Itaxsoftware.net

itaxsoftware.net

Itaxsoftware.net |

|

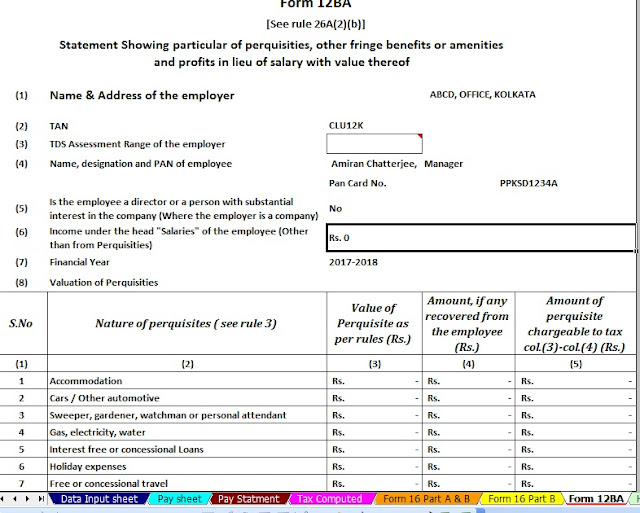

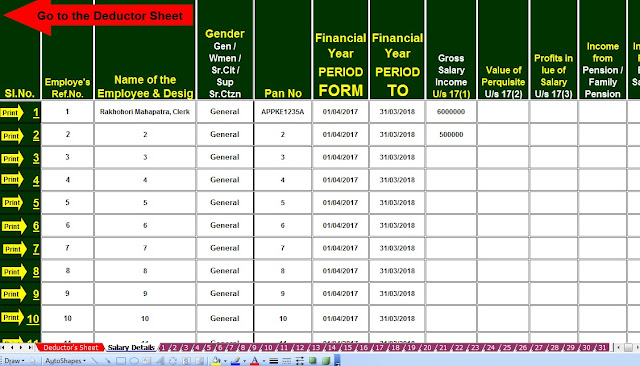

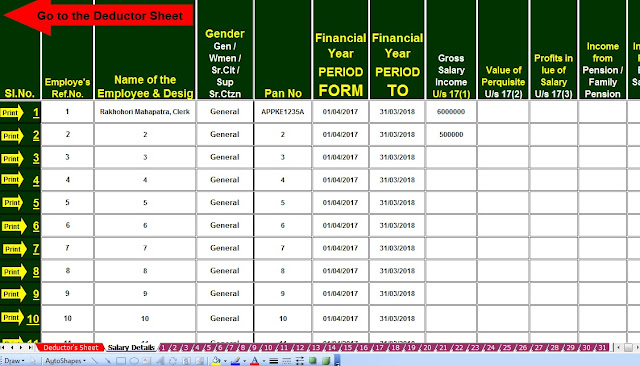

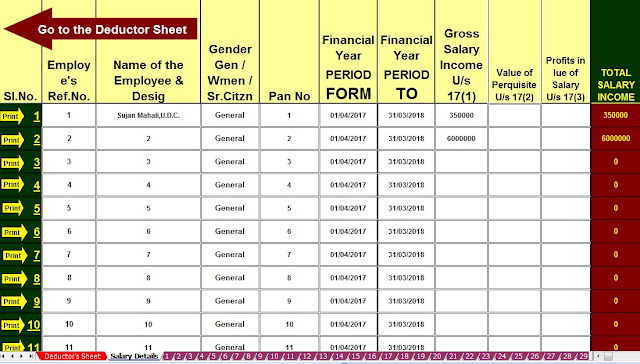

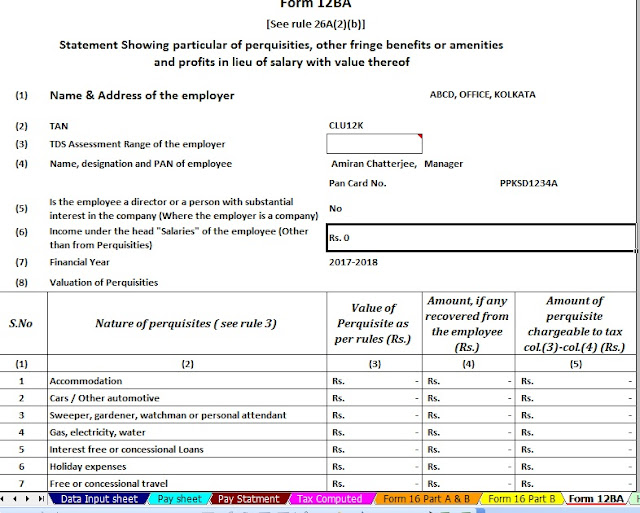

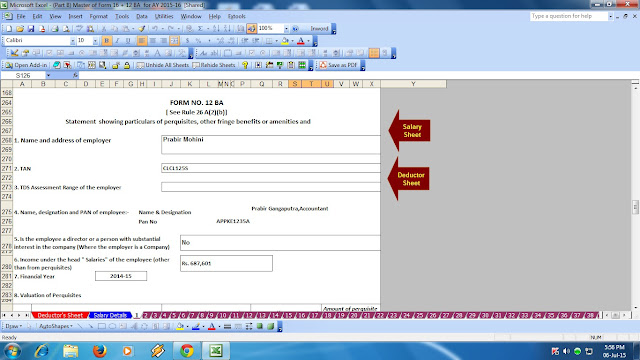

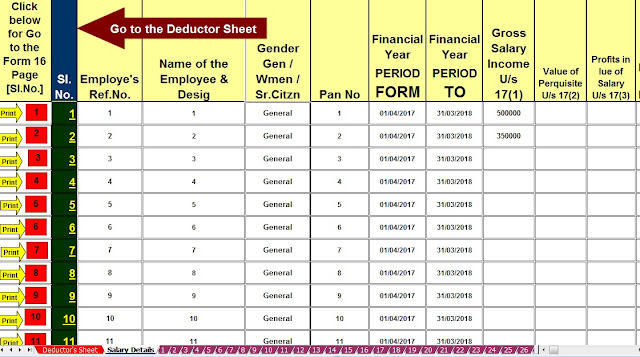

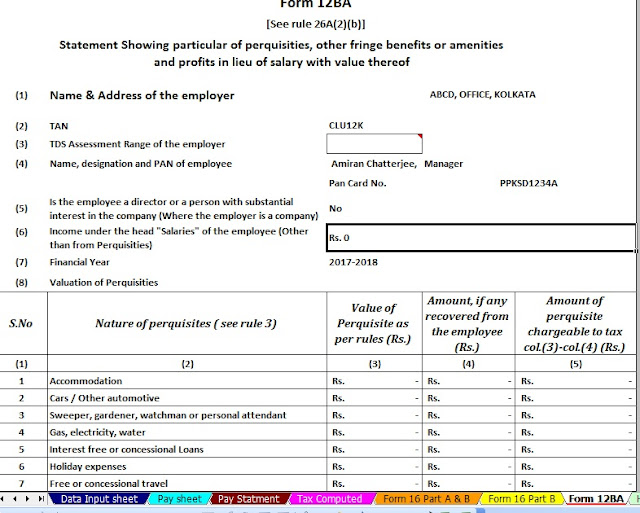

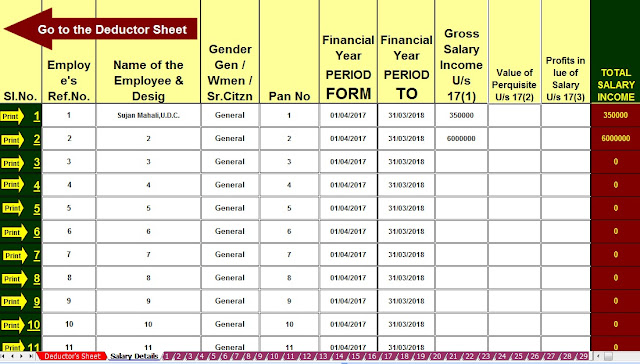

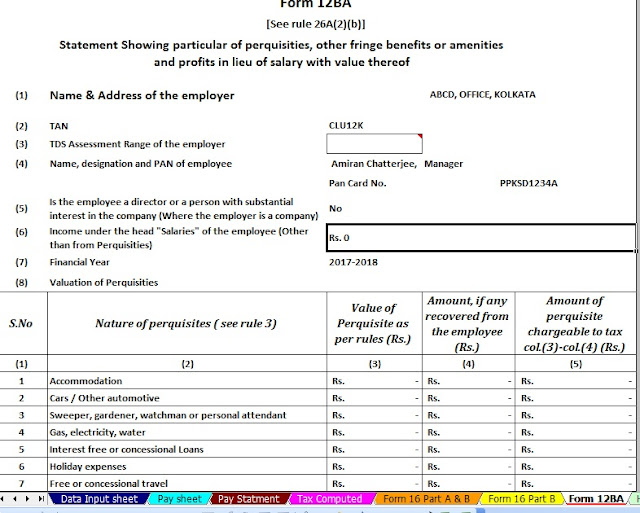

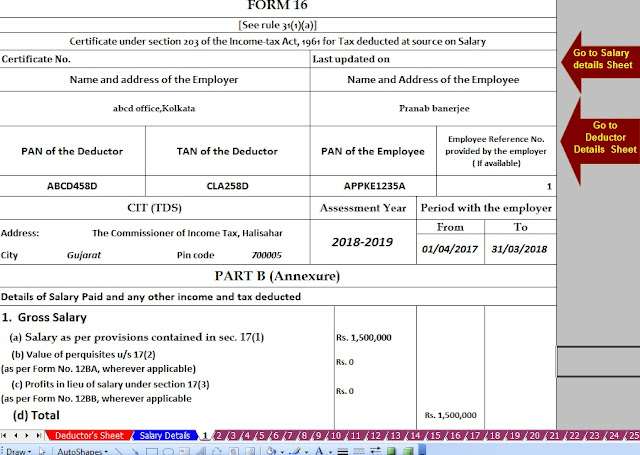

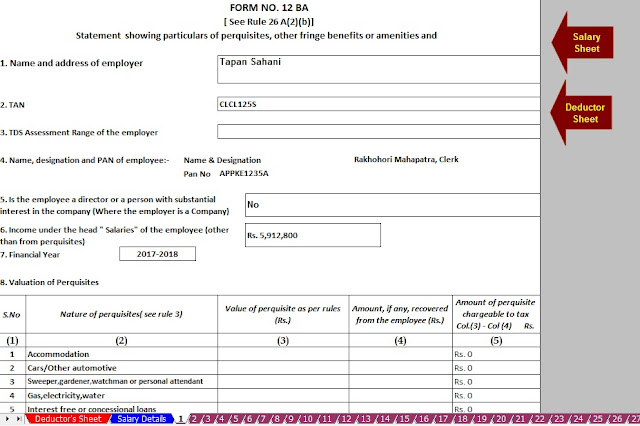

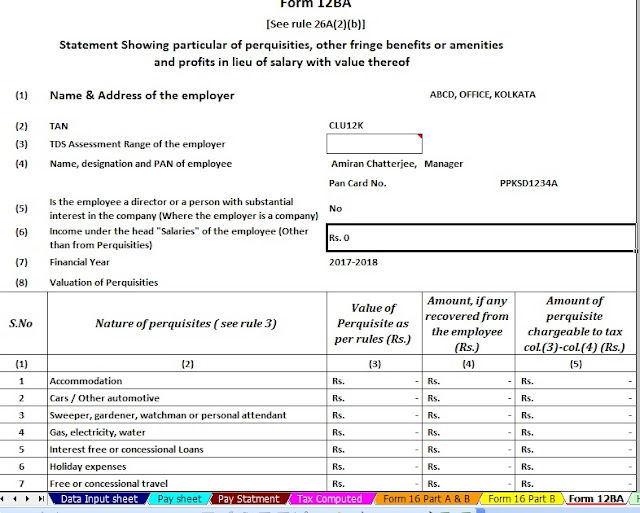

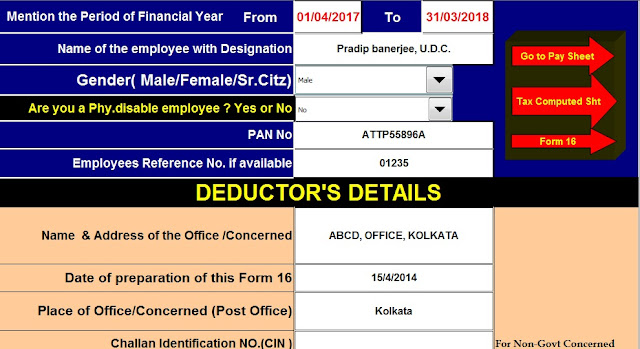

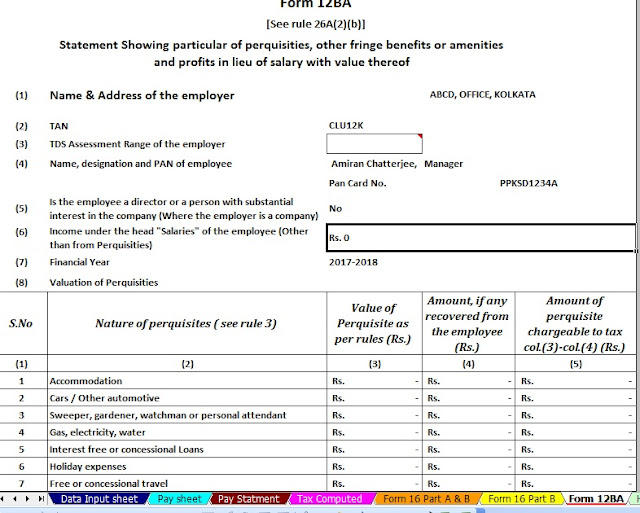

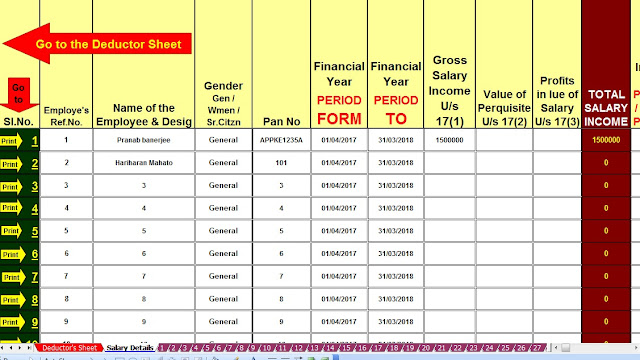

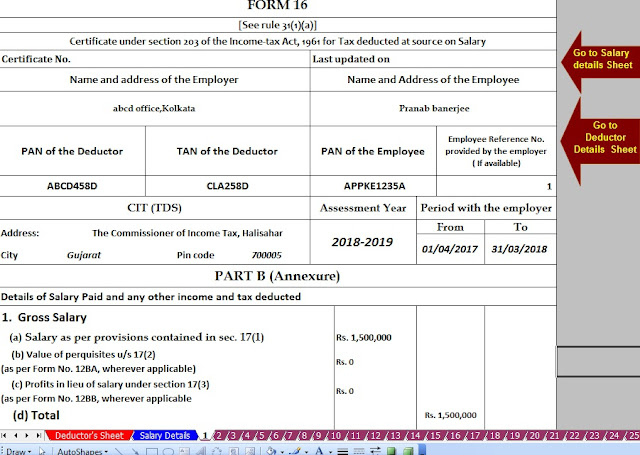

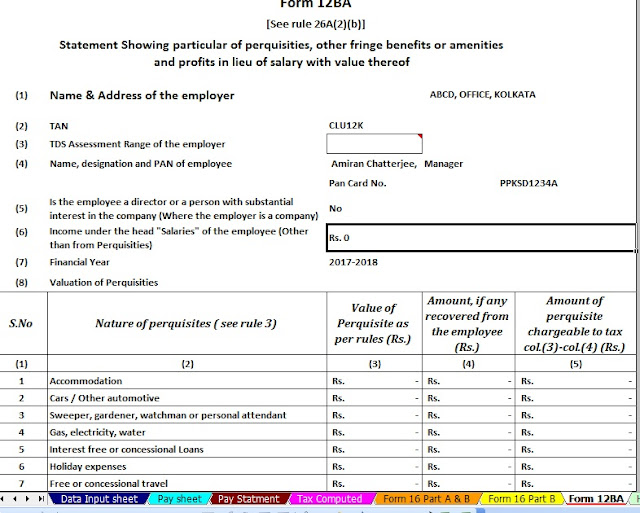

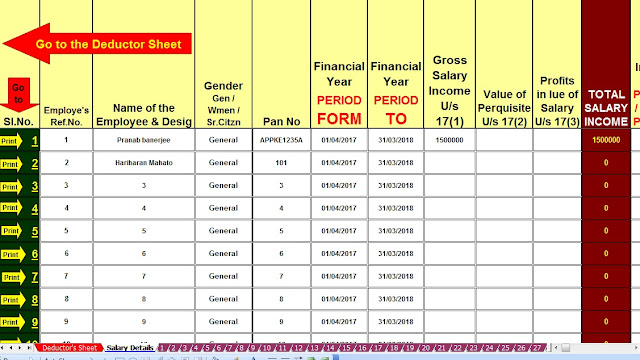

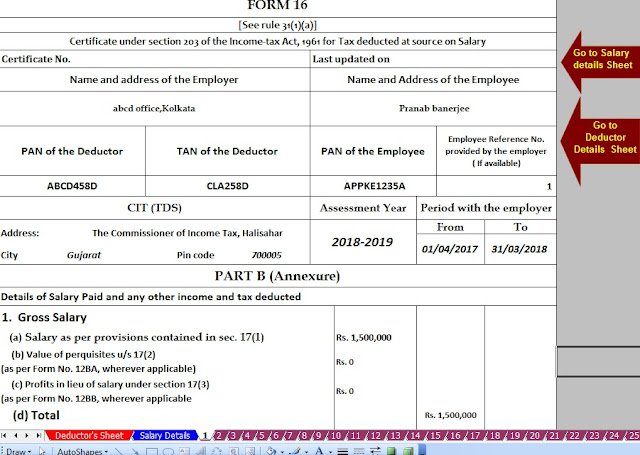

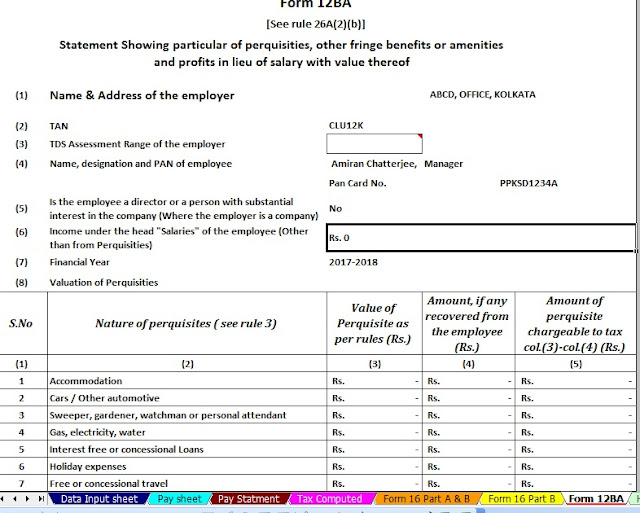

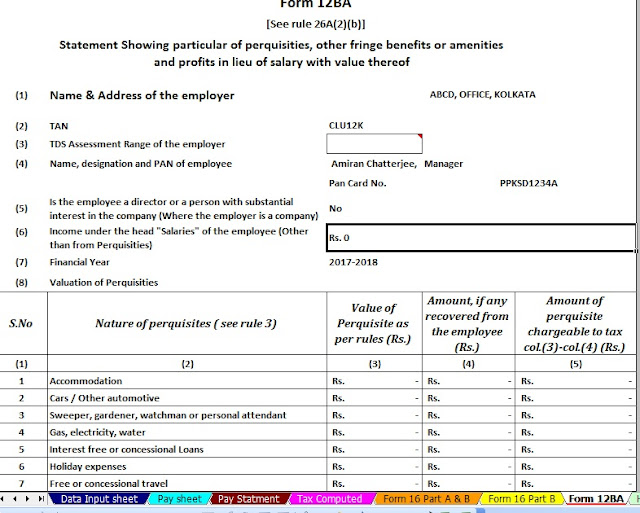

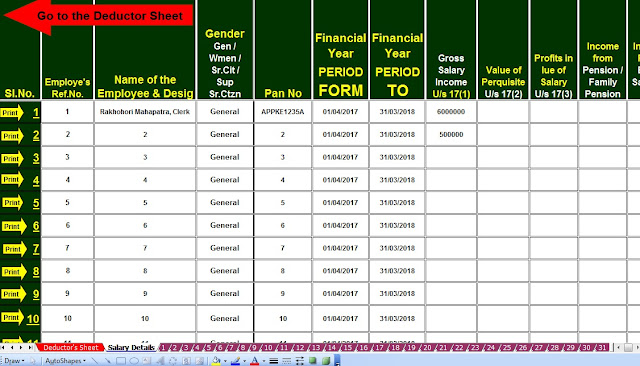

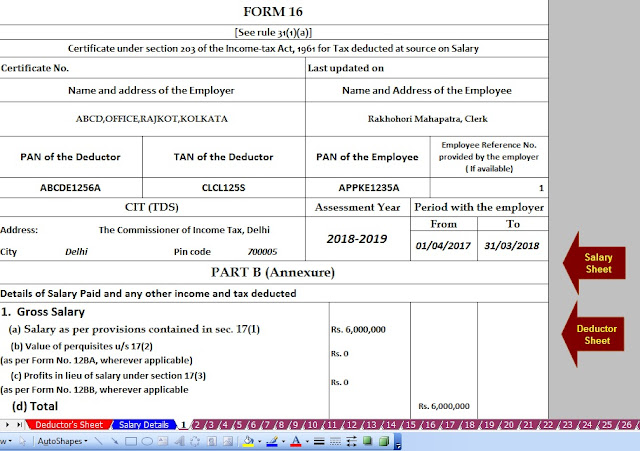

Posted: 24 Apr 2018 05:49 AM PDT For a person earning income from Salary, documents Form 16, and Form 12 BA are provided by an employer which has details about his salary, perquisites, and tax deducted at source(TDS) by his employer. These are used while calculating Tax liability. Tax on income we looked into details of Form 16. Form 12 BA give details of Perquisites given by the employer to employee. In Perquisites, we had looked into what are perquisites, what income tax laws apply to it, about the valuation of perquisites and the taxation with an example, which perquisites are exempted from tax, Difference between Prerequisite, Allowance and Fringe benefit. In this article, we shall see how Form 12 BA shows the information about perquisites. Form 12 BAForm 12BA is the statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof. It comes under the Section 26A, subsection 2 point B. Form No. 12BA, if the amount of salary paid or payable to the employee is more than one lakh and fifty thousand rupees, which shall accompany the return of income of the employee. [Explanation: “Salary” for the purposes of this rule shall have the same meaning as given in rule 3.] Note: The limit has changed to one lakh and eight thousand (1,80,000) by circular in 2011. Please don’t confuse Form 12BA with Form 12B, the difference is more than just the one letter. Form 12B comes into picture when people change job in the middle of the Financial year. Details of previous employment to the new employer are provided by the employee in Form 12B. Changing jobs often leads to a situation where an individual gets tax exemptions twice than what is due to him—from his earlier employer as well as from his new employer. The income earned from the previous job has to be clubbed with the income from the new job to compute the total tax payable for the year. Changing Jobs: Take Care Of Bank Account, Tax Liability discusses it in detail. According to section 192, it is the option/discretion of the employee whether or not to file Form No 12B. The current employer can’t insist on the filing of Form No 12B. If the employee chooses not to file, then employers’ obligation is limited to compute TDS on salary payable by him. If Form 12B is filed, then the current employer can deduct the TDS on salary paid by the previous employer (in case no TDS was deducted by the previous employer). And if the TDS was deducted by the previous employer, any excess or shortfall can also be adjusted. It is always in the interest of an employee to furnish such details because otherwise there can be the duplication of exemptions and deductions and there can be a shortfall in tax deduction and as a result, the employee would become liable to deposit advance tax. Click to download Automated Master of Form 16 Part B with Form 12 BA for the FY 2017-18 [ This Excel Based Utility can prepare at a time 50 employees Form 16 Part B with 12 BA]This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from itaxsoftware.net. To stop receiving these emails, you may unsubscribe now. |

Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

itaxsoftware.net

Itaxsoftware.net |

|

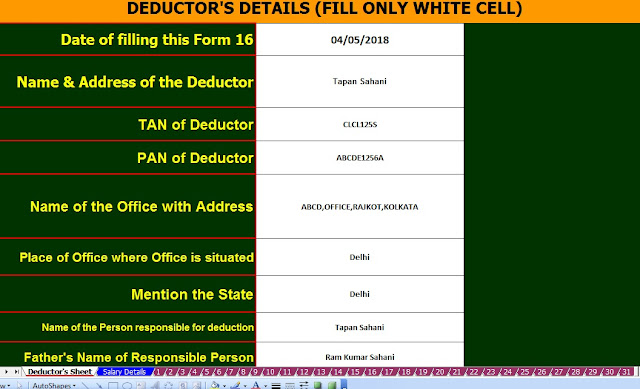

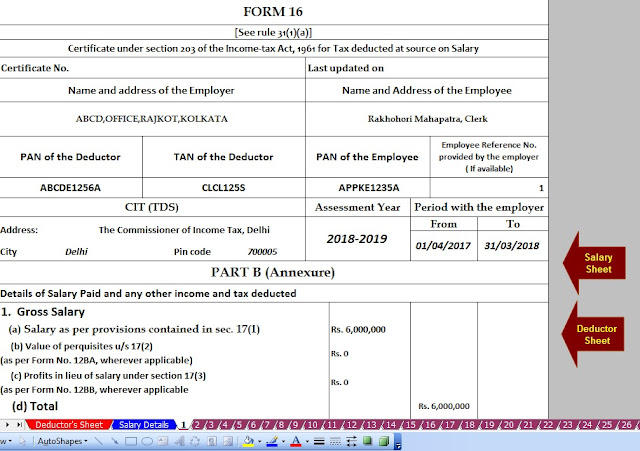

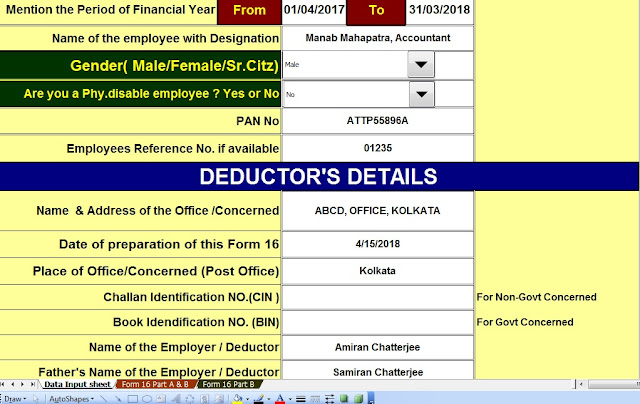

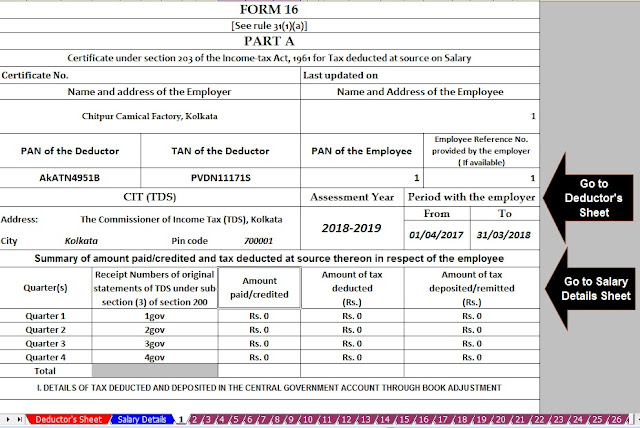

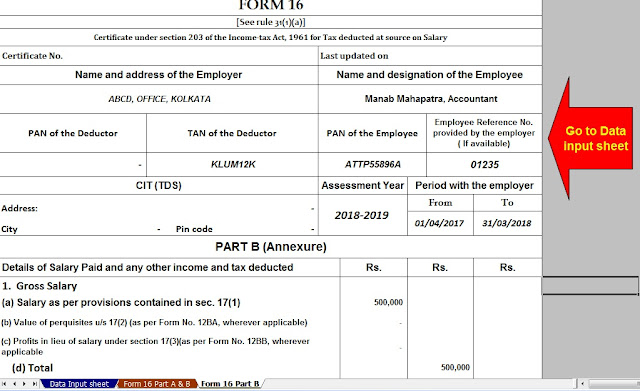

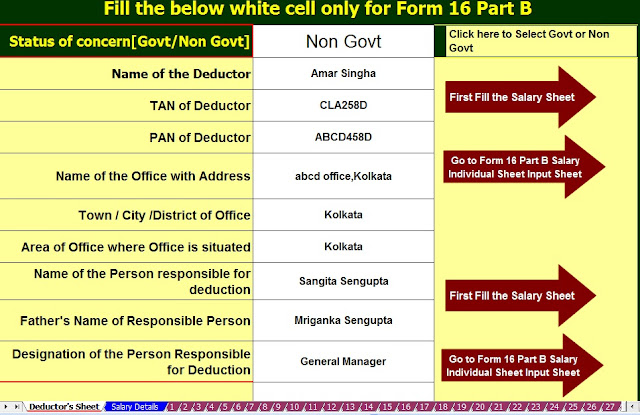

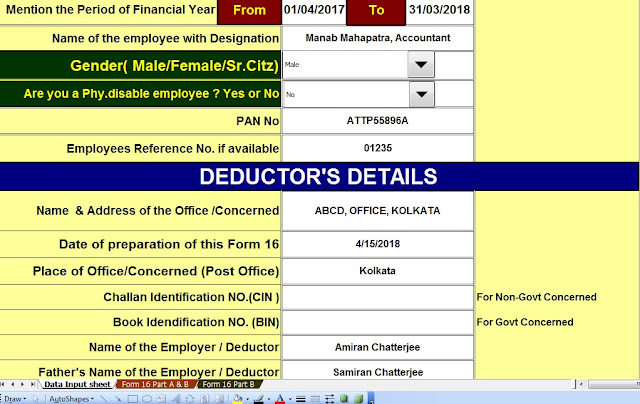

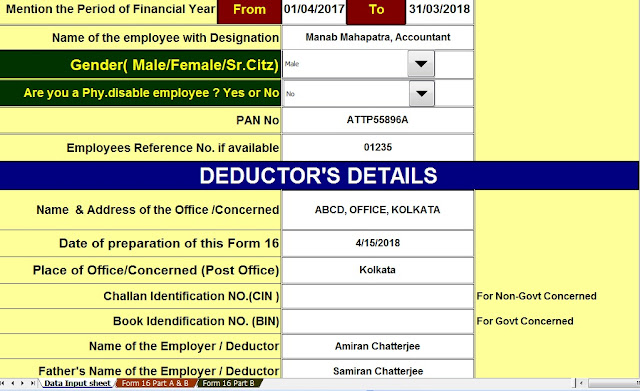

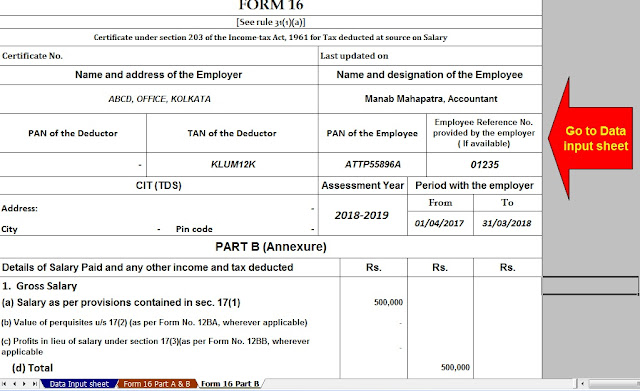

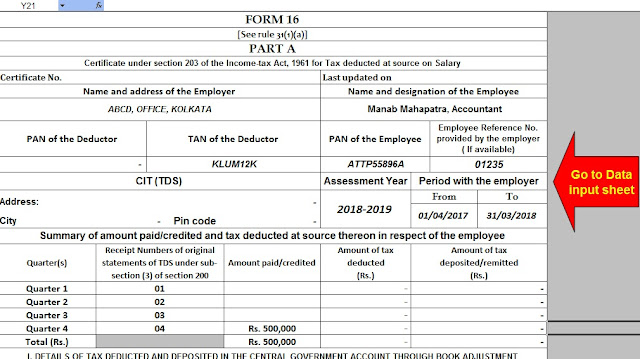

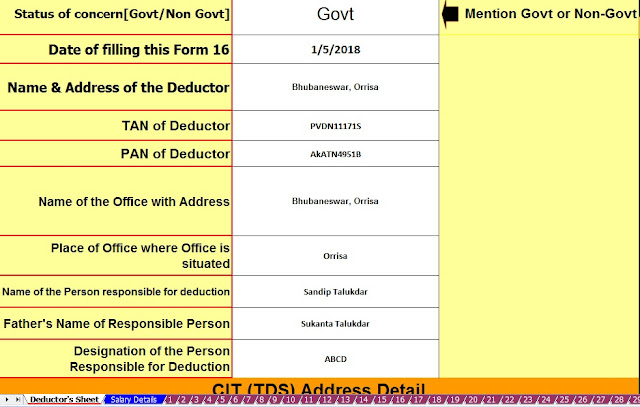

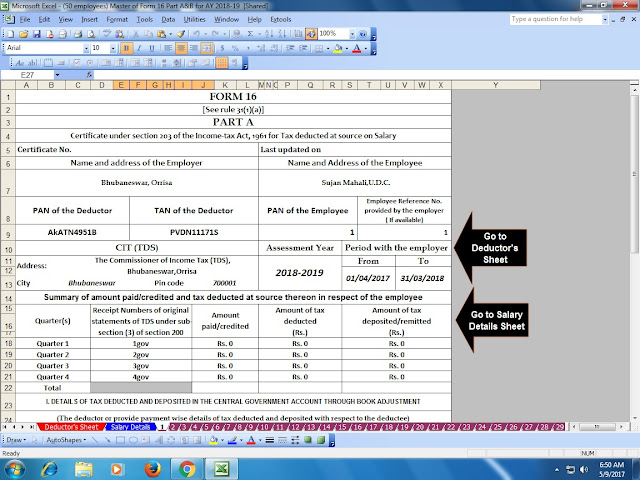

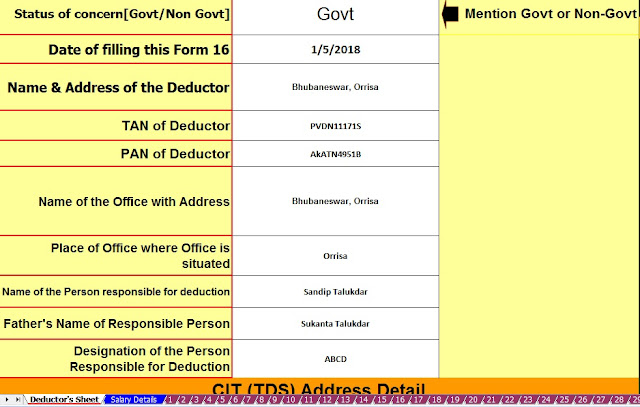

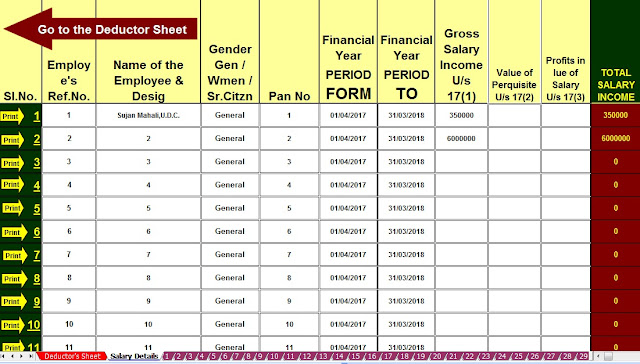

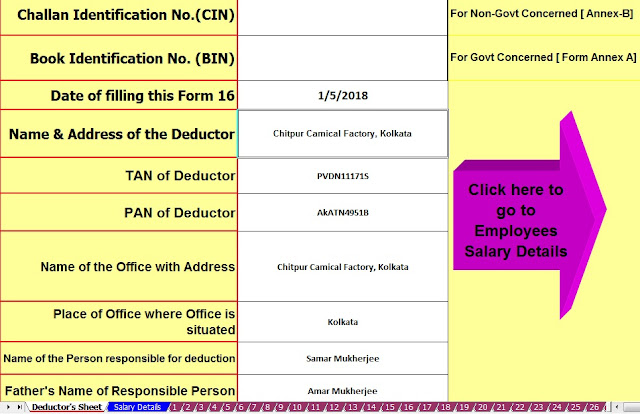

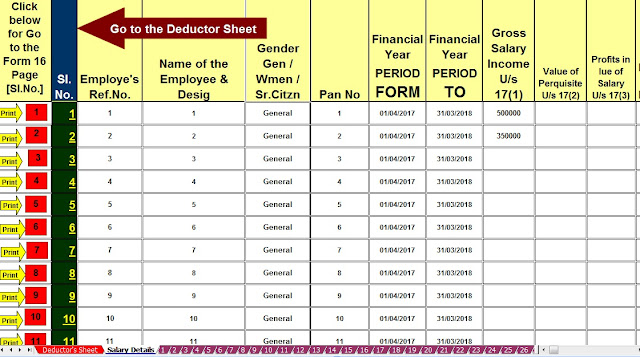

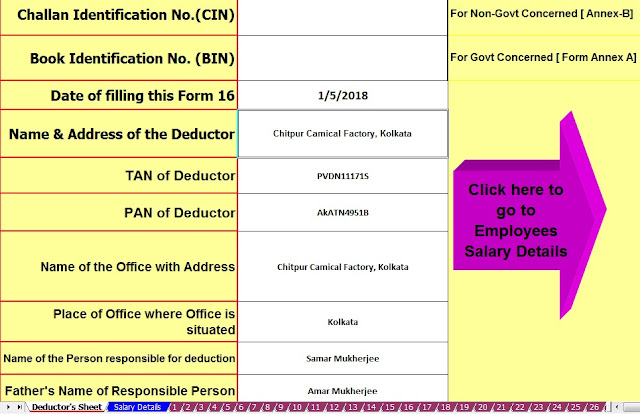

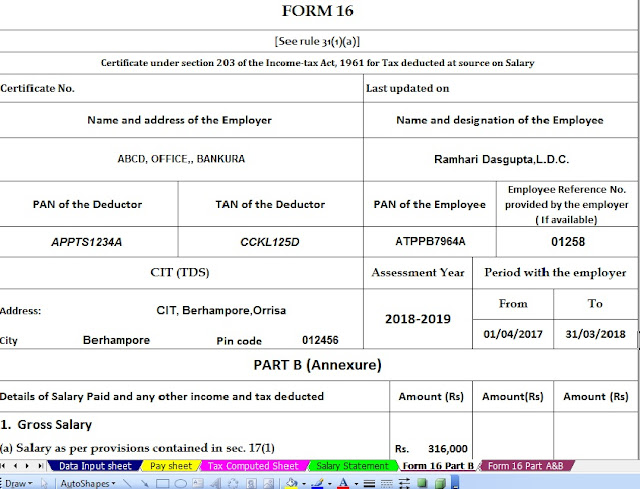

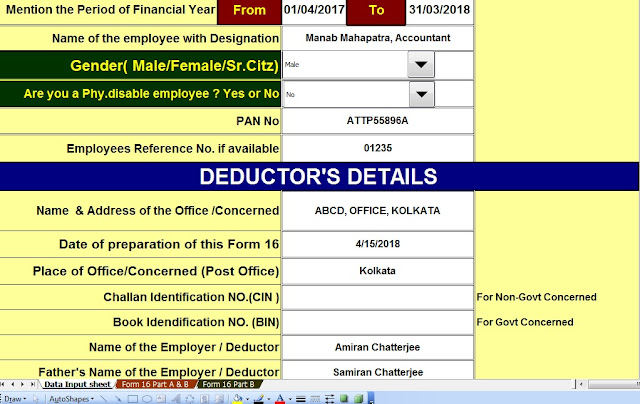

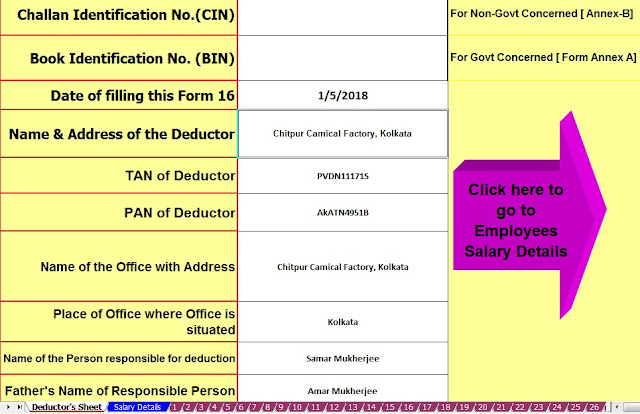

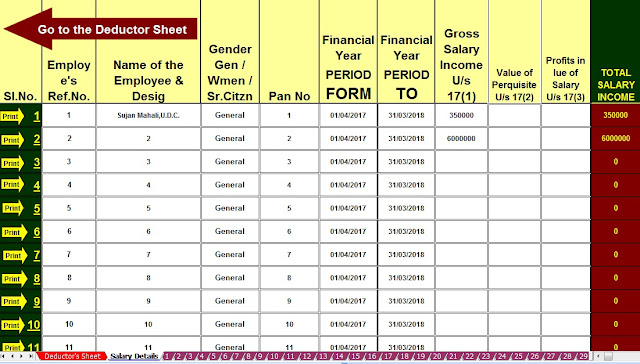

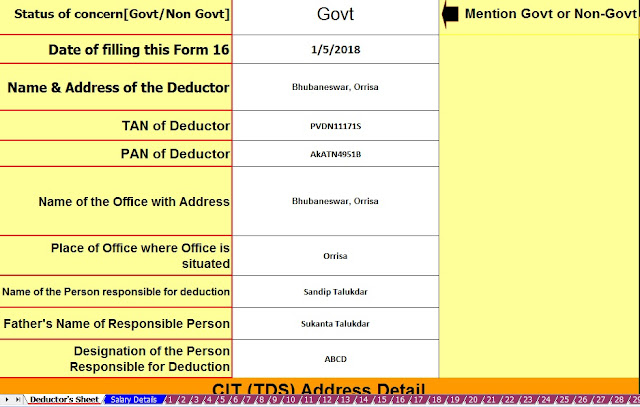

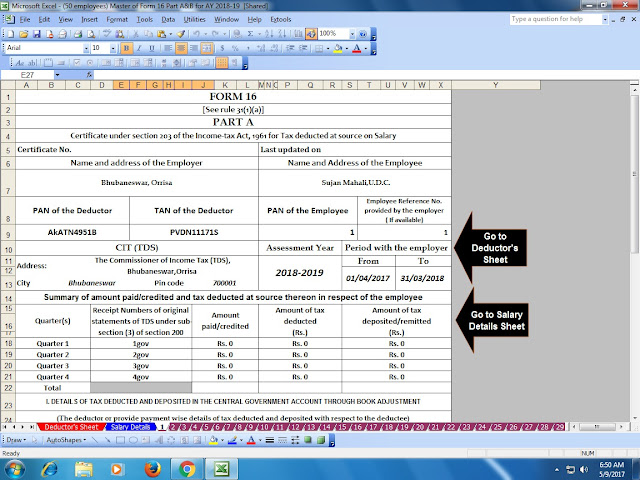

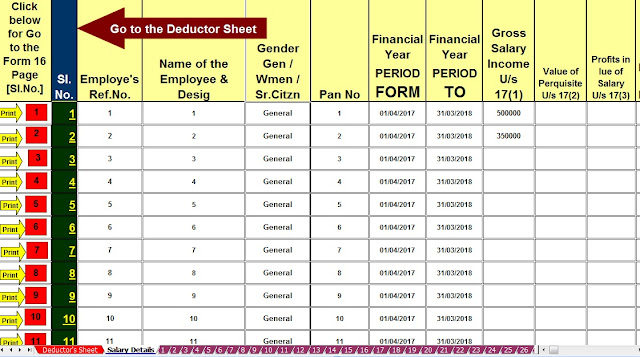

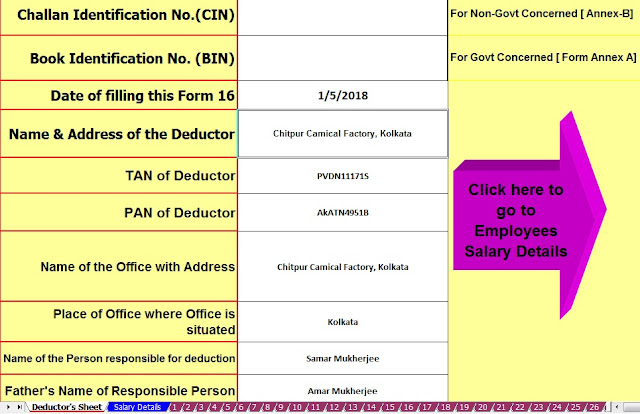

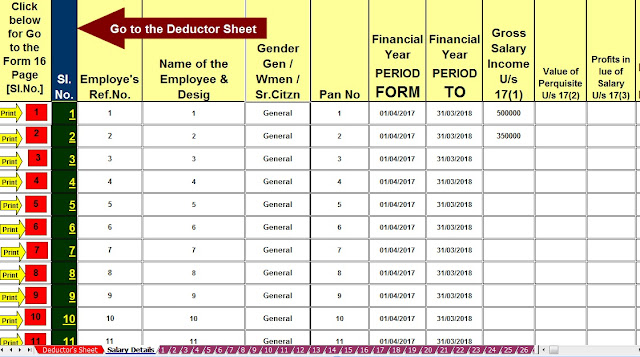

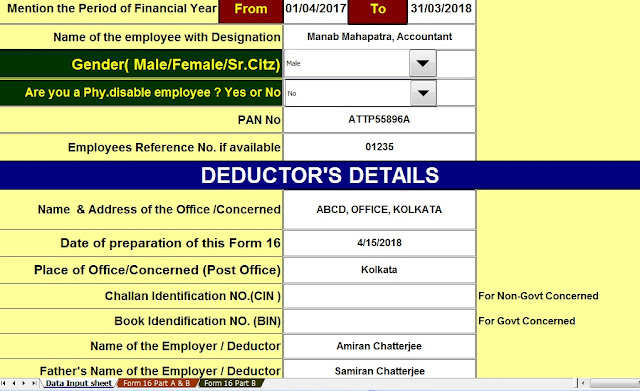

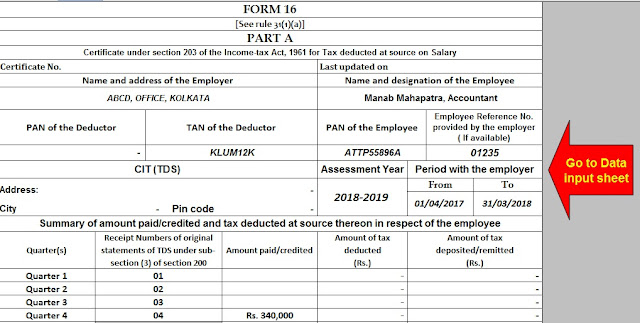

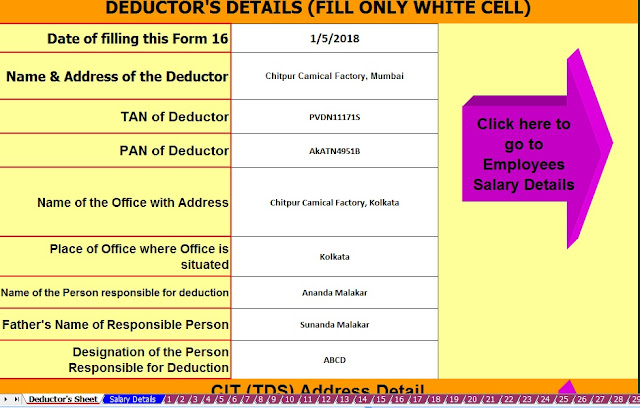

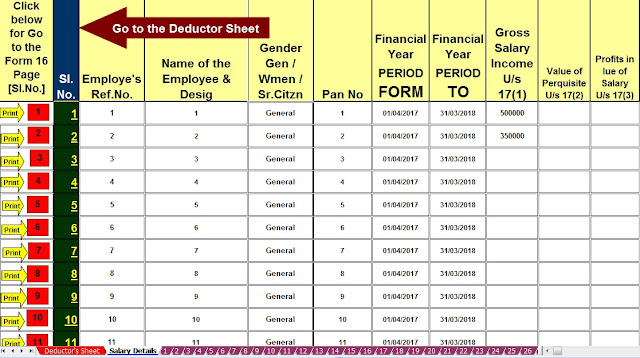

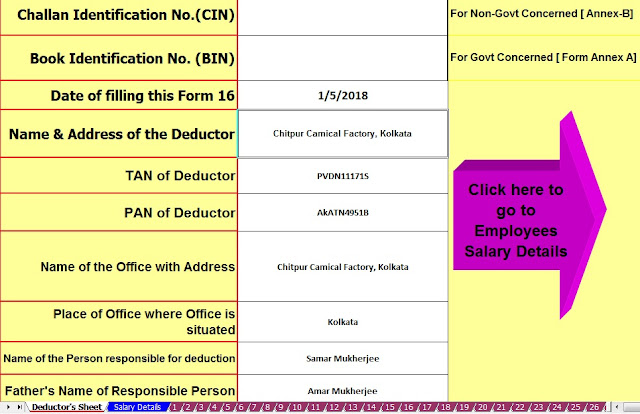

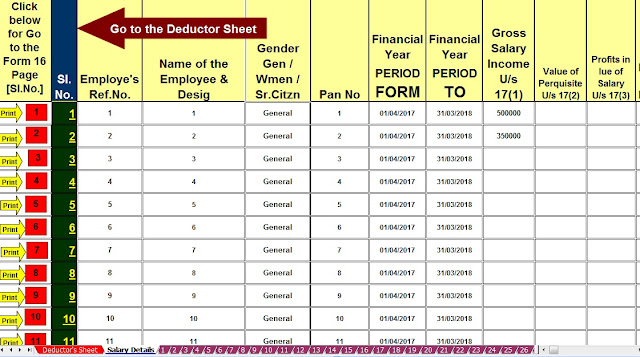

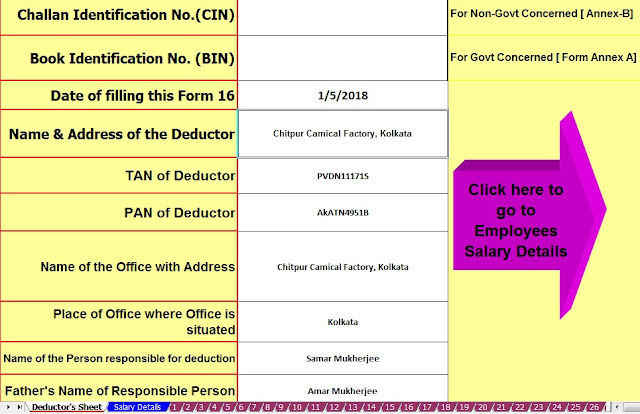

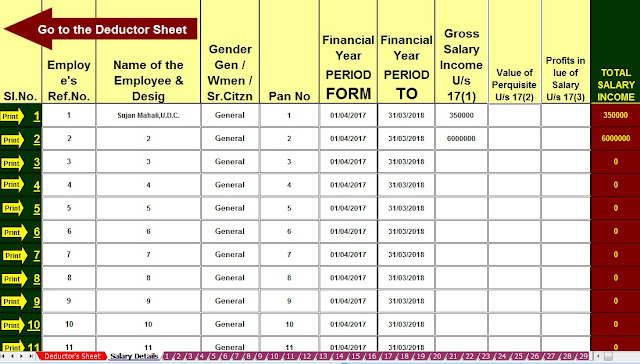

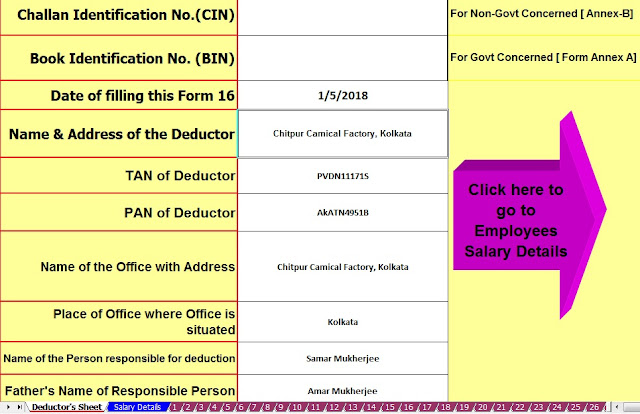

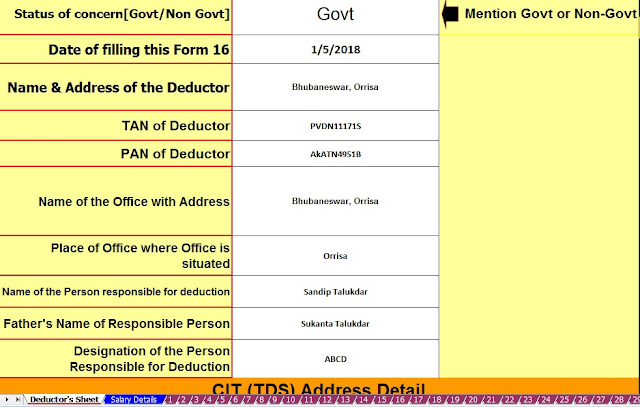

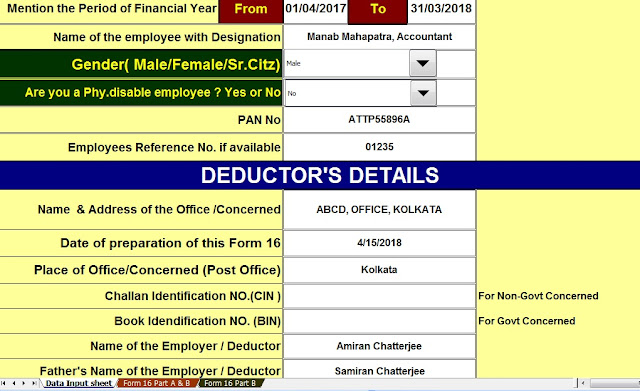

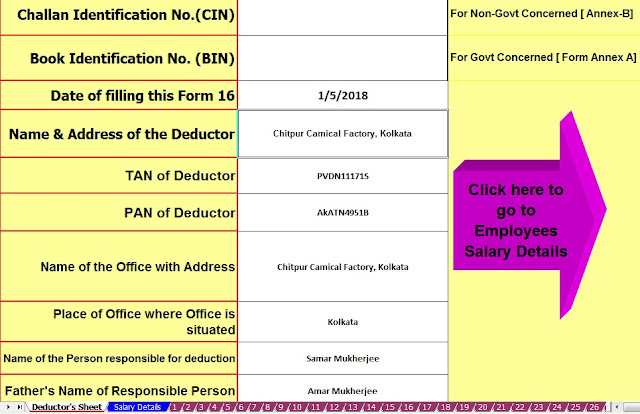

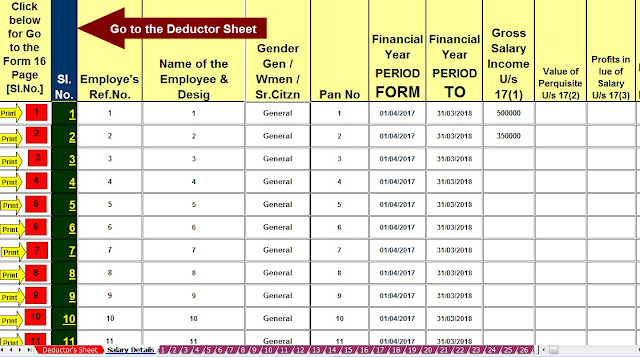

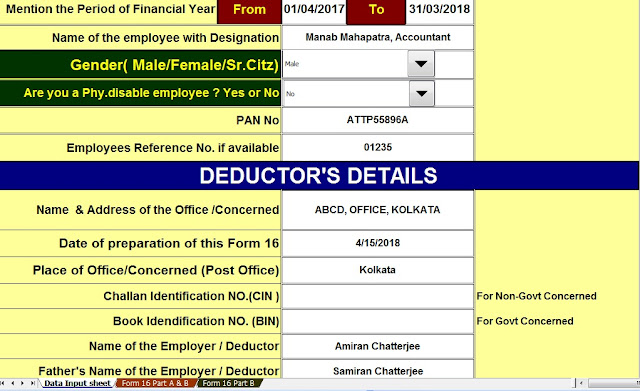

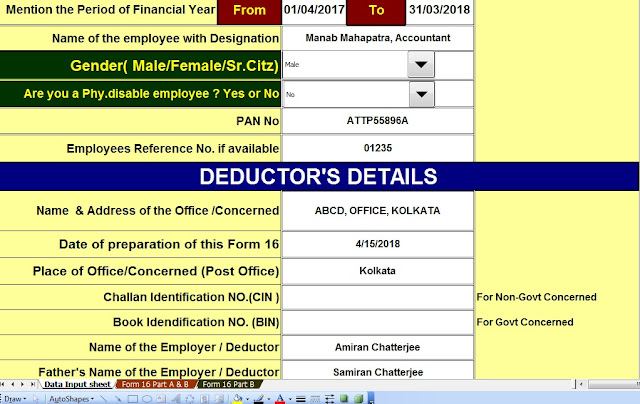

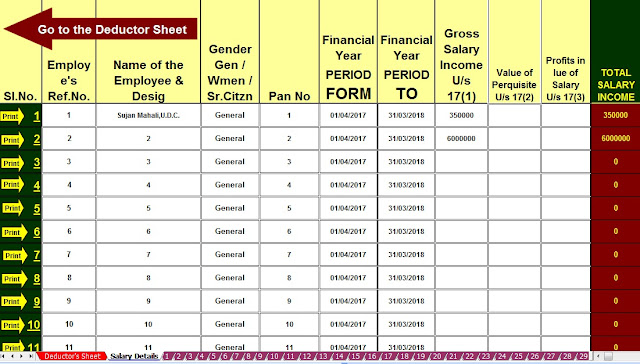

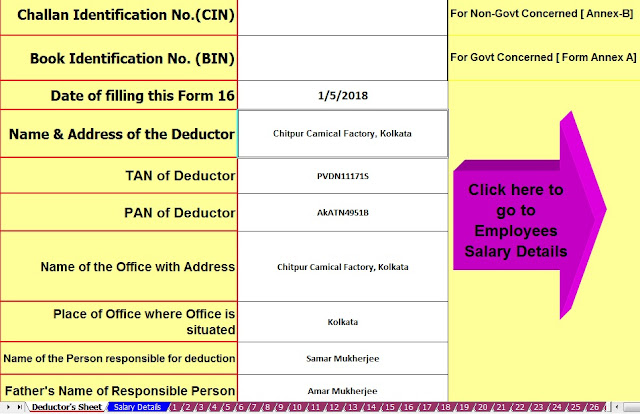

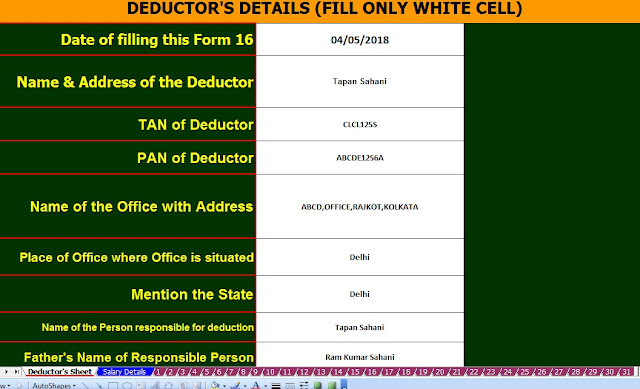

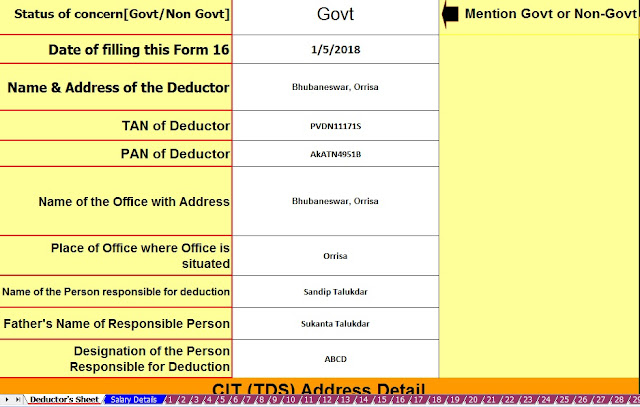

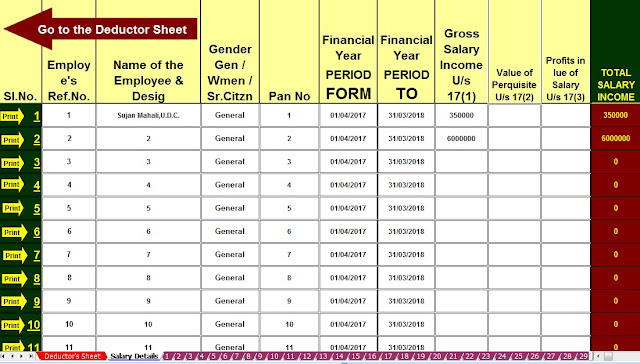

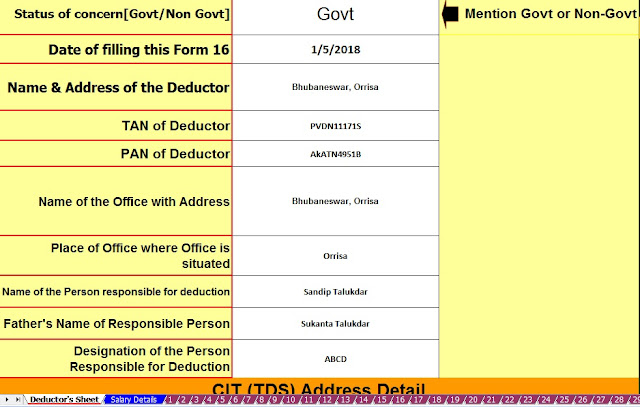

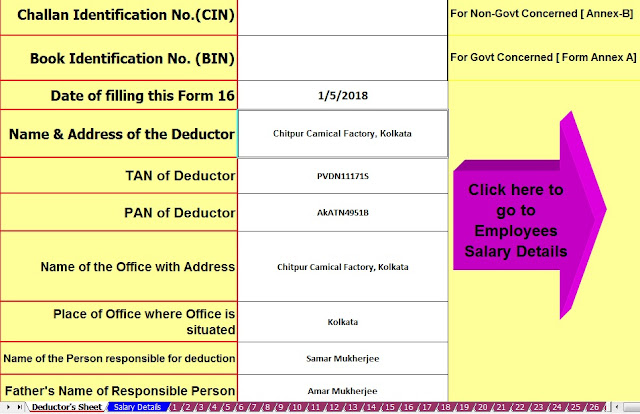

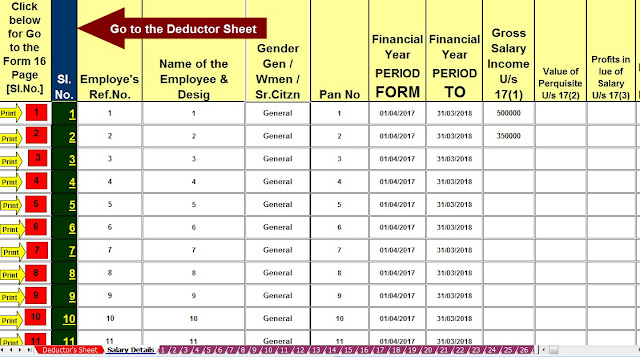

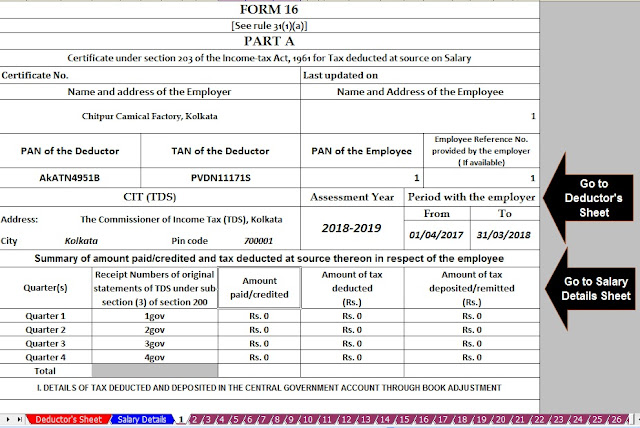

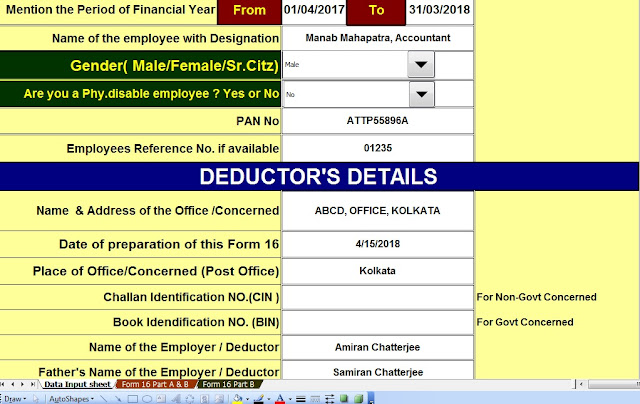

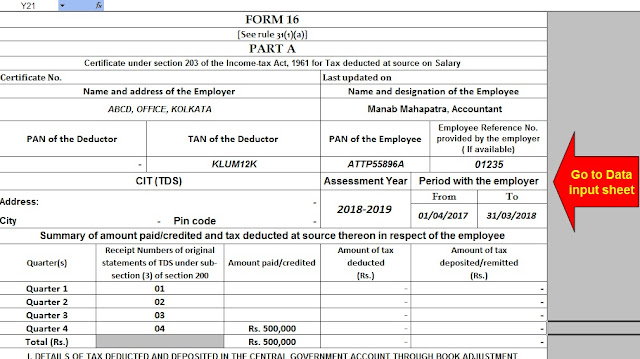

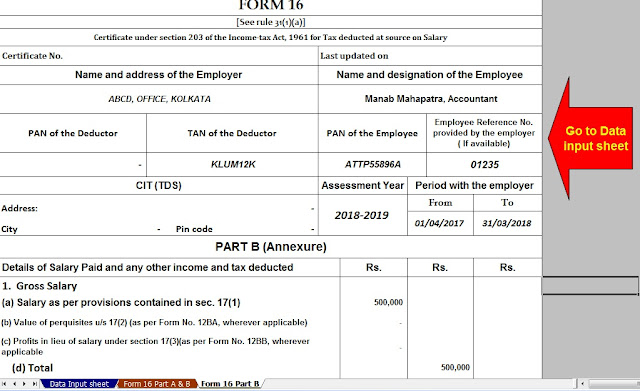

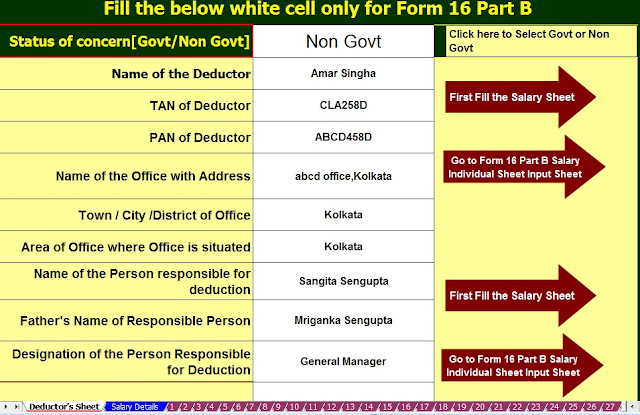

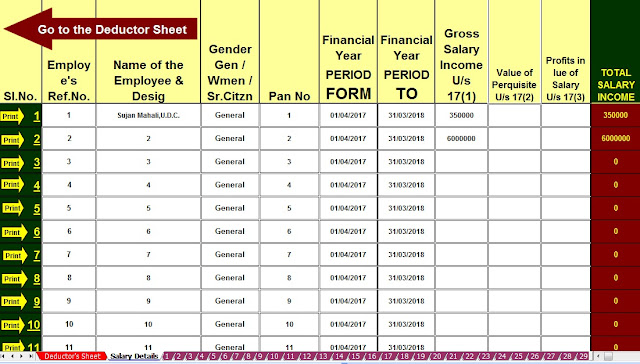

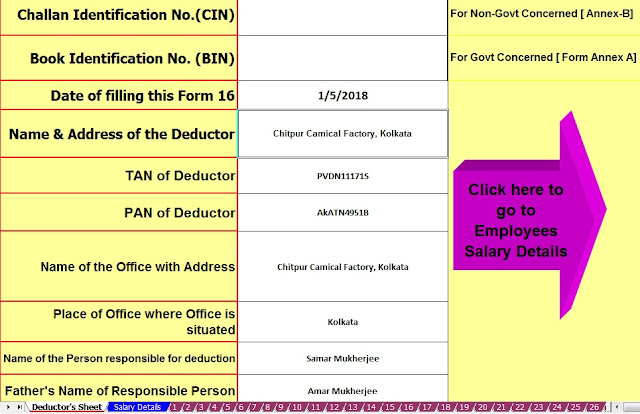

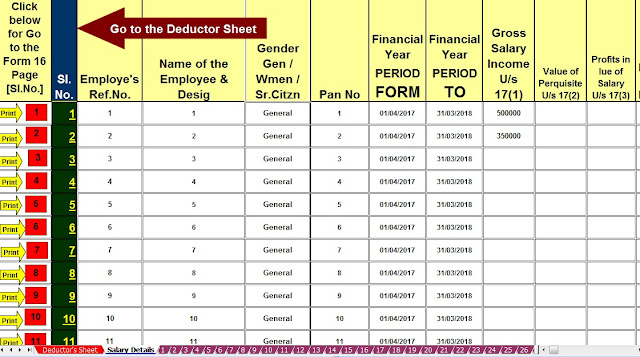

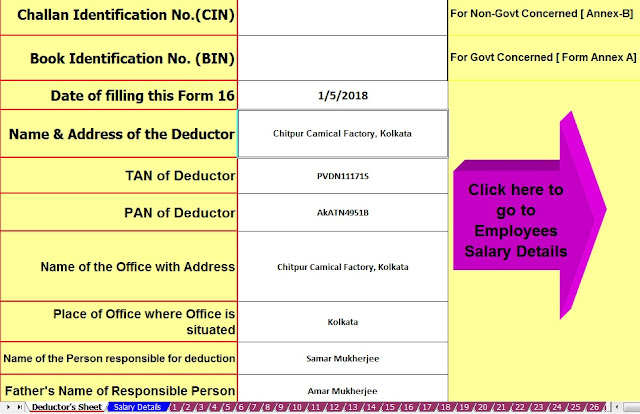

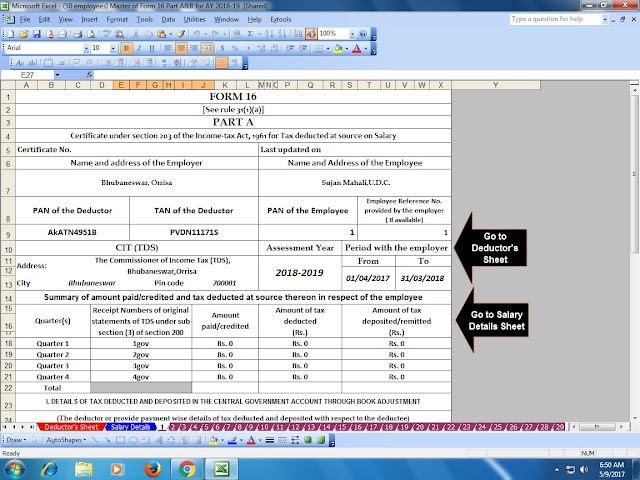

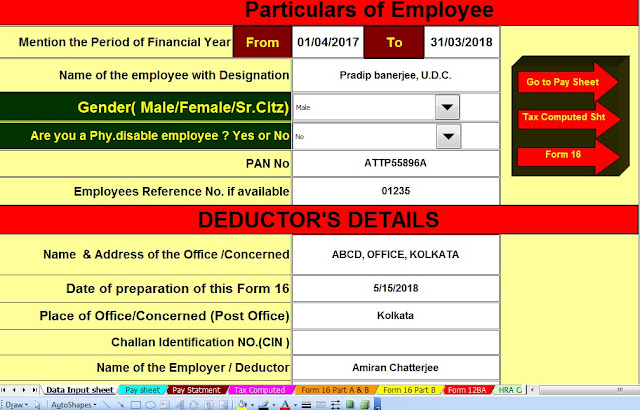

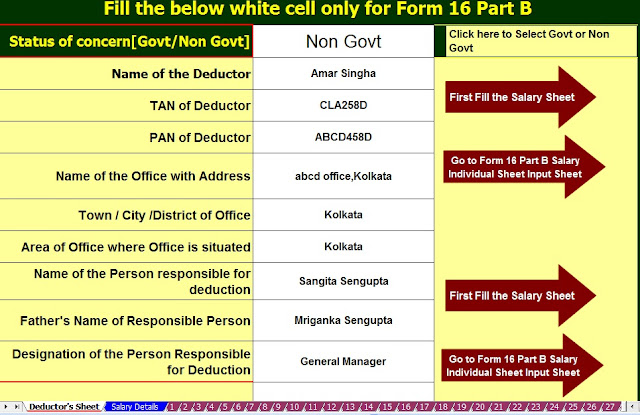

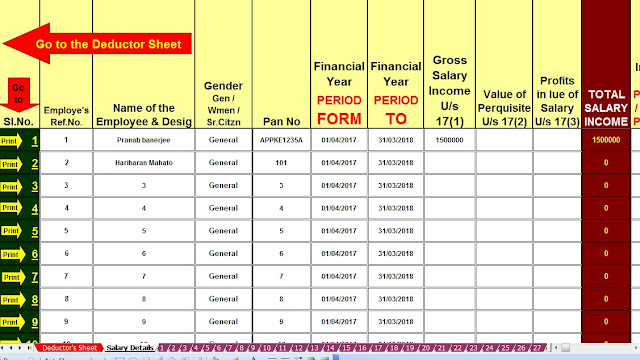

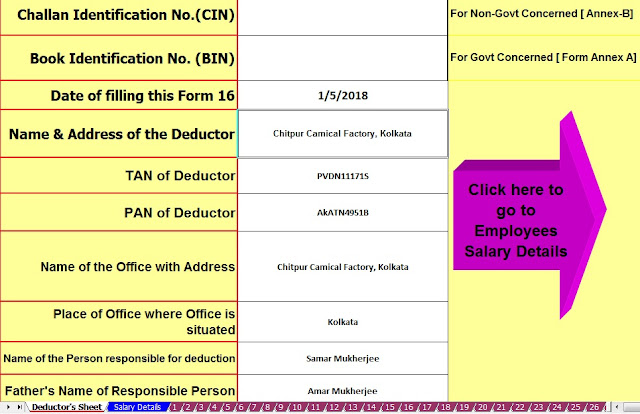

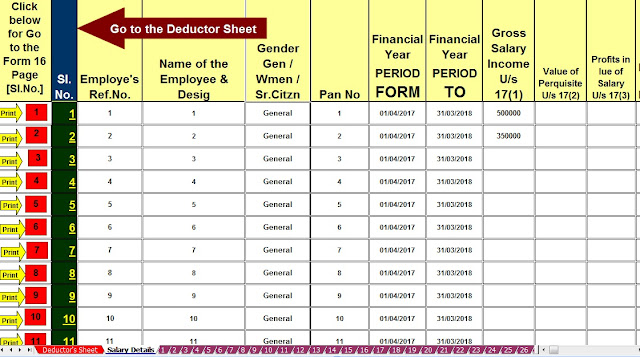

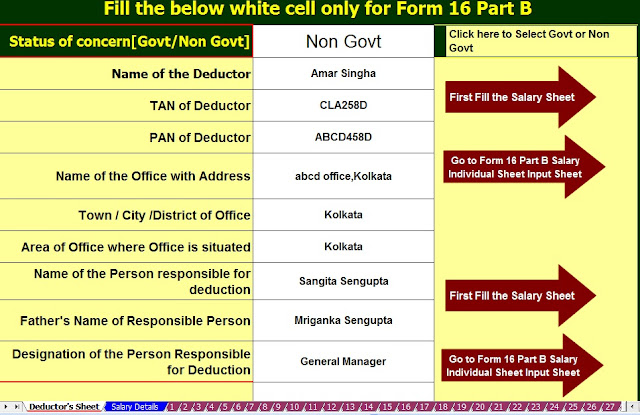

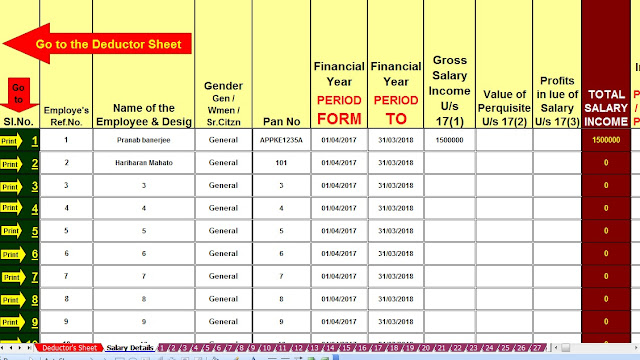

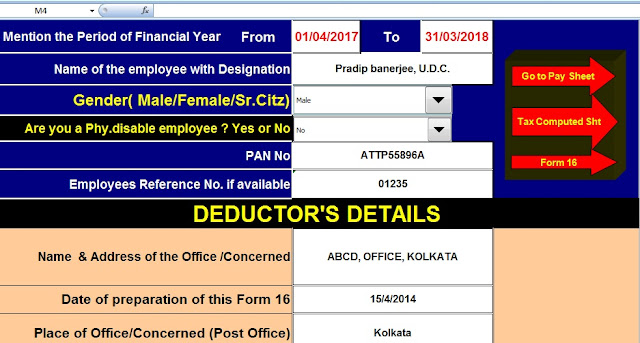

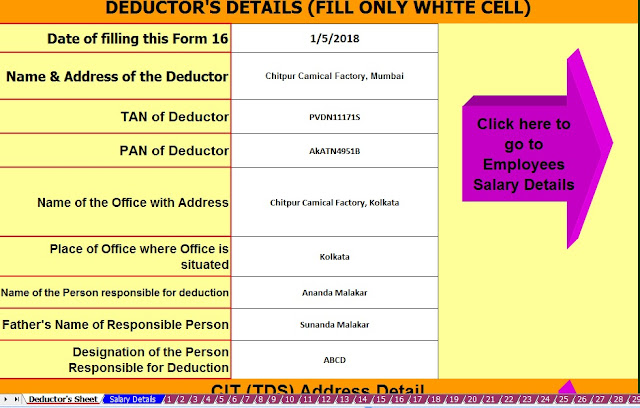

Posted: 25 Apr 2018 09:17 PM PDT Some of the Govt and Non-Govt Concerned have few employees who have need some of the Form 16 Part B or Part A&B for F.Y.2017-18. Some of the Concerned have not competent to download From 16 Part A from the TRACES PORTAL. Also, it appears that some of the Concerned have no Internet Facility to download the Form 16 Part A from the TRACES PORTAL as per the Income Tax Notification. In this concept below given Excel Based Software which can prepare both of Form 16 Part A&B and Form 16 Part B. If you have to need Form 16 Part B, you can print the Form 16 Part B or if you have to need Form 16 Part A&B you can print the Part A&B for F.Y.2017-18. Download Excel Based Software which can prepare at a time Income Tax Form 16 Part A&B and Form 16 Part B ( One by One). from the below link. A feature of this Excel Utility:-1) You can prepare both of Form 16 Part A&B and Form 16 Part B for F.Y.2017-18 ( One by One) 2) Automatic Calculation of Income Tax liability as per Finance Budget 2017-18 3) You can prepare more than 50 employees Form 16 Part A&B and Form 16 Part B ( One by One) 4) Easy to install in any computer and easy to generate just like as an Excel File 5) All Income Tax amended Section and limit of each section have in this Software 6) Automatic Convert the Amount into the In-Word Download Automated Form 16 Part A&B and Part B ( One by One) for F.Y.2017-18 [ This Excel Utility can prepare Form 16 One by One) |

itaxsoftware.net

Itaxsoftware.net |

|

Download Automated Income Tax Form 16 Part B with 12 BA for F.Y.2017-18 Posted: 26 Apr 2018 05:25 AM PDT Click here to download the excel based Form 16 Part B with 12 BA for F.Y.2017-18. This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA.

|

itaxsoftware.net

Itaxsoftware.net |

|

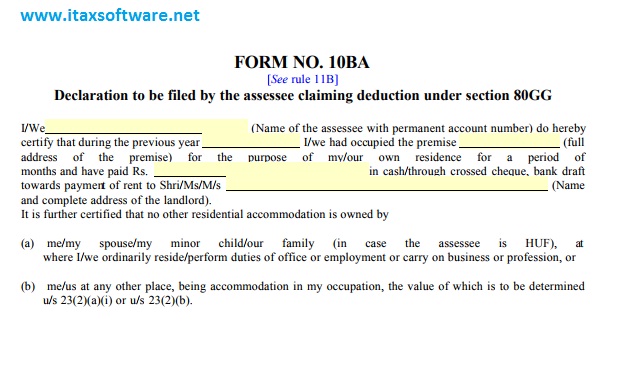

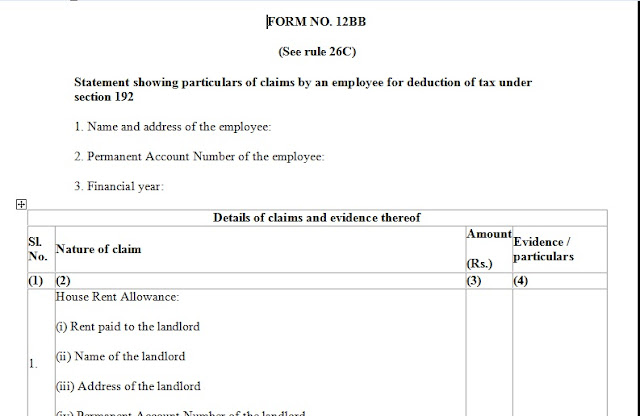

Posted: 27 Apr 2018 05:22 AM PDT CBDT has recently notified new form 12BB to claim a tax deduction on LTA (Leave Travel Allowance), HRA (House Rent Allowance) and Interest paid on home loans. As per new rules, you need to submit your proof of travel in new form 12BB for claiming LTA benefits. In addition to this, you need to furnish detail of HRA and deduction of interest borrowing in the same form. This new notification is applicable from 1st June 2016. Earlier also employers were taking a declaration from an employee. However, there was no standard format for the same. Introduction for this new form will standardize the process. Download New Form 12BB for LTA, HRA & Interest DeductionDownload Form 12BB in Word FormatDownload Form 12BB in Excel Format How to fill up New Form 12BB? You need to first furnish your name, address, PAN card number and financial year in the form 12BB. After furnishing this information you need to go to the respective section and fill out information. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

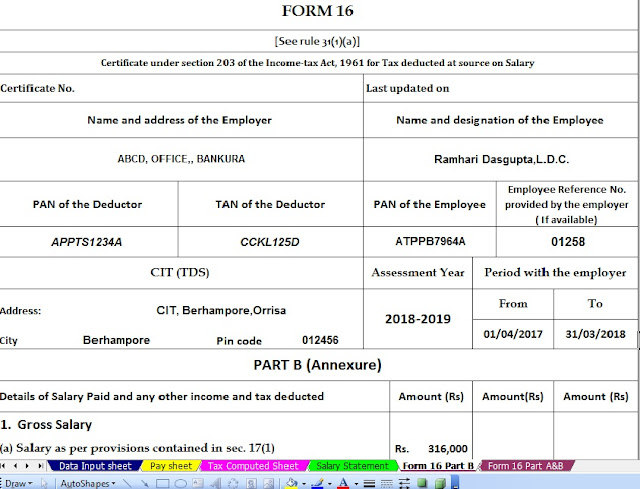

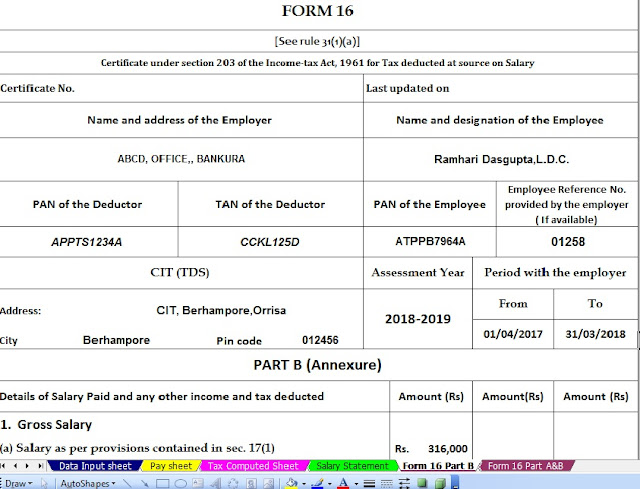

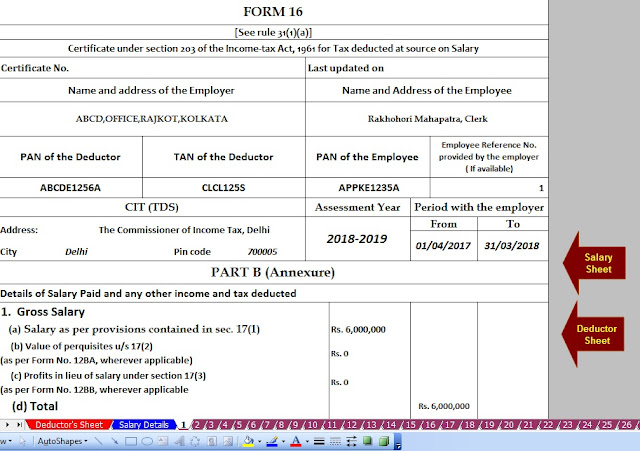

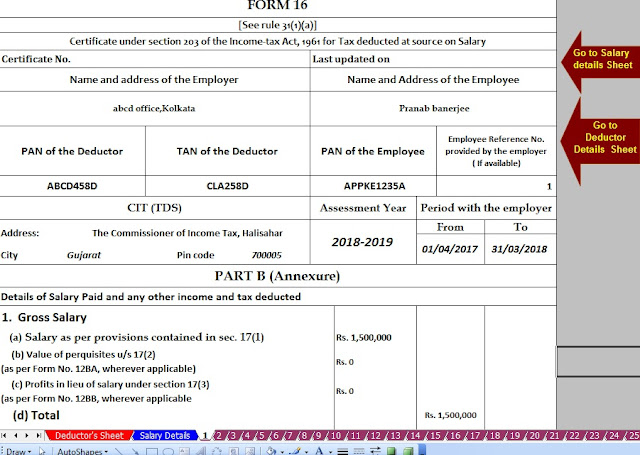

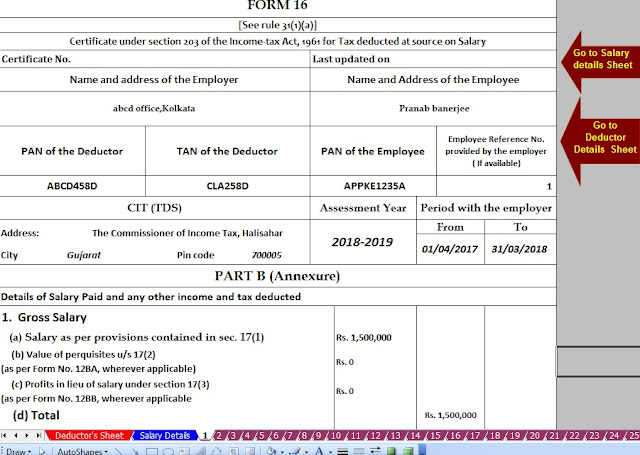

Prepare Automated One by One Form 16 Part B for the Financial Year 2017-18 and A.Y.2018-19 Posted: 28 Apr 2018 05:30 AM PDT As per the CBDT notified that the Form 16 Part A must be download from the TRACES PORTAL and Form 16 Part B must be prepared by the Employer. In this recent time to prepare the Form 16 Part B for most of Govt and Private Concerned and hand over the Form 16 Part B to their employer in April 2019 for the Financial Year 2017-18. Most of the Concerned have the huge quantity of employees and give them the Form 16 Part B. In this regard, if the all concerned may start to prepare the Form 16 Part B so they can complete the total Employees Form 16 Part B in the stipulated time. Given an Excel Based Income Tax Form 16 Part B which can prepare One by One Form 16 Part B for F.Y.2017-18. The Feature of the Excel Utility:-1) You can prepare One by One Form 16 Part B for F.Y.2017-18 as per latest amended Tax Section. 2) Easy to install on any Computer and prepare the Form 16 Part B, just like as an Excel File. 3) You can prepare more than 100 employees Form 16 Part B One by One by this one Excel Utility. 4) All the Income Tax Section have in this Excel utility as per the Finance Bill 2017-18 5) Automatic Convert the Amount into the In-Words. Download the Automated Form 16 Part B for F.Y.2017-18 which can prepare One by One |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 29 Apr 2018 04:58 AM PDT The CBDT has already Circulate vide Circular No.4/2013 dated 17/4/2013 that the Part A(Annexure) of Salary Certificate Form 16 is mandatory to download from the Income Tax New Web Site TRACE and the Part B (Annexure) must be prepare by the Employer/Deductor. As per the New Amended Salary Certificate Form 16 has already Changed of Format of Form 16 vide Notification No. 11/2013, where the Form 16 made in two part. One Part -A and Part - B. The Part A has now mandatory to download from the Web Site TRACES Portal. Click here to download Form 16 Part B and Form 16 Part A&B for the Financial Year 2017-18 [ This Utility can prepare one by one employee Form 16 Part B & Part A&B for FY 17-18] |

itaxsoftware.net

Itaxsoftware.net |

|

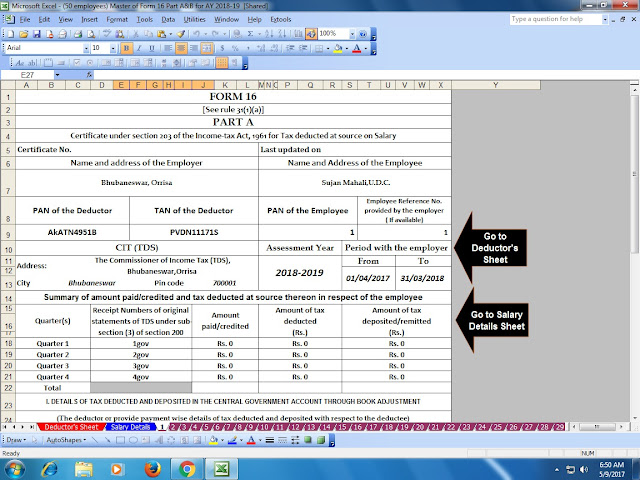

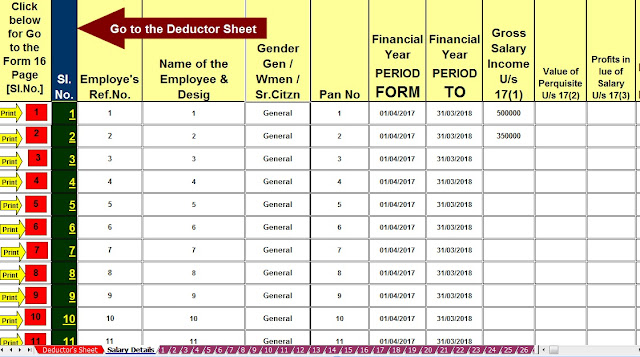

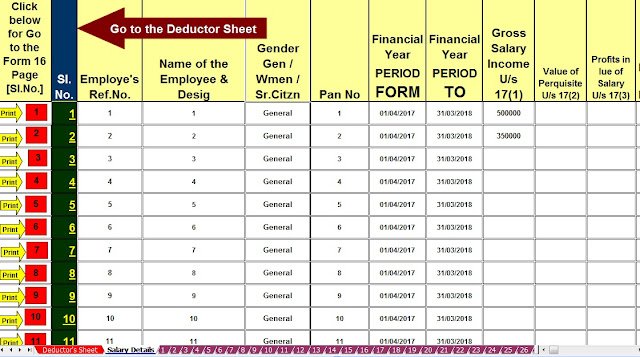

Download & Prepare at a time 50 employees Excel Based Master of Form 16 Part A&B for F.Y.2017-18 Posted: 30 Apr 2018 04:35 AM PDT Click here to Download Automated Income Tax Form 16 Part A&B which can prepare at a time 50 employees Form 16 Part A&B for Financial Year 2017-18 & Ass Year 2018-19.This Excel Utility most easy install to any computer just like as an Excel File and easy to generate with the New Income Tax Slab Rate for F.Y.2017-18

|

itaxsoftware.net

Itaxsoftware.net |

|

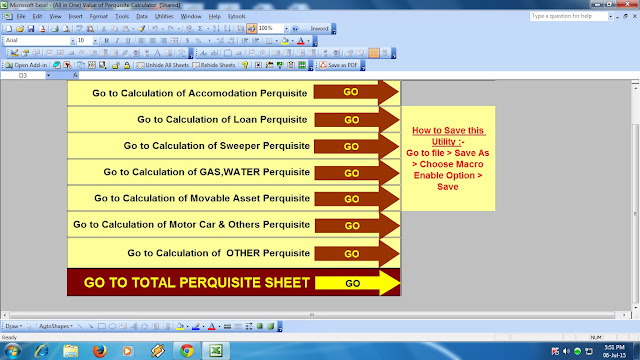

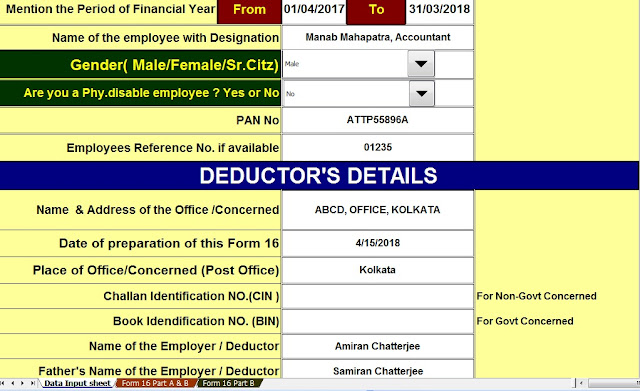

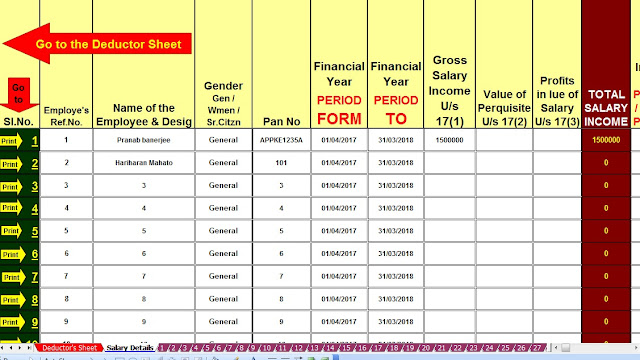

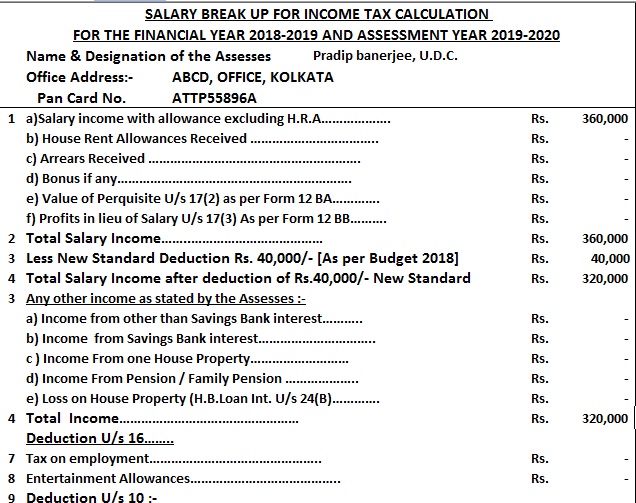

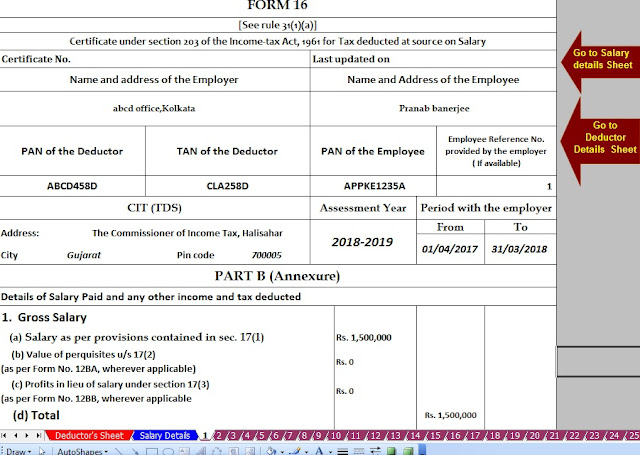

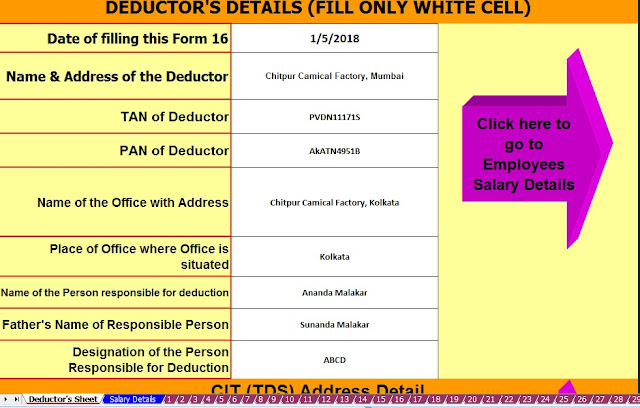

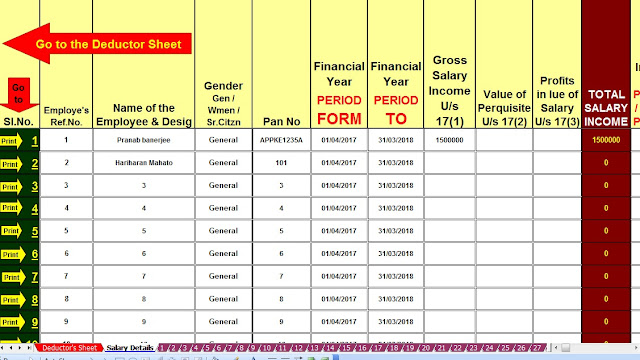

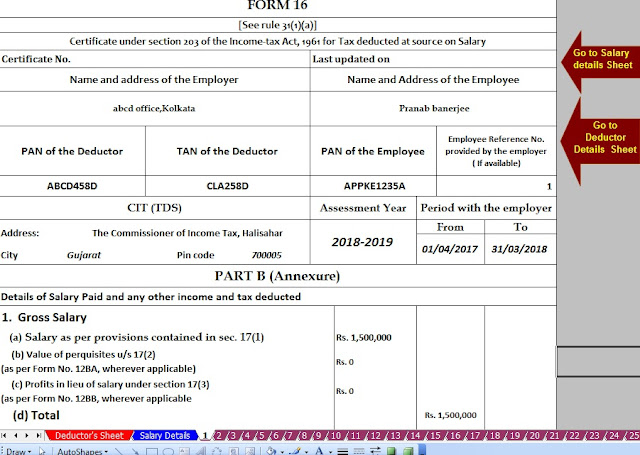

Posted: 01 May 2018 06:15 AM PDT Form 16 and Form 12 BA are provided by the employer which was details about the employee's Salary and Value of Perquisite U/s 17(1) and 17(2) of Income Tax Rules, these are used while calculating Tax Liability and filling Income Tax Return where we look in to the details of Salary in Form 16 and the details of Value of Perquisite U/s 17(2) which provided by the employer to the employee which is shown in this Form 12 BA. You can easily calculate the employee's Taxable Income and the Tax Payable or Refundable with the Automatic Form 16 Part B and also you can get more one step with this form 16 Part B, that the Form 12 BA. Below given the Excel Based Income Tax Salary Certificate Form 16 Part B with Form 12 BA, which most effective for the Financial Year 2017-18 and Assessment Year 2018-19. Click here to download this utility Automatic Form 16 with Form 12 BA for Ass year 2018-19 |

itaxsoftware.net

Itaxsoftware.net |

|

Prepare at a time 100 employees Excel Based Form 16 Part A&B For F.Y.2017-18 Posted: 02 May 2018 05:48 AM PDT Click here to download Automated Income Tax Form 16 Part A&B which can prepare at a time 100 employees Form 16 Part A&B for F.Y.2017-18.This Excel Utility can prepare at a time 100 employees Form 16 Part A&B for F.Y.2017-18, with the new Income Tax Slab for f.Y.2017-18.

|

|

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 03 May 2018 05:28 AM PDT Download Automated 100 employees Form 16 Part B For FY 2017-18 [This Utility Can Prepare at a time 100 employees Form 16 Part-B]Download Automated 50 employees Form 16 Part B For FY 2017-18 [ This Utility can prepare at a time 50 employees Form 16 Part B]The main feature of this Excel Utility are :-1) Automatic prepare at a time 100 employees Form 16 Part A&B as per the latest Income Tax Slab F.Y.2017-182) All the Income Tax Amended Section have in this Utility as per the Finance Budget 2017-18.3) Automatic Convert the Amount in to the In-Word.4) This Utility can prepare more than 1000 employees Form 16 Part A&B[This Excel Utility can prepare at a time 100 or 50 employees Form 16 Part B with updated Tax Slab and Section]Rebate u/s 87A of the Income Tax Act 1961As per the Finance Budget 2017 amended the87A that the Tax Rebate Rs. 2,500/- U/s 87A is entitled in this financial year 2017-18 REBATE OF RS 2500/- FOR INDIVIDUALS HAVING TOTAL INCOME UPTO RS 3.5 LAKH [SECTION 87A] Finance Act 2013 provided relief in the form of rebate to individual taxpayers, resident in India, who are in lower income bracket, i. e. having total income not exceeding Rs 3,50,000/- Amount of rebate is Rs 2500/- or the amount of tax payable, whichever is lower. This rebate is available for A.Y. 2017-18 . Finance Act 2013, has introduced new section, namely Section 87A. This newly inserted section gives rebate up to maximum of Rs. 2500/- to the assesses having Net Total Income Less than Rs. 3,5,000/-. The rebate under this section is available to the resident Individuals w.e.f. A.Y. 2017-18.

Conditions required to be fulfilled: · The rebate is allowed only to the individual assesses (not to HUF/Firm/AOP/BOI) · The individual should be resident in India · Total income should be up to or less than Rs. 3,50,000/-. Total Income here means Income under all heads of Income (Salary, House property, Business & Profession, Capital Gain and Other sources) after deducting the deduction under chapter VI i.e. deduction from 80C to 80U. ·No deduction is available to Super Senior Citizens whose age is more than 80 years. Quantum of Rebate: The rebate will be the lower of · 100% of the tax payable on Total Income; or Rs.3,500/- The Tax Rebate Rs. 3,500/- U/s 87A is allowed in this financial year 2017-18. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

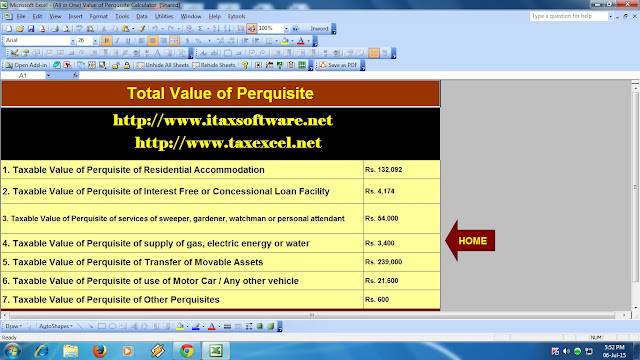

Posted: 04 May 2018 04:58 AM PDT Perquisites mean any casual emoluments, fees or profit attached to an office in addition to salary and wages. In simple words, it’s a personal advantage. It does not cover a mere reimbursement of any expenditure incidental to the employment. Download All in One Value of Perquisite U/s 17(2) [ All type of Value of Calculator U/s 17(2)Like if an employee is provided with a watchman for official use there is no personal advantage to the employee, hence there are no perquisites. If the watchman is provided for personal as well as official use, the value of the perquisites only relating to personal use is taxable. Similarly, if the traveling bills for official duties are reimbursed to the employee, there is no advantage to the assessee, so it is not a prerequisite. The perquisites may be in cash or in kind or in the money or money’s worth and also in amenities which are not convertible to the money. All cash allowance is included in the ordinary meaning of perquisites: - all cash allowance is included and hence taxable under section 17(2) of income tax act. City compensatory allowance, bad climate allowance, shift allowance and incentive bonus are included as perquisites under section 17(2) of income tax act. A prerequisite is taxable as salary only when it is provided by the employer during the continuance of employment: - any perquisites allowed by a person other than the employer is taxable as income from other sources. For example, tips received by hotel waiters from customers are taxable as income from other sources The wide scope of the inclusive definition of perquisites: - the definition of the perquisites is inclusive but not limited to them only. The scope of an inclusive definition cannot be restricted only to those words which accrue in definition, but with extending to many other things not mentioned in it. Therefore, any other item not listed in the definition of perquisites will have to be evaluated in accordance with the general and commercial meaning of the word perquisites. Section 17(2) of income tax perquisites includes. 1- Rent free accommodation under section 17(2) 1 2- Accommodation in the concessional rate of rent under section 17(2) 2 3- Any benefit or amenity to the specified employee who is either a director or has a substantial interest in the company or whose income under salaries exceeds Rs. 50000 under section 17(2)3 4- Obligation of the employee paid or reimbursed by the employer under section 17(2)4 5- Any sum payable by the employer to effect an assurance on the life of the assets or to effect a contract of an annuity under section 17(2) 5 6- Prescribed fringe benefits or amenity under section 17(2)6 When an employee receives ‘perquisites’ from his job, Form 12BA is provided by his employer to the employee. Perquisites are the benefits derived from a job or a position and these are in addition to salary already being paid to the employee. This form is basically a detailed statement with information about perquisites, fringe benefits or amenities and profits in lieu of salary. The Income Tax Act has set out rules for calculation of a monetary value of these perquisites. The value of these payments is shown in the form and also the amount that is taxable to the employee towards these perquisites. Do note that this is form is added to the Form 16 you will receive from the employer. Value of Perquisites u/s17(2) of the Income Tax Act is already included in Part B of your Form 16. The TDS deducted on perquisites is also included in Form 16. Therefore Form 12BA is an additional detail meant only for perquisites. Download the Master of Form 16 Part B with 12 BA for F.Y.2017-18 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA] |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

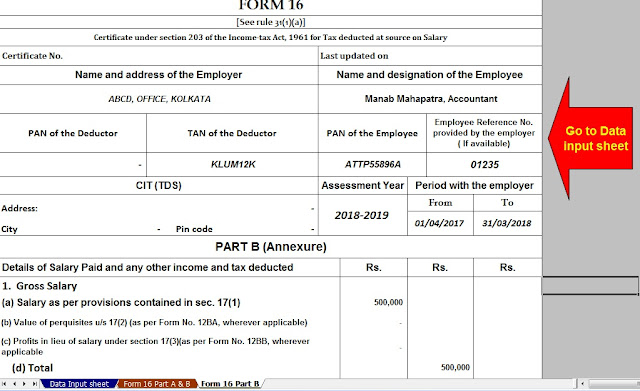

Download Automated Master of Form 16 Part B with Form 12 BA for the Financial Year 2017-18 Posted: 05 May 2018 06:02 PM PDT For the person earning income from Salary , documents Form 16, and Form 12BA are provided by an employer which has details about his salary, perquisites and tax deducted at source(TDS) by his employer.Looked into details of Form 16. Form 12BA give details of Perquisites given by the employer to the employee had looked into what are perquisites, what income tax laws apply to it, about the valuation of perquisites and the taxation with an example, which perquisites are exempted from tax, Difference between Perquisite, Allowance, and Fringe benefit. In this article, we shall see how Form 12BA shows the information about perquisites. Form 12BAForm 12BA is a statement showing particulars of perquisites, other fringe benefits or amenities, and profits in lieu of salary with value thereof. |

Form No. 12BA, if the amount of salary paid or payable to the employee is more than one lakh and fifty thousand rupees, which shall accompany the return of income of the employee. [Explanation : “Salary” for the purposes of this rule shall have the same meaning as given in rule 3.] |

Note:The limit has changed to one lakh and eight thousand (1,80,000) by circular in 2011. |

Download Automated Master of Form 16 Part B with Form 12 BA FY 2017-18 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA for Assessment Year 2018-19] |

This posting includes an audio/video/photo media file: Download Now |

|

Posted: 05 May 2018 05:19 AM PDT Click here to Download the Automated Income Tax Form 16 Part B for Financial Year 2017-18 & Ass year 2018-19 with the new Tax Slab for F.Y.2017-18.This Excel Utility can prepare more than 100 employees Form 16 Part B ( One by One). Most easy to install just like an Excel File and most easy to generate. All the New Amended Income Tax Section have in this Excel Utility.

|

itaxsoftware.net

Itaxsoftware.net |

|

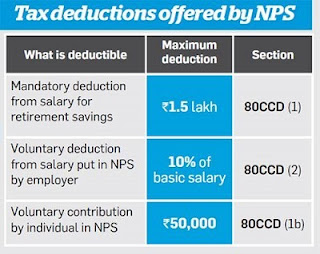

Posted: 06 May 2018 05:08 AM PDT Tax Deductions available under section 80 of Income Tax Act, 1961Section 80C (Individual & HUF) : - In all, total deductions under section 80C, 80CCC and 80CCD (1) cannot exceed Rs 1.50 lakh for the current assessment year. Which means total investments, expenses, and payments up to a limit of Rs 1.50 lakh are eligible for tax deductions mentioned in the above-mentioned sections. These sections cover many savings schemes like National Savings Certificates (NSCs), Public Provident Fund (PPF) and other pension plans, life insurance premiums, government bond investments. Here’s a section-wise breakup of deductions and exemptions available under the above-mentioned codes:Section 80CCC (Individual): - This section provides tax deductions for any investments made in an annuity plan or Life Insurance Corporation (LIC) or pension received under funds mentioned in Section 10(23AAB).Section 80CCD (1) (Individual): - The deductions under this section are aimed at encouraging people to save. These deductions are allowed to people who avail the National Pensions Savings Scheme (NPS). Under this, an individual can avail a deduction of up to 10 percent of his/her salary or Rs 1.50 lakh whichever is lower if the person has employed or the lower of Rs 1.50 lakhs or 10 percent of gross income, if the individual is self-employed.Download Automated Master of Form 16 Part B which can prepare at a time 100 Employees Form 16 Part B for F.Y.2016-17 |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 07 May 2018 05:19 AM PDT DEDUCTIONS FROM GROSS TOTAL INCOME (CHAPTER VI-A) UPDATED AS ON APRIL 1, 2017 1. DEDUCTION IN RESPECT OF INVESTMENTS IN SPECIFIED ASSETS (SECTION 80C) Section 80C provides for a deduction of savings in specified modes of Investments from gross total income. It is available only to an Individual or HUF. The Maximum permissible deduction is Rs.1.5 lakh along with deduction u/s 80CCC & 80CCD. Admissible Deductions:- 1. Premium paid on insurance on the life of the Individual or HUF only to the extent of such premium or other payment made not in excess of 10% (As amended by the Finance Act,2012) of Actual Capital Sum Assured. Explanation to Sec 80C (3A) has been introduced to provide that the Actual Capital Sum Assured in respect of the life insurance policies to be issued on or after 1st April, 2012 shall mean the minimum amount assured under the policy on happening of the event at any time during the term of the policy without taking into Account the following:- · The Value of Premium to be Returned or · Any Benefit by way of bonus or otherwise to be received over & above the sum actually assured. Download Automated Income Tax Master of Form 16 Part A&B and Part B for F.Y.2017-18 & A.Y. 2018-19 as per New Tax Slab as per the Finance Budget 2017-18 [ This Excel Utility can prepare One by One Form 16 Part A&B & Part B for F.Y.2017-18, with all amended Tax Section with Tax Slab for F.Y.2017-18]2. Sum paid under the contract for deferred on the life of the Assessee or his/her spouse or children. 3. Sum deducted by the government from the salary of an employee for securing a deferred annuity for self, spouse or children. 4. Contribution to any PPF. 5. Contribution by an employee to RPF. 6. Contribution by an employee to an Approved Superannuation Fund. 7. The contribution made to any PPF set up by the Central Government. 8. Subscription to any deposit scheme or contribution to any Pension fund set up by the National Housing Bank. 9. Payment of Tuition fees by an Individual Assessee at the time of admission to any university, college, school or other educational institutions within India for the purpose of full-time education of any two children. 10. Subscription to deposit scheme of Public Sector, engaged in providing housing finance. 11. Subscription to units of Mutual Funds notified u/s 10(23D). 12. Sum deposited in Fixed Deposits (FDs) with tenure of five years. 13. Sum deposited in 5 yrs Post Office Time Deposit (POTD) scheme. 2. DEDUCTION IN RESPECT OF CONTRIBUTION TO CERTAIN PENSION FUNDS (SECTION 80CCC) Deduction in respect of Payment of premium for annuity plan of LIC or any other Insurer is provided. The Premium must be deposited to keep in force a contract for annuity plan of LIC or any other insurer for receiving a pension from the fund. For this purpose, the Interest or Bonus accrued or credited to the Assessee’s Account shall not be reckoned as Contribution. The Maximum Deduction allowed is Rs.1.5 lakh. 3. DEDUCTION IN RESPECT OF CONTRIBUTION TO PENSION SCHEME OF CENTRAL GOVERNMENT (SECTION 80CCD) Contribution towards NPS by Employee[80CCD(1)]: Taxpayer is an individual and he is employed by the central government (on or after January 1, 2004), or employed by any other person or self-employed. He has in the previous year deposited any amount in his account under NPS. Under this, Employee is to contribute 10% of their salary or more and deduction is available under section 80CCD(1) which is restricted to 10% of the salary and for a person other than employee deduction is restricted to 10% of GTI. For the A.Y 2015-16 amount of deductible under section 80CCD(1) cannot exceed Rs. 1 Lacs. Contribution towards NPS by Employer [80CCD(2)]: Contribution by the employer to NPS is deductible under section 80CCD(2) in the hands of the concerned employee in the year in which contribution is made. However, no deduction is available in respect of employer’s contribution which is in excess of 10 percent of the salary of the employee. 4. LIMIT ON DEDUCTION U/S 80C, 80CCC, 80CCD The Limit for maximum deduction available u/s 80C, 80CCC, 80CCD (combined together) is Rs.1.5 Lakh only. 5. DEDUCTION IN RESPECT OF MEDICAL INSURANCE PREMIUM (SECTION 80D) This Section provides for a deduction of Rs. 25000 in respect of premium paid towards a health insurance policy for the Assessee or his family (spouse and dependent children) or any contribution made to the Central Government Health Scheme in aggregate and a further deduction of Rs. 30,000 is allowed of premium paid in respect of health insurance policy for parents. An increased deduction of Rs. 30000 shall be allowed in case any of the persons mentioned above are senior citizens (i.e. of age 60 years or above).Further, it is provided that for claiming such deduction u/s 80D the payment must be by any mode other than cash. Further Deduction of Rs. 5000 shall be allowed in respect of payment made on Account of preventive health check-up of self, spouse, children or parents made during the previous year. This deduction is within the overall limit of Rs. 25000 or Rs.30000, as the case maybe. For claiming this deduction payment can be by any mode including cash. 6. DEDUCTION IN RESPECT OF REHABILITATION OF HANDICAPPED DEPENDENT RELATIVE (SECTION 80DD) It provides for a deduction to an Assessee being an individual or HUF who is a resident in India. Deduction of Rs. 75,000 is available in respect of any Amount paid for the medical treatment (including nursing), training and rehabilitation of a dependent, or any amount paid or deposited under a scheme framed in this behalf. In the case of severe disability (i.e. a person with 80% or more disability), the deduction of Rs. 1,25,000 (Rs. 1,00,000 for the assessment year 2010 -11 to 2015-16 Rs. 75,000 up to the assessment year 2009-10) shall be available. Dependent means In the case of an Individual the spouse, children, parents, brothers, sisters, of the individual and in the case of HUF, any member who is wholly dependent on the assessee. 7. DEDUCTION IN RESPECT OF MEDICAL TREATMENT (SECTION 80DDB) The deduction of Rs. 40000 or Amount actually paid whichever is less shall be allowed to an Assessee who is resident in India being an Individual or HUF. A deduction shall be allowed of any amount paid for the medical treatment of such disease or ailment as may be specified in the rules. In case the Amount is paid in respect of a senior citizen (i.e. of age 60 years or above) then the deduction would be Rs.60000 or the Amount actually paid whichever is less. 8. DEDUCTION IN RESPECT OF INTEREST ON LOAN TAKEN FOR HIGHER EDUCATION (SECTION 80E) This section provides deduction to an Individual in respect of any interest paid on loan taken for the purpose of pursuing his higher education or the for the purpose of higher education [i.e all fields of studies (including vocational studies)pursued after passing the senior secondary examination] of his/her relative i.e. spouse or children of the Individual or the student for whom the Individual is the legal guardian. The loan must have been taken from any financial institution or approved charitable institution. The amount of deduction is amount is paid by the individual during the previous year and such amount is paid out of his income chargeable to income tax. 9. DEDUCTION IN RESPECT OF INTEREST ON LOAN TAKEN FOR RESIDENTIAL HOUSE PROPERTY APPLICABLE FORM a.y 2017-18 (SECTION 80EE) The following conditions should be satisfied in order to claim deduction under section 80EE:-

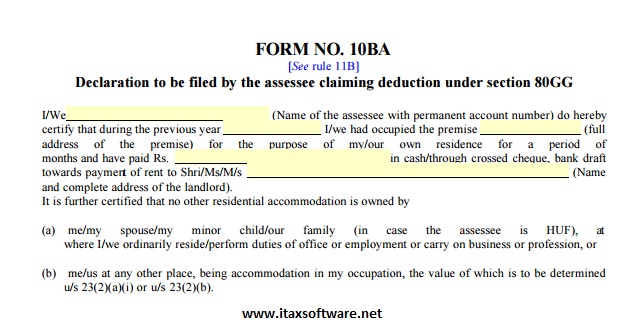

If above conditions are satisfied, the assess can claim deduction under section 80EE of the interest payable on the above loan or Rs. 50,000 whichever is less. This deduction is available for the assessment year 2017-18 and subsequent assessment years. 10. DEDUCTION IN RESPECT OF DONATIONS TO CERTAIN FUNDS, CHARITABLE INSTITUTIONS ETC. (SECTION 80G) The deduction under section 80G is available to any taxpayer (may be individual, company, firm or any other person, may be resident or non -resident). The various donations specified under this section are eligible for deduction up to either 50% or 100% with or without restrictions. Sub-Section 5D has been inserted in section 80G to provide that no deduction shall be allowed in respect of donation of any sum exceeding Rs.10000 unless such sum is paid by any mode other than cash. 12. DEDUCTION IN RESPECT OF RENT PAID (SECTION 80GG) Admissible deduction:- The deduction will be least of the following:- · Actual Rent paid less 10% of the total income before allowing such deduction, or · 25% of such total income or · Rs. 5000 per month Total income will not include long-term capital gains and any income referred to in sections 115A to 115D. Conditions to be satisfied:- · Assessee should not be in receipt of House Rent Allowance. · The expenditure incurred by him on rent of any furnished or unfurnished accommodation should exceed 10% of his total income arrived at after all deductions under Chapter VI-A except section 80GG. · The Accommodation should be occupied by the Assessee for the purpose of his own residence. · The Assessee should not have self-occupied residential premises in any other place. · Assessee should file a declaration in form 10BA, confirming the details of rent paid. |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 08 May 2018 06:30 AM PDT Before planning your taxes one should be aware of the total income and tax liability in order to be smart tax saver. The government has provided with many plans using which individuals can make better investment decision along with tax saving options. Individuals often get stuck with 80C tax benefits only during tax planning. While there is little doubt 80C investments are best for tax saving purposes, there are other investment options which can help you save tax if invested smartly. Download Automated Master of Form 16 Part B for Financial Year 2017-18 & Ass year 2018-19 with the all amended Income Tax Section including new Income Tax Slab Rate for F.Y.2017-18 [ This Excel-based software can prepare at a time 50 employees Form 16 Part B for F.Y. 2017-18 with the all amended Income Tax Section and Income Tax new Slab Rate for F.Y.2017-18]NPS The Government of India (GOI) launched the National Pension System for individuals in May of 2009. Under the NPS, each Subscriber will open an account with Central Recordkeeping Agency (CRA) which will be identified through unique Permanent Retirement Account Number (PRAN). The NPS offers you an additional tax deduction for the investment up to Rs. 50,000 in under subsection 80CCD (1B). This is over and above the deduction of Rs. 1.5 lakh available under sec 80C of Income Tax Act. 1961. Returns would depend on the asset class that you choose. For example, you could select equity, which is a high-risk instrument or corporate debt or government debt. Interest on education loan (Section 80E) The deduction is allowed only on the interest repayment part, not on the principal amount of education loan. Means that only interest repayment is available for the tax deduction while filing income tax return. This deduction is over and above the 80C limit and there is no maximum limit on claiming deduction under 80E. Not many are aware of the scheme, and one needs to educate people more on this section and its benefits. House rent allowance (Section 80GG) If you are staying in a rented apartment or house and paying rent, you can claim tax deduction under Sec 80GG of the Income Tax Act. The amount of deduction is based on the city that you are residing. Again, some cities need to be revamped to factor in an increased rental in this city, but that has not happened so far. More details and exact break-up cannot be sought from your company, so it is best talking to the HR department on the exact tax benefits that you would get. Home Loans In the Union Budget last year, Finance Minister Arun Jaitley increased the limit on deduction on home loan interest under Section 24 to Rs 2 lakhs. An additional deduction of Rs 50,000 on home loan interest can be claimed to start the financial year 2016-17 under Sec 80EE of the Income Tax Act. However, to be able to claim this deduction, you must meet certain conditions. The principal amount continues to be a part of the overall benefits under Sec 80C Max Rs. 1.5 Lakhs. Health Insurance (Section 80D) Individuals should take a health insurance policy, which would enable them to save tax up to Rs 25,000 in the case of ordinary citizens and Rs 30,000 in the case of senior citizens. So, one can go ahead and take a good health insurance policy. This is again a tax option that you have apart from the usual 80C benefits. The Sec 80D benefits also include the benefits on expenses incurred towards preventive health check-ups. Donations (Section 80G) Section 80G of income tax law provides tax benefits on the amount donated to NGO's. So, it maybe time to be a little more generous than before. However, the deduction can be made only if you are donating by cash or draft. The deduction can be either 50 per cent or 100 per cent. You have to claim this deduction when filing your tax returns and quoting of PAN number to the institution where you donated is a must. There is an entire list of institutions and establishments where you can donate. Medical treatment under Sec 80DDB For certain specific diseases, Income Tax Act offers tax benefits to an individual under section 80DDB on the basis of expenses incurred by him for the treatment of such diseases or ailment. This is not only for the person filing the tax returns but, also for individuals dependents of such an individual. However, this tax benefit is not available for Non-Resident Indians. In case it is a Hindu Undivided Family one can claim it for members of such an HUF. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Free Download Amount to In Words Excel Tools Posted: 09 May 2018 05:44 AM PDT Most of Concerned have been used the Excel for their Account Matter. But it is not possible to Amount to In Words without any VB Code. Somewhere create the VB Code for Convert the Amount to In Words. When we have to need the Amount Rs.500 to In Words, most of Excel User manually the Five Hundred. But if you have a unique Excel Tools and install in your Computer, the Amount will Convert to the In Words automatically as your required Cell. For an example: - One Excel Sheet has 3 column with the amount of each column and willing to Sum to the Next Cell, Just type " words" the Amount will be Convert automatically as the amount of Sum.Below the Picture what is the Excel tools activity 1) Unzip the file 2) Copy the Sword Tools 3) Paste it in your any Drive 4) Open a new Excel Work Sheet 5) Click to Tools Menu > Choose Add-Ins >Click Add-Ins > Browse and select the In word Tools > OK FOR OFFICE 2007 USERS: - Open a New Work Sheet > Go to Open menu > Click the Excel Option>Select Add-Ins > Browse the Excel Tool Menu ( where you paste Excel Tool) >Select > OK NOW CLOSE THIS EXCEL WORKSHEET OR BOOK AND RE-OPEN ANY EXCEL SHEET, PUT THE AMOUNT IN A-1 CELL > CLICK THE B1 CELL, PUT THE FORMULA =WORD(A1), CLICK ANYWHERE IN THIS WORKSHEET, LOOK THE B1 CELL. Click here to Download the Excel Utility |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

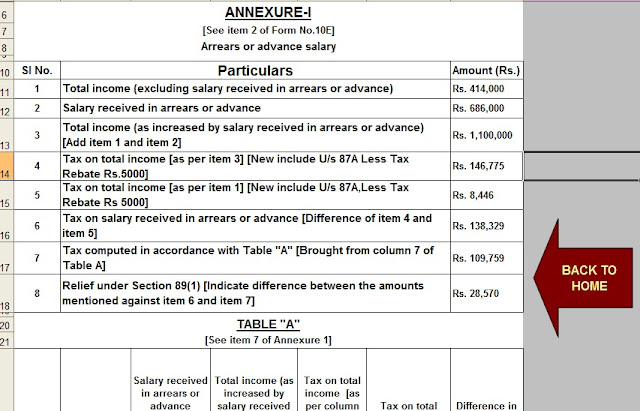

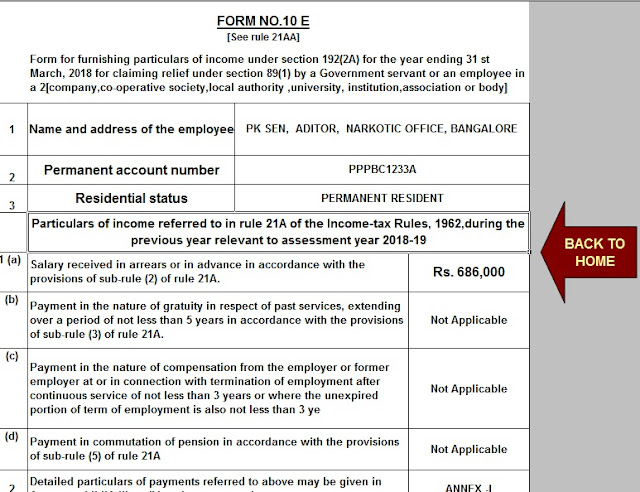

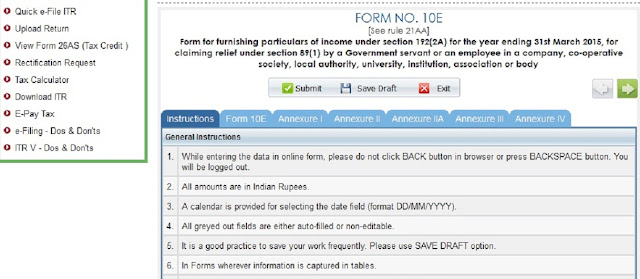

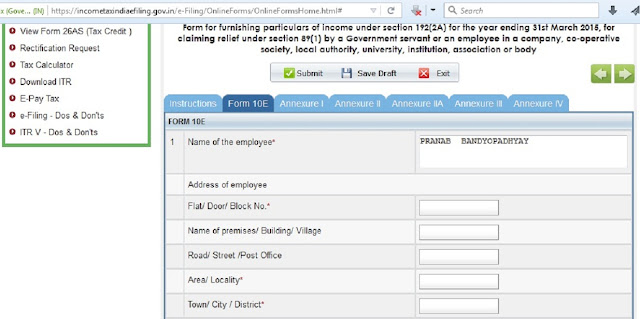

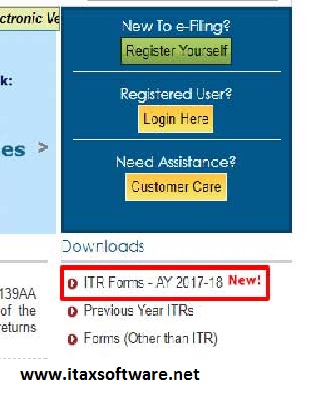

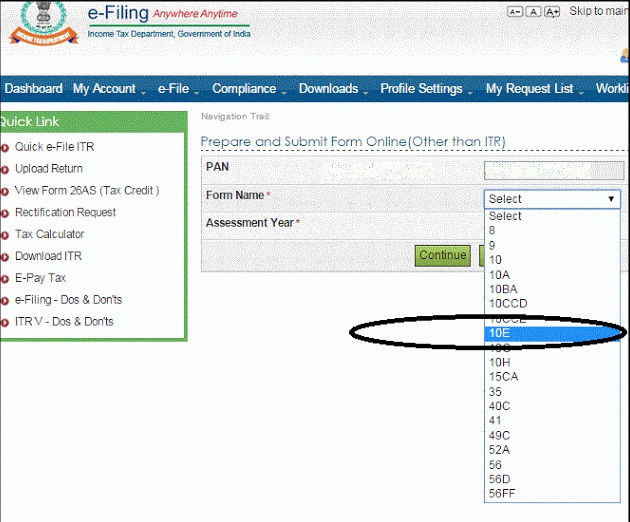

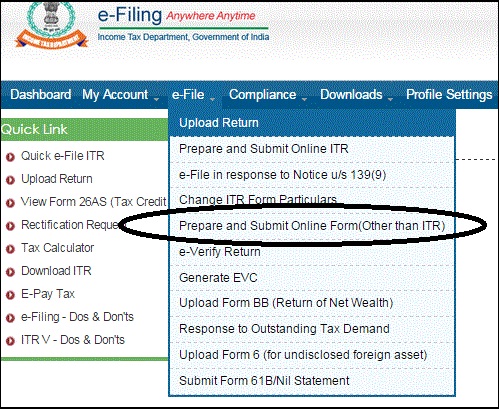

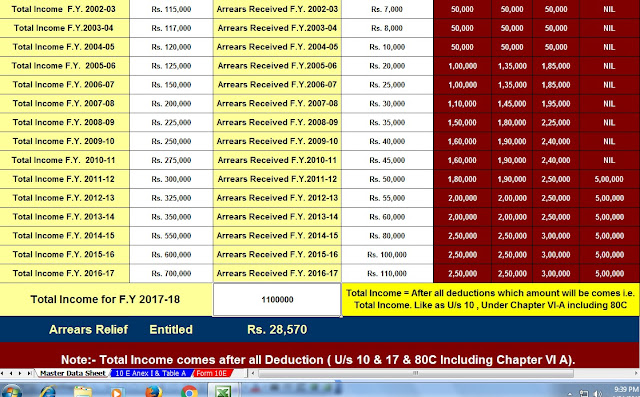

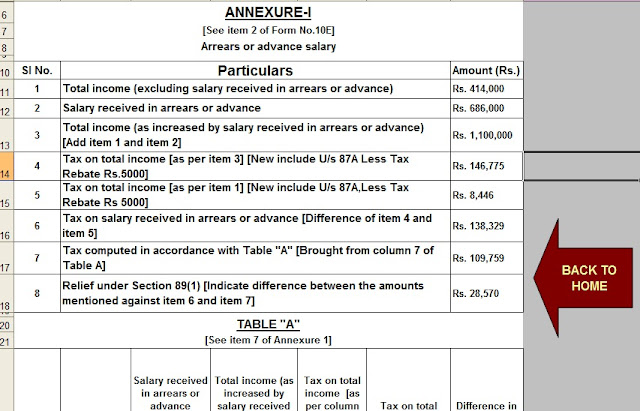

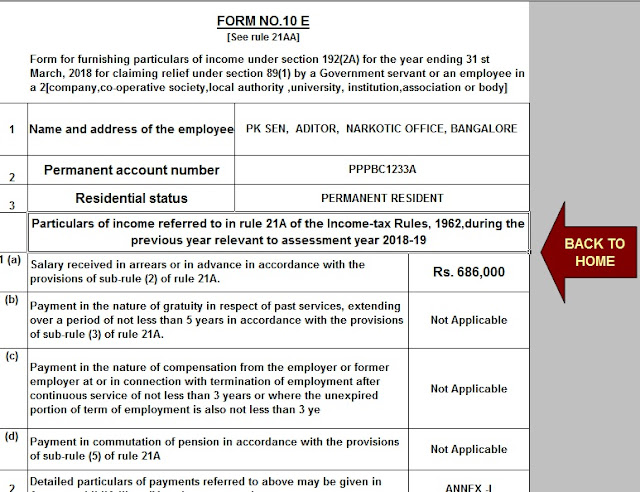

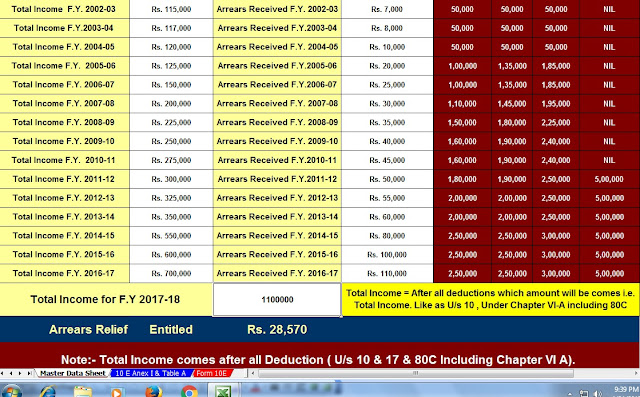

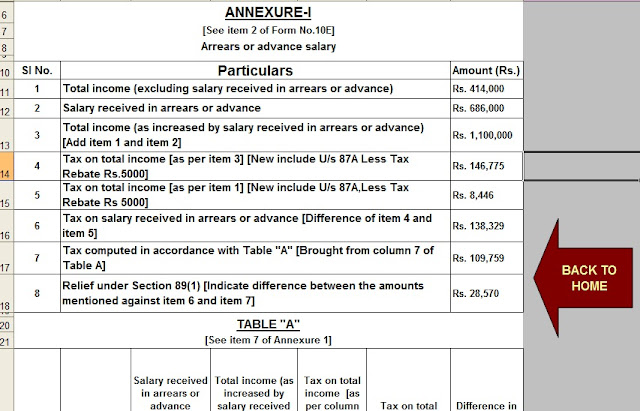

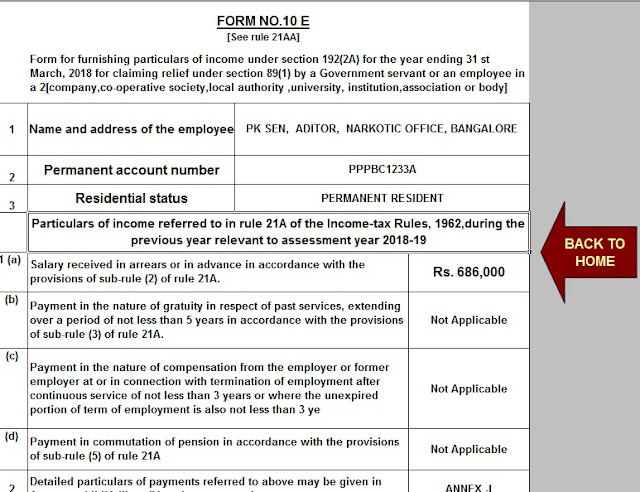

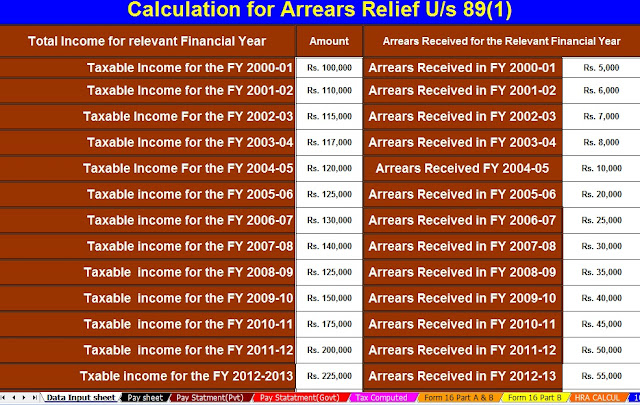

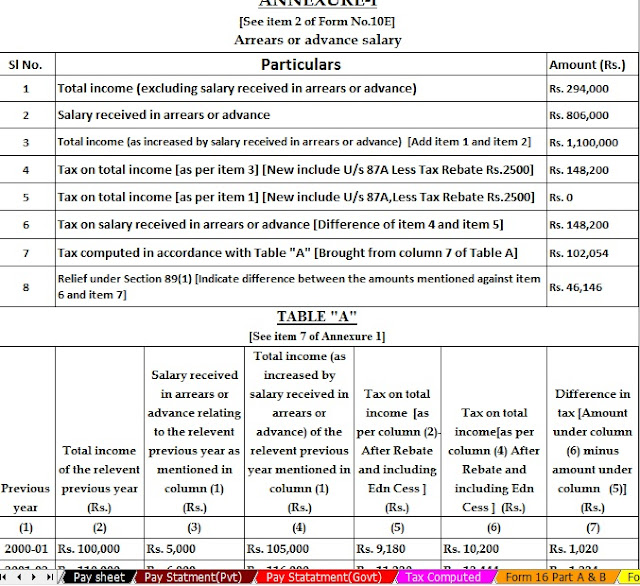

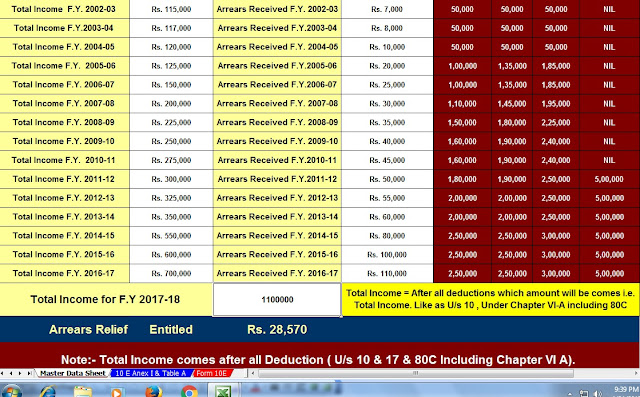

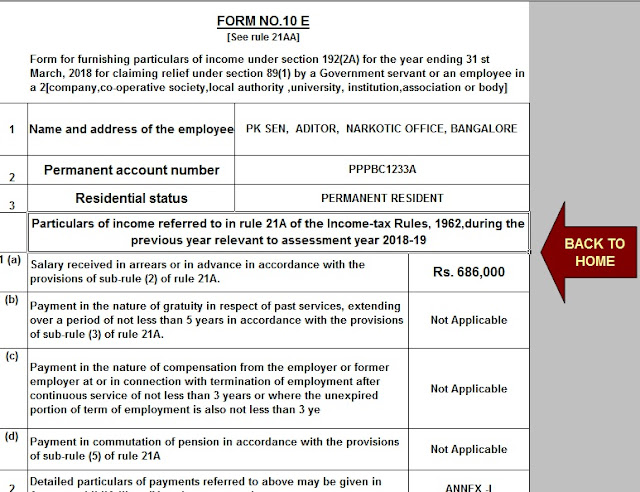

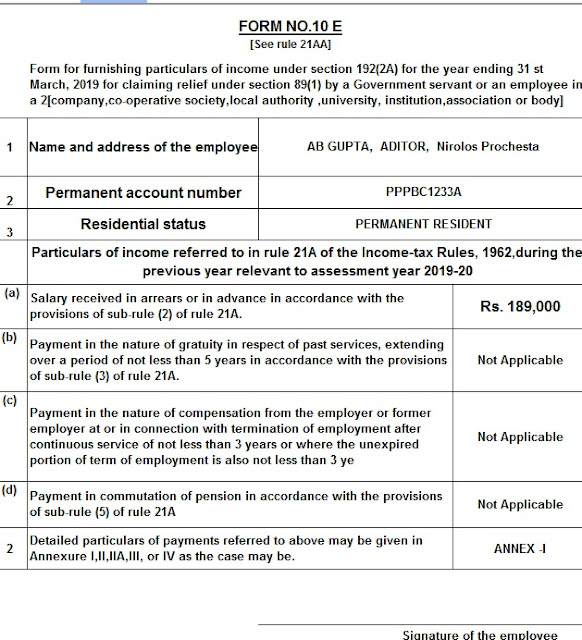

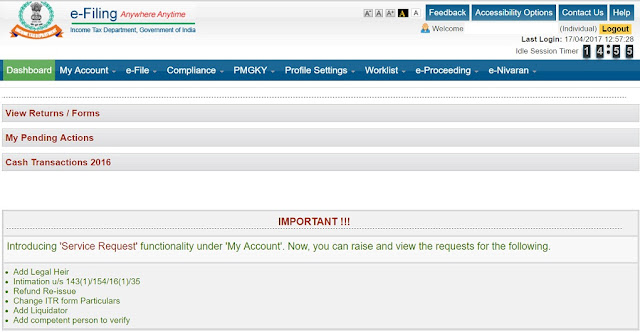

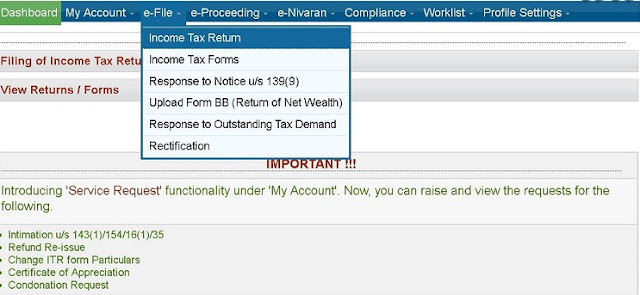

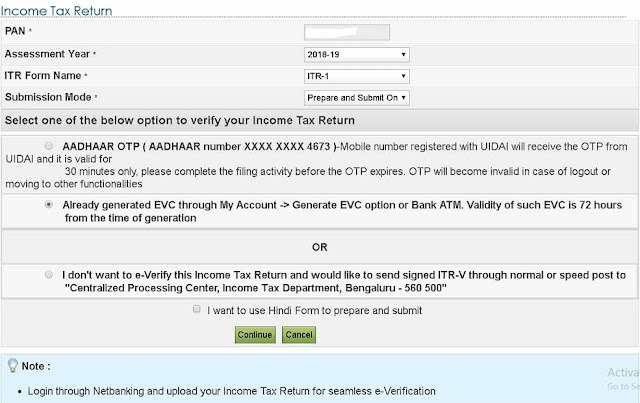

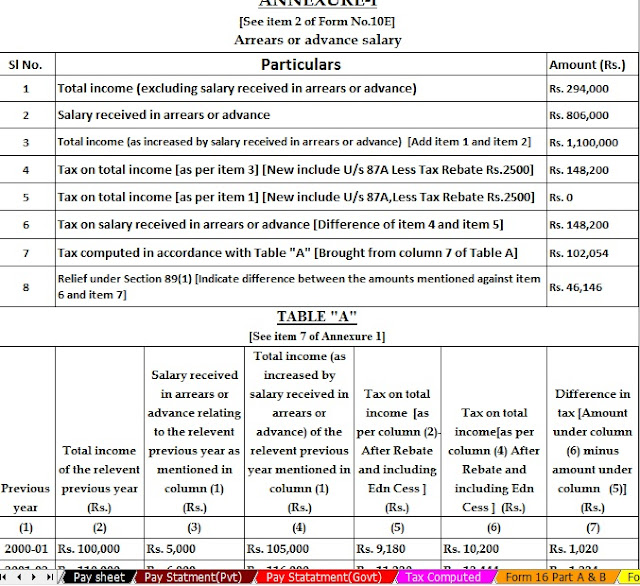

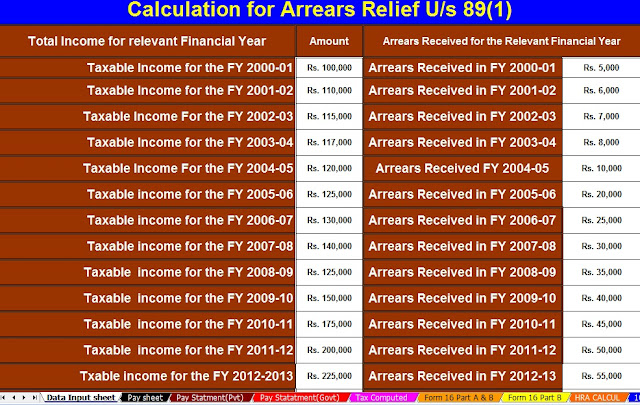

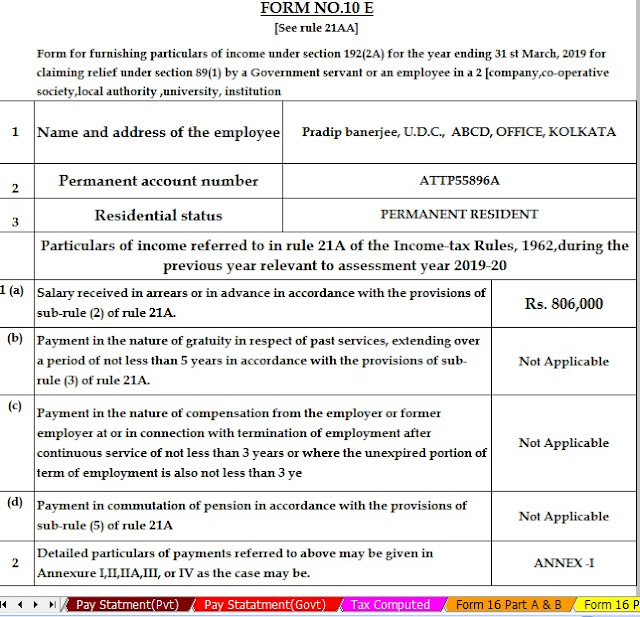

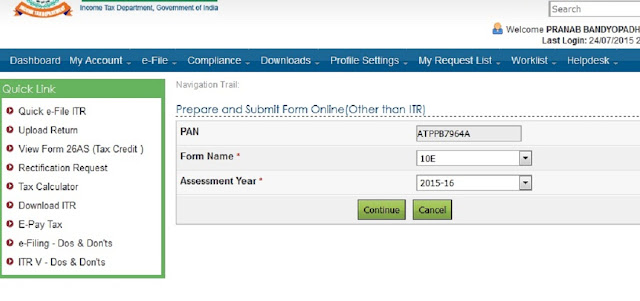

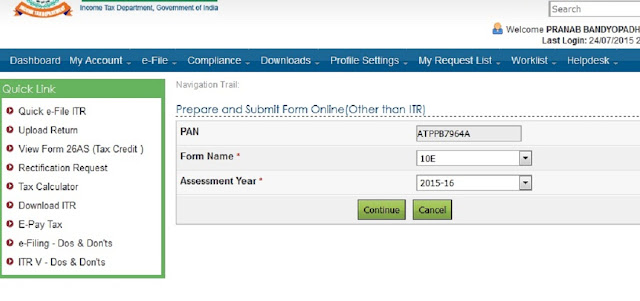

Posted: 10 May 2018 07:25 AM PDT Income Tax Department has disallowed relief u/s 89(1) which was claimed by Assessee during his/her filing of Income Tax Return for the Assessment Year 2017-18. Earlier there was no doubt in claiming such relief up to A.Y. 2017-18 from Income Tax Department. Simply Assessee claims in ITR form and Income Tax Department allows the same as claimed by Assessee. But now, w.e.f. Assessment Year 2015-16, It is compulsory to upload online 10E form otherwise claim will be rejected and demand will be raised by I.T. Department. All Assessees who had already claimed rebate u/s 89(1) in the A.Y. 2015-16 have been informed by Income Tax Department through intimation order under section 143(1) that claim amount of rebate has been rejected and raised demand along with interest for the same. Procedure to upload 10E Form It is clear without uploading 10E form, relief under section 89(1) cannot be claimed. Now the question is that how can we upload 10E Form along with ITR-1 (Sahaj), ITR-2 etc Forms. It has been found that 10E form is not ITR forms.The 10E form is other than ITR form which is available in income tax website after login for E-Filing of incometaxindiaefiling.gov.inas shown in below Snapshot:-

Download Arrears Relief Calculator Since the Financial Year 2000-01 to 2017-18 |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

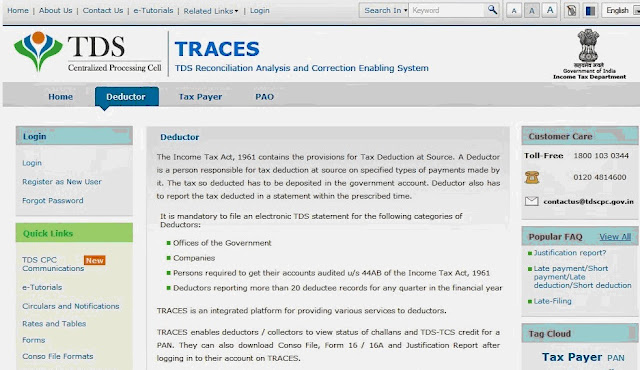

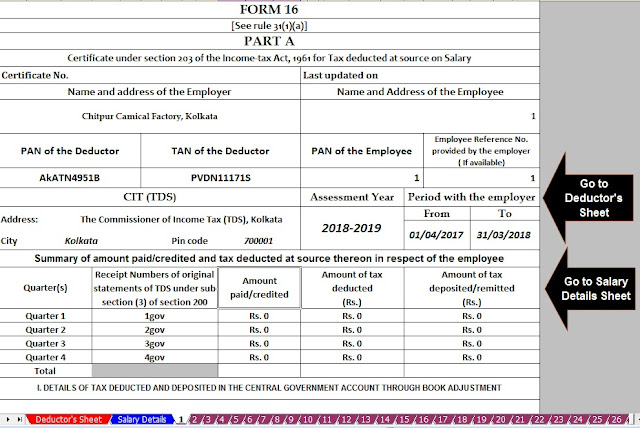

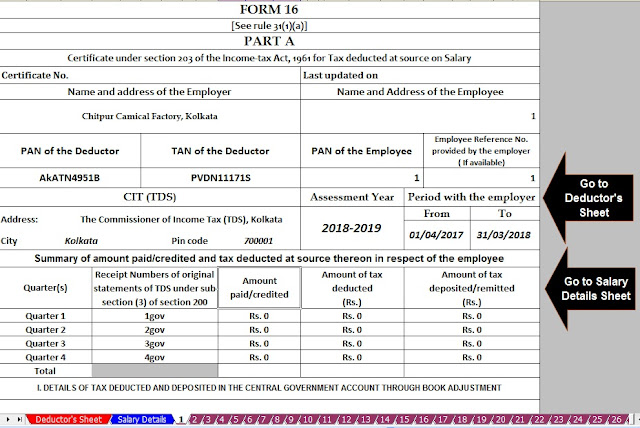

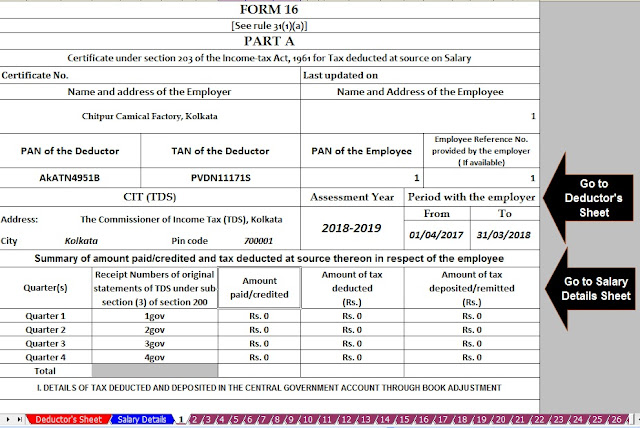

Posted: 11 May 2018 09:48 PM PDT The latest Income Tax Department Notified Vide Notification No 11/2013 that the Salary Certificate Form 16 Part A is now Mandatory to Download from the TRACES Portal and the Form 16 Part B must be prepared by the Employer or Deductor. This Notification with effect for the Financial Year 2012-13 and on words. You can easily download the Form 16 Part A from the TRACES portal after registering the TAN WHICH FREE OF COST. If you have not Download the Form 16 Part A from the TRACES Portal, you have to do this must. It is also observed that the various Concerned Govt and Non- Govt Concerned have not intimated about this Notification. In this Regard, various Concerned have already prepared the both of Part A and Part B ( Amended) New Form 16 which also Notify vide Notification No 11/2013. Below given the Excel-based Software can prepare both of Salary Certificate Form 16 Part A and Part B for Financial Year 2017-18( New Amended Format) in one software and you can also be prepared the Form 16 Part B in this one Software. This Excel Based Software is most handy. Download this utility from below:- Download Income Tax Form 16 Part A&B and part B for FY 2017-18 ( One by One Preparation Form 16 for F.Y.2017-18 ) |

itaxsoftware.net

Itaxsoftware.net |

|

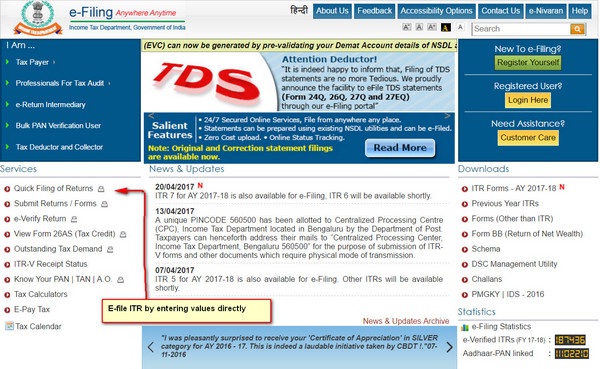

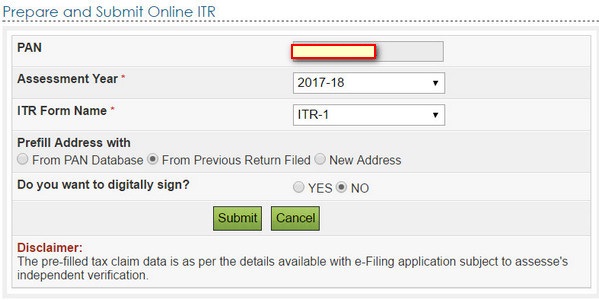

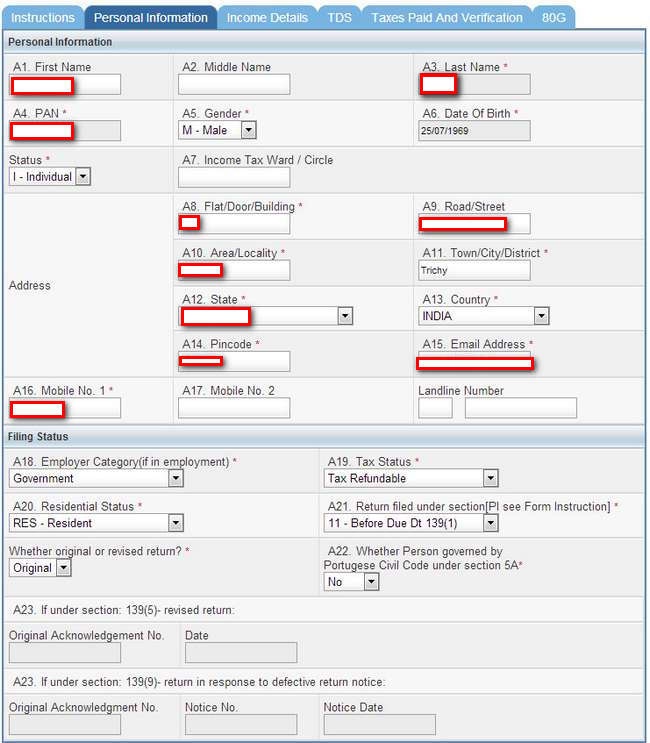

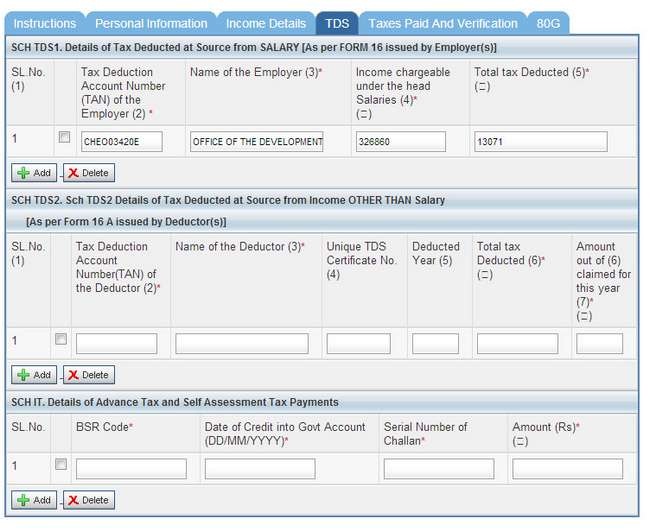

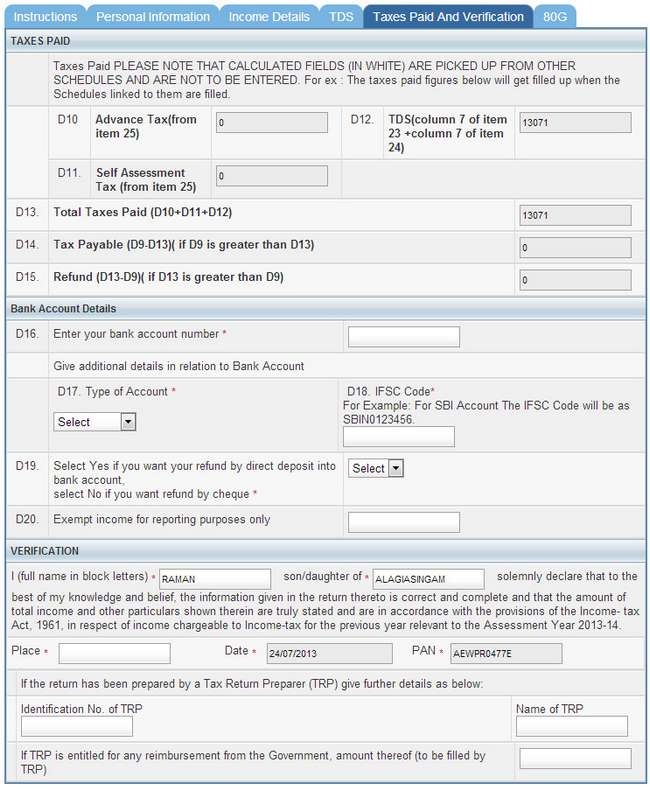

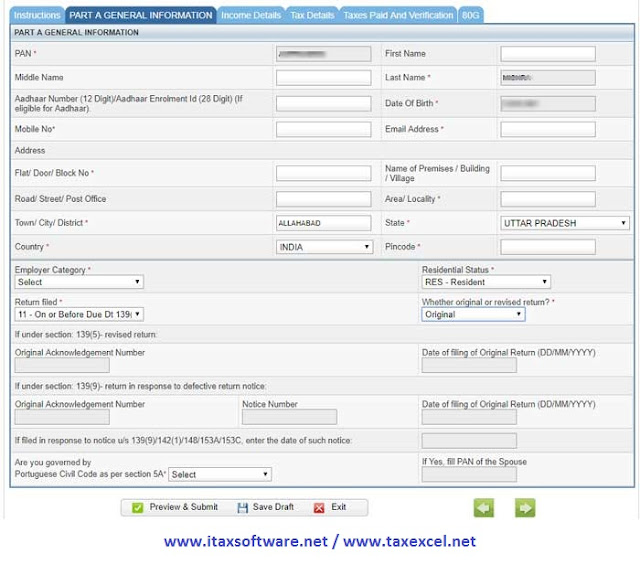

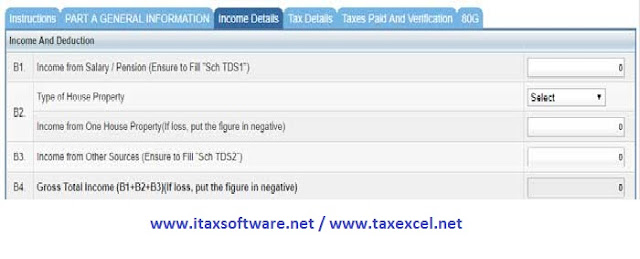

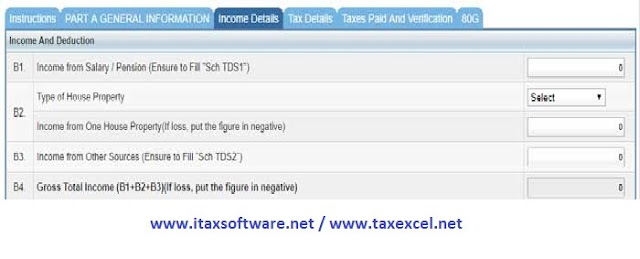

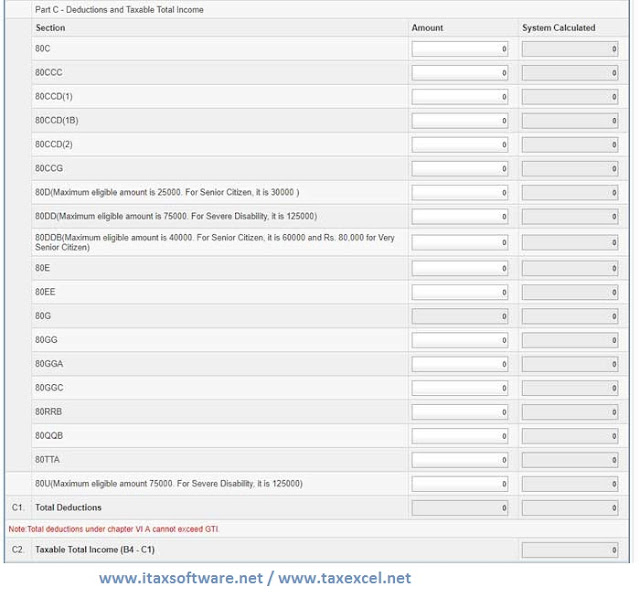

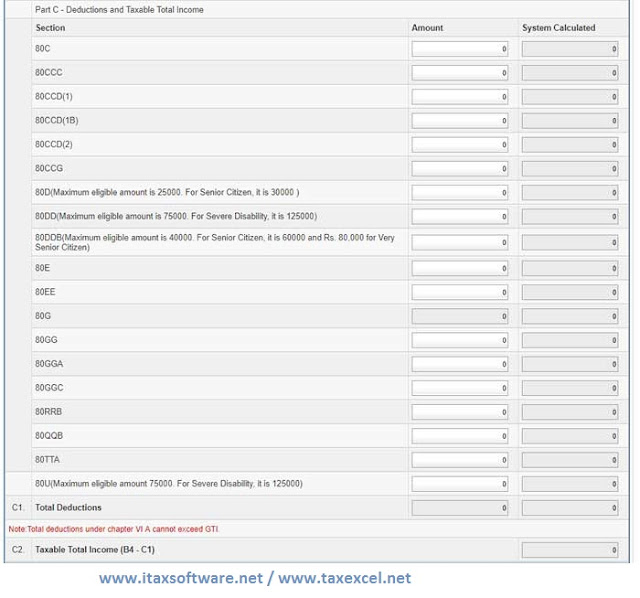

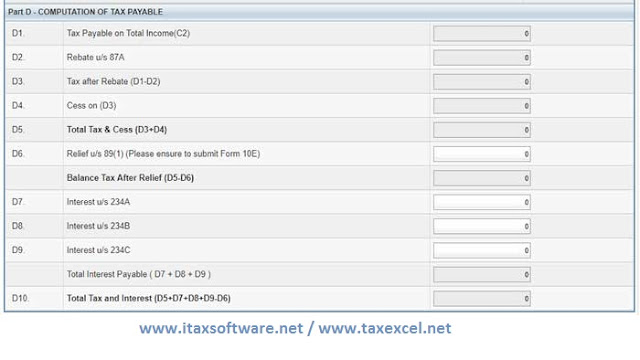

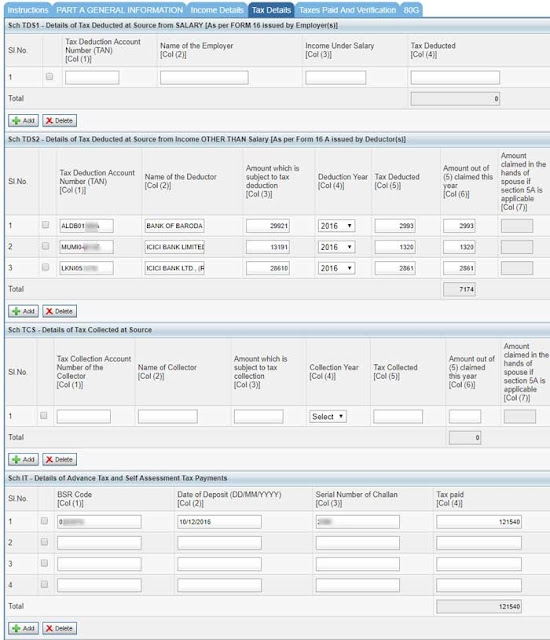

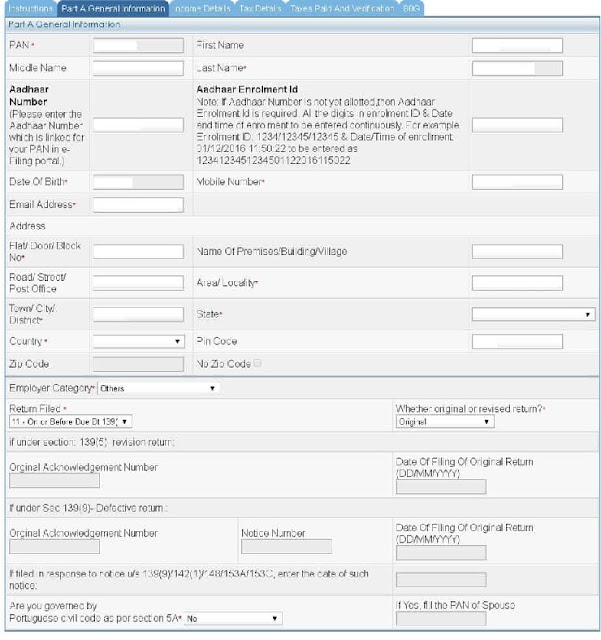

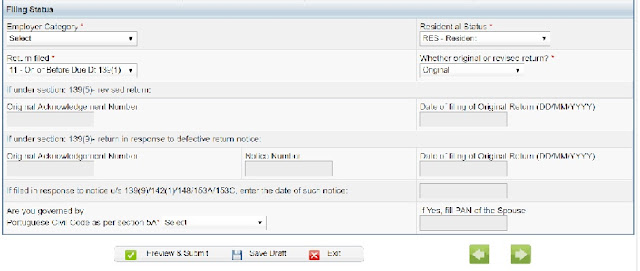

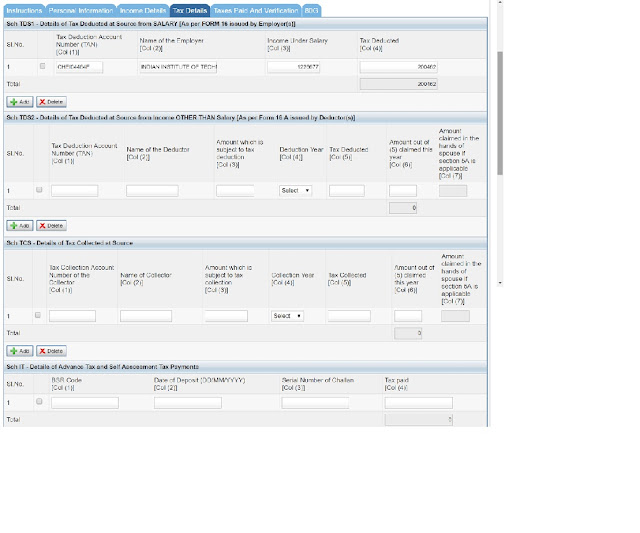

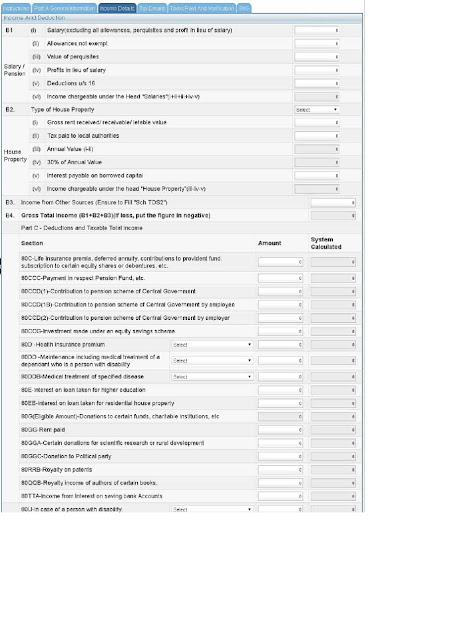

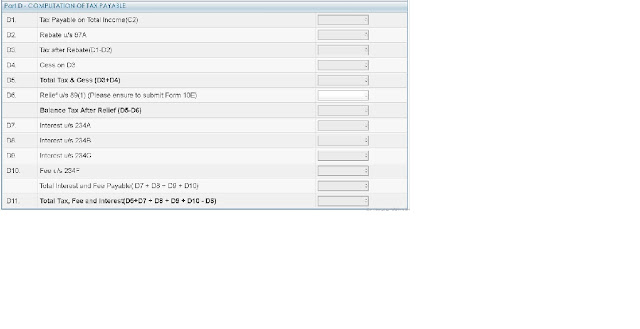

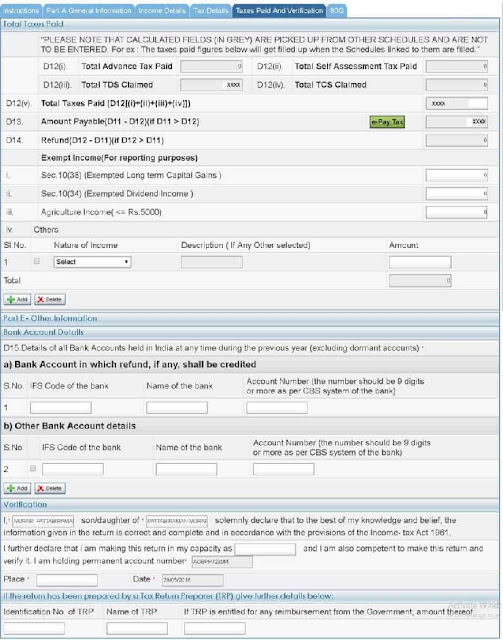

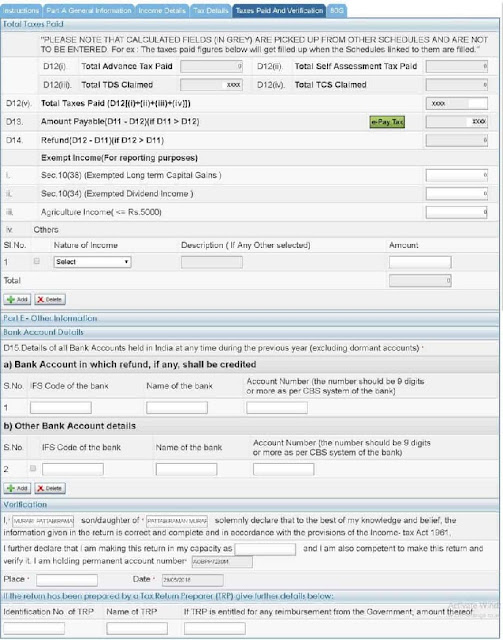

How to file ITR-1 Online ? – Income Tax 2016-17 (A.Y 2017-18) – Easy steps to file ITR-1 Online Posted: 12 May 2018 08:15 AM PDT The Calculation and TDS process of Income Tax liability of Salaried Employees for the year 2016-17 (The assessment year 2017-18) would have been over by this time. Now it’s time for Employees to receive Form-16 from the Employer and file their income tax return. Easy E-filing by entering the data directly on the Income Tax E-filing website. This is the most user-friendly method. As of now, ITR-1 and ITR-4S can be filed in this method 1. Go to this Income Tax Department’s Official online ITR filing Website. Register using your PAN and get username and password, if you have not already registered. 2. After successful registration, Click the “Quick Filing of E-Returns” hyperlink available in the left menu. 3. Once you have successfully logged in you will land in to following page. 4. After you select the ITR type and relevant year for which ITR has to be filed, entry page of ITR will be shown. The first tab will be containing the instructions for filling the data. 5. As you are in logged in session, it is better to save the data entered after each tab is completed. However, Submit Button has to be used only after entry of all the data. The following Screenshot is Personal Information entry tab. Once an entry is completed save the data as the draft and proceed to next tab. 6. Following Screenshots are relating to entry tabs for Income Tax details, Details of Income Tax Deducted by the employer, and Bank Account details. Enter the values in these fields as per Form-16 provided by the employer. Tax Deducted by the Employer and paid into Govt Account will be available under TDS tab. TDS details can also be verified through Form-26AS which is an online feature available in Income Tax Website to get the details of the Income Tax Paid in respect of a PAN. After entry of data in all these tabs are completed, click Submit button to generate ITR-V Button. ITR-V is a document which contains the summary of your income, deductions and income tax paid. This document has to be signed and sent to the Income Tax Central Processing Center at Bangalore. Address of this center will be available in the mail sent to you attaching filled up ITR-V form. Please note that Online E-filing will get completed only after receipt of this ITR-V at Central Processing Center at Bangalore. Alternatively, the taxpayer can also e-verify the return filed using his / her Aadhaar ID. In that case, there is no need to send the physical copy of ITR-5 to Income Tax Central Processing Center. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

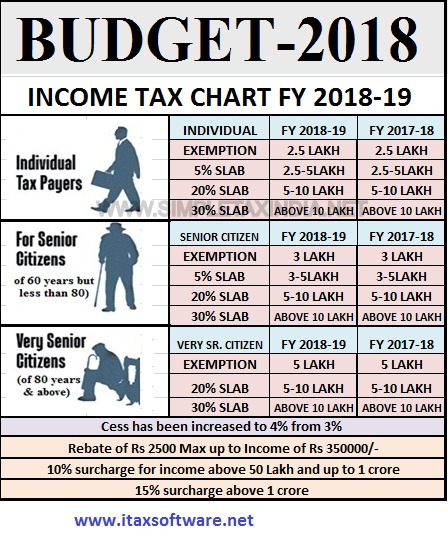

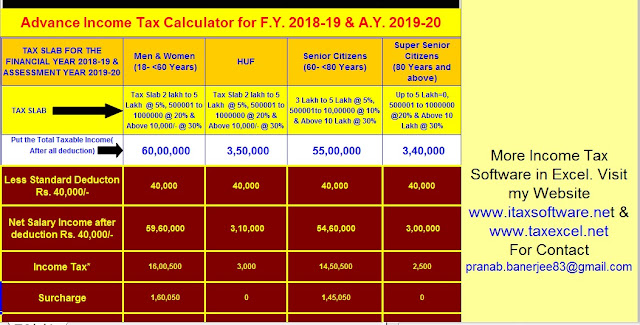

Automated Advance Tax Calculator for F.Y.2018-19 & A.Y.2019-20 with Budget 2018 Highlights Posted: 13 May 2018 06:33 AM PDT Budget 2018 Highlights – some changes you must know1) No Change in Income Tax Slab Rates for FY 2018-19 or AY 2019-20There is no change in IT Slab Rates for individuals. Hence, the applicable tax slab will be as below. 2) EPF Contribution by Government for new employees and womenThe government will contribute 8.33% of Employee Provident Fund (EPF) for new employees by the Government for three years. Women employees contribution to EPF now reduced to 8% from the earlier 12%. This reduced contribution will be for the first 3 years of employment. Both these moves will bring in more take home for both new employees and women. Along with this, Government will contribute 12% to EPF for new employees for three years by the Government in sectors employing the large number of people like textile, leather, and footwear. Also, paid maternity leave is now increased from 12 weeks to 26 weeks, along with the provision of crèches. 3) Rs.40,000 Standard Deduction for Salaried individuals and pensionersRs.40,000 standard deduction is available for all salaried individuals in lieu of the present exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses. This is I think a big relief many as it will rejoice the salaried individuals. 4) TDS limit raised for Senior CitizensExemption of interest income on deposits with banks and post offices to be increased from Rs.10,000/- to Rs.50,000/- and TDS will not be required to be deducted on such income, under section 194A. This benefit shall be available also for interest from all fixed deposits schemes and recurring deposit schemes. But do remember one thing that AVOIDING TDS DOES NOT MEAN AVOIDING TAX. 5) Sec.80D limit raised to Rs.50,000 for Senior Citizenslimit of deduction for health insurance premium and or medical expenditure from Rs.30,000/- to Rs.50,000/-, under section 80D. All senior citizens will now be able to claim the benefit of the deduction up to Rs.50,000/- per annum in respect of any health insurance premium and/or any general medical expenditure incurred. This I think a much-awaited relief to many senior citizens. Because the premium of health insurance will increase as you grow older. Hence, by increasing Sec.80D limit, Government really helped this class. 6) Limit of deduction on medical expenditure critical illness for senior citizens raisedThe limit of deduction for medical expenditure in respect of certain critical illness from, Rs.60,000/- in case of senior citizens and from Rs.80,000/- in case of very senior citizens, to Rs.1 lakh in respect of all senior citizens, under section 80DDB. 7) Pradhan Mantri Vaya Vandana Yojana extended to March 2020Pradhan Mantri Vaya Vandana Yojana is the 10 years 8% guaranteed pension scheme meant for senior citizens. The earlier deadline for the closure of this scheme was 3rd May 2018. Now, this is extended to until March 2020. Also, the good news is that the earlier limit under this scheme was Rs.7,50,000, which is now increased to Rs.15,00,000. 8) Education and Health Cess increased to 4%Currently, there is 3% cess on personal income tax consisting of 2% for primary education and 1% for secondary and higher education. Now this 3% existing educational and higher education cess is replaced to 4% HEALTH AND EDUCATION CESS. Other important proposals of Budget 2018 Highlights are as below. a) National Health Protection SchemeThe government will launch the National Health Protection Scheme. In this scheme, each family will be covered for Rs.5 lakh of health insurance per year. This will be for secondary and tertiary care hospitalization. This will be the world’s largest government-funded health care programmed. This is mainly to the poor and vulnerable families. Along with this, Government will provide nutritional support to all TB patients at the rate of Rs.500 per month for the duration of their treatment. b) E-Assessment is made mandatoryNow no more paper filling IT return allowed. From now onward you have to file IT Returns only through online mode. This will actually reduce the time taken to process your IT returns. Click here to Download the Automated Advance Tax Calculator for F.Y. 2018-19 & Assessment Year 2019-20 |

itaxsoftware.net

Itaxsoftware.net |

|

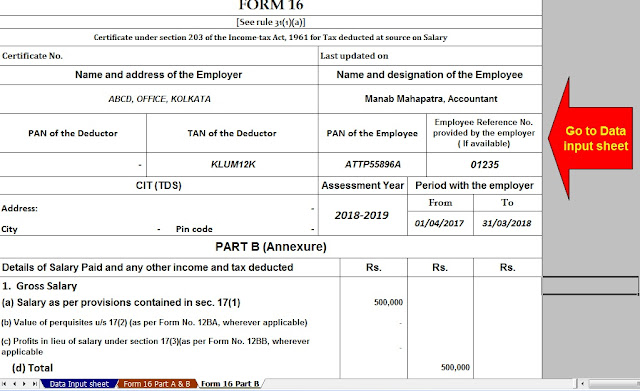

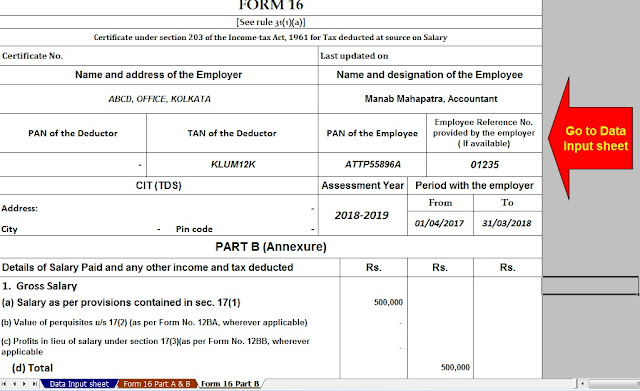

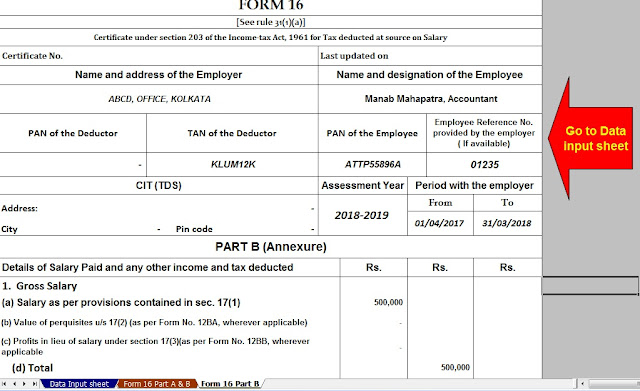

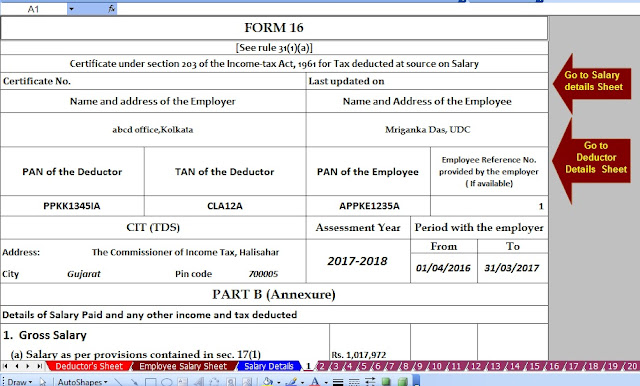

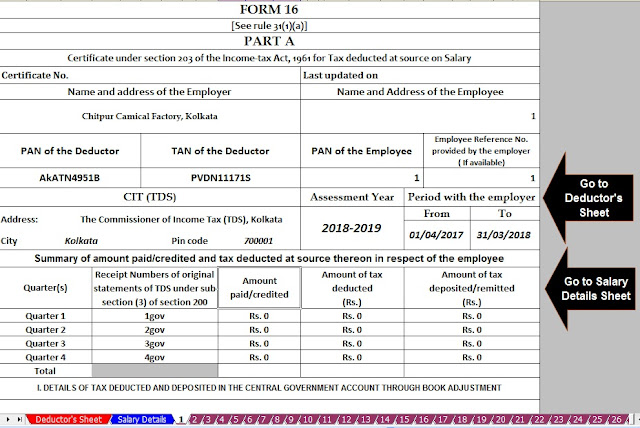

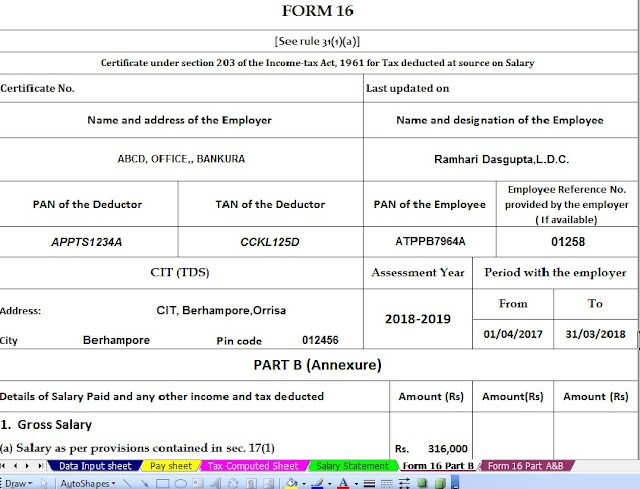

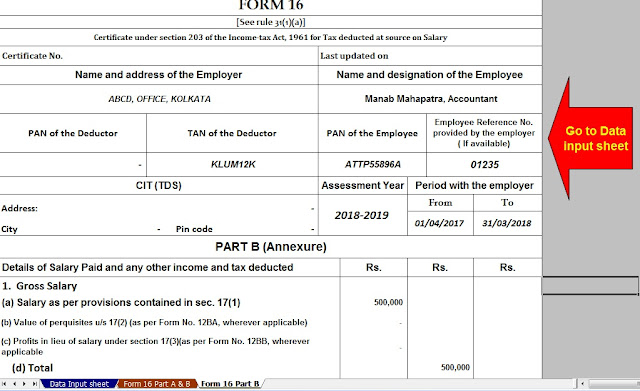

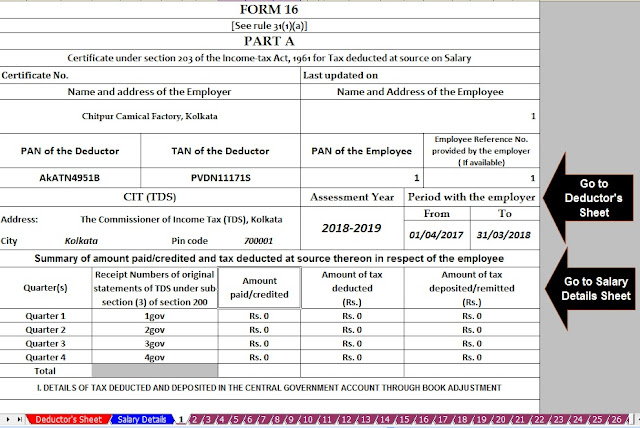

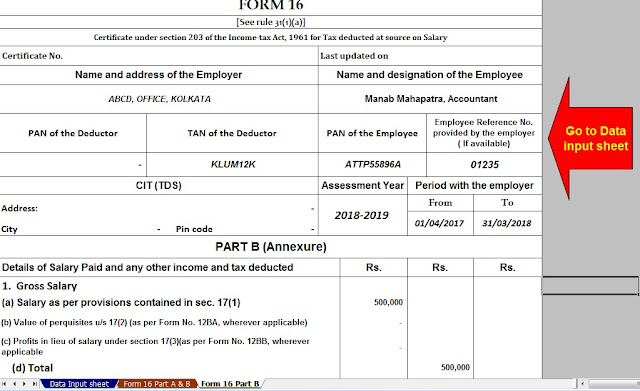

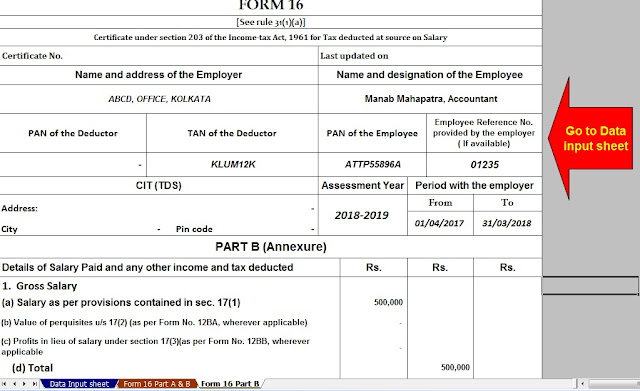

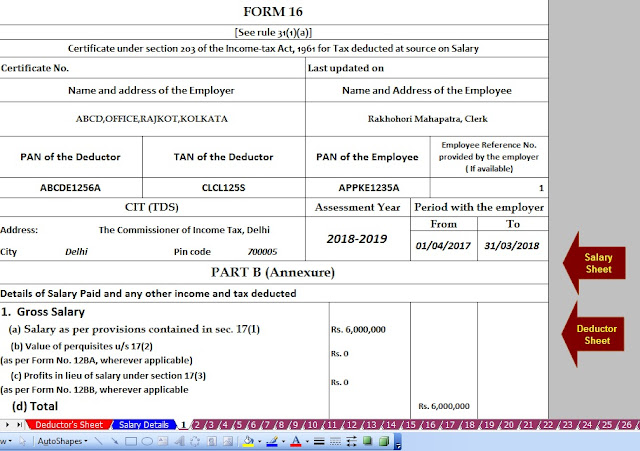

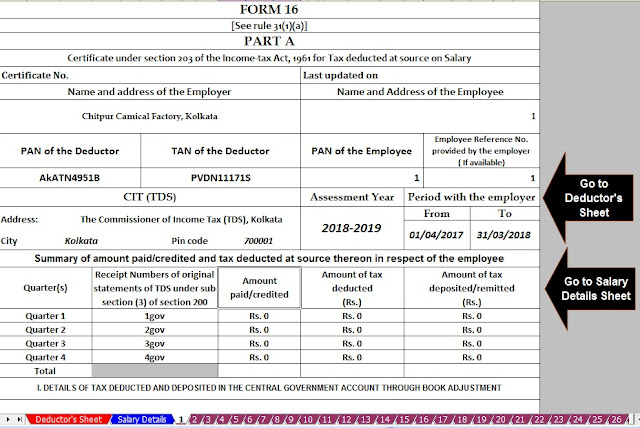

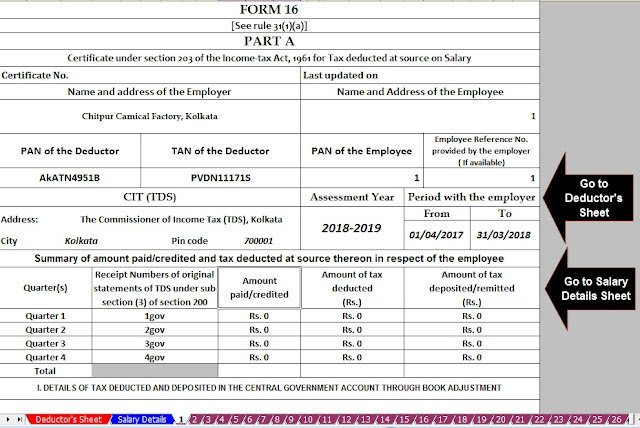

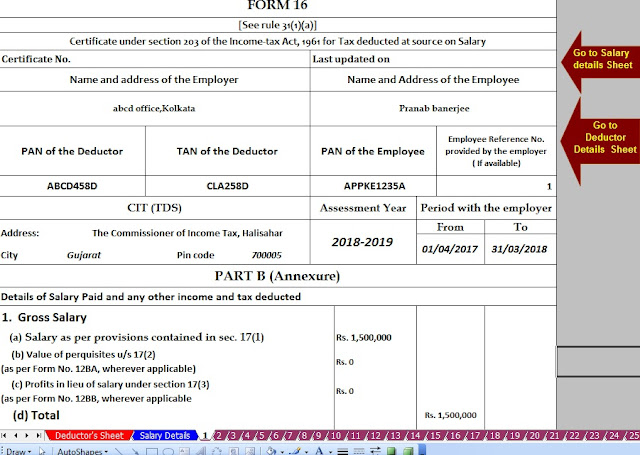

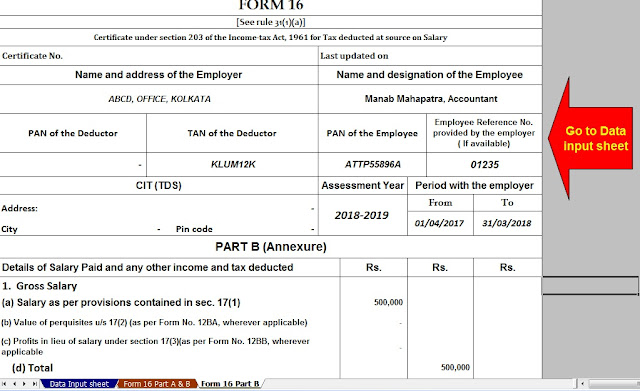

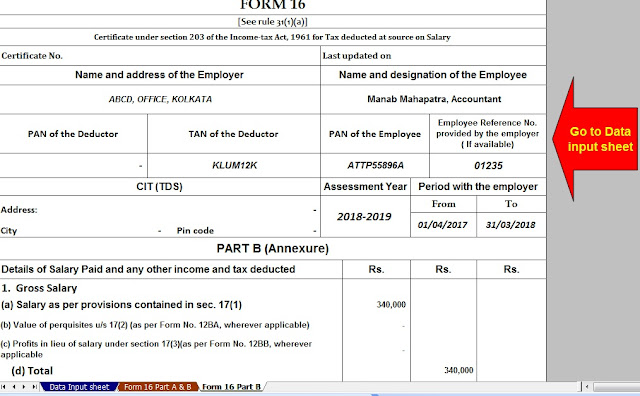

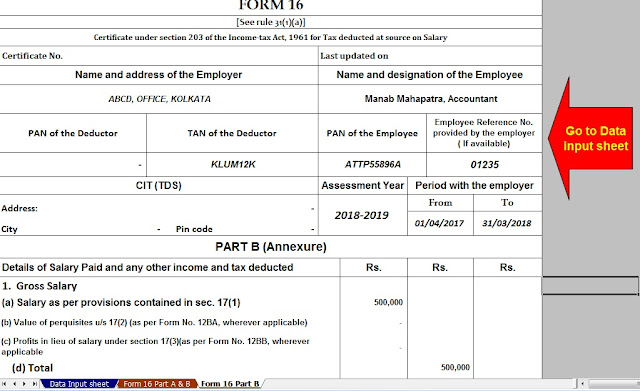

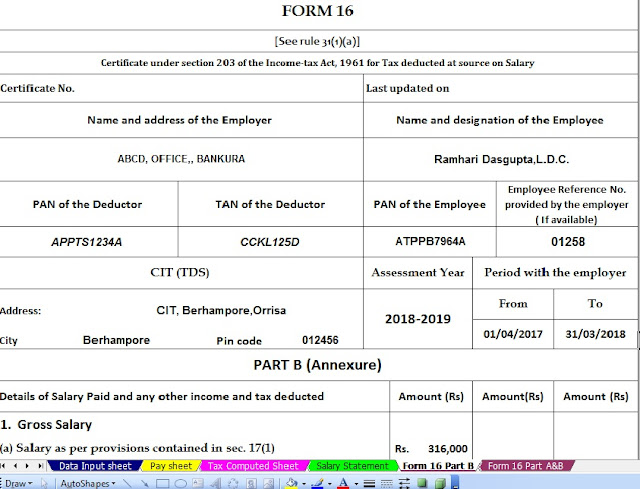

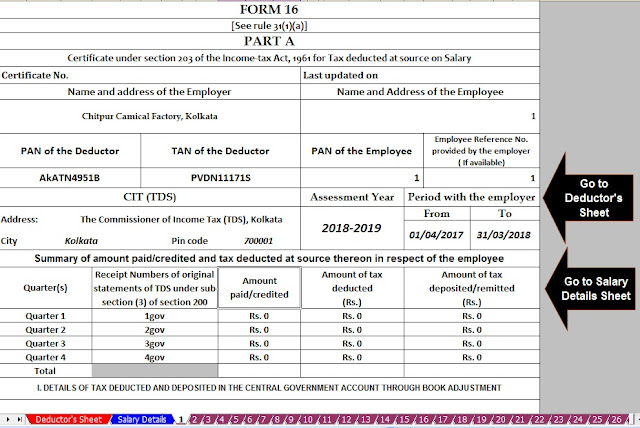

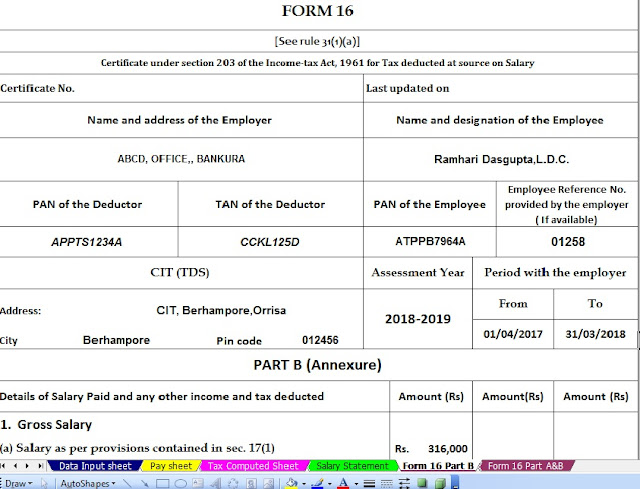

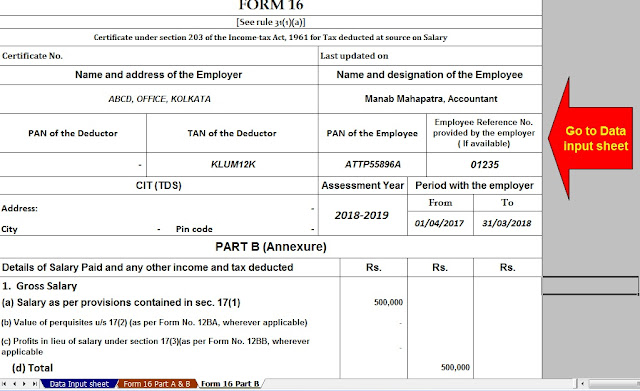

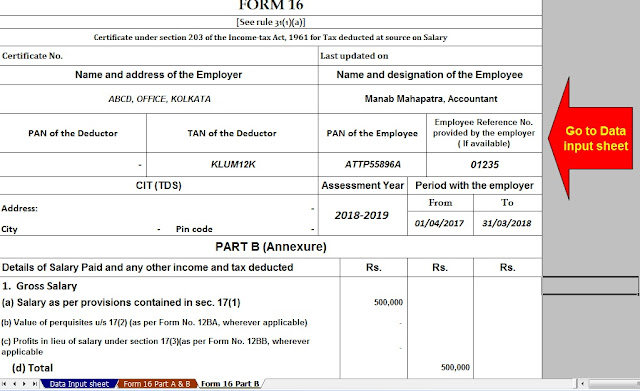

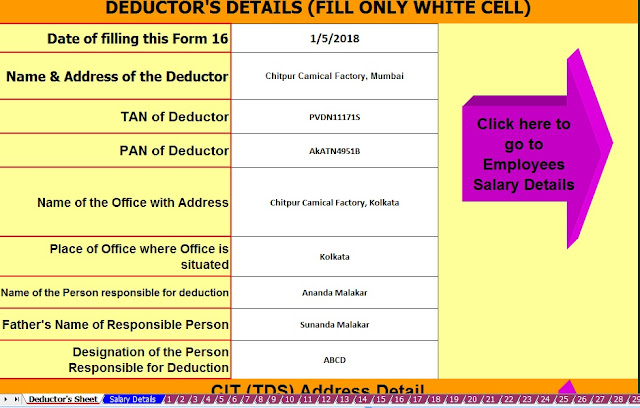

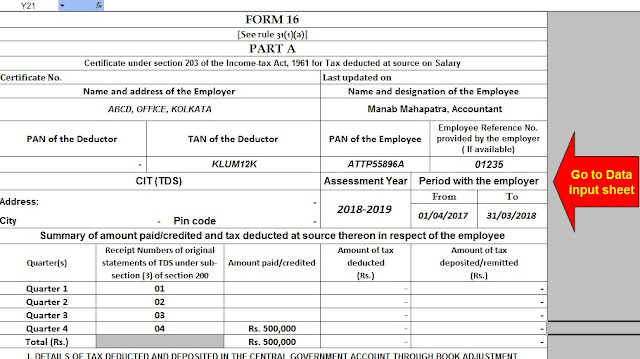

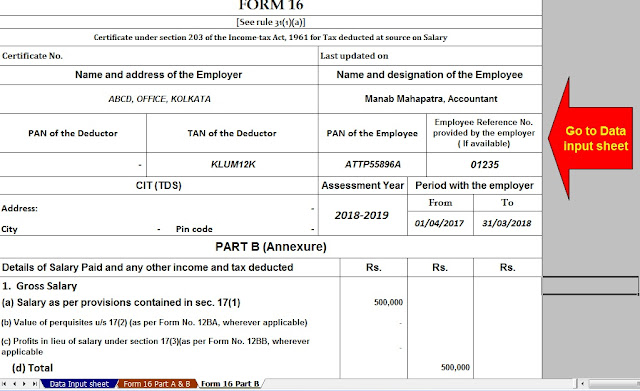

Posted: 14 May 2018 07:02 AM PDT What is Form 16? Every year your employer will issue this document. It is a certificate under section 203 of the Income-Tax Act, 1961, which gives information on the tax deducted at source (TDS) from income chargeable under the head “salaries”. Simply put, it gives details of the tax deducted by the employer. If you have not received your Form 16, you can use the worksheet that the income tax (I-T) department provides to calculate and declare the amount. Form 16 is useful in filing your income tax return (ITR). What’s inside it? Understanding the content of Form 16 helps you file your I-T returns; you may be able to do it yourself, without help from a chartered accountant or a financial planner, especially if your income comes entirely from your salary, and you have no other source of income. Click here to download Automatic Master of Form 16Part A & B [ Prepare at a time 50 employees Form 16 Part A & B for the Financial Year 2017-18 & Ass Year 2018-19]Main Feature of this Excel Utility :-

|

|

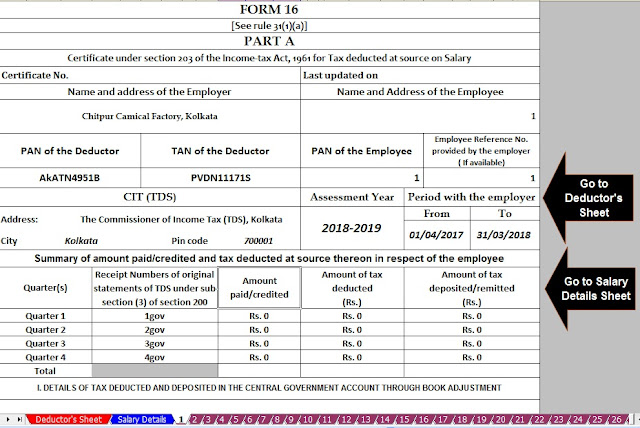

Form 16 has two sections—part A and part B. Part A consists of your personal details such as your name and address, your employer’s name and address, Permanent Account Number (PAN) of both, the employer’s Tax Deduction Account Number (TAN), and others. These details help the I-T department track the flow of money from your and your employer’s accounts. Part A also gives details such as the assessment year (AY)—the year in which your tax liability is calculated for the income earned the previous year. For example, for income earned between 1 April 2017 and 31 March 2018, AY will be 2018-19. This portion of the form also gives details of your period of employment with the current employer. For instance, if in the last financial year, you have worked from 1 April 2017 to 31 March 2018, it will be mentioned in the form. Next, it gives a summary of the TDS by the employer on behalf of the employee. This is the amount that the employer deducts from your salary as tax periodically and credits it to the I-T department. For instance, if every month your employer deducts Rs.3,000 as tax from your salary, it will be shown in the Form 16 Part A as deposited by your employer to the government. The summary space will be divided based on the periodicity of how your employer credits the tax to the I-T department. Part B of Form 16 is the one that gives most of the details that you need to file I-T return, such as salary paid, other income, tax deducted, and more. Your gross income is mentioned first. Those who need to pay professional tax should note that the tax is not considered on the gross income. Next, deductions are mentioned. These include those under sections 80C, 80CCC and 80CCD (contributions towards Public Provident Fund, life insurance policies, pension, among others). Remember, the aggregate amount deductible under these three sections should not exceed Rs.1.5 lakh. And additional exemption Rs. 50,000/- U/s 80CCD(1B) out of the limit of U/s 80C Rs.1.5 Lakh. Then come the deductions under other sections such as 80D (health insurance premium), 80E (interest on education loan), 80G (donations), and others. The total deductions are reduced from the gross income to arrive at the taxable income. Tax is calculated on this amount based on the new tax slab for the Financial Year 2017-18. How to use it? Form 16 is one of the documents that you need to keep handy before or while filing your ITR, which has to be done till 31 July. While all deduction related details are mentioned in Form 16. |

This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from itaxsoftware.net. |

To stop receiving these emails, you may unsubscribe now. |

| Email delivery powered by Google |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 15 May 2018 07:40 AM PDT The New Pension System has generated a lot of interest ever since Budget 2015 announced additional tax benefits for investments in the scheme. For someone in the 30 percent tax bracket, this is a clear benefit of Rs 15,000 on investment of Rs 50,000 over and above the Rs 1.5 lakh allowed under Section 80 C. This article gives an overview of NPS, explains NPS tax benefits, answers frequently asked questions regarding NPS and tax. Download &Prepare at a time 100 employees Master of Form 16 Part B for Financial Year 2017-18 with new Tax Slab for F.Y.2017-18 |

Feature of this Excel Utility :- |

|

Overview of NPS National Pension Scheme is a government approved pension scheme for Indian citizens in the 18-60 age group.

The official site for NPS is npscra.nsdl.co.in and www.npstrust.org.in . Detailed explanation of the NPS is covered in our article Understanding National Pension Scheme – NPS NPS Tax Benefits Tax benefits on NPS are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). All the tax benefits, annuity restrictions, exit and withdrawal rules are applicable to NPS Tier-I account only. NPS Tier-II account is liopen-ended ended mutual fund. You can take out the money at any time. Section 80CCD(1)

Section 80CCD(2)

Section 80CCD(1B) ,

Therefore, the total tax benefits that can be claimed for NPS under Section 80CCD(1) + Section 80CCD(1B) equals to 2 Lakhs for financial year 2017-18. If Employees have savings Rs. 1,50,000 under 80C excluding NPS Deductions, Then the Employee can show their NPS Deductions, under 80 CCD(1B), which is over the 1,50,000 Limit. If the Employee have less than 1.5 Lakh savings in 80C and exceeds 50,000 towards NPS, then the Employee can split their NPS Amount to 80CCD(1) and 80CCD(IB). |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 16 May 2018 05:23 AM PDT As per the Income Tax Department's New Notification Dated 19/2/2013 that the Salary Certificate Form 16 have already Changed the Format of Form 16. In this New Format of Form 16 have two parts one of Part A and another is Part B. In Part A have the details of Tax Deposited in to the Central Govt and in the Part B have the details of employee's Salary Details. As per the previous format of Form 16 have One Part but this new Amended Form 16 have two parts. Most of the Employer have not know about this new Notification of the CBDT. Click here to download Automated Form 16 Part B with Form 12 BA for the Financial Year 2017-18 and Assessment Year 2018-19 [This Excel Based Software can prepare at a time 50 employees Form 16 Part B with Form 12 BA for F.Y.2017-18]Click here to download Automated Form 16 Part B with Form 12 BA for the Financial Year 2017-18 and Assessment Year 2018-19 [This Excel Based Software can prepare at a time 50 employees Form 16 Part B with Form 12 BA for F.Y.2017-18] |

itaxsoftware.net

Itaxsoftware.net |

|

Prepare at a time 100 employees Form 16 Part B for F.Y.2017-18 & A.Y.2018-19 Posted: 17 May 2018 05:10 AM PDT |

Feature of this Excel Utility:- |

1) Automated Tax Calculate as per the New Income Tax Slab for F.Y.2017-18 2) Prepare at a time 100 employees Form 16 Part B for F.Y.2017-18 3) Automatic Convert the Amount into the In-Words ( Without any Excel Formula) 4) You can prepare more than 1000 employees Form 16 Part B by this one Software. 5) All the Income Tax Amended Section and siling of the Tax Section have in this Excel Utility as per the Finance Budget 2017-18.

|

|

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Automated Income Tax Form 16 A&B and Part B for F.Y.2017-18 Posted: 18 May 2018 05:26 AM PDT Click here to Download Automated One by One Preparation Excel Based Software Form 16 Part A&B for Financial Year 2017-18 & Ass Year 2018-19Main Feature of this Excel Utility:-1) Automatic calculates Income Tax as per New Tax Slab for F.Y. 2017-182) All the Income Tax Section have in this Excel Utility as per New Budget 2017-18 3) This Excel Utility can use both of Government & Non-Government Concerned 4) Easy to generate and easy to install on any computer 5) Automatic Convert Amount into the In-Words without any Excel Formula. 6) This Excel Utility can prepare more than 100 employees Form 16 Part A&B One by One.

|

itaxsoftware.net

Itaxsoftware.net |

|

Prepare at a time 100 employees Form 16 Part B for F.Y.2017-18 Posted: 19 May 2018 06:37 AM PDT Click here to Download Master of Form 16 Part B for F.Y.2017-18, this Excel Utility can prepare at a time 100 employees Form 16 Part B with New Tax Slab and other Amended Tax Section as per Finance Budget 2017-18.

|

itaxsoftware.net

Itaxsoftware.net |

|

Download & Prepare at a time 100 employees Excel Based Form 16 Part A&B for F.Y.2017-18 Posted: 20 May 2018 05:05 AM PDT Click here to Download & Prepare at a time 100 employees Excel Based Form 16 Part A&B for F.Y.2017-18 [ This Excel Utility can prepare at a time 100 employees Form 16 Part A&B for F.Y.2017-18. Who have not competent to Download the Form 16 Part A from the Income Tax Traces Portal, they can use this Excel Utility.] |

itaxsoftware.net

Itaxsoftware.net |

|

Download and prepare at a time 100 employees Form 16 Part B for F.Y.2017-18 & Ass Year 2018-19 Posted: 21 May 2018 05:26 AM PDT The Income Tax Department has already Circulate that the Salary Certificate Form 16 Part A must be download from the New Web Site TRACES vide Circular No.4/2013 dated 17/4/2013 and it is clear that the Part A(Annexure) of Salary Certificate Form 16 is mandatory to download from the Income Tax New Web Site TRACE and the Part B (Annexure) must be prepared by the Employer/Deductor. As per the New Amended Salary Certificate Form, 16 has already Changed of Format of Form 16 vide Notification No. 11/2013, where the Form 16 made in two part. One Part -A and Part - B. The Part A has now mandatory to download from the Web Site TRACES Portal. This Excel Utility have in a Zip file, and also have an Instruction about " How to prepare the limitless Form 16 Part-B for the Financial Year 2017-18. You can easily prepare limit less Form 16 Part-B by this one Excel Based Software. First prepare 100 employees Salary Certificate Form 16 Part B and save the same in another name and location, then you can again prepare another 100 employees Form 16 Part B and Save the same in another name and location, in this manner you can prepare to limitless Form 16 part B by this One Excel Based Software. |

Main Feature of this Excel Utility:- |

1) Prepare automatic at a time 100 employees Form 16 Part B for F.Y 2017-18 2) Inbuilt the Salary Structure with Tax Section as per Finance Budget 2017 3) New Tax Slab Rate for the Financial Year 2017-18 4) Income Tax Rebate reduced Rs.2,500/- who’s taxable income less than 3.5 Lakh. 5) Automatic Convert the Amount into the In-Words

|

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 22 May 2018 08:41 AM PDT Some of the Govt and Non-Govt Concerned yet not prepared the Salary Certificate Form 16 and they have yet not able to serve the Form 16 to their employees. Now it is the time of filing of Income Tax Return.But without the Form 16, they can not be able to File the Income Tax Return. In this regard, it is necessary to serve the Form 16 to the employees positively. HERE IS GIVEN BELOW ONE UNIQUE EXCEL BASED FORM 16 PART A 7 B PREPARATION SOFTWARE FOR THE FINANCIAL YEAR 2017-18 AND ASSESSMENT YEAR 2018-19. The CBDT has already changed the Format of Form 16 dated at 19/2/2013. In this Format have two part. Part A which found the Tax Deducted At Source and deposited into the Central Govt Account and another Part B which is found the details of employee's Salary. This Part B is mandatory to prepare by the employer. This Part A is mandatory to download from the Income Tax TRACES Portal. Most of the Employer or deductor yet not well known about this new Format of form 16. Also, most of the employer could not able to download the Form 16 Part A from the TRACES portal. Who has not able to download the Form 16 Part A from the TRACES Portal, they can use this below-given file Form 16 Part A&B in New Format of Form 16. This Excel Based Software can prepare at a time 100 employees Form 16 Part A&B for the Financial Year 2017-18 and Assessment Year 2018-19. This Utility can use both of Govt and Non Govt Concerned. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 23 May 2018 07:56 AM PDT Click here to download Automated 50 employees Excel Based Master of Form 16 Part B for F.Y.2017-18. [This Excel Utility can prepare at a time 50 Employees Form 16 Part B for f.Y.2017-18] |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 24 May 2018 05:24 AM PDT As per the CBDT has made the changed of Format of Form 16 vide notification No.11/2013 Dated 19/2/2013. In this Format have two parts one Part A( Annexure A and B) and another Part B where the details of employee's Salary Data. Previously the Format of Form 16 was on One page and One Part, but now this new amended Format of Form 16 has two parts ( Part A and B) But Some of concerned have not yet well known about this New Notification and some of Concerned could not be able to download the Form 16 Part A from the TRACES Portal, they can use this Excel Based Automated Form 16 Part A&B. If the Concerned able to download the Form 16 Part A from the TRACES Portal, but the Form 16 Part B ( Salary Certificate) have not prepared till now, they can use the only Master of Form 16 Part B which can prepare at a time 50 employees Form 16 Part B. Below given Excel Based Software which can prepare at a time 50 employees Form 16 Part B and Part A&B for the Financial Year 2017-18. |

Feature of this Excel Utility:- |

1. Automatic Calculate the Income Tax Liability of each employee 2. Automatic Calculate and prepare the Form 16 Part A&B for F.Y. 2017-18 3. Automatic prepare at a time 50 employees Form 16 Part A&B for F.Y. 2017-18 4. Prevent the double entry of PAN NO and Name of Employee 5. Easy to install and easy to generate 6. You can prepare more than 200 employees Form 16 Part A&B by this One Software 7. All the Income Tax Section have in this Excel Utility with the brief of each section 1) Click here to Download the Master of Form 16 Part B ( Prepare at a time 50 employees from 16 Part B ) |

itaxsoftware.net

Itaxsoftware.net |

|

Prepare One by One Automated Income Tax Form 16 Part B for F.Y.2017-18 Posted: 25 May 2018 07:53 AM PDT |

Main Feature of this Excel Utility:-1) Automatic calculates Income Tax as per New Tax Slab for F.Y. 2017-182) All the Income Tax Section have in this Excel Utility as per New Budget 2017-18 3) This Excel Utility can use both of Government & Non-Government Concerned 4) Easy to generate and easy to install on any computer 5) Automatic Convert Amount into the In-Words without any Excel Formula. |

itaxsoftware.net

Itaxsoftware.net |

|

Prepare at a time 100 employees Automated Master of Form 16 Part B for F.Y.2017-18 Posted: 26 May 2018 06:01 AM PDT Download & Prepare at a time 100 employees Automated Excel Based Income Tax Master of Form 16 Part B for F.Y.2017-18 [This Excel Utility can prepare at a time 100 employees Form 16 Part B for F.Y. 2017-18] |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 27 May 2018 04:31 AM PDT Now this month is March 2018 is the end of the F.Y.2017-18 and Income Tax Preparation and submit the Tax Statement to the employer by the employee with their Tax Savings deposit. Also, it is time to prepare the Form 16 Part B by each employer/ Deductor for distributing the Form 16 Part B for the Financial Year 2017-18 and Assessment Year 2018-19. Some of concerned have less than 10 employees and also give the Form 16 Part B to the employees in this Financial Year. Below given Excel Based Software for prepare automated Form 16 Part B for FY 2017-18 with the all latest Tax Slab and Tax Section as per the Finance Budget 2017-18. The feature of this Excel Utility:-

Click here to download Automated Form 16 Part B for the Financial Year 2017-18 [This Excel Utility can prepare Form 16 Part B One by One] |

itaxsoftware.net

Itaxsoftware.net |

|

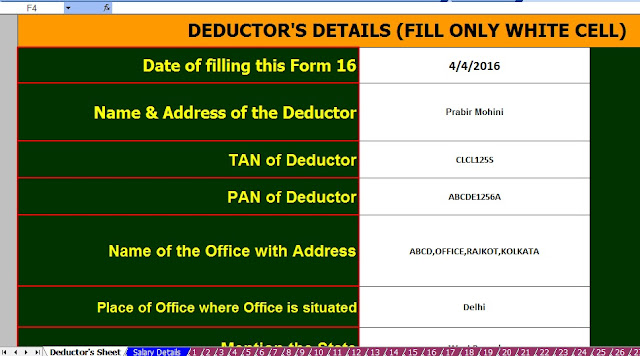

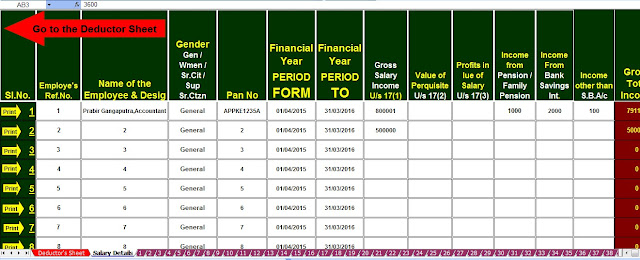

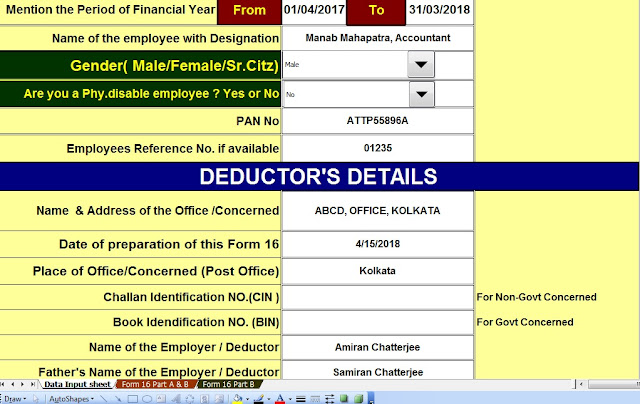

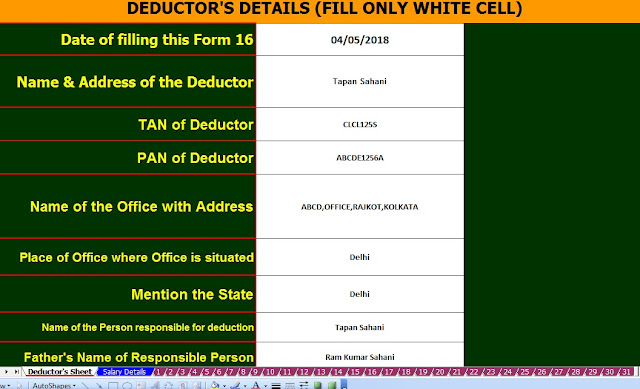

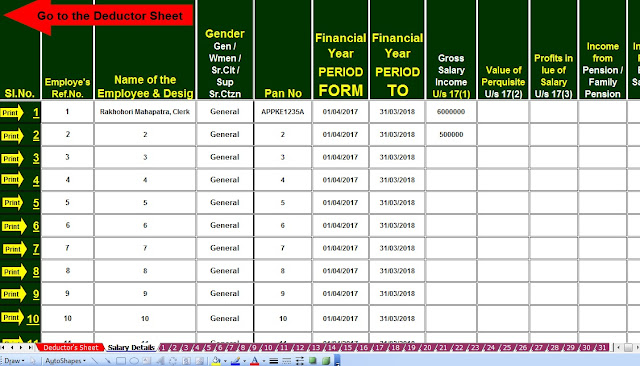

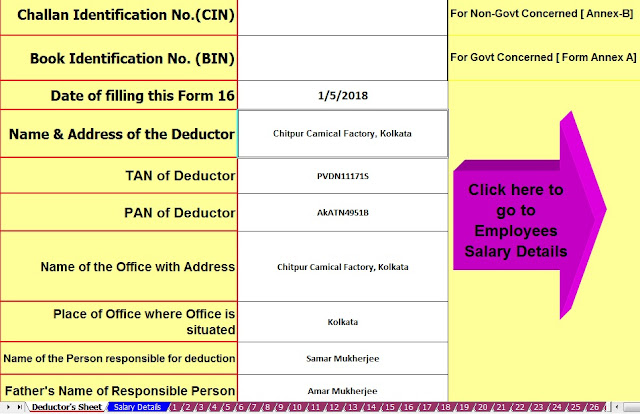

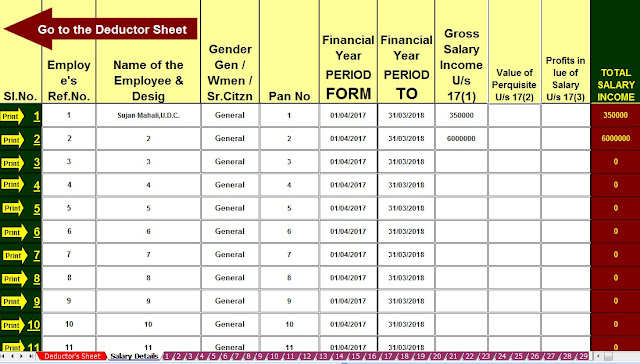

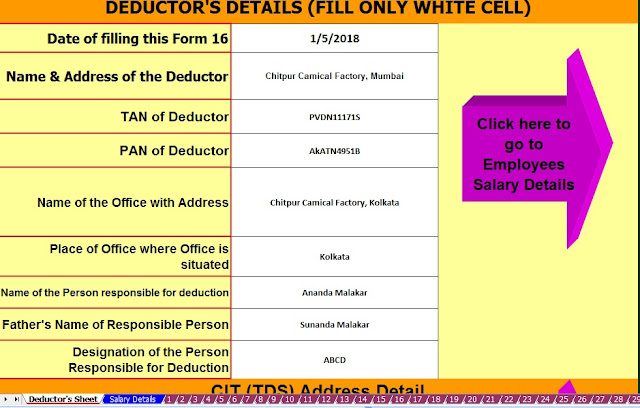

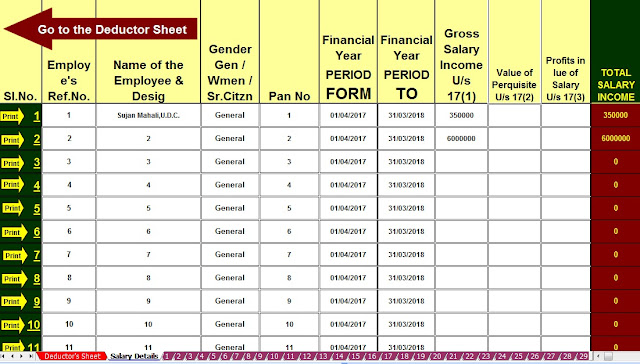

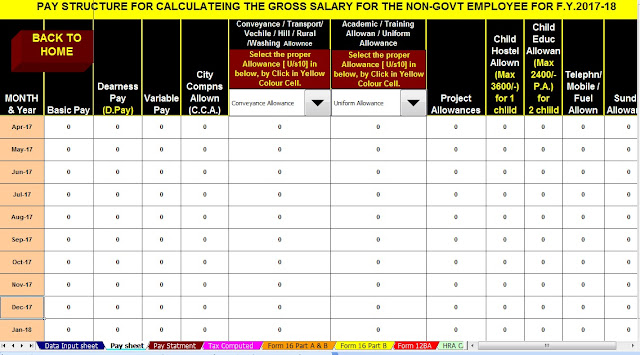

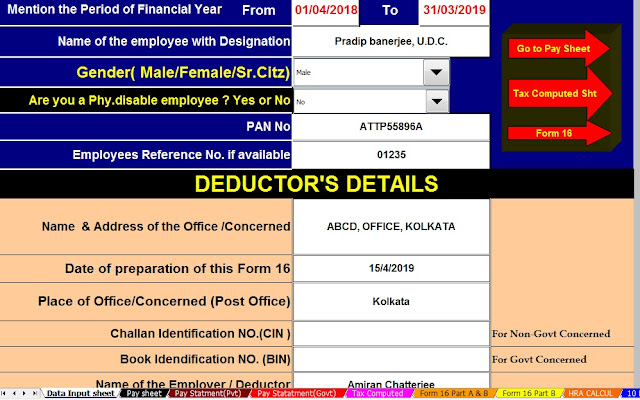

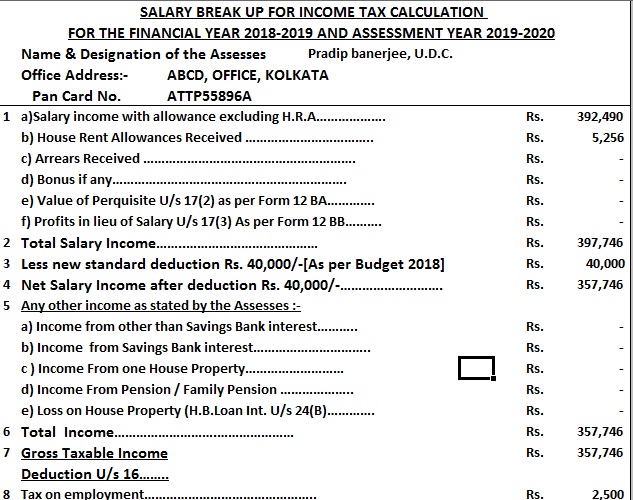

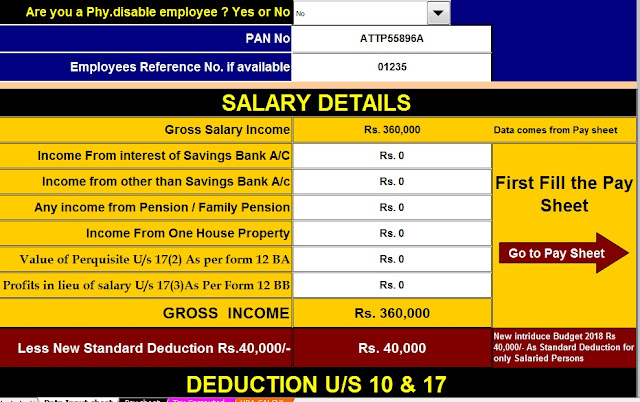

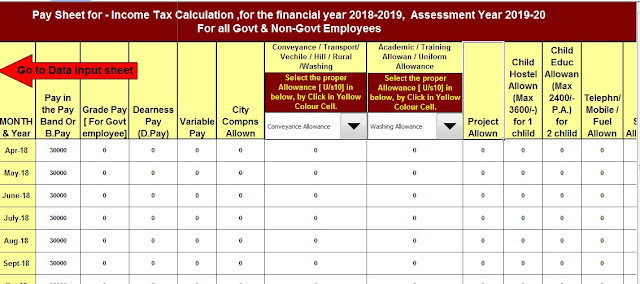

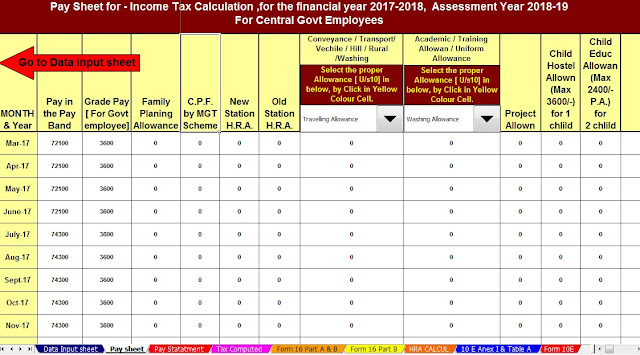

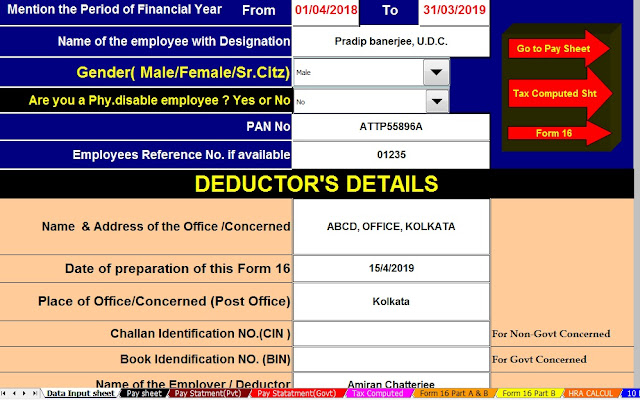

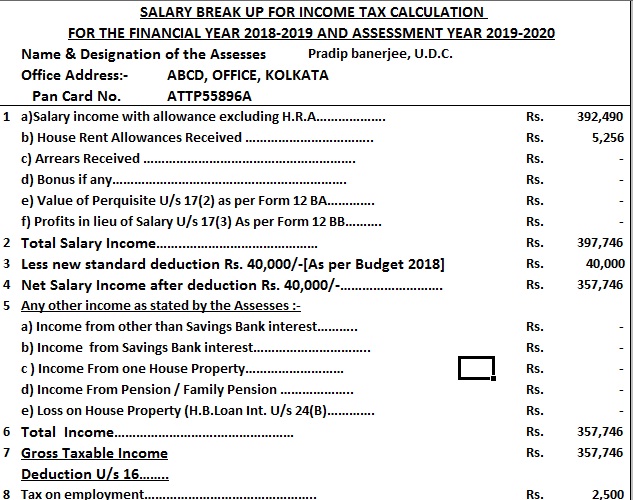

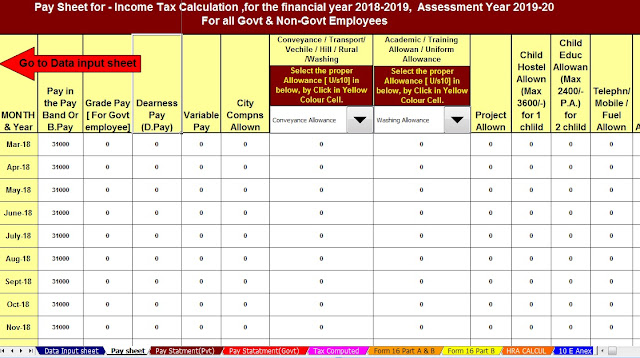

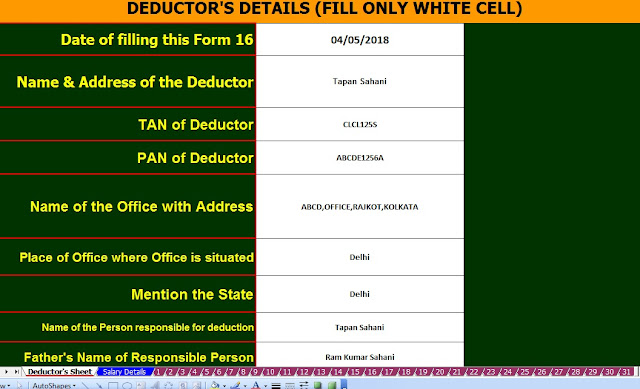

Posted: 28 May 2018 06:51 AM PDT

|

|

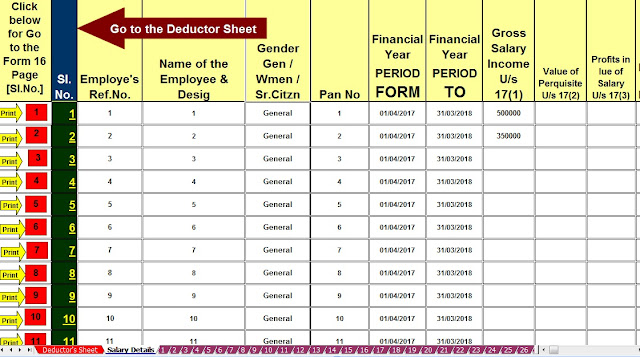

| Employer & Employees Details Sheet |

|

| Salary Structure with Tax Deduction All Section |

|

|

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 29 May 2018 05:13 AM PDT And another Part Form 16 Part B is mandatory to prepare by the Employer of Govt or Non-Govt Concerned. In this Form 16 Part B has employee’s Salary details and all Deductions as per the Income Tax Section. Now in this time to prepare the Income Tax Form 16 Part B which will be given to the employee to the end of each financial year, and which will be prepared by the Employers in the different Govt and Non- Govt Cornered for the end of the Financial year 2017-18 and Assessment Year 2018-19. It appears from the various Concerned have the different Pay Structure and the various benefits which have given to the employees. Various Concerned has faced a problem to prepare the Huge Quantity of Form 16 Part B as manually or their own creation database. I have given below some Automatic Form 16 Part B preparation Excel utility which can prepare One by One Form 16 Part B, Prepare at a time 50 employees Form 16 Part B and Prepare at a time 100 employees Form 16 Part b just a moment without any help of Tax Expert. This all is Excel-based Software which can prepare the Form 16 Part B with all of the Income Tax Section with New Income Tax Slab for F.Y.2017-18, automatically convert the Amount into the Word. No need for the manual filling of Tax Form. All of the above mentioned Income Tax Form 16 Part B for F.Y. 2017-18 is given below with the link for Download. 1) Prepare One by One Form 16 Part B for F.Y. 2017-18 [ This Excel Utility can prepare one by one Form 16 Part B]2) Prepare at time 50 employees Form 16 Part B for F.Y. 2017-18 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B]3) Prepare at time 100 employees Form 16 Part B[ This Excel Utility can prepare at a time 100 employees Form 16 Part B]4) Prepare at a time 50 employees Form 16 Part B with 12 BA for f.Y. 2017-18 |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 30 May 2018 05:59 AM PDT The Income Tax Department (New Portal i.e. TRACES) had made compulsory to download Form No. 16 (Part-A) (TDS Certificate for Salaried Employee) from TRACES (New Website of TDS) from Assessment Year 2013-14 by its new circular 4/2013 dated 17.04.2012 for TDS Deductor on or after 01.04.2012. Download request for Form No. 16 Part A for a particular Fin Year & can be submitted only after Form 24Q statement for Q4 for the selected Financial Year is filed by dedicator and processed by TDS CPC. Until you have not submitted the Last Quarter Challan (24Q or 26Q), you can not download your Form 16 (Part-A) from TRACES portal. Procedure to Download Form No. 16 : Select from Menu:

Enter Search Criteria

Token Number Details (Contd.)

Details to be printed on Form 16

Download File

Search File to Download

Search Results

Convert.ZIP File into PDF ZIP file downloaded from TRACES will contain Form 16 details for all requested PANs

Download below the Automated Form 16 Part B1) Click here to Download the Master of Amended Form 16 Part B which can prepare at a time 50 employees Form 16 Part B for the F,Y 2017-182) Click here to Download Master of Form 16 Part B with Form 12 BA, which can prepare at a time 50 employees Form 16 Part B with Form 12 BA for F.Y 2017-183) Click here to Download One by One Preparation Amended Version Form 16 Part B for FY2017-18 |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 31 May 2018 05:40 AM PDT Download & Prepare at a time 50 employees Automated Excel Based Income Tax Form 16 Part A&B For F.Y.2017-18 [ This Excel Utility can prepare at a time 50 employees Form 16 Part A&B for Financial Year 2017-18 ] |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 01 Jun 2018 05:11 AM PDT Download and Prepare at a time 50 employees Excel Based Form 16 Part B with Form 12 BA for F.Y. 2017-18 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA for the Financial Year 2017-18] |

itaxsoftware.net

Itaxsoftware.net |

|

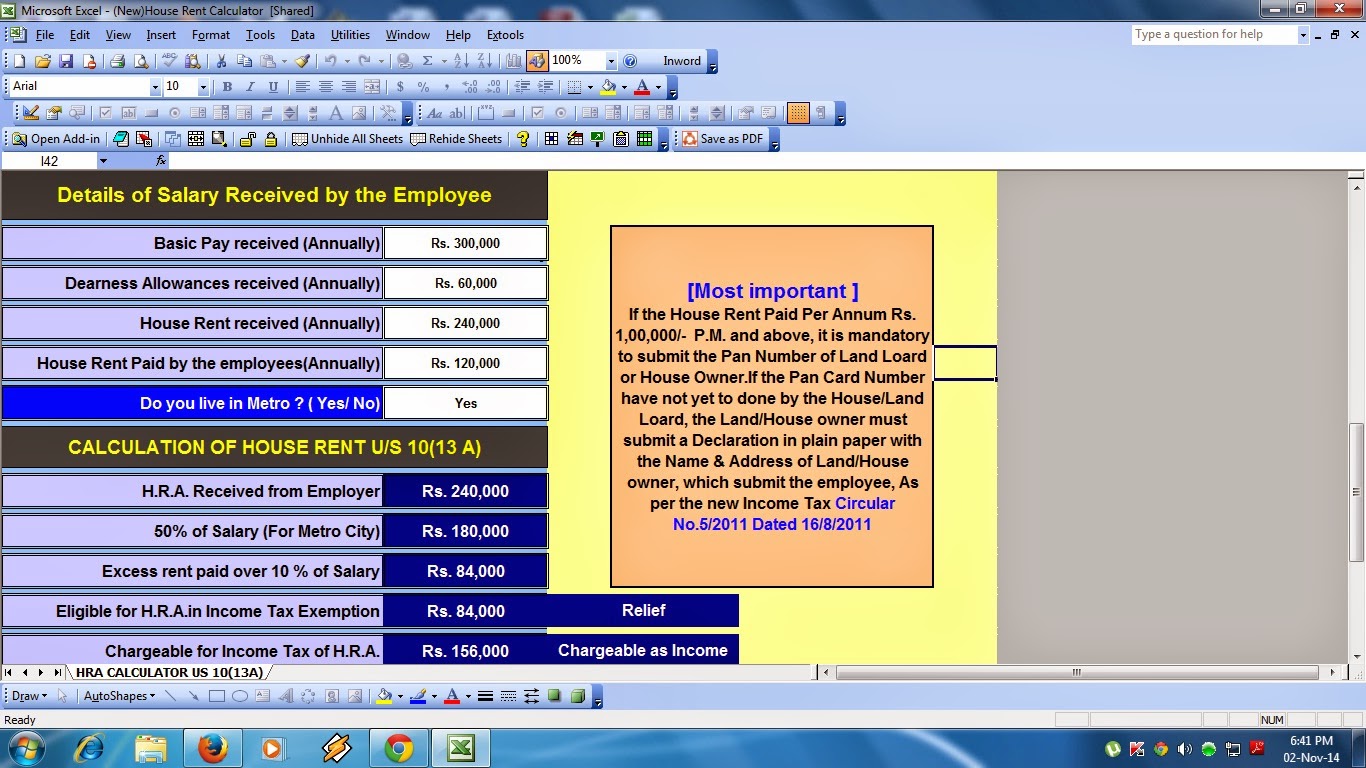

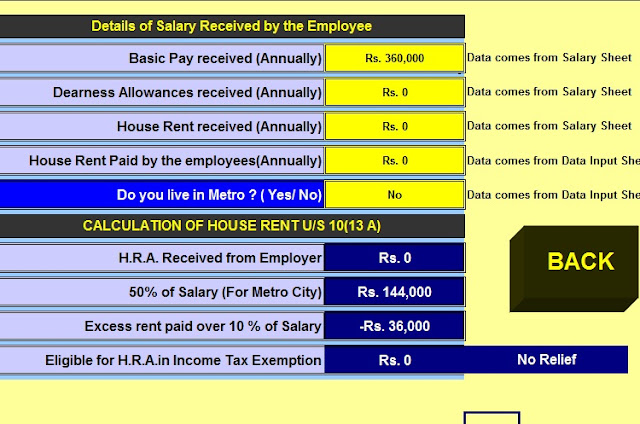

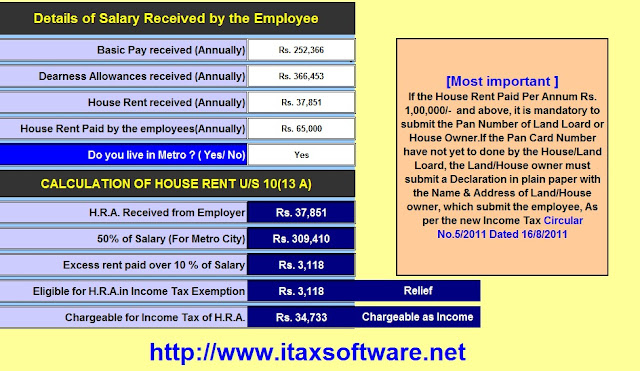

Posted: 02 Jun 2018 05:46 AM PDT Click here to Download the Automated HRA Exemption Calculator ( Updated) Snapshot of Excel Based HRA Calculator :- If you are a salaried taxpayer claiming HRA(house rent allowance) deduction, watch out. The central government has lowered the exemption limit for reporting the rent received. Salaried taxpayers claiming HRA exemption and paying a rent of over Rs 1 lakh per year have to give landlord’s PAN (permanent account number). Till now, if the total rent paid was less than Rs 15,000 a month there was no need to submit the landlord's PAN details. The new rule effectively lowers the rent limit from Rs 15,000 a month to Rs 8,333 per month for claiming HRA exemption without making any disclosures. "Further, if annual rent paid by the employee exceeds Rs 1,00,000 per annul, it is mandatory for the employee to report PAN of the landlord to the employer," the Central Board of Direct Taxes said in its latest circular. "In case the landlord does not have a PAN, a declaration to this effect from the landlord along with the name and address of the landlord should be filed by the employee," it said. Though incurring actual expenditure on payment of rent is a per-requisite for claiming deduction under section 10(13A) of the I-Tax Act, it has been decided as an administrative measure that salaried employees drawing HRA up to Rs 3,000 per month will be exempted from production of rent receipt. The new rule is aimed at people claiming HRA exemption for living in their own house. "It has to be noted that only the expenditure actually incurred on payment of rent in respect of residential accommodation occupied by the assessee subject to the limits laid down in Rule 2A, qualifies for exemption from income-tax," CBDT said in its circular. Thus, HRA granted to an employee who is residing in a house/flat owned by him is not exempt from income-tax. "The disbursing authorities should satisfy themselves in this regard by insisting on production of evidence of actual payment of rent before excluding the house rent allowance or any portion thereof from the total income of the employee," CBDT said. Click here to Download the Automated HRA Exemption Calculator ( Updated) |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Prepare Automated One by One Form 16 Part B for the Financial Year 2017-18 and A.Y.2018-19 Posted: 03 Jun 2018 05:20 AM PDT As per the CBDT notified that the Form 16 Part A must be download from the TRACES PORTAL and Form 16 Part B must be prepared by the Employer. In this recent time to prepare the Form 16 Part B for most of Govt and Private Concerned and hand over the Form 16 Part B to their employer in April 2019 for the Financial Year 2017-18. Most of the Concerned have the huge quantity of employees and give them the Form 16 Part B. In this regard, if the all concerned may start to prepare the Form 16 Part B so they can complete the total Employees Form 16 Part B in the stipulated time. Given an Excel Based Income Tax Form 16 Part B which can prepare One by One Form 16 Part B for F.Y.2017-18. The Feature of the Excel Utility:-1) You can prepare One by One Form 16 Part B for F.Y.2017-18 as per latest amended Tax Section. 2) Easy to install on any Computer and prepare the Form 16 Part B, just like as an Excel File. 3) You can prepare more than 100 employees Form 16 Part B One by One by this one Excel Utility. 4) All the Income Tax Section have in this Excel utility as per the Finance Bill 2017-18 5) Automatic Convert the Amount into the In-Words. Download the Automated Form 16 Part B for F.Y.2017-18 which can prepare One by One |

itaxsoftware.net

Itaxsoftware.net |

|

Prepare at a time 50 employees Form 16 Part A&B for F.Y.2017-18 & A.Y.2018-19 Posted: 04 Jun 2018 05:31 AM PDT Highlights of Income-tax Slab 2017-18· The Slab for Tax-free Income is the same. For FY 2017-18, No Tax on income up to Rs.2.5 lakhs. · The Government has reduced the tax rate for the income up to Rs 5 lakhs. The new tax rate for income between 2.5 lakhs to 5 lakhs is 5%. · The Upper limit to claim income tax deduction under section 80C is still at 1.5 lakhs. · The government has reduced the income tax rebate. Now, it is Rs 2,000 instead of Rs 5000. · The Upper limit to get the rebate is also reduced. Now, you would be eligible for the rebate if income is less than Rs 3.5 lakhs. Earlier this limit was at 5 lakhs. · The threshold for surcharge came down. Now, you have to pay a surcharge if your taxable income is more than 50 lakhs (5 million rupees). Earlier, this limit was 1 crore. Click here to Download Automated 50 employees, Master of Form 16 Part A&B For F.Y.2017-18 & Assessment Year 2018-19, |

Main Feature of this Excel Utility:- |

1) Automated Calculate Income Tax as per New Income Tax Slab for F.Y.2017-18 2) Inbuilt the Salary Structure with all deduction of all Income Tax Section as modified by the Finance Budget 2017-18 3) This Excel Utility can Use Both of Government & Non-Government Concerned 4) Automated Convert the Amount into the In-Words ( Without any Excel Formula) 5) You can prepare more than 1000 employees by this one Excel Utility ( One by One)

|

itaxsoftware.net

Itaxsoftware.net |

|

Prepare at a time 100 employees automatic Form 16 Part B for the Financial Year 2017-18 Posted: 05 Jun 2018 06:01 AM PDT Now the time of prepare Form 16 Part B where the all of the salary details have in this Form 16 Part B. As the CBDT already modified the Format of Form 16 and this Form 16 have in two parts One is Part A and Part B. As per the CBDT notification the Form 16 Part A is mandatory to download from the TRACES Portal and the Form 16 Part B must be prepared by the employer for each of their employees In Form 16, Part A has all details of employees Tax Deducted and deposited into the Central Govt as monthly or Quarterly.In the Form 16 Part B where the details of employees salary and this Form 16 is mandatory to prepare by the Employer. Below given the unique Excel Based Software which can prepare at a time 100 employees Form 16 Part B for the Financial Year 2017-18 and Assessment Year 2018-19. This Excel Utility can reduce your time to prepare of Form 16 Part B with the all modified Income Tax Section as per the Finance Budget 2017-18. The feature of this Excel Utility:-

Click to download Master of Form 16 Part B for FY 2017-18 [This Excel Utility can prepare at a time 100 employees Form 16 Part B with all amended Tax Section with Tax Slab for FY 2017-18] |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 06 Jun 2018 05:45 AM PDT Section 80C Deduction for AY 2018-19 (FY 2017-18) is Rs.1,50,000: Section 80C lists down arious options where an Individual can invest and claim exemption from income. For ay 2018-19, the deduction under section 80C is limited at Rs.1,50,000. The deduction under section 80C is allowed from your Gross Total Income. The deduction is allowed for various investments, expenses and payments. Section 80C Deduction for ay 2018-19 (FY 2017-18) is allowed to Individuals as well as Hindu Undivided Family business. Details of 80C Deduction for ay 2018-19 (FY 2017-18)

Life Insurance Premiums : Section 80C DeductionLife insurance premium on life of himself, spouse and children or paid by an HUF for any member of his family. Insurance premium is deductible subject to maximum ceiling given below. Provident Fund, Public Provident Fund and other superannuation funds : Section 80C DeductionContributing to recognized superannuation fund like Provident fund, Public provident fund and Mutual funds are eligible for deductions under section 80C. Usually the employer invests in such superannuation funds by deducting the investment amount from salary. ELSS constitute a type of Mutual fund which are sold with a lock in period of 3 years and returns obtained from the ELSS scheme are tax free. Any premium paid towards any annuity plan, whether deferred or immediate will give tax relief in that financial year. Click here to Download Automated 50 employees Master of Form 16 Part B for F.Y.2017-18 &Ass Year 2018-19Main feature of this Excel Utility :- 1) Automatic Income Tax Calculation as per the new Tax Slab for F.Y.2017-18 2) Automatic Prepare at a time 50 employees Form 16 Part B for F.Y.207-18 3) All Amended Income Tax Section have in this utility as per Budget 2017 4) Automatic Convert the Amount to In-Words 5) You can prepare more than 1000 employees Form 16 Part B by this One Excel Utility.

Investments in Infrastructure public Company : Section 80C DeductionAmount invested in deposit scheme of public company engaged in infrastructure facility or approved mutual fund. Bank Fixed Deposits : Section 80C DeductionBank fixed deposits which are deductible under section 80C are regular fixed deposits with interest being compounded quarterly with a lock in period of 5 years. National Savings Certificates (NSCs) : Section 80C DeductionInvestments in National Savings Certificate are also deductible under this section and these investments are available from the Indian postal services or post offices. Deposits in various types of accounts : Section 80C DeductionAny sum deposited in an account under the senior citizen Saving scheme, sum deposited as 5 years time deposit in an account under the post office time deposit, sum deposited in Sukanya Samriddi Account are all eligible for deduction under this section. Tuition fee : Section 80C DeductionAn Individual can claim deductions on children’s tuition fees only for two children and that too for the educational institutions situated in India only.

The deduction with respect to Home loan repayment can be claimed only if the loan has been taken from specified financial institutions or entities like your employer a public limited company, central or state government, or board, corporation, university established by law. In Computing the total income of an individual or Hindu Undivided family, the above contributions, expenses and investments shall be made available for deduction u/s 80c of the Income Tax Act 1961 capped up to Rs. 1,50,000/- . The legislator’s intention behind the section 80C is to boost investments and savings among the Tax Payers. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 07 Jun 2018 05:37 AM PDT Some of the Govt and Non-Govt Concerned have few employees who have need some of the Form 16 Part B or Part A&B for F.Y.2017-18. Some of the Concerned have not competent to download From 16 Part A from the TRACES PORTAL. Also, it appears that some of the Concerned have no Internet Facility to download the Form 16 Part A from the TRACES PORTAL as per the Income Tax Notification. In this concept below given Excel Based Software which can prepare both of Form 16 Part A&B and Form 16 Part B. If you have to need Form 16 Part B, you can print the Form 16 Part B or if you have to need Form 16 Part A&B you can print the Part A&B for F.Y.2017-18. Download Excel Based Software which can prepare at a time Income Tax Form 16 Part A&B and Form 16 Part B ( One by One). from the below link. A feature of this Excel Utility:-1) You can prepare both of Form 16 Part A&B and Form 16 Part B for F.Y.2017-18 ( One by One) 2) Automatic Calculation of Income Tax liability as per Finance Budget 2017-18 3) You can prepare more than 50 employees Form 16 Part A&B and Form 16 Part B ( One by One) 4) Easy to install in any computer and easy to generate just like as an Excel File 5) All Income Tax amended Section and limit of each section have in this Software 6) Automatic Convert the Amount into the In-Word Download Automated Form 16 Part A&B and Part B ( One by One) for F.Y.2017-18 [ This Excel Utility can prepare Form 16 One by One) |

itaxsoftware.net

Itaxsoftware.net |

|