - NFIR

|

AICPIN for July 2016 - Labour Bureau Press Release Posted: 31 Aug 2016 10:01 AM PDT

AICPIN for July 2016 - Labour Bureau Press Release

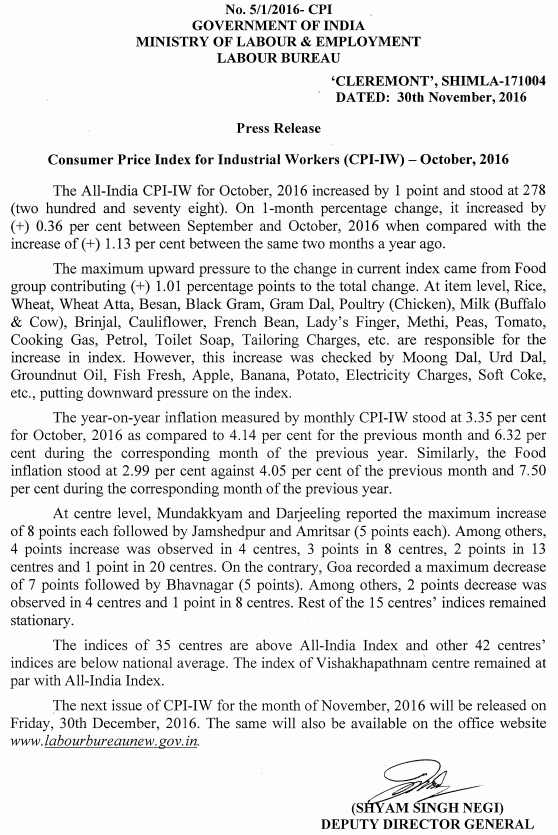

No.5/1/2016- CPI

GOVERNMENT OF INDIA

MINISTRY OF LABOUR & EMPLOYMENT

LABOUR BUREAU

CLEREMONT, SHIMLA-171004

DATED: 31st August, 2016

Press Release

Consumer Price Index for Industrial Workers (CPI-IW) - July, 2016

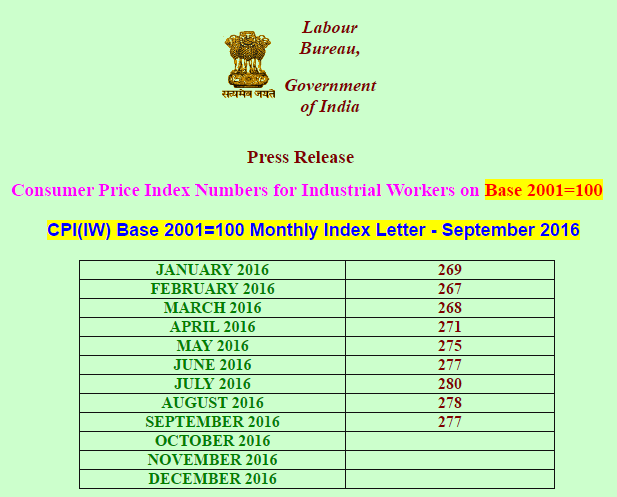

The All-India CPI-IW for July, 2016 increased by 3 points and pegged at 280 (two hundred and eighty). On 1-month percentage change, it increased by (+) 1.08 per cent between June, 2016 and July, 2016 when compared with the increase of (+) 0.77 per cent between the same two months a year ago.

The maximum upward pressure to the change in current index came from Food group contributing (+) 1.65 percentage points to the total change. The House Rent index furtehr accentuated the overall index (+) 0.86 percentage points. At item level, Rice, Wheat, Wheet atta, Besan, Black Gram, Gram Dal, Groundnut Oil, Eggs (Hen), Poultry (Chicken), Milk, Chillies Green, Garlic, Onion, Brinjal, Cabbage, Cauliflower, Gourd, Palak, Potato, Pumpkin, Banana, Sugar etc. are responsible for the increase in index. Howerer, this increase was checked by Fish Fresh, French Beans, Tomato, Electriccity Charges, Petrol, etc. putting downward pressure on the index.

The year-on-year inflation measured by monthly CPI-IW stood at 6.46 per cent for July, 2016 as compared to 6.13 per cent for the previous month and 4.37 per cent during the corresponding month of the previous year. Similarly, the Food inflation stood at 9.34 per cent against 8.33 per cent of the previous month and 3.21 per cent during the corresponding month of the previous year.

At centre level, Bokaro reported the maximum increase of 11 points followed by munger-Jamalpur(10) points, Girdhi, Agar and Delhi (9)points each. Among others, 7 points increase was observed in 4 centres, 6 poiints in 10 centres, 5 points in 5 centres, 4 points in 9 centres, 3 pints in 8 centres, 2 pints in 8 centres, 5 pionts in 5 centres, 4 points in 9 centres, 3 points in 8 centres, 2 points in 8 centres and 1 point in 5 centres. On the contray, Mysore recorded a maximum decrease of 6 points followed by Mundakkayam and Coimbatore (5 points each), and Hubli Dharwar and Ernakulam (4 points each). Among others, 3 points decrease was observed in 4 centres, 2 points in 2 centres adn 1 point in 5 centres. Rest of the 8 centres’ indices remained stationary.

The indices of 33 centres are above All-India Index and other 43 centres indices are below national average. The indices of Vishakhapatnam and Mundakkayam centres remained at par with All-India Index.

The next issue of CPI-IW for the month of August, 2016 will be released on Friday, 30th September, 2016. The same will also be available on the office website www.labourbureaunew.gov.in.

sd/-

(SHYAM SINGH NEGI)

DEPUTY DIRECTOR GENERAL

Authority: www.labourbureaunew.gov.in

FOUNDER OF 'CENTRAL GOVERNMENT EMPLOYEES NEWS' TITLE AND KEYWORD...

"90PAISA" - No.1 BLOG FOR CENTRAL GOVT EMPLOYEES AND PENSIONERS...! |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

7th Pay Commission Resolution Notified by Central Government Posted: 31 Aug 2016 04:46 AM PDT

7th Pay Commission Resolution Notified by Central Government

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(Department of Pension and Pensioners’ Welfare)

RESOLUTION

New Delhi, the 4th August, 2016

No.38/37/2016-P&PW (A) – The Terms of Reference of the Seventh Central Pay Commission as contained in Ministry of Finance (Department of Expenditure) Resolution No.1/1/2013-E.III (A) dated 28.2.2014 included the following:

“To examine the principles which should govern the structure of pension and other retirement benefits, including revision of pension in the case of employees who have retired prior to the date of effect of these recommendations, keeping in view that retirement benefits of all Central Government employees appointed on and after 01.01.2004 are covered by the New Pension Scheme (NPS).”

2. The Commission, on 19th November, 2015, submitted its report to the Government on Terms of Reference as contained in aforementioned Resolution dated 28.02.2014. Government, after consideration, has decided to accept the recommendations of the Commission on pensioner benefits to the Central Government civil employees, including employees of the Union Territories and Members of All India Services subject to certain modifications, as specified hereinafter ..

3. Detailed recommendations of the Commission relating to pensionary benefits and the decisions taken thereon by the Government are listed in the statement annexed to this Resolution.

4. The revised provisions regarding pensionary benefits, which have been accepted as indicated in the Annexure, will be effective from 01.01.2016.

(Vandana Sharma)

Joint Secretary to the Govt. of India

ANNEXURE

Statement showing the recommendations of the Seventh Central Pay Commission relating to principles which should govern the structure of pension and other terminal benefits and the decisions of the Government thereon.

Authority: http://www.pensionersportal.gov.in/

FOUNDER OF 'CENTRAL GOVERNMENT EMPLOYEES NEWS' TITLE AND KEYWORD...

"90PAISA" - No.1 BLOG FOR CENTRAL GOVT EMPLOYEES AND PENSIONERS...! |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Issues arisen consequent upon 7th CPC recommendations and Government decisions - NFIR Posted: 31 Aug 2016 04:46 AM PDT

Issues arisen consequent upon 7th CPC recommendations and Government decisions - NFIR

NFIR

National Federation of Indian Railwaymen

3, Chelmsford Road, New Delhi - 110 055

No.IV/NFIR/7 CPC (Imp)/2016/MoF

Dated: 31/08/2016

The General Secretaries of

Affiliated Uions of NFIR

Dear Brother,

Sub: Issues arisen consequent upon 7th CPC recommendations and Government decisions - reg.

The affiliates are aware that the Indefinite Strike action from I 11/07/2016 on Charter of demands mainly "minimum wage and multiplying factor" was deferred on official commitment given by the Government through Finance Ministry's statement on 6th July,20l6 for constituting High Level Committee to examine the issues.

A committee under the Chairmanship of Additional Secretary (Expenditure) with Joint Secretary (Pers), Joint Secretary (Estt), Joint Secretary (lmp) as its members will deal the issues raised through a memorandum of JCM (Staff Side), submitted to the Empowered Committee, among them the major issues are "upward revision of Minimum wage as well Muliiplying Factor".

The 1st introductory meeting chaired by Addl. Secretary (Exp) was held on 30th August ,2016 at North Block, New Delhi attended by myself, S/Shri Shiva Gopal Mishra & M.S. Raja. In the preamble, we tried to impress upon the Addl. Secretary (Exp) the need for revision of minimum wage and Multiplying factor formula on the basis of facts and merits already presented by JCM (Staff Sidef After brief discussion, it was agreed that another meeting of the Committee will be fixed to be held in consultation with the JCM (Staff Side).

We also met Cabinet Secretary, Government of India thereafter and conveyed our disappointment over the delay in sorting out important issues. The Cabinet Secretary has stated that orders have since been issued by the Government for payment of Gratuity to the employees governed by the NPS. He said that the Government has also issued orders revising the salary calculation limit to Rs.7000/- for payment of Bonus/PLB w.e.f. 2014. The Cabinet Secretary has also assured to positively consider remaining pending issues.

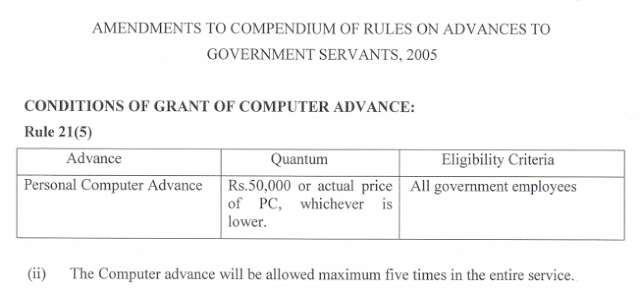

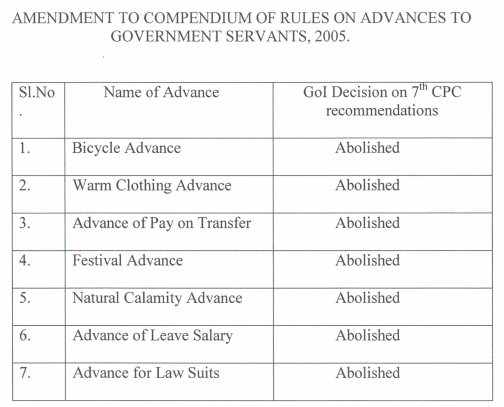

The affiliates may please note that a meeting between the Standing Committee of JCM (Staff Side) and the Committee Chaired by Finance Secretiry (Expenditure) will take place on lst September, 2016 at North Block, New Delhi. In the said meeting the issues pertaining to the negative recommendations of 7th CPC on allowances and advances will be dealt.

Yours fraternally,

sd/-

(Dr.M.Raghavaiah)

General Secretary

Source: NFIR

FOUNDER OF 'CENTRAL GOVERNMENT EMPLOYEES NEWS' TITLE AND KEYWORD...

"90PAISA" - No.1 BLOG FOR CENTRAL GOVT EMPLOYEES AND PENSIONERS...! |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from CENTRAL GOVERNMENT EMPLOYEES NEWS. To stop receiving these emails, you may unsubscribe now. |

Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 2 September 2016 14:45:46 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

Posted: 01 Sep 2016 11:34 PM PDT

RECENT POSTSBonus entitlement for 2014-15 and 2015-16 will be released on the revised norms for central government employeesIn a good news for central government employees, government has announced annual bonus to the employees which has been pending for the last two years.The bonus entitlement for 2014-15 and 2015-16 will be released on the revised norms for central government employees.Government has also announced to increase the minimum wage of non-agricultural workers to Rs 350 a day from the present Rs 246 a day.All cheers to some 33 lakh central government employees.Government has announced annual bonus to the employees which has been pending for the last two years.The bonus entitlement for 2014-15 and 2015-16 will be released on the revised norms for central government employees.Labour Minister Bandaru Dattatreya, Power Minister Piyush goyal were also present when the announcement was made.Union Finance Minister Jaitley also said the government will increase the minimum wage of non-agricultural workers to Rs 350 a day from the present Rs 246 a day.Labour Minister Bandaru Dattatreya also said Asha and Anganwadi workers and Mid day meal volunteers will be given the facilities of ESIC soon.On the whole these announcements are certainly a news to cheer. These moves comes after a series of reforms brought by the Government - like the implementation of One Rank One Pension and the much awaited 7th Pay Commission.Source: DDI News

Posted: 01 Sep 2016 11:42 PM PDT

RECENT POSTSBonus entitlement for 2014-15 and 2015-16 will be released on the revised norms for central government employeesIn a good news for central government employees, government has announced annual bonus to the employees which has been pending for the last two years.The bonus entitlement for 2014-15 and 2015-16 will be released on the revised norms for central government employees.Government has also announced to increase the minimum wage of non-agricultural workers to Rs 350 a day from the present Rs 246 a day.All cheers to some 33 lakh central government employees.Government has announced annual bonus to the employees which has been pending for the last two years.The bonus entitlement for 2014-15 and 2015-16 will be released on the revised norms for central government employees.Labour Minister Bandaru Dattatreya, Power Minister Piyush goyal were also present when the announcement was made.Union Finance Minister Jaitley also said the government will increase the minimum wage of non-agricultural workers to Rs 350 a day from the present Rs 246 a day.Labour Minister Bandaru Dattatreya also said Asha and Anganwadi workers and Mid day meal volunteers will be given the facilities of ESIC soon.On the whole these announcements are certainly a news to cheer. These moves comes after a series of reforms brought by the Government - like the implementation of One Rank One Pension and the much awaited 7th Pay Commission.Source: DDI News

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 31 August 2016 14:47:32 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

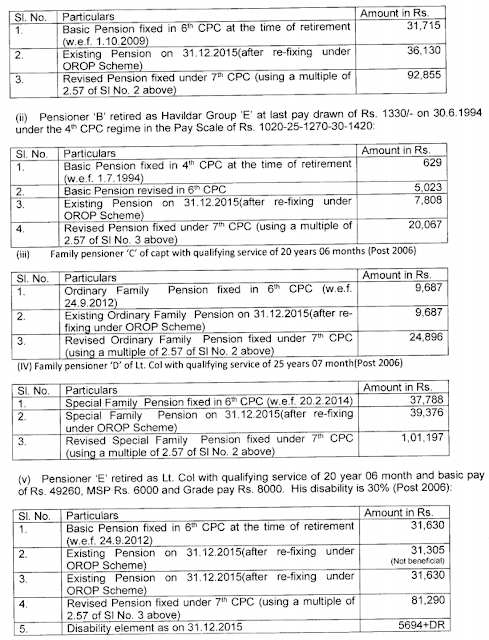

Posted: 30 Aug 2016 06:25 PM PDT

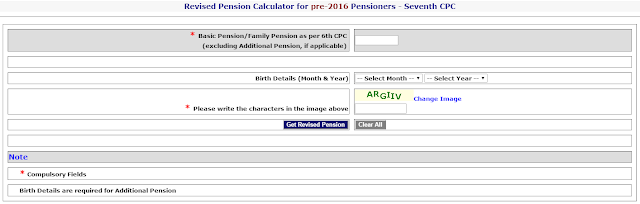

7th CPC Pension and Arrears Calculator for pre-2016 Pensioners - Pensioners Portal

Posted: 30 Aug 2016 06:27 PM PDT

Pensioners Portal (www.pensionersportal.gov.in) is the nodal department for formulation of policies relating to pension & other retirement benefits of Central Government Pensioners/Family Pensioners. The portal is provided a simple and accurate calculator for finding out your revised pension/family pension with arrears as per the 7th Pay Commission.

Posted: 30 Aug 2016 06:28 PM PDT

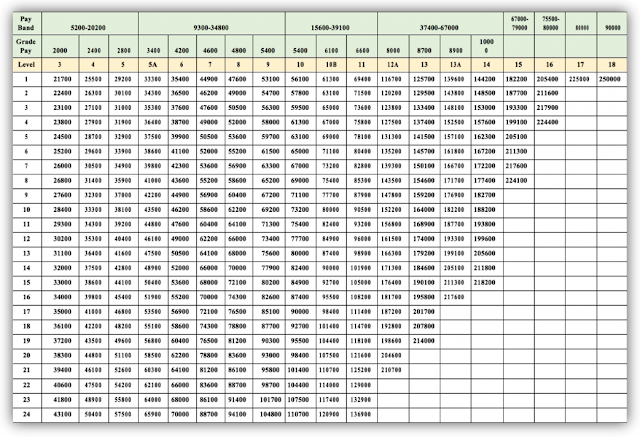

Seventh Central Pay Commission’s recommendations - revision of pay scales- amendment of Service Rules/Recruitment RulesNo. AB.14017/13/2016-Estt. (RR)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and TrainingNew DelhiDated: 29th August, 2016OFFICE MEMORANDUMSubject:- Seventh Central Pay Commission’s recommendations - revision of pay scales- amendment of Service Rules/Recruitment RulesThe undersigned is directed to refer to the Office Memorandum of even number dated 9.8.2015 on the above mentioned subject wherein it was requested that as per the CCS (Revised Pay) Rules 2016 issued by Department of Expenditure vide Notification dated 25th July, 2016, consequential amendment in the existing Service Rules/Recruitment Rules shall be made by the Ministries/Departments by substituting the existing Pay Band and Grade Pay by the new pay structure i.e. “LEVEL in the PAY MATRIX” straightaway without making a reference to the Department of Personnel and Training (DOP&T)/Union Public Service Commission (UPSC).2. In this regard, a confirmation meeting is scheduled to be taken by Joint Secretary (Establishment) to take stock of the latest position of amendment in Service Rules/Recruitment Rules. Joint Secretary (Administration/Establishment) of all Ministries/Departments along with the cadre controlling officers is requested to attend the meeting as per the schedule Annexed or depute a senior officer conversant with the matter to brief the progress:3. The meetings would be held in Room No: 190, 1st Floor, North Block.sd/-(G. Jayanthi)Director (E-l)Authority: www.persmin.gov.in

This posting includes an audio/video/photo media file: Download Now

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 30 August 2016 14:34:30 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

- Grant of Productivity Linked Bonus and Ad-hoc bonus for Central Government employees for the year 2014-15 – Enhancement of the calculation ceiling

- Extension of benefits of ‘Retirement Gratuity and Death Gratuity’ to the Central Government employees covered by new Defined Contribution Pension System (National Pension System)

- 7th CPC Pension Revision – Clarification on the points raised by banks in the meeting held on 22.08.2016

- 7th Pay Commission – Second meeting on Allowances on 01.09.2016

- Clarification on Children Education Allowance (CEA) – Dopt orders on 22.8.2016

- Consolidated guidelines issued by Dopt on Technical Resignation & Lien

- 7th CPC Arrears included in August 2016 salary as a separate component – Railway Board Order

- Clarification on admissibility of Transport Allowance in the cases where the officers are drawing Grade Pay of 10,000

- Central Secretariat employees seek pay parity

Posted: 29 Aug 2016 09:27 PM PDT

Grant of Productivity Linked Bonus (PLB) and non-productivity Linked Bonus (Ad-hoc bonus) in case of Central Government employees for the accounting year 2014-15 – enhancement of the calculation ceiling- Regarding.No.7/4/2014-E-IIIAGovernment of IndiaMinistry of Finance(Department of Expenditure)North Block, New DelhiDated the 29th August, 2016Office MemorandumSubject: Grant of Productivity Linked Bonus (PLB) and non-productivity Linked Bonus (Ad-hoc bonus) in case of Central Government employees for the accounting year 2014-15 – enhancement of the calculation ceiling- Regarding.The undersigned is directed to invite attention to this Ministry’s 0M No.7/24/2007/E-lll.A dated regarding grant of non-productivity Linked Bonus (Ad-hoc Bonus) to the Central Government employees for the accounting year 2014-2015, whereby the calculation ceiling for the purpose of payment of ad-hoc bonus was monthly emoluments of Rs.3500. The Productivity Linked Bonus (PLB) in case of Central Government employees working under certain Ministries/Departments, where such PLB was in operation in 2014-15, was also paid by the respective Ministries/Departments for the accounting year 2014-15 based on the concurrence of this Ministry with the calculation ceiling at monthly emoluments of Rs. 3500.2. The question of enhancement of the calculation ceiling for the purpose of payment of PLB and non-PLB (ad-hoc bonus), as the case may be, to the Central Government employees has been considered and the President is pleased to decide that the calculation ceiling of monthly emoluments for the purpose of payment of PLB and ad-hoc bonus, as the case may be, shall be revised to Rs.7000 w.e.f. 01.04.2014, i.e., for the accounting year 2014-15.3. Accordingly, the PLB or ad-hoc bonus, as the case may be, as already paid to the eligible Central Government employees for the accounting year 2014-15 in terms of the above 0M dated 16.10.2015 pertaining to ad-hoc bonus and the respective sanctions issued by the concerned Ministries/Departments in respect of PLB under the respective schemes in operation during 2014-15 based on the specific concurrence of this Ministry, shall be re-worked out based on the calculation ceiling of monthly emoluments of Rs.7000 instead of Rs.3500.4. While re-working out payment of PLB or ad-hoc orders, as the case may be, under these orders for the accounting year 2014-15, all the other terms and conditions under which the payment was made shall remain unchanged.5. In respect of their application to the employees working in the Indian Audit and Accounts Departments, these orders are issued in consultation with the office of the Comptroller and Auditor General of India.6. Hindi version of this order will follow.sd/-(Amar Nath Singh)DirectorAuthority: http://finmin.nic.in/

This posting includes an audio/video/photo media file: Download Now

Posted: 29 Aug 2016 09:54 AM PDT

Extension of benefits of ‘Retirement Gratuity and Death Gratuity’ to the Central Government employees covered by new Defined Contribution Pension System (National Pension System) — regarding.No.7/5/2012-P&PW(F)/B

This posting includes an audio/video/photo media file: Download Now

Posted: 29 Aug 2016 09:52 AM PDT

employed/ re-employed pensioner.

pensioners.

to the pensioners of UT Chandigarh on the pattern of Punjab State Government

This posting includes an audio/video/photo media file: Download Now

7th Pay Commission – Second meeting on Allowances on 01.09.2016

Posted: 29 Aug 2016 08:34 AM PDT

7th Pay Commission – Second meeting on Allowances on 01.09.2016

7th Pay Commission – Second meeting on Allowances on 01.09.2016 will be held at Room No. 72 North Block, New Delhi under the Chairmanship of Finance Secretary and Secretary (Expenditure) Committee will seek views of National Joint Council of Action (NJCA).

No.11-1/2016-ICGOVERNMENT OF INDIAMINISTRY OF FINANCEDepartment of Expenditure(Implementation Cell)

Room No.216, Hotel Ashok,Chankyapuri, New Delhi,Dated :22/23.08.2016

To

Shri Shiva Gopal Mishra

Secretary, National Council (Staff Side), JCM

13C, Feroz Shah Road,

New Delhi.

Subject:

Sir,I am directed to inform that the 2nd Meeting of the Committee on Allowances will be hedl on 01st September, 2016 at 3.00 PM in Room No.72, North Block, New Delhi under the Chairmanship of Finance Secretary & Secretary (Expenditure).2. I am further directed to inform that the Committee on Allowances has desired to meet the representatives of the National Joint Council of Action (NJCA) in the aforesaid meeting to obtain their views on the recommendations of 7th Central Pay Commission relating to allowances.3. You are, therefore, requested to attend the aforesaid meeting with their members of Standing Committee of National Council Staff Side (JCM). The names of the members attending the meeting may please be sent on or before 29th August, 2016 to the undersigned so that necessary arrangements can be made.Yours sincerely,sd/-(Abhay N.Sahay)Under Secretary (IC-7th CPC)

Source: AIRF

Click to read the Finance Ministry Letter

Clarification on Children Education Allowance (CEA) – Dopt orders on 22.8.2016

Posted: 29 Aug 2016 08:32 AM PDT

Clarification on Children Education Allowance (CEA) – Dopt orders on 22.8.2016No.A-27012/01/2015-Estt.(AL)Government of IndiaMinistry of Personnel, Public Grievances & PensionDepartment of Personnel & TrainingNew Delhi, dated 22nd August, 2016.OFFICE MEMORANDUMSubject: Children Education Allowance (CEA) – ClarificationThe undersigned is directed to refer to Department of Personnel & Training’s O.M. No.12011/ 03/ 2008-Estt.(Allowance) dated 2nd September, 2008 and subsequent clarifications issued from time to time on the subject mentioned above and to say that E-Receipts produced by Central Govt. employees as a proof of payment of fee, etc., may be treated as original and hence may be allowed for claiming reimbursement of CEA.2. This issues with the approval of Joint Secretary (Establishment).3. Hindi version will follow.sd/-(Mukul Ratra)DirectorAuthority: www.persmin.gov.in

This posting includes an audio/video/photo media file: Download Now

Consolidated guidelines issued by Dopt on Technical Resignation & Lien

Posted: 29 Aug 2016 08:30 AM PDT

Consolidated guidelines issued by Dopt on Technical Resignation & LienNo.28020/1/2010-Estt.(C)Government of IndiaMinistry of Personnel, Public Grievances & Pensions(Department of Personnel & Training)North Block, New DelhiDated 17th August, 2016OFFICE MEMORANDUMSubject: Technical Resignation & Lien- Consolidated guidelines.The undersigned is directed to refer to this Department’s OM of even number dated the 26th December, 2013 on the above subject and to say that guidelines/ instructions regarding Technical Resignation have been issued from time to time. It is now proposed to further consolidate these instructions, as the Department continues to receive frequent references on these issues.2.1 Technical Resignation2.1.1 As per the Ministry of Finance OM No. 3379-E.III (B)/65 dated the 17th June, 1965, the resignation is treated as a technical formality where a Government servant has applied through proper channel for a post in the same or some other Department, and is on selection, required to resign the previous post for administrative reasons. The resignation will be treated as technical resignation if these conditions are met, even if the Government servant has not mentioned the word “Technical” while submitting his resignation. The benefit of past service, if otherwise admissible under rules, may be given in such cases. Resignation in other cases including where competent authority has not allowed the Government servant to forward the application through proper channel will not be treated as a technical resignation and benefit of past service will not be admissible. Also, no question of benefit of a resignation being treated as a technical resignation arises in case of it being from a post held on ad hoc basis.2.1.2 This benefit is also admissible to Government servants who have applied before joining the Government service and on that account the application was not routed through proper channel. The benefit of past service is allowed in such cases subject to the fulfillment of the following conditions:(i) the Government servant should intimate the details of such application immediately on their joining;(ii) the Government servant at the time of resignation should specifically make a request, indicating that he is resigning to take up another appointment under the Government for which he applied before joining the Government service;(iii) the authority accepting the resignation should satisfy itself that had the employee been in service on the date of application for the post mentioned by the employee, his application would have been forwarded through proper channel.(DOPT’s O.M.No.13/24/92-Estt(Pay-1) dated 22.01.1993)2.2 Carry forward of Leave benefits(i) In terms of Rule 9(2) of the CCS (Leave) Rules, 1972, technical resignation shall not result in the lapse of leave to the credit of the Government servant. The balance of unutilized Child Care Leave(CCL) as well as all other leaves of the kind due &admissible will be carried forward.(ii) As per rule 39-D of the CCS(Leave) Rules,1972, in case of permanent absorption in PSUs/ Autonomous Bodies/ State Government etc., the Government servant shall be granted cash equivalent of leave salary in respect of EL & HPL at his credit subject to overall limit of 300 days.2.3 Carry forward of LTCEntitlement to LTC may be carried forward in case of a Central Government Servant who joins another post after having submitted Technical Resignation. In case of a Government Servant who resigns within 8 years of his appointment and joins another post in the Government after Technical Resignation, the Government Servant will be treated as a fresh recruit for a period of 8 years from the date of his initial appointment under Government. Thus if a Government Servant joins another Department after serving in Government for 4 years, he will be treated as a fresh recruit for 4 years in the new Department.2.4. Pay Protection, eligibility of past service for reckoning of the minimum period for grant of Annual IncrementIn cases of appointment of a Government servant to another post in Government on acceptance of technical resignation, the protection of pay is given in terms of the Ministry of Finance OM No. 3379-EMI (B)/65 dated the 17th June,1965 read with proviso to FR 22-B.Thus, if the pay fixed in the new post is less than his pay in the post he holds substantively, he will draw the presumptive pay of the pay he holds substantively into account for FR-9(24). 24). Past service rendered by such a Government servant is taken the minimum period for grant of annual increment in the new post/ se ice! cadre In Government under the provisions of FR 26 read with Rule 10 of CCS (RP) case the Government servant rejoins his earlier posts, he will be entitled to increments for the period of his absence from that post.2.5 GPF transferTransfer of GPF on technical resignation would be governed by Rule 35 of the General Provident Fund (Central Services) Rules, 1960.2.6 SeniorityOn technical resignation, seniority in the post held by the Government servant on substantive basis continues to be protected. However, in case of a Government servant deciding to rejoin his substantive post, the period spent in another department which he had joined after submitting his technical resignation will not count for minimum qualifying service for promotion in the higher post.2.7 Applicability of Pension SchemeIn cases where Government servants, who had originally joined government service prior to 01.01.2004, apply for posts in the same or other Departments and on selection they are asked to tender technical resignation, the past services are counted towards pension if the new post is in a pensionable establishment in terms of Rule 26(2) of the CCS(Pension) Rules, 1972. They will thus continue to be covered under the CCS(Pension) Rules, 1972 even if they join the new post after 1.1.2004.(Department of Pension & Pensioners Welfare’s O.M.No.28/30/2004-P&PW(B) dated 26.07.2005)2.8 New Pension SchemeIn case of `Technical Resignation’ of to their Personal Retirement Account (PRA) Pension System (NPS), the balance standing along-with their PRAN will be carried forward to the new office.2.9 Transfer of Service Book from parent Department to present Department.As per SR – 198, the Service Book is to be maintained for a Government servant from the date of his/her first appointment to Government service and it must be kept in the custody of the Head of Office in which he is serving and transferred with him from office to office.2.10 Need for Medical examination.In cases where a person has already been examined by a Medical Board in respect of his previous appointment and if standard of medical examination prescribed for the new post is the same, then he need not be required to undergo a fresh examination.2.11 Verification of Character & AntecedentsIn the case of a person who was originally employed in an office of the Central Government, if the period intervening between date of discharge from his previous office and the date of securing a new appointment, is less than a year, it would be sufficient if the appointing authority, before making the appointment, satisfies itself by a reference to the office in which the candidate was previously employed that (a) that office have verified his character and antecedents; and (b) his conduct while in the employ in that office did not render him unsuitable for employment under Government. If however, more than a year has lapsed after the discharge of the person from his previous office, verification should be carried out in full/afresh, in accordance with O.M.No.18011/9(s)/78-Estt(B) dated 2nd July, 1982.3.1 Lien3.1.1 Lien is defined in FR 9(13). It represents the right of a Government employee to hold a regular post, whether permanent or temporary, either immediately or on the termination of the period of absence. The ,. benefit of having a lien in a post/service/cadre is enjoyed by all employees who are confirmed in the post/service/cadre of entry or who have been promoted to a higher post, declared as having completed the probation where it is prescribed. It is also available to those who have been promoted on regular basis to a higher post where no probation is prescribed under the rules, as. the case may be.3.1.2 The above right will, however, be subject to the condition that the junior-most person in the cadre will be liable to be reVerted to the lower post/service/cadre if at any time the number of persons so entitled is more than the posts available in that cadre/ service.(DOPT’s O.M.No.18011/1/86-Estt (D) dated 28.03.1998)3.2 Lien on a postA Government servant who has acquired a lien on a post retains a lien on that post-(a) while performing the duties of that post;(b) while on foreign service, or holding a temporary post or officiating in another post;(c) during joining time on transfer to another post; unless he is transferred substantively to a post on lower pay, in which case his lien is transferred to the new post from the date on which he is relieved of his duties in the old post;(d) while on leave; and(e) while under: suspension.A Government servant on acquiring a lien on a post will cease to hold any lien previously acquired on any other post.3.3 Retention of lien for appointment in another central government office/ State Government(i) A permanent Government servant appointed in another Central Government Department/Office/ State Government, has to resign from his parent department unless he reverts; to that department within a period of 2 years, or 3 years in exceptional cases; An undertaking to abide by this condition may be taken from him at the time of forwarding Of his application to other departments/offices.(ii) The exceptional cases may be when the Government servant is not confirmed in the department/office where he has joined within a period of 2 years. In such cases he may be permitted to retain the lien in the parent department/ office for one more year. While granting such permission, a fresh undertaking similar to the one indicated above may be taken from the employee.(iii) Timely action should be taken to ensure extension/ reversion/ resignation of the employees to their parent cadres on completion of the prescribed period of 2/3 years. In cases, where employees do not respond to instructions, suitable action should be initiated against them for violating the agreement/ undertaking given by them as per (i) and (ii) above and for termination of their lien. Adequate opportunity may, however, be given to the officer prior to such consideration.(iv) Temporary Government servants will be required to severe connections with the Government in case of their selection for outside posts. No lien will be retained in such cases.(DOPT O.M.No.8/4/70-Estt(C) dated 06.03.1974)3.4 Termination of Lien3.4.1 A Government servant’s lien on a post may in no circumstances be terminated even with his consent if the result will be to leave him without a lien upon a permanent post. Unless his lien is transferred, a Government servant holding substantively a permanent post retains lien on that post. It will not be correct to deny a Government servant lien to a post he was holding substantively on the plea that he had not requested for retention of lien while submitting his Technical Resignation, or to relieve such a Government servant with a condition on that no lien will be retained.3.4.2 A Government employee’s lien on a post shall stand terminated on his acquiring a lien on a permanent post (whether under the Central Government or a State Government) outside the cadre on which he is borne.3.4.3 No lien shall be retained:a. where a Government servant has proceeded on immediate absorption basis to a post or service outside his service/ cadre/ post in the Government from the date of absorption; andb. on foreign service/ deputation beyond the maximum limit admissible under the orders of the Government issued from time to time.(Notification No.28020/1/96-Estt(C) dated 09.02.1998)3.5 Transfer of LienThe lien of a Government servant, who is not performing the duties of the post to which the lien pertains, can be transferred to another post in the same cadre subject to the provisions of Fundamental Rule 15.(Notification No.28020/1/96-Estt(C) dated 09.02.1998)3.6 Joining Time, Joining Time Pay &Travelling AllowanceProvisions relating to joining time are as follows:3.6.1 For appointment to posts under the Central Government on results of a competition and/or interview open to Government servants and others, Central Government employees and permanent/ provisionally permanent State Government employees will be entitled to joining time under the CCS(Joining Time) Rules,1979. Joining time will be included as qualifying service in the new job.3.6.2 A Government servant on joining time shall be regarded as on duty during that period and shall be entitled to be paid joining time pay equal to the pay which was drawn before relinquishment of charge in the old post. He will also be entitled to Dearness Allowance, if any, appropriate to the joining time pay. In addition, he can also draw compensatory allowances like House Rent Allowance as applicable to the old station from which he was transferred. He shall not be allowed Conveyance Allowance or permanent Travelling Allowance.3.6.3 For appointments to posts under the Central Government on the basis of results of a Competition and / or interview open to Government servants and others, Central Government employees and permanent/ provisionally permanent State Government employees shall be entitled to Transfer Travelling Allowance(TTA). However, temporary Central Government employees with less than 3 years of regular continuous service would not be entitled for TTA, as they are not entitled joining time pay under Joining Time Rules.4. All Ministries/ Departments are requested to bring the instructions/ guidelines to the notice of all concerned.sd/-(Slukesh Chaturvedi)Director (Estt.)Source: www.persmin.nic.in

This posting includes an audio/video/photo media file: Download Now

7th CPC Arrears included in August 2016 salary as a separate component – Railway Board Order

Posted: 29 Aug 2016 08:28 AM PDT

7th CPC Arrears included in August 2016 salary as a separate component – Railway Board Order“Arrears payable as per 7th CPC will be calculated by the system and the same will be included in August 2016 salary, as a separate component.”GOVERNMENT OF INDIAMINISTRY OF RAILWAYSRAILWAY BOARDRBA No. 51/2016No. 2016/AC-H(CC)/IPAS/37/7 (Zonal Railways)3rd August, 2016General Manager,All Zonal Railways and Production UnitsSub:- Pay Commission -Pay Fixation-IPASRailway Board has issued a notification regarding the modalities of pay fixation arising out of Government’s acceptance of 7th CPC recommendations. It is presumed that all the Zonal Railways are in the state of preparedness for implementing these recommendations, as notified by Railway Board. Now that IPAS has been implemented in all the Zonal Railways (except Metro Railway, Kolkata), pay fixation and generation of pay bills and payment of arrears will also be done through IPAS Pay Commission Dte has issued separate instructions on the subject vide Railway Board’s orders 93/2016 and 94/ 2016 which includes the statement of fixation. These instructions are to be read along with the notification of Railway Service (Revised Pay) rules, 2016.a) CRIS has already started the modification of IPAS and the system is expected to be in place by 4th August, 2016;b) There will be a window in IPAS to carry out the 7tlrl CPC activities which includes special categories viz., ASMs, TTES, Traffic Assistant/ Metro, Dieticians and Perfusionists, etc where upgradation of pay has been granted; Concerned Accounts Staff of Estt. Gaz Section in case of Gazetted establishments and Bill Clerk in Personnel Branch in case of NoniGazetted Staff can generate Draft pay fixation statement and confirm the same on IPAS after necessary check and verification;c) The above processes shall be completed in all respect by 15th August, 2016 without fail;d) Salary Bills for the month of August’2016 shall be generated from IPAS as per the revised pay as per 7th CPC recommendations, after necessary checks and verifications;e) All the allowances will be worked out in IPAS on the basis of pay drawn as per 6th CPC;f) The arrears payable as per 7th CPC will be calculated by the system and the same will be included in August 2016 salary, as a separate component.g) All statutory recoveries via, Income Tax, etc and other recoveries via, PF, NPS, advances recoveries, etc will be done at source as per the usual practice;h) As already mentioned the system of pro-check is dispensed with for this payment in August’2016. However all the pay fixation statement should be sent to associate Accounts Office for vetting within a span of two months.i) Accounts Department shall check (post audit) this statement within 3 months. If some changes are required then, the same can be returned to the concerned Clerks for rectification.j) Accounts Personnel and other Bill preparing Officers shall make an advance plan for finally completing this work by 31.10.2016, as per instructions.k) Any over payment/ under payment has to be adjusted in subsequent salary bill;l) Once this process is completed then the system will save the revised pay data for future use, while retaining the pay data as per 6th CPC also in a separate table for calculation of allowances till further notification of GOI in this regard.m) Fixation statement duly sanctioned by the Bill Preparing authority and vetted by Accounts Department shall be filed properly in the Service Records of the concerned Officer/ Staff;2. As regards to the Production Units and Metro Railway where IPAS has not been implemented, the above process may be carried out using their in-house software itself and ensure the compliance of Railway Board’s instructions.3. The above instructions may be scrupulously followed.sd/-(B.B. Verma)Advisor / Accounts

Posted: 29 Aug 2016 08:27 AM PDT

Clarification on admissibility of Transport Allowance in the cases where the officers are drawing Grade Pay of Rs. 10,000/- in PB-4 - regardingGovernment of IndiaMinistry of FinanceDepartment or ExpenditureNew Delhi, 19th August, 2016OFFICE MEMORANDUMSubject : Clarification on admissibility of Transport Allowance in the cases where the officers are drawing Grade Pay of Rs. 10,000/- in PB-4 — regarding.Reference is invited to this Department’s Office Memorandum No.21 (2)/2008- E.II(B) dated 29.08 2008. Para ‘3 ot the stipulates that Officers drawing Grade Pay of Rs.10, OOO/- & above and those in the Scale. who are entitled to the use of official car in terms of Department of Expenditure (DOE) ON. NO. dated 28.01.1994. shall be given the option to avail themselves of the existing facility or to draw the Transport Allowance at the rate of Rs.7,000/- p.m. plus Dearness Allowance thereon2. Several references have been received in this Department seeking clarification on the admissibility of Transport Allowance to officers drawing Grade Pay Rs. 10000/- under Dynamic ACP Scheme or NFU Scheme, A few cases have also been filed in the Courts in this regard. Hon’ble Central’ Administrative (CAT), Principal Bench, New Delhi, in Order dated 13.05.2014 in O.A. No.4062/2013 filed by Shri Radhacharan Shakiya & Others VIS union Of India & Others, held that the Applicants were not entitled 10 draw Transport Allowance @ Rs.7,000/. p.m. plus DA thereon. The said order of the Tribunal has also been upheld by Hon’ble High Court of Delhi in their Order dated 03.09.2014 passed in writ petition (Civil) NO. 3445/2014, filed by Shri Radhacharan Shakiya & Others.3.Accordingly. it is clarified that the officers, who are entitled for the use of official car for commuting between residence to Office and back, in terms of DOE’s 0M 20(5)E-II(A)/93 dated 28-01-1994, are not eligible to opt for drawal of Transport Allowance @ Rs.7000/- p.m. + DA thereon, in terms of DOE’s O.M, No.21(2)/2008-E.II(B) dated 29.08 2008, even though they are drawing Grade pay of Rs. 10,000/- in PB-4 under Dynamic ACP Scheme or under the scheme of Non Functional Upgradation (NFU).4. Hindi version is attached.(Nirmala Dev)Deputy Secretary to the Govt. of IndiaAuthority: www.persmin.gov.in

This posting includes an audio/video/photo media file: Download Now

Central Secretariat employees seek pay parity

Posted: 29 Aug 2016 08:25 AM PDT

Central Secretariat employees seek pay parityPress Information BureauGovernment of IndiaMinistry of Personnel, Public Grievances & Pensions18-August-2016 17:07 ISTCentral Secretariat employees seek pay parityA delegation of the Central Secretariat Stenographers’ Service (CSSS) Association, called on the Union Minister of State (Independent Charge) for Development of North Eastern Region (DoNER), MoS PMO, Personnel, Public Grievances, Pensions, Atomic Energy and Space, Dr Jitendra Singh here today and sought his intervention for parity in pay fixation and related issues.The delegation led by Shri Raj Kishore Singh submitted a memorandum listing details of their long pending issues and suggesting options to resolve the same. According to the memorandum, while applying Rule 8 of CCS (RP) Rules 2008, the pay of direct recruits and new entrants is fixed at higher stage, when compared to the existing employees who were promoted in the same grade. This leads to discrimination in the fixation of pay of Personal Assistants of one category vis-à-vis the other category.The memorandum also stated that the issue has been lingering on in the National Anomaly Committee for the last four years, but it has not been addressed. It pleaded that the mechanism of grant of “stepping up” to certain employees should be provided only in exceptional cases and not resorted to as a routine matter to sort out discrepancies which may affect a large number of employees.Members of the delegation suggested that their issue can be addressed by incorporating a new provision in the Rules wherein if a promotee’s pay is getting fixed at a stage lower than that of a direct recruit, then the pay of the promotee should be fixed at the same stage as that of a direct recruit / new entrant. The other option suggested by them was to amend the CCS (RP) Rules so as to appropriately fix the pay in the Pay Band for a particular post carrying a specific Grade Pay.Dr Jitendra Singh gave a sympathetic hearing to the members of delegation and assured them that DoPT will try to sort out their issue to the maximum extent possible.

gr bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 5 Sep 2016 6:20 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

- Country wide general strike on 2nd September - Confederation

- Railway Board orders on entitlement of Pass/PTOs after implementation 7th CPC

- 10 lakhs Central Government employees are participated in today’s nationwide general strike – Confederation

- 7th Pay Commission Expected HRA Calculator 2016

|

Country wide general strike on 2nd September - Confederation Posted: 04 Sep 2016 08:13 PM PDT

Country wide general strike on 2nd September - Confederation

2nd September 2016 General Strike

Reflection of Workers’ Anger

Hemalata

The country wide general strike on 2nd September this year was even bigger and more widespread than that held on the same day last year, as initial reports from all over the country suggest. The country wide general strike this year too was held on the same 12 point charter of demands. The central trade unions claimed a participation of 15 crore workers in the strike last year. The impact of the strike this year was so huge that even before the trade unions made any claims, the electronic media reported that 18 crore workers participated in the strike.

This gives big rebuff to the claims made by the government that it was working for the benefit of the workers and for providing them social security benefits. It is also significant that the BMS, which withdrew from the strike in the last minute in 2015, did not join the strike call this year at all. Besides, the BJP led government used everything within its capacity to create confusion among the workers and sabotage the strike. The BMS became a willing ally of the government in these efforts, declaring that it was ‘withdrawing’ from a strike that it has never called, but also claiming ‘historic victory’ for the workers. All these were nothing but manoeuvres by the BJP and the BMS, both members of the same parivar headed by the RSS to deceive the workers in their efforts to serve their corporate masters. The corporate media, particularly the electronic media, as usual, aired these false claims and added their might to the misinformation campaign.

But the working class of the country refused to be deceived. As the reports show, despite the call of the BMS leadership to organise ‘victory rallies and meetings’, BMS members were not willing to oppose the strike. In fact, in several places they joined the strike. Workers who were not organised into any unions, who joined the strike last year, as in Pune industrial area, joined the strike this time too. In several places the strike spread to newer areas encompassing newer sections of workers. In many states, not only the states that are traditional strongholds of trade unions, but in many others, the strike turned into a bandh. This was mainly due to the massive participation of the road transport workers as a result of which life in these states came to a standstill. In many districts of Assam, Bihar, Haryana, Jharkhand, Karnataka, Madhya Pradesh, Odisha, Punjab wore a bandh like look. Despite the attempts by the TMC government in West Bengal to suppress the strike by issuing warnings and threats to the workers, state transport buses in the state plied empty and a bandh like situation prevailed in almost all the districts. In Kerala and Tripura, as always, strike turned into a bandh.

The anger of the workers against the policies of the government was visible in many ways. Around 70000 anganwadi employees and ASHAs, most of them who were not members of any union joined the strike in Gujarat. Thousands of them participated in the demonstrations held at the district headquarters in many districts. All the workers in the minor ports of Bhavnagar in Gujarat, Gangavaram and Kakinada in Andhra Pradesh joined the strike. These workers are not members of any of the central trade unions that called the strike. Similarly in many industrial clusters across the country, thousands of workers, who are not members of any union, joined the strike.

While there were a few areas like the port sector where the strike was not as good as the last time, and a few districts where the strike in the road transport sector was not as effective as last year, overall the strike was observed in many more industrial clusters and sectors and many newer sections of workers joined it.

It was not only the misinformation and misleading campaign of the government with its huge advertisements in the media aided and abetted by the BMS that the workers confronted. In several states they were subjected to victimisation, police repression and physical attacks. In Haryana 22 leaders of road transport workers’ union were arrested and the striking workers were lathi charged; police went to the residential areas where contract workers lived and coerced them to join duties. Several coal workers in Jharkhand were suspended for joining the strike. The police conducted a flag march to intimidate workers and also lathi charged workers standing peacefully near a theatre in Noida. In West Bengal CITU leader and former MP Suraj Pathak and many CITU leaders were arrested. TMC goons attacked the workers and their supporters, including women, participating in the rallies. Around 5000 workers were arrested in different parts of Assam.

The extent of the strike and the support it received could be gauged from the reports that were available till the evening of 2nd September though comprehensive reports from all the states and sectors are yet to come. In several states local state level unions joined the strike. In Telangana, the TRS affiliated union joined the strike; the TNTUC belonging to the ruling TDP in Andhra Pradesh supported the strike in Telangana. Even in Vijayawada in Andhra Pradesh, though TNTUC opposed the strike, workers belonging to it joined the strike. In Odisha the chief minister himself expressed his support to the strike when the trade union leaders met him. The Left parties openly supported the strike. Even while the BMS was not part of the strike and BMS leadership directed its members to observe ‘victory rallies’, local units of the BMS were not in a position to oppose the strike; in several states BMS members joined the strike.

Overwhelming majority of bank and insurance employees all over the country joined the strike. State government employees in most of the states joined the strike. Particularly noteworthy is the participation of state government employees in the north eastern states including Arunachal Pradesh, Manipur, Mizoram, Nagaland, Meghalaya etc who participated in the strike for the first time. Participation of central government employees – of the income tax employees, postal employees in particular was massive. Defence employees in several defence production units joined the strike. BSNL employees all over the country joined the strike. The strike was near total in the coal sector. Overwhelming majority of contract workers in the public sector participated in the strike. Strike among medical and sales representatives was total in almost all the states.

Scheme workers including anganwadi employees, ASHAs, midday meal workers participated in the strike all over the country. Teaching and non teaching staff of National Child Labour Project joined the strike in Bihar, Maharashtra etc. Traditional sector workers like the plantation workers, cashew, coir, and fisheries workers participated in the strike in their lakhs. Unorganised workers in beedi, construction, head load workers, auto and rickshaw drivers, street vendors, domestic workers in several states joined the strike and also participated in the demonstrations, rasta roko and rail roko. Municipal and conservancy workers, panchayat workers, village chowkidars etc also joined the strike.

In Andhra Pradesh, strike was total in Vizag steel and DCI; around 70% of workers of permanent workers in the Vizag Shipyard participated in the strike. The TTD in the holy town of Tirupati was totally paralysed. Autos all over the state went on strike. Almost all the industrial clusters including the Renigunta industrial area were closed down. In several major cities truck owners associations participated in the strike. This along with the strike of the head load workers throughout the state brought all commercial transactions in the state to a standstill.

In Assam strike took the form of complete bandh in almost all districts seriously affecting public and private transport. No oil refinery in the state functioned. ONGC remained paralysed. More than 15 lakhs tea garden workers joined the strike. All public and private educational institutions remained closed. Railway transport was disrupted due to the rail roko by the unorganised workers, peasants, agricultural workers etc.

In Bihar too the strike was turned into bandh in many districts. Road transport including bus and tempo services was off the road. Workers in several industrial clusters went on strike.

Workers in almost all the major industrial areas in NCR Delh joined the strike. Massive joint demonstrations were held in several centres. The central demonstration was addressed by the national trade union leaders.

In Gujarat, an estimated 4 lakhs workers in 22 districts joined the strike and organised demonstrations in many districts.

Strike was highly successful in Haryana including in the Gurgaon, Manesar industrial areas. Workers in the Manesar plant of Maruti Suzuki, Honda, Hero Honda and other industrial units joined the strike and held demonstrations.

Demonstrations were held in Jammu region in support of the strike while Kashmir region continues to be under curfew. Thousands of workers from different sectors participated in the demonstrations.

In Jharkhand strike was observed in industrial areas including in Jamshedpur that never participated in any strike till now. It was reported to be more massive than the strike in 2015.

An estimated 50 lakhs workers participated in the strike in Karnataka. Strike was total in the road transport sector and in all the major industries in Bengaluru and Mysore. 19 lakhs workers in the industrial clusters of Bengaluru joined the strike. Strike was total in both the units of Mico, L&T, Chenna metals, Toyota, ITC, Vikrant Tyres etc. In BEL in Bengaluru, the union affiliated to INTUC did not join the strike; despite this 80% of workers, 800 out of the total 1073 workers, more than the membership of the CITU affiliated union, joined the strike.

The strike in transport sector in several cities and towns in Madhya Pradesh was total. Hamalis of agricultural mandis also participated affecting commercial transactions.

Strike was total in many private industrial areas in Maharashtra including the Pune, Aurangabad, Nagpur, Nasik, Mumbai, Solapur etc. Major industries like Ceat Ltd, Thysun Crupp, Sansonite India, Crompton Grieves, beer manufacturing units, pharma industries, liquor and textile industries were closed. Strike was total among beedi and power loom workers in Solapur.

Strike created a bandh like situation in Odisha. It was total among iron ore, manganese and coal mines workers and near total among the contract workers. Road transport including autos was totally paralysed.

Strike evoked massive response in Punjab with workers. Road transport was paralysed and industrial clusters remaining closed. Unorganised workers participated in the demonstrations in thousands.

The garment industry in Tiruppur in Tamil Nadu witnessed total strike. Strike was also effective in the Coimbatore industrial area. It was total in Ashok Leyland, Ennore Foundries, Simpson Group of companies and all three factories of TI Group in Chennai. Workers in BHEL Trichy and Ranipet, ordinance factory in Nilgiris, defence production units in Avadi and Aravangadu were totally in strike. In Aravangadu, BMS members also joined the strike. Contract workers in Manali industrial belt MFL, ATC Tyres in Tirunelveli and TCL Lancer, in L&T, in Tyre machinery making Honey Well company went on strike.

There was bandh like situation in the state due to the total participation of road transport workers in the strike in Telangana. There was total strike in most of the public sector undertakings in the state. Strike was also total in most of the industrial clusters in and around Hyderabad. On the whole the strike was reported to be even more successful than last year.

Strike was total in Udhampur industrial area of Uttarakhand and partial in that in Haridwar. It was also total in public road transport in the state but partial in private road transport.

In West Bengal, bandh like situation prevailed in many districts despite the threats and intimidation of the TMC government and its goons. Government ran buses without passengers in the morning but was compelled to withdraw later. Jute mills were closed. Commercial activities were nominal. Educational institutions in several districts were closed. Most of the tea gardens remained closed.

This strike, the seventeenth joint country wide general strike after the advent of neoliberal policies in the country, was preceded by joint campaign that was better organised and taken up to the block and in some states lower level to reach the workers. In addition, CITU prepared campaign material to make the workers aware of the issues and their relationship to the government policies. Booklets exposing government claims were also published which were translated into local languages. During the strike the lower level committees were regularly up dated with information exposing government claims. This has helped in preventing the workers from succumbing to the confusion sought to be created by the government and the BMS.

This country wide general strike will definitely be a mile stone in the working class struggles of the country.

Source: Confederation

Revision of provisions regulating pension/gratuity/commutation of pension/family pension/disability pension/ex-gratia lump-sum-compensation Central Trade Unions reiterate countrywide General Strike on 2nd September 2016 - Press Statement |

|

Railway Board orders on entitlement of Pass/PTOs after implementation 7th CPC Posted: 04 Sep 2016 08:07 PM PDT

Railway Board orders on entitlement of Pass/PTOs after implementation 7th CPC

Government of India

Ministry of Railways

(Railway Board)

No. E(W)2016/PS5-1/8

New Delhi, dated 31.08.2016

The General Managers (P)

All Indian Railways &

Production Units.

Sub:Regulation of entitlement of Passes & PTOs till issue of orders on the basis of Railway Services (Revised Pay) Rules, 2016.

Ref: Board’s letters No.E(W)2008/PS5-l/38 dated 06.01.2011 & 03.02.2011.

Revised pay limits for entitlement of Passes & PTOs as well as travel entitlements linked with the Grade Pay were introduced vide Board’s above reffered letters, consequent to implementation of 6th Central Pay Commission’s recommendations.

2. Pursuant to the notification of Railway Services (Revised Pay) Rules, 2016, Railway servants shall draw pay in the Revised pay structure in the Level applicable to the post to which appointed, and the Grade Pay component has been done away with. The issue regarding linking of the Level of posts for pass entitlement on the revised pay structure is under consideration. Hence, till further orders, Grade Pay in the pre-revised scales i.e. 6th Central Pay Commission’s scale shall continue to be the basis for gradation and related entitlement on all kinds of Passes as well as PTOs.

3. In respect of persons appointed to different posts on or after 01.01.2016, the notional Grade Pay which they would have drawn in the pre-revised pay structure should be taken into account for fixing their pass entitlement.

4. This issues with the concurrence of the Finance Directorate of the Ministry of Railways.

sd-

(V. Muralidharan)

Dy. Director Estt. (Welfare)-I

Railway Board

Source: AIRF

Revision of provisions regulating pension/gratuity/commutation of pension/family pension/disability pension/ex-gratia lump-sum-compensation Central Trade Unions reiterate countrywide General Strike on 2nd September 2016 - Press Statement |

|

Posted: 04 Sep 2016 08:05 PM PDT

10 lakhs Central Government employees are participated in today’s nationwide general strike – Confederation

PRESS STATEMENT

Dated 2nd September 2016

The initial report received at the Confederation Central Head Quarters indicate the participation of about ten lakhs Central Government employees in today’s nationwide general strike action of the Indian Working Class. Earlier, endorsing the call of the Central Trade Unions, the Confederation of Central Government employees and workers had called upon the Central Government employees to take part in the one-day strike to compel the Government to withdraw the anti-people and anti-labour neo-liberal policies pursued by the Central Government.

Offices of the Postal, Income Tax, Ground Water Board, Survey of India, Geological Survey of India, Printing and Stationery department, Botanical Survey of India, Indian Bureau of Mines, RMS offices, census department, Indian Space Research organization, Central Government Health Scheme, Atomic Energy, Medical Stores depots, Film Institute of India, AGMARK, Indian Council for Medical Research, Film division and various other autonomous scientific and research institutions etc. remained closed and the work completely paralysed.

The strike also affected the functioning of various offices of Indian Audit & Accounts department, Civil Accounts, Central Excise and Customs, CPWD etc. Total civilian employees of various Defence organisations and Defence Accounts Departments participated in the strike. The Strike was total in Kerala, West Bengal, Tamilnadu, Andhra, Telangana, Jharkhand, Chattisgarh, Odisha, Assam, North Eastern states, Karnataka, Maharashtra, Punjab, Madhya Pradesh and 70 to 80% in other states.

The Central Government employees were particularly unhappy over the totally negative attitude of the NDA Government towards their demands while implementing 7th Central Pay Commission recommendations. Ban on creation of new posts, non-filling up of about six lakhs vacant posts, introduction of New Contributory Pension Scheme, non-regularisation of Gramin Dak Sevaks and casual, contract workers, ceiling on compassionate appointments, rejection of the demand for increase in the minimum wage and fitment formula, reduction in the percentage of House Rent Allowance, abolition of 52 allowances etc. are some of the retrograde measures taken by the Central Government.

The Confederation National Secretariat Congratulates the Central Government employees, who undertook intensive campaign to make the strike a grand success. The Confederation salutes all its members for their whole hearted participation in the strike and making it an unprecedented success.

M. Krishnan

Secretary General

Source: Confederation

RECENT POSTS Revision of provisions regulating pension/gratuity/commutation of pension/family pension/disability pension/ex-gratia lump-sum-compensation Central Trade Unions reiterate countrywide General Strike on 2nd September 2016 - Press Statement |

|

7th Pay Commission Expected HRA Calculator 2016 Posted: 04 Sep 2016 08:03 PM PDT

7th Pay Commission Expected HRA Calculator 2016

7th Central Pay Commission has recommended to reduce the percentage of House Rent Allowance. Since the CG Employees didn’t expect this development, they showed their resentment through agitations. Federation raised this issue in all negotiating forums before the Govt.

Seeing the resentment over Allowances including HRA, the Central Government agreed to constitute a High Level committee to examine the Allowances. Accordingly, FM revealed in the Parliament that the Committee has been constituted on 22.07.2016 and the first meeting of the Committee has been held on 04.08.2016. And the Committee has been asked to submit its report within four months.

It is said that there are possibilities to recommend two types of increase in respect of HRA. A simple calculator is prepared for CG Staff to know the amount of increase in HRA as per these two proposal.

The proposed HRA rates mentioned here is not Final and not approved. It is an assumption. The Final Decision on HRA will be taken by Govt after the Committee submits its report.

RECENT POSTS Revision of provisions regulating pension/gratuity/commutation of pension/family pension/disability pension/ex-gratia lump-sum-compensation Central Trade Unions reiterate countrywide General Strike on 2nd September 2016 - Press Statement |

gr bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 6 Sep 2016 6:18 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

|

Posted: 05 Sep 2016 11:29 PM PDT

Revision of pay-scale of Data Entry Operator in Defence Accounts Department - implantation of Supreme court judgement

Office of the Controller General of Defence Accounts,

Ulan Batar Road, Palam, Delhi Cantt-110010

No. EDP/113/II(PC)/Vol-18

Dated 01-09-2016

Circular

To

All PCsDA/ CsDA/ PCof A( Fys) / CF&A( Fys) / PI FA/ IFA

Subject: Revision of pay-scale of Data Entry Operator in Defence Accounts Department. - implantation of Supreme court judgement.

Reference: This qus letter no. EDP/113/II(PC)/VoI-13 dated 04-01-2005

1. The Hon’ble Supreme Court vide its Judgement Dated 09.12.2014 against Civil Appeals No. 10862 to 10867 of 2014 has given the final verdict that "‘Data Entry Operators Grade-A are not entitled for scale of pay of Rs 1350-2200 w.e.f. 01.01.1986 or thereafter merely on the basis of their qualifications or for the fact that they have completed their period of requisite service.

2. They further hold that any decision rendered by any Tribunal or any High Court contrary to their decision is wrong.

3. Accordingly, the matter was taken up with the Ministry of Defence(Finance), Government of India and MOD(F) vide their ID No. 1418/C/16 dated 13.06.2016 has directed CGDA for the implementation of Hon’ble Supreme Court Judgment dated 09-12-2014. (copy attached).

4. 'It is therefore, enjoined upon all Principal Controllers/Controllers:

to implement the said Supreme Court verdict and re-fix the pay of all DEOs who have earlier been granted the pay parity based on interim order of Mumbai High Court against an undertaking from the DEOs concerned as per this wing letter no. EDP/113/II(PC)/Vol-13 dated 04-01-2005.

to initiate recovery action of the overpayments made till date. However, to avoid the financial hardship to the affected DEOs, overpayment, thus calculated, may be recovered as per extant orders of Govt. of India.

A monthly report regarding details of overpayment, recovery effected, progressive balance, is to be conveyed to HQrs till liquidation of the demand.

Jt.CGDA (IT&S) has seen.

(Kavita Garg)

SrDy.CGDA(IT&S) |

This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from CENTRAL GOVERNMENT EMPLOYEES NEWS. |

To stop receiving these emails, you may unsubscribe now. |

| Email delivery powered by Google |

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 7 September 2016 18:28:27 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

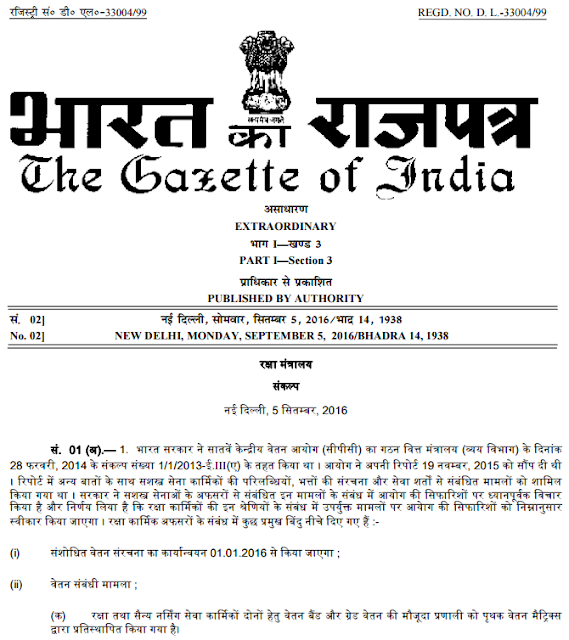

- Implementation of Recommendations of 7th CPC- Issue of Resolution in respect of Armed Forces Personnel - (PBORs)

- Implementation of Recommendations of 7th CPC- Issue of Resolution in respect of Armed Forces Personnel - (Officers)

- Change of date of holiday on account of Bakrid for all Central Government offices – Dopt

- Disbursement of salary and pension to Central Government employees and pensioners on account of “ONAM” Festival

- DA from July 2016 will be 3% - NC JCM Secretary writes to Finance Secretary

Posted: 07 Sep 2016 05:38 AM PDT

Implementation of Recommendations of 7th CPC- Issue of Resolution in respect of Armed Forces Personnel - (PBORs)

Authrity: http://www.mod.nic.in/

This posting includes an audio/video/photo media file: Download Now

Posted: 07 Sep 2016 05:35 AM PDT

Implementation of Recommendations of 7th CPC- Issue of Resolution in respect of Armed Forces Personnel - (Officers)

Authority: http://www.mod.nic.in/

This posting includes an audio/video/photo media file: Download Now

Change of date of holiday on account of Bakrid for all Central Government offices – Dopt

Posted: 07 Sep 2016 03:23 AM PDT

Change of date of holiday on account of Bakrid for all Central Government offices – Dopt

Change of date of holiday on account of Id-ul-Zuha (Bakrid) during 2016 for all Central Government administrative offices located at Delhi / New Delhi.

F.N0.12/11/2016-JCA2Government of IndiaMinistry of Personnel Public Grievances and PensionsDepartment of Personnel and Training

North Block, New DelhiDated the 6th September, 2016OFFICE MEMORANDUM

Sub: Change of date of holiday on account of Id-ul-Zuha (Bakrid) during 2016 for all Central Government administrative offices located at Delhi / New Delhi.As per list of holidays circulated vide this Ministry’s 0.M.No.12/ 7/2015-JCA-2 dated the 11th June, 2015, the holiday on account of Id-ul-Zuha (Bakrid) falls on Monday the 12h September, 2016. It has been brought to notice of this Ministry that in Delhi Id-ul- Zuha (Bakrid) will be celebrated on 13th September, 2016. Accordingly, it has been decided to shift the Id-ul-Zuha (Bakrid) holiday to 13th September, 2016 in place of 12th September, 2016 as notified earlier, for all Central Government administrative offices at Delhi / New Delhi.2. For Offices outside Delhi / New Delhi the Employees Coordination Committees or Head of Offices (where such Committees are not functioning) can decide the date depending upon the decision of the concerned State Government.

sd/-

Click to view the order

Posted: 07 Sep 2016 03:21 AM PDT

Disbursement of salary and pension to Central Government employees and pensioners on account of “ONAM” FestivalDisbursement of salary to Central Government employees working in the State of Kerala on 9th September 2016 on account of “ONAM” FestivalRef: D-16/2016Dated: 23-08-2016The Controller Galeral of Accounts,Ministry ot Finance, Department of Expenditure,Nayak Bhawan, Khan Market,New Delhi – 110 003Dear Sir,Sub:- Disbursement of Salary to Central Government employees working in the State of Kerala on 9th September 2016 on account Of “ONAM” Festival.ONAM is the State Festival of Kerala. The Festival commences on 5th September 2016 and culminates cn 14-09-2016. This is also a social festival and is celebrated by one and all. It had been the normal practice to draw and disburse the salary and pension of the employees and pensioners in the month in which the festival falls well prior to the commencement of the festival.We shall be grateful if orders are issued to all Departments to disburse the salary and pension for the month of September, 2016 by September 2016 in respect of all employees and pensioners in the State of Kerala. A copy of the order issued by your office on 10-08-2015 in this mater is enclosed for ready reference.Thanking you,Yours faithfully,(M.Krishnan)Secretary GeneralSource: Confederation

RECENT POSTS

DA from July 2016 will be 3% - NC JCM Secretary writes to Finance Secretary

DA from July 2016 will be 3% - NC JCM Secretary writes to Finance Secretary

Posted: 06 Sep 2016 08:05 AM PDT

DA from July 2016 will be 3% - NC JCM Secretary writes to Finance SecretaryFuture computation of Dearness Allowance and adoption base index figure to Revised Minimum Wage – Regarding“The next instalment of DA, which has become due as on 1.07.2016 if computed on the above basis of 260.46, shall work out to 3.28%. On ignoring the faction, the DA with effect from 01.07.2016 shall be 3%. We, request you to kindly take the above into account and issue orders for grant of 3% DA w.e.f. 01.07.2016.”Shiva Gopal MishraSecretaryPh:23382286National council (Staff Side)

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 8 September 2016 18:17:51 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

- Central Government employees getting restive over several issues – Com. S.G. Mishra

- Revision of pay of employees stagnating at the maximum of the Pay Band and Grade Pay or scale in pre-revised structure

- Bunching of stages in 7th CPC revised pay structure under CCS (RP) Rules, 2016

- Dr Jitendra Singh to inaugurate the Central Government Workshop on e-Office tomorrow

- 7th CPC Defence Resolution : Government Decision on 7th CPC Recommendations

Central Government employees getting restive over several issues – Com. S.G. Mishra

Posted: 07 Sep 2016 10:48 AM PDT

Central Government employees getting restive over several issues – Com. S.G. MishraDespite the largesse it gave to its 48 lakh employees and 55 lakh pensioners, at an estimated cost of Rs. 1.02 lakh crore with 23.55 per cent hike in pay and allowances, the 7th Pay Commission continues to be a source of an irritant for the Narendra Modi government as issues on allowances are not settled.The Centre had set up a ‘Committee on Allowances’ which met last Thursday under the chairmanship of the Union Secretary, Finance (Expenditure), with representatives of government staff unions.A brief (www.ncjcmstaffside.com) on the meeting the same day by Shiva Gopal Mishra, Secretary (Staff Side), National Council/Joint Consultative Machinery for central employees, shows the unions are getting restive over several issues.At the meeting, representatives of the unions expressed their anguish over ‘non-formation of a high-level committee’. According to them, it was agreed upon in July by the Group of Ministers for settling the issue of Minimum Wage and Multiplying Factor. The unions want the ‘minimum wage’ for central employees to be fixed at Rs. 26,000 as opposed to Rs. 18,000 recommended by the 7th Central Pay Commission. “The Secretary, Finance (Expenditure), told that, the committee constituted under the chairmanship of Addl. Secretary (Exp.) with J.S. (Pers.), JS (Estt.) and JS(Imp.) as Members has been made only for this purpose. Let us believe that, after the meeting, report of the said committee would be sent to the Government of India for its acceptance,” Mr. Mishra noted.Te unions made a strong case for implementation of the allowances to be decided by the committee from January 1, 2016. Besides, they wanted that House Rent Allowance be fixed at the range of 10 to 30 per cent of the basic linked to the classification of the town of posting, children education Allowance of Rs. 3,000 and hostel subsidy of Rs. 10, 000.Source: NC JCM Staff Side

Posted: 07 Sep 2016 10:46 AM PDT

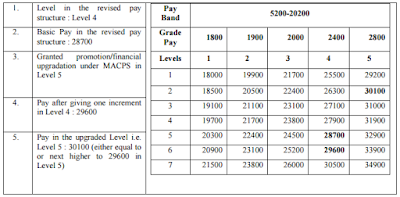

Revision of pay of employees stagnating at the maximum of the Pay Band and Grade Pay or scale in pre-revised structure under Central Civil Services (Revised Pay) Rules, 2016.

No.1-6/2016-ICGovernment of IndiaDepartment of ExpenditureImplementation CellRoom No.214, The Ashok, New DelhiDated the 7th September,2016OFFICE MEMORANDUMSubject: Revision of pay of employees stagnating at the maximum of the Pay Band and Grade Pay or scale in pre-revised structure under Central Civil Services (Revised Pay) Rules, 2016.The undersigned is directed to say that consequent upon notification of Central Civil Services (Revised Pay) Rules, 2016, representations have been received regarding provision of additional increments in the revised pay structure on 01.01.2016 in case of employees who had been stagnating at the maximum of the Pay Band and Grade Pay or scale in the pre-revised pay structure.2. The matter was examined in this Department and it has been decided that in case of persons who had been drawing maximum of the applicable Pay Band and Grade Pay or scale, as the case may be, for more than two years as on 01.01.2016, one increment in the applicable Level in the Pay Matrix shall be granted on 01.01.2016 for every two completed years of stagnation at the maximum of the said Pay Band and Grade Pay or scale. Grant of additional increment (s) shall be subject to condition that the pay arrived at after grant of such increment does not exceed the maximum of the applicable Level in the Pay Matrix. Illustrations:

3. After fixation of pay on 01.01.2016 as indicated above, the date of increment shall be regulated as per the provisions of Rule 10 of Central Civil Services (Revised Pay) Rules, 2016.

(R.K.Chaturvedi)Joint Secretary to the Govt. of IndiaAuthority: www.finmin.nic.in

This posting includes an audio/video/photo media file: Download Now

Bunching of stages in 7th CPC revised pay structure under CCS (RP) Rules, 2016

Posted: 07 Sep 2016 09:21 AM PDT