CA GROUPS

WELCOME TO CA GROUPS

CA GROUPS |

|

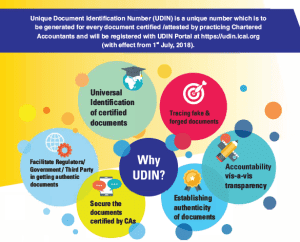

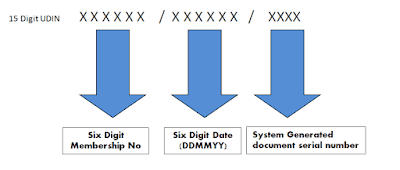

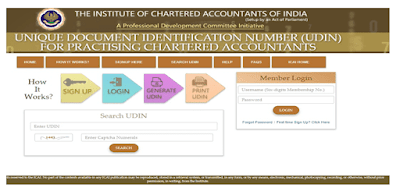

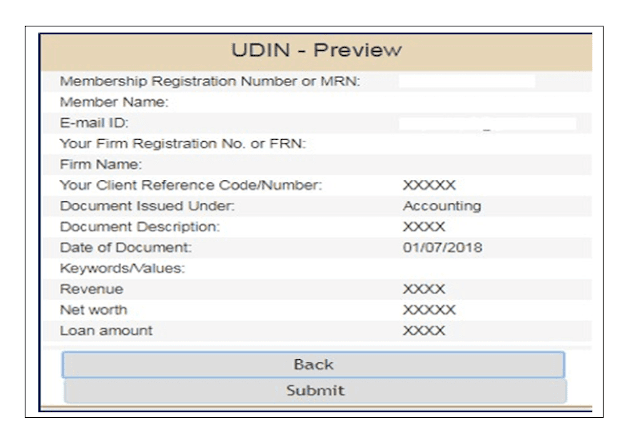

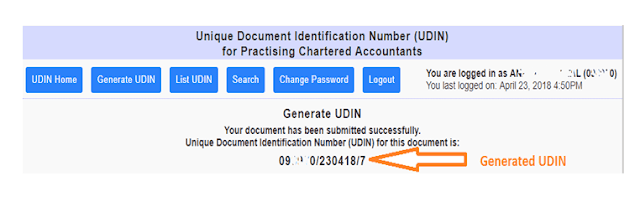

UDIN to be generated for every document certified by practicing CA : ICAI Posted: 10 Jul 2018 05:32 AM PDT UDIN to be generated for every document certified by practicing CA : ICAI.The Institute of Chartered Accountants of India ( ICAI ) has launched a new system to system to generate a new unique identification Number keep the records of attestations by the Chartered Accountants. This will help the Institute to track all the certifications and also make fake certifications / third part certifications harder to get. . The move aims at bring more accountability and transparency in accounting in the light of recent controversies including the PNB Scam where the Chartered Accountants were allegedly involved in the scam. The new system will also help to secure the documents certified by CAs and to establish the authenticity of the documents. . Unique Document Identification Number (UDIN) is a unique number, which will be generated by the system for every document certified/ attested by a Chartered Accountant and registered with the UDIN portal available at https:/udin.icai.org/. . It has been noticed that financial statements and documents were being certified/ attested by third persons, in lieu of Chartered Accountants. . As these statements are being relied upon by the authorities as true statements and certificates, UDIN can be generated by a practicing CA by registering his/her documents/ certificates on UDIN Portal for verification. . A practising Chartered Accountant can generate a UDIN for certificate/ document attested by him either in individual capacity or as a partner. At present, this facility is recommendatory. However, it is learnt that ICAI is mulling to make the same compulsory in near future, so as to curb the menace of fake or forged documents. . There is no restriction on the number of UDINs to be generated by a CA. The UDIN once generated can be withdrawn or cancelled with narration. Hence if any user search for this UDIN, appropriate narration indicated by Member with the date of revoke will be displayed for reference. . While registering the certificate for generation of UDIN, the member has to compulsorily provide Key values (minimum three and maximum five),which are found in the document or certificate generated. . After ICAI Introduced UDIN there are mny question which are going on in the mind of Practicing CA’s like, What is UDIN, Why ICAI Introduced UDIN, How to create an account on the UDIN portal of ICAI, What is Unique Document Identification Number, How to generate UDIN number, UDIN to be generated for every document certified by practicing CA, How to generate a Unique Document Identification Number (UDIN), Unique Document Identification Number (UDIN), What is the Use of UDIN. . These questions are answered in below article, please read carefully. . Unique Document Identification Number (UDIN) is a unique number which is to be generated for every document certified /attested by practicing Chartered Accountants and will be registered with UDIN Portal at https:/udin.icai.org/ (with effect from 1st July, 2018).UDIN to be generated for every document certified by practicing CA. .1. What is Unique Document Identification Number (UDIN)? . Unique Document Identification Number (UDIN) is a unique number, which will be generated by the system for every document certified/ attested by a Chartered Accountant and registered with the UDIN portal available at https:/udin.icai.org/. . . 2. What is the Algorithm of UDIN? . Algorithm of UDIN comprises of the following: 1. The Membership Number of the Member attesting the document/ certificate. 2. The Date (dd/mm/yy) when certificate is issued. 3. The Document Serial Number allotted automatically by system. . 3. Why UDIN? . It has been noticed that financial statements and documents were being certified/ attested by third persons, in lieu of Chartered Accountants. As these statements are being relied upon by the authorities as true statements and certificates, UDIN can be generated by a practicing CA by registering his/her documents/ certificates on UDIN Portal for verification. . . 4. Who can generate UDIN? . A practising Chartered Accountant can generate a UDIN for certificate/ document attested by him either in individual capacity or as a partner. . . 5. Whether UDIN is mandatory for the CA members of ICAI for each certification done? . At present, this facility is recommendatory. But ICAI is mulling to make the same compulsory in near future, so as to curb the menace of fake or forged documents. . . 6. What is the link to crosscheck whether the certificate number so indicated is valid? . The Certificate Number can be cross checked at https://udin.icai.org?mode=searchudin . . 7. How many UDINs can be generated by a CA? Is there any limit? . There is no restriction on the number of UDINs to be generated by a CA. . . 8. How to create an account on the UDIN portal? . To register at UDIN portal, please take the following steps: Step 1: Enter the homepage https://udin.icai.org Step 2: Click button “For first time sign up, click here” .

. . 9. How to Sign in?

10. Should the password be changed after login for safety? . The password generated is encrypted to ensure its appropriate safety. However, Members may change the password at any time. “Change Password” menu can be used to change the password.

. 15. How to generate a Unique Document Identification Number (UDIN)?

. UDIN that have been generated would be displayed as watermarked on document(s) else the UDIN can be mentioned on the document(s) using a pen. “List UDIN” menu can be used to print the UDIN. . . 16. Can one see the various certificate numbers generated? . Yes, one can see and search the various certificates number generated using the search option. . . 17. Is any modification possible in case incorrect information such as client reference code/number, Document Issued Under, Document Description, Date of Document, Keywords within the document, etc., has been submitted? . No change is possible in the data already registered by a Chartered Accountant in the online system. Therefore, members are requested to thoroughly check the details in preview option before submission of their application. Information filled in can be edited/ modified any number of times before the submission. But once it is submitted, it cannot be edited. . . 18. Can a Certificate number once generated be revoked or cancelled? . The UDIN once generated can be withdrawn or cancelled with narration. Hence if any user search for this UDIN, appropriate narration indicated by Member with the date of revoke will be displayed for reference. . . 19. What is the validity of a UDIN on the portal for viewing by a third party? . As of now, there is no time limit. . . 20. Is UDIN mandatorily required to be registered for the search? . Yes, UDIN will be available for search by the end user only after registration. . . 21. What are the key values and are they necessary? . While registering the certificate for generation of UDIN, the member has to compulsorily provide Key values (minimum three and maximum five), which are found in the document or certificate generated. Key values can be any financial figure extracted from the attested statement or certificate such as Turnover Net profit, Utilization amount, Import amount, Export amount, Duty refund, Refund, Net worth, Revenue, Input tax credit, Loan amount, Total Assets, Net owned funds, Profitability, Capital To Risk Asset Ratio (CRAR), Statutory Liquidity Ratio, Gross fixed assets, Net loss, Misc. expenditure, Total capital investment, Sanction amount, Other (please specify any key words), etc. . . 22. What happens if while registering on UDIN Portal, the information is not accepted or the password is not sent? . Credentials do not match with the database as maintained by the regional offices. Probably, the database maintained does not have the correct email ID or mobile number, or the regional offices may have entered the same wrongly. For example, entering multiple email IDs in one field, providing space before the email IDs, etc. . You may reach the PDC Department at (011) 3011 0444, 0444 or by writing to ud...@icai.org. For all issues relating to the data regarding enrolment dates, DOB, email IDs, phone number corrections, etc., please get in touch with the respective regional offices. . Western Region Northern Region . ICAI Tower, C-40, G-Block, Bandra Kurla Complex, Bandra (E) MUMBAI – 400 051 Phone : [+91] (22) 3367 1400 / 1500 [+91] (22) 3367 1462, 463 E-mail: w...@icai.in;wi...@icai.in;rav iar...@icai.in Website: http://www.wirc-icai.org ICAI Bhawan, 52-53-54, Institutional Area, Vishwas Nagar, Shahdara, Near Karkardooma Court DELHI – 110 032 Phone: [+91] (11) 3989 3990, 3021 0600 [+91] (11) 3021 0636, 629 Email: n...@icai.in;ni...@icai.in;shi...@icai.in Website: http://www.nirc-icai.org . Central Region ICAI Bhawan, Plot No.9, Block No.A-1, Lakhanpur Kanpur 208024 (UP) Phone: [+91] (512) 3092600 [+91] (512) 3092634, 681 Email: c...@icai.in;ci...@icai.in;skg...@icai.in Website: http://www.circ-icai.org . Eastern Region Southern Region, ICAI Bhawan, 382/A, Prantik Pally Rajdanga, (Near Acropolis Mall & Garden High School), Kasba, KOLKATA – 700 107 Phone: [+91] (33) 3084 0210 / 03 [+91] (33) 3084 0296, 289 Email: e r...@icai.in;ei...@icai.in;alo...@icai.in Website: http://www.eirc-icai.org ICAI Bhawan, 122, Mahatma Gandhi Road Post Box No. 3314, Nungambakkam CHENNAI – 600 034 Phone: [+91] (44) 3989 3989, 3021 0300 [+91] (44) 3021 0355, 391 Email: s...@icai.in;si...@icai.in; girid...@icai.in Website: http://www.sircoficai.org . . 23. Is online generation of UID number is mandatory? Or, if the UID number is generated offline, can the same be entered in back date? . Yes, it is mandatory that the numbers to be generated online only. . . 24. How will the UDIN appear on the documents? . UDIN that have been generated would be displayed as watermarked on document(s) else the UDIN can be mentioned on the document(s) using a pen. “List UDIN” menu can be used to print the UDIN. . . 25. Can UDIN be generated as per the category of the area of certificate? . Yes, UDIN can be generated in the specific area of certificate, like Goods & Service Tax Act, banks, Companies Act, Income-tax Act, finance and capital market, public finance and government accounting, etc,. . Log Out . Click logout, when you wish to leave this application. Please note, there is a provision of automatic logout, if there is no activity for five minutes. . For any assistance/ clarification, members may call us at (011) 30110444 or email at ud...@icai.in. . DOWNLOAD Following File in PDF Format FAQs- UDINUDIN Process Flow.REGARDS ACA SOURAV BAGARIA |

| You are subscribed to email updates from WELCOME TO CA GROUPS. To stop receiving these emails, you may unsubscribe now. |

Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

WELCOME TO CA GROUPS

CA GROUPS |

|

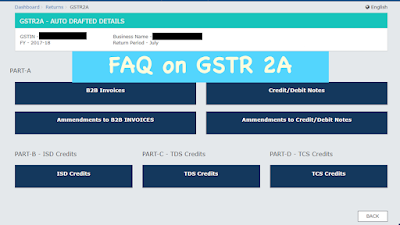

All About GSTR-2A: Frequently Asked questions Posted: 13 Jul 2018 08:10 AM PDT All About GSTR-2A: Frequently Asked questions.1. What is Form GSTR-2A? . Form GSTR-2A is a system generated ‘draft’ Statement of Inward Supplies for a receiver taxpayer. It is auto-populated from the Form GSTR-1/5, Form GSTR-6 (ISD), Form GSTR-7 (TDS), and Form GSTR-8 (TCS), filed/ submitted/ uploaded by the supplier taxpayer, from whom goods and/or services have been procured or received by the receiver taxpayer, in a given tax period. . It is created for a recipient when the Form GSTR-1/5, 6, 7 (Tax Deductor) & 8 (Tax Collector) is filed submitted/ uploaded by the supplier taxpayer. The details become available to the recipient for view and the details are updated incrementally as and when supplier taxpayer upload or change details in their respective Form GSTR, for the given tax period. Form GSTR-2A of a tax period is available for view only. . . 2. When can I as a taxpayer view Form GSTR-2A of a tax period? . 1. When the counterparty has not submitted/filed Form GSTR-1: Any/all invoices uploaded by supplier in their Form GSTR-1/ GSTR-5 will be visible in the Form GSTR-2A. . However, ISD details will be auto-populated to GSTR-2A on submission of Form GSTR-6, only.. 2. When the counterparty has submitted/filed their return: When the counterparty has submitted/filed their return, the invoices available in the Form GSTR-2A will continue to be available for viewing. . Note: Details of TDS and TCS returns will be available as and when Form GSTR-7 & 8 will be made operational. . . 3. Do I as a taxpayer have to file Form GSTR-2A? . No, you don’t have to file Form GSTR-2A. It is a read-only document provided to you, so that you have a record of all the invoices received from various suppliers in a given tax period. . . 4. Can I as a taxpayer download and keep a copy of my Form GSTR-2A for future reference? . Yes, Form GSTR-2A for a given tax period will be available for viewing and/or downloading in post-login mode on the GST portal. . . 5. Can I as a taxpayer make changes to or add an invoice in my Form GSTR-2A, in case there are any errors or omission in the details uploaded by my supplier taxpayers? . No, you cannot make any changes or add an invoice to the Form GSTR-2A, as it is a read-only document. . . 6. Which details are available in Form GSTR-2A? . Following details are available in Form GSTR-2A, in following sections: . a. PART A – auto-populated from Form GSTR-1/5 (refer to 2.1) b. PART B – auto-populated from Form GSTR 6 (ISD credits received) . . 7. How do I as a taxpayer, know if there are any details auto-populated in my Form GSTR-2A? Or Will I be intimated as and when there is a new entry in my Form GSTR-2 for a given tax period? . No intimation is sent to the taxpayer. The taxpayer can check same in post-login mode on the GST portal. . . |

. REGARDS ACA SOURAV BAGARIA |

WELCOME TO CA GROUPS

CA GROUPS |

- Form GST APL 01 : A form for Appeal to GST Appellate Authority

- Appeal filing limit increased by CBDT, ITAT 20L, HC 50L, SC 1Cr

- Government increases the threshold monetary limits for filing Departmental Appeals

- Gist of key amendments proposed in GST Law

|

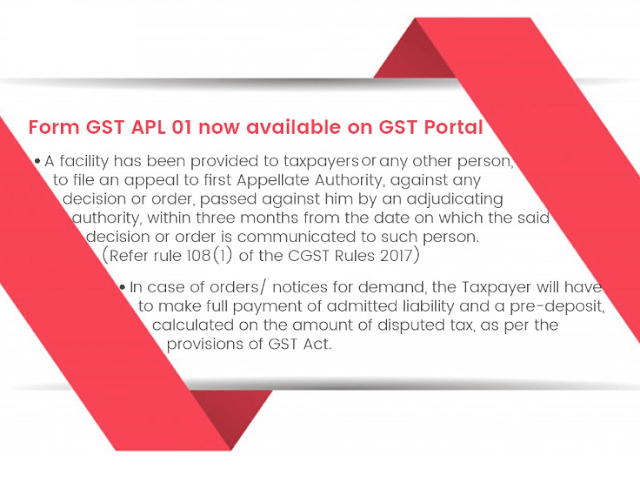

Form GST APL 01 : A form for Appeal to GST Appellate Authority Posted: 14 Jul 2018 07:53 AM PDT Form GST APL 01 : A form for Appeal to GST Appellate Authority.New Functionality update on GST Portal for Form GST APL 01 (A form for Appeal to Appellate Authority) is now made available on GST Portal. . A facility has been provided to taxpayers or any other person, to file an appeal to first Appellate Authority, against any decision or order, passed against him by an adjudicating authority, within three months from the date on which the said decision or order is communicated to such person. . (Refer rule 108 (1) of the CGST Rules 2017) . . In case of orders/ notices for demand, the Taxpayer will hay to make full payment of admitted liability and a pre-deposit, calculated on the amount of disputed tax, as per the provisions of GST Act. |

||||||||||||||||

|

Appeal filing limit increased by CBDT, ITAT 20L, HC 50L, SC 1Cr Posted: 14 Jul 2018 07:48 AM PDT Appeal filing limit increased by CBDT, ITAT 20L, HC 50L, SC 1CrBelow is the official Circular by CBDT increasing appeal filing limit. Appeal filing limit increased by CBDT, ITAT 20L, HC 50L, SC 1CrCircular No. 3/2018F No 279/Misc. 142/2007-ITJ (Pt) Government of India Ministry of Finance Department of Revenue Central Board Direct Taxes . Subject: Revision of monetary limits for filing of appeals by the Department before Income Tax Appellate Tribunal, High Courts and SLPs/appeals before Supreme Court-measures for reducing litigation-Reg.. Reference is invited to Board’s Circular No. 21 of 2015 dated 10.12.2015 wherein monetary limits and other conditions for filing departmental appeals (in Income-tax matters) before Income Tax Appellate Tribunal, High Courts and SLPs/ appeals before Supreme Court were specified. . 2. In supersession of the above Circular, it has been decided by the Board that departmental appeals may be filed on merits before Income Tax Appellate Tribunal and High Courts and SLPs/ appeals before Supreme Court keeping in view the monetary limits and conditions specified below. . 3. Henceforth, appeals/ SLPs shall not be filed in cases where the tax effect does not exceed the monetary limits given hereunder: .

. It is clarified that an appeal should not be filed merely because the tax effect in a case exceeds the monetary limits prescribed above. Filing of appeal in such cases is to be decided on merits of the case.. 4. For this purpose, ‘tax effect’ means the difference between the tax on the total income assessed and the tax that would have been chargeable had such total income been reduced by the amount of income in respect of the issues against which appeal is intended to be filed (hereinafter referred to as ‘disputed issues’). Further, ‘tax effect’ shall be tax including applicable surcharge and cess. However, the tax will not include any interest thereon, except where chargeability of interest itself is in dispute. In case the chargeability of interest is the issue under dispute, the amount of interest shall be the tax effect. In cases where returned loss is reduced or assessed as income, the tax effect would include notional tax on disputed additions. In case of penalty orders, the tax effect will mean quantum of penalty deleted or reduced in the order to be appealed against. . 5. The Assessing Officer shall calculate the tax effect separately for every assessment year in respect of the disputed issues in the case of every assessee. If, in the case of an assessee, the disputed issues arise in more than one assessment year, appeal can be filed in respect of such assessment year or years in which the tax effect in respect of the disputed issues exceeds the monetary limit specified in para 3. No appeal shall be filed in respect of an assessment year or years in which the tax effect is less than the monetary limit specified in para 3. In other words, henceforth, appeals can be filed only with reference to the tax effect in the relevant assessment year. However, in case of a composite order of any High Court or appellate authority, which involves more than one assessment year and common issues in more than one assessment year, appeals shall be filed in respect of all such assessment years even if the tax effect is less than the prescribed monetary limits in any of the year(s), if it is decided to file appeal in respect of the year(s) in which tax effect exceeds the monetary limit prescribed. In case where a composite order/judgement involves more than one assessee, each assessee shall be dealt with separately. . 6. Further, where income is computed under the provisions of section 115JB or section 1lSJC, for the purposes of determination of ‘tax effect’, tax on the total income assessed shall be computed as per the following formula- . (A – B) + (C – D) where, A = the total income assessed as per the provisions other than the provisions contained in section 115JB or section 1lSJC (herein called general provisions); B = the total income that would have been chargeable had the total income assessed as per the general provisions been reduced by the amount of the disputed issues under general provisions; C = the total income assessed as per the provisions contained in section 115JB or section 1lSJC; D = the total income that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JCwas reduced by the amount of disputed issues under the said provisions: . . However, where the amount of disputed issues is considered both under the provisions contained in section 115JB or section 115JC and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D. . . 7. In a case where appeal before a Tribunal or a Court is not filed only on account of the tax effect being less than the monetary limit specified above, the Pr. Commissioner of Income-tax/ Commissioner of Income Tax shall specifically record that “even though the decision is not acceptable, appeal is not being filed only on the consideration that the tax effect is less than the monetary limit specified in this Circular”. Further, in such cases, there will be no presumption that the Income-tax Department has acquiesced in the decision on the disputed issues. The Income-tax Department shall not be precluded from filing an appeal against the disputed issues in the case of the same assessee for any other assessment year, or in the case of any other assessee for the same or any other assessment year, if the tax effect exceeds the specified monetary limits. . 8. In the past, a number of instances have come to the notice of the Board, whereby an assessee has claimed relief from the Tribunal or the Court only on the ground that the Department has implicitly accepted the decision of the Tribunal or Court in the case of the assessee for any other assessment year or in the case of any other assessee for the same or any other assessment year, by not filing an appeal on the same disputed issues. The Departmental representatives/counsels must make every effort to bring to the notice of the Tribunal or the Court that the appeal in such cases was not filed or not admitted only for the reason of the tax effect being less than the specified monetary limit and, therefore, no inference should be drawn that the decisions rendered therein were acceptable to the Department. Accordingly, they should impress upon the Tribunal or the Court that such cases do not have any precedent value and also bring to the notice of the Tribunal/ Court the provisions of sub section (4) of section 268A of the Income-tax Act, 1961 which read as under : . “(4) The Appellate Tribunal or Court, hearing such appeal or reference, shall have regard to the orders, instructions or directions issued under sub-section (1) and the circumstances under which such appeal or application for reference was filed or not filed in respect of any case.” . 9. As the evidence of not filing appeal due to this Circular may have to be produced in courts, the judicial folders in the office of Pr.CsIT/ CsIT must be maintained in a systemic manner for easy retrieval. . 10. Adverse judgments relating to the following issues should be contested on merits notwithstanding that the tax effect entailed is less than the monetary limits specified in para 3 above or there is no tax effect: . (a) Where the Constitutional validity of the provisions of an Act or Rule is under challenge, or (b) Where Board’s order, Notification, Instruction or Circular has been held to be illegal or ultra vires, or (c) Where Revenue Audit objection in the case has been accepted by the Department, or (d) Where the addition relates to undisclosed foreign assets/ bank accounts. . 11. The monetary limits specified in para 3 above shall not apply to writ matters and Direct tax matters other than In com e tax. Filing of a pp ea ls in other Direct tax matters shall continue to be governed by relevant provisions of statute and rules. Further, in cases where the tax effect is not quantifiable or not involved, such as the case of registration of trusts or institutions under section 12A/ 12AA of the IT Act, 1961 etc., filing of appeal shall not be governed by the limits specified in para 3 above and decision to file appeals in such cases may be taken on merits of a particular case. . 12. It is clarified that the monetary limit of Rs. 20 lakhs for filing appeals before the ITAT would apply equally to cross objections under section 253(4) of t h e Act. Cross objections below this monetary limit, already filed, should be pursued for dismissal as withdrawn/ not pressed. Filing of cross objections below the monetary limit may not be considered henceforth. Similarly references to High Courts and SLPs/ appeals before Supreme Court below the monetary limit of Rs. 50 lakhs and Rs. 1 Crore respectively should be pursued for dismissal as withdrawn/ not pressed. References before High Court and SLPs/ appeals below these limits may not be considered henceforth. . 13. This Circular will apply to SLPs/appeals/cross objections/references to be filed henceforth in SC/HCs/Tribunal and it shall also apply retrospectively to pending SLPs/appeals/cross objections/references. Pending appeals below the specified tax limits in para 3 above may be withdrawn/ not pressed. . 14. The above may be brought to the notice of all concerned. . 15. This issues under Section 268A of the Income-tax Act 1961. . 16. Hindi version will follow. . (Neetika Bansal) Director (ITJ), CBDT, New Delhi. |

||||||||||||||||

|

Government increases the threshold monetary limits for filing Departmental Appeals Posted: 14 Jul 2018 07:42 AM PDT Government increases the threshold monetary limits for filing Departmental Appeals.In order to reduce the long pending grievances of taxpayers and to minimise litigations pertaining to tax matters and to facilitate the Ease of Doing Business, Government of India has decided to increase the threshold monetary limits for filing Departmental Appeals at various levels, be it Appellate Tribunals, High Courts and the Supreme Court in the following manner :- . .

. . This is a major step in the direction of litigation management of both direct and indirect taxes as it will effectively reduce minor litigations and help the Department to focus on high value litigations. In case of CBDT, out of total cases filed by the Department in ITAT, 34% of cases will be withdrawn. In case of High Courts, 48% of cases will be withdrawn and in case of Supreme Court 54% of cases will be withdrawn. The total percentage of reduction of litigation from Department’s side will get reduced by 41%. However, this will not apply in such cases where substantial point of law is involved. . Similarly, in case of CBIC, out of total cases filed by the Department in CESTAT, 16% of cases will be withdrawn. In case of High Courts, 22% of cases will be withdrawn and in case of Supreme Court21% of cases will be withdrawn. The total percentage of reduction of litigation from Department’s side will get reduced by 18%. However, this will not apply in such cases where substantial point of law is involved. . This step will also reduce future litigation flow from the Department side. . . DOWNLOAD NOTIFICATION From Below DOWNLOAD NOW |

||||||||||||||||

|

Gist of key amendments proposed in GST Law Posted: 14 Jul 2018 07:22 AM PDT Gist of key amendments proposed in GST Law.A year old Goods and Services Tax (“GST”) is all set to see slew of amendments soon. To iron out the practical hindrances and issues being faced by the Industry Inc since the implementation of GST, the GST Council (apex decision making body for GST) on July 9, 2018 had unveiled the draft of proposed changes in GST law before they are introduced in the upcoming monsoon session of the Parliament. Total 46 amendments are suggested as a major step towards facilitating trade and ease of doing business. . Importantly, blockage of credits will be minimized as now it is proposed to allow ITC in respect of food and beverages, health services and travel benefits to employees, which are obligatory for an employer to provide to its employees under law along with allowing ITC for dumpers, work-trucks, fork-lift trucks and other special purpose vehicles used in business. Noticeable, no credit shall be available in respect of general insurance, servicing, repair and maintenance in respect of motor vehicles, vessels and aircraft on which ITC is not available. Further to ease out worries due to non-revision of returns, it is suggested to enable the taxpayers to correct inadvertent mistakes by filing an amendment return. . Another significant amendments includes classification of merchant sales, high seas Sale transactions etc. under Schedule III to settle reversal of credit issues, restricting reverse charge implications under Section 9(4) to specified class of registered persons, allowing debit/credit notes to be issued against multiple invoices at a time etc. The amendments also seek to give effect to some of the decisions taken by the GST Council in the past like raising the turnover threshold for availing composition scheme increased from Rs 1 crore to Rs 1.5 crore. . The public is invited to give their valuable suggestions on these proposed amendments till July 15. Inviting suggestions is indeed a remarkable step towards identifying essence of taxpayers in partnering nation growth and development. List of amendments proposed show receptiveness of the GST Council towards concerns of the taxpayers which time and again has been represented vide various mechanisms of writs, Industry representations etc. With these changes coming in, a large number of writs may have to be withdrawn subsequently. . Gist of key amendments proposed in GST law:

. Furthermore, vide Explanation (2)(c)(i) under Section 54 of the CGST Act, It is proposed to allow receipt of payment in Indian rupees in case of export of services where permitted by the Reserve Bank of India since particularly in the case of exports to Nepal and Bhutan, the payment is received in Indian rupees as per RBI regulations.In this respect, the provisions of Section 2(6)(iv) of the IGST Act are also being amended to provide that services shall qualify as exports even if the payment for the services supplied is received in Indian rupees as per RBI regulations. .

.

DOWNLOAD NOW |

WELCOME TO CA GROUPS

CA GROUPS |

- Download DIR-3 KYC eForm Here for filing purpose

- DIR-3 KYC: Improved Transparency with Aadhaar Linked OTP Authentication

- FAQS ON eFORM DIR-3 KYC

- KYC of Directors, Form DIR-3 KYC Under Companies Act, 2013 By CS POOJA AGARWAL

|

Download DIR-3 KYC eForm Here for filing purpose Posted: 15 Jul 2018 12:05 AM PDT Download DIR-3 KYC eForm Here for filing purposeClick on the below link to download DIR-3 KYC .Once the link opens up, Click on CTRL+Save (Windows) and Command+Save (MAC). Save it on the desktop to open it properly. |

|||

|

DIR-3 KYC: Improved Transparency with Aadhaar Linked OTP Authentication Posted: 14 Jul 2018 11:42 PM PDT DIR-3 KYC: Improved Transparency with Aadhaar Linked OTP AuthenticationWhy this KYC of Directors Required by MCA? As part of updating its registry, MCA would be conducting KYC of all Directors of all companies annually through a new eform viz. DIR-3 KYC to be notified and deployed shortly. Accordingly, every Director who has been allotted DIN on or before 31st March 2018 and whose DIN is in ‘Approved’ status, would be mandatorily required to file form DIR-3 KYC on or before 31st August 2018. While filing the form, the Unique Personal Mobile Number and Personal Email ID would have to be mandatorily indicated and would be duly verified by One Time Password(OTP). The form should be filed by every Director using his own DSC and should be duly certified by a practising professional (CA/CS/CMA). Filing of DIR-3 KYC would be mandatory for Disqualified Directors also. The Ministry of Corporate Affairs has amended the provisions of Companies (Appointment and Qualification of Directors) Rules, 2014 and notified the Companies (Appointment and Qualification of Directors) Fourth Amendment Rules, 2018 which shall come into force from 10th July 2018. According to the amendments, the Ministry has prescribed the format of e-form DIR-3 KYC. The Central Government or Regional Director (Northern Region) or any officer authorised by the Central Government or Regional Director (Northern Region) shall be empowered to deactivate the Director Identification Number (DIN) of an individual who does not intimate his particulars in e-form DIR-3-KYC within the stipulated time. The de-activated DIN shall only be re-activated after e-form DIR-3-KYC is filed along with prescribed fee of Rupees 5,000/-. After expiry of the due date by which the KYC form is to be filed, the MCA21 system will mark all approved DINs (allotted on or before 31st March 2018) against which DIR-3 KYC form has not been filed as ‘Deactivated’ with reason as ‘Non-filing of DIR-3 KYC’. After the due date filing of DIR-3 KYC in respect of such deactivated DINs shall be allowed upon payment of a specified fee only, without prejudice to any other action that may be taken. KYC is an acronym for "Know Your Customer", a term commonly used for Customer Identification Process. Know Your Customer (KYC) norms are now mandatory for ALL who was allotted a DIN by or on 31st of March 2018 and whose DIN is in approved status and to make an application in eForm DIR-3 KYC. Key Features:

The following attachment is mandatory to be filed in all cases:

Following Documents duly attested by Practising Professional (CS/CA/CMA):

In the case of Foreign Director:

Important key points while filing form:

Fees Details for DIR-3 KYC:

Once Application filed, Approval mail shall be sent to the email ID of the applicant and to the user who has filed the eForm. MCA notifies DIR-3 KYC will be available on MCA21 Company Forms Download page w.e.f 14th July 2018 for filing purposes. Click here to download the form. DOWNLOAD FILE in pdf format below . DOWNLOAD NOW |

|||

|

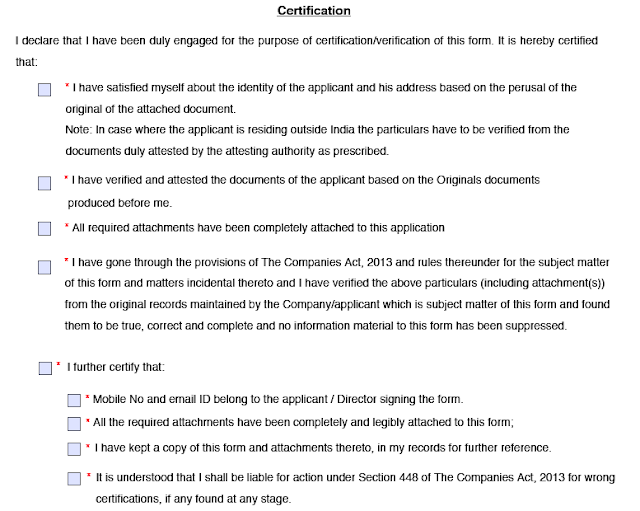

Posted: 14 Jul 2018 10:27 PM PDT FAQS ON eFORM DIR-3 KYC. A recently new form notified by Ministry of Corporate Affairs (MCA), which states that, “As part of updating its registry, MCA would be conducting KYC of all Directors of all companies annually through a new eform viz. DIR-3 KYC to be notified and deployed shortly”. . Accordingly, every Director who has been allotted DIN on or before 31st March, 2018 and whose DIN is in ‘Approved’ status, would be mandatorily required to file form DIR-3 KYC on or before 31st August, 2018. While filing the form, the Unique Personal Mobile Number and Personal Email ID would have to be mandatorily indicated and would be duly verified by One Time Password (OTP). The form should be filed by every Director using his own DSC and should be duly certified by a practicing professional (CA/CS/CMA). Filing of DIR-3 KYC would be mandatory for Disqualified Directors also. . After expiry of the due date by which the KYC form is to be filed, the MCA21 system will mark all approved DINs (allotted on or before 31st March 2018) against which DIR-3 KYC form has not been filed as ‘Deactivated’ with reason as ‘Non-filing of DIR-3 KYC’. After the due date filing of DIR-3 KYC in respect of such deactivated DINs shall be allowed upon payment of a specified fee only, without prejudice to any other action that may be taken. . eForm DIR – 3 KYC, is introduced for directly disqualified the Director, by inactive his/her DIN. This is directly relating to the 30-35 lakh “active directors” on company boards will have to submit PAN-authenticated digital signatures and a certificate from a Chartered Accountant or a Company Secretary or a Cost Accountant to remain on boards as part of a massive KYC exercise undertaken by the government to ensure that only genuine individuals are responsible for running the affairs of companies. The ministry of corporate affairs has ordered that it will be conducting the KYC exercise with all the 50 lakh individuals holding DINs, or director identification numbers, being asked to fill up an electronic form by August 31. Those who do not submit the form will see their DINs deactivated. The exercise covers all DINs issued up to March 31, 2018. . While the original plan was to go for an Aadhaar-linked authentication, the move had to be shelved in the wake of the ongoing case in the Supreme Court. PAN-authenticated digital signatures will also serve the purpose, explained government officials. PAN in the digital signature will be matched with the income tax department’s database to ensure that bogus directors are weeded out. Besides, most of the PANs are linked to Aadhaar, providing further comfort. . . Companies (Appointment and Qualification of Directors) Rules, 2014 . In the Companies (Appointment and Qualification of Directors) Rules, 2014, . (i) The rule 11 shall be renumbered as sub-rule (1) thereof and after sub-rule (1) as so renumbered, the following sub-rules shall be inserted, namely:- "(2) The Central Government or Regional Director (Northern Region), or any officer authorised by the Central Government or Regional Director (Northern Region) shall, deactivate the Director Identification Number (DIN), of an individual who does not intimate his particulars in e-form DIR-3-KYC within stipulated time in accordance with rule 12A (3) The de-activated DIN shall be re-activated only after e-form DIR-3-KYC is filed along with fee as prescribed under Companies (Registration Offices and Fees) Rules, 2014. (ii) after rule12, the following shall be inserted, namely:- "12A Directors KYC:- Every individual who has been allotted a Director Identification Number (DIN) as on 31 st March of a financial year as per these rules shall, submit e-form DIR-3-KYC to the Central Government on or before 30th April of immediate next financial year. Provided that every individual who has already been allotted a Director Identification Number (DIN) as at 31st March, 2018, shall submit eform DIR-3 KYC on or before 31stAugust, 2018." ..Rule 12A of Companies (Appointment and Qualification of Directors) Rules, 2014, is introduced for Director either to comply with Rules or face Disqualification directly by rendering his/her DIN as Inactive. Once it is Deactivated, then they are not able to file any eFORM in Future..FAQS ON eFORM DIR-3 KYC. 1. What is DIR - 3 KYC eForm ?. DIR-3 eKYC form is newly introduced form, whereby every Individual who is holding DIN is required to file his /her details in eForm DIR-3 KYC every year on or before April 30 every year. However, For the current year, DIR-3 KYC is required to be filed on or before August 31, 2018. However, such CKYC Form (Central KYC Registry) is already applicable to Bank, Depository Participant, Stock Broker, Mutual Fund etc., whenever Client open account with intermediaries, it is used for the purpose of Anti Money Laundering since long. The form is unique among all respective authority like SEBI, RBI, IRDA etc. But, as after finding many loop holes in current scenario, the same scheme is extended to Director also by Ministry of corporate Affairs, which might not be part of above authority. . . 2. To Whom the eForm DIR – 3 KYC is Applicable ? . ALL DIRECTORS, (Whether Qualified or Disqualified) DIR-3 eKYC form would be applicable to all Directors, who have been allotted a DIN on or before 31st March 2018. The date for allotment of DIN can be ascertained from the date of DIN allotment letter. . The DIN eKYC form must be filed using the Directors own DSC (Digital Signature) and should be certified by a practicing Professional like Chartered Accountant, Company Secretary or Cost Accountant. . Any Companies, who have continuously not filed company annual return for 3 years have recently been disqualified by the MCA. However, MCA has already provided an opportunity for reactivating such companies through the Condonation of Delay scheme. Many Companies has obtained such facility also. . Even though, there are many companies whose, Directors been disqualified by the MCA are required to file DIN eKYC to update their email and phone number on MCA record. Failure to file DIR-3 eKYC form by disqualified Directors will also lead to additional penalty. . FOR EXAMPLE à If, DIN was allotted to Mr. A on or before 31stMarch, 2018, then he would require to file DIR-3 KYC on or 31st August, 2018. à If, DIN was allotted to Mr. A on or after 1st April 2018, then he would need to file DIR-3 KYC before 30th April 2019. . . 3. Who has to File eFORM DIR – 3 KYC ? . All the Individuals Whether they are residents in Indian national, Non Residents or Foreign nationals, who are directors/ partners any Companies/LLP anywhere are needed to file. . . 4. Is eFORM DIR – 3 KYC also applicable to Partners/Designated Partners ? . Any Individual, who are partner/designated partner of an LLP holding a valid DIN (Director Identification Number) allotted on or before 31st March 2018, then it would be mandatorily required to file form DIR-3 KYC on or before 31st August 2018. . . 5. If any Director had been allotted multiple DIN, Is there any need to File eFORM DIR – 3 KYC, for each DIN ? . YES, Though, holding Multiple DIN, is always not good, however if by any reason, without knowing the same, if any Director holding multiple DIN on or before 31st March, 2018, it is advisable to surrender the one of such DIN as soon as possible, during the course Director also need to File eFORM DIR – 3 KYC, for all the DIN, which holds on or before 31st March, 2018. . . 6. If any Director holding multiple Directorship in Company, is there any need to file the eFORM DIR – 3 KYC, for each Company ? . NO, eFORM DIR – 3 KYC, need to file based on DIRECTOR IDENTIFICATION NUMBER (DIN), so even though, if any Director holding multiple Directorship in Company, then also they need to File eFORM DIR – 3 KYC, only once according to their DIN. . . 7. Why DIR – 3 KYC Form ? . TO CHECK THE MENACE OF SHELL COMPANIES The practice started by MCA in February 2017, for effectively tackling the malpractices by shell companies/ponzy companies/khoka companies in a comprehensive manner adopting whole of the government approach. . To consolidated relevant information at one place and based upon inputs from all law enforcement agencies, the Serious Fraud Investigation Office under the Ministry of Corporate Affairs has undertaken the exercise of preparing comprehensive digital database of shell companies and their associates that were identified by various law enforcement agencies. This database, as on date, comprises of 3 lists, viz

. . 8. Is there any Due Date for Filing of DIR-3 eKYC ? . YES, . Due Date is always come with each and every Form (whether existing or new), by virtue of that, Ministry of Corporate Affairs has fixed 31st August 2018 as the due date for filing DIR-3 eKYC Form. However, previous record also shows that, if necessary arise extension may be granted by Ministry, but it is always advised to complete the process on or before due date. However, if DIN eKYC is not completed on or before the due date as mentioned above, the MCA system will automatically deactivate those DINs for which the form is not filed. In such cases, the system will show the message that DIN was deactivated for ‘Non-filing of DIR-3 KYC’. Once, DIN is deactivated for non-filing of DIN eKYC form, it can be reactivated by paying a penalty and by filing DIR-3 eKYC form. . . 9. Is there any Fees for Filing of DIR-3 eKYC ? . As of now, NO SUCH FILING FEES IS PRESCRIBED by MCA. But it is matter of Fact, in next year, we may need to pay the Fees. . . 10. Is there any Penalty Fees for late Filing of DIR-3 eKYC ? . Yes, of course, if no penalty levied, then compliance level not upto the mark, and ultimate vision of such form may not be achieved, so if any delay in Filing of DIR – 3 eKYC or DIN eKYC, the Penalty Fees of Rs. 5,000 per Form should be levied. The Central Government or Regional Director (Northern Region) are hereby authorized to deactivate DIN against which DIR-3 KYC is not filed within due date, deactivated DIN means a person cannot act as a Director while his DIN is deactivated and any act done by him/her will be invalid and which might attract various penalties under Companies Act, 2013. In addition to the above penalty, any wrong information, if any provided in the form, will also liable for penalty under Section 448 and 449 of the Companies Act, 2013. . . 11. Which information necessary for filing of Form ? . As no such form is notified by MCA, but Pursuant to [Rule 12A of The (Companies Appointment and Qualification of Directors) Rules, 2014], the details need to be provided such as While we still await actual eForm, the draft form attached with Rules requires the following information: 1) Director Identification Number (DIN) 2) Full Name of Individual 3) Fathers Name of Individual 4) Other basic details like

6) Voters Identity Card Number (optional) 7) Passport (mandatory for foreign national holding DIN) 8) Driving License (optional) 9) Aadhar card Number (mandatory) 10) Personal Mobile and Personal Email (mandatory) 11) Permanent Residential address, 12) If present residential address is different from Permanent Residential address then provide present Residential Address. 13) Mobile No. and Email id shall be of the Director himself only. 14) In case of Indian nationals, Passport if not Mandatory, In case of foreign nationals Passport is Mandatory. . In addition to above, it also requires, following Documents duly attested by Practising Professional: Ø Proof of Identity like PAN / Passport / Aaadhar card Ø The proof of identity document should have persons’ full name, his father’s full name along with photograph of the applicant and his date of birth. Ø Proof of Address. Ø Optional attachments, if any. . In case of Foreign Director - Ø Copy of Passport and residential proof Ø (any 1 out of Bank Statement/ Electricity bill/ Telephone bill/ Mobile bill, but not older than 1 year). . Other Information/Documents required:

. 12. Is there any attachments Required ? . PAN CARD For all Indian Nationals, PAN card is to be filed compulsorily. . PASSPORT For all foreign nationals who are having DIN, their passport number is to be mentioned in the form compulsorily. Passport is not compulsory for Indian residents but they have to provide their details of their passport if they have the same. . AAADHAR CARD Aaadhar is mandatory for filing this form. Aaadhar details should match the PAN and DIN details. Present residential address shall be the same as per the address proof documents attached along with this form. . PASSPORT SIZE PHOTO As it is not mandatory, but in optional Attachment it is advisable to attached the same and also keep record the same for Compliance Purpose. . . 13. Who are eligible to File Such Form ? . As per notification on MCA, DIR – 3 eKYC duly certified by a practicing professional like,Chartered Accountant, Company Secretary or Cost Accountant. . . 14. Is it mandatory for a person to have DSC to file DIR-3 KYC ? . YES, It is mandatory to affix DSC of Director on his e-form DIR-3 KYC. So this is the First Step to obtain DSC of Directors. . . 15. What happen if Director Effect of director fails to file DIR-3 KYC? . If, by any reason, Director is fail to file the DIR – 3 KYC eForm within Due Date then, MCA21 system will MARK ALL APPROVED DINS AS ‘DEACTIVATED’ with reasons as ‘Non-filing of DIR-3 KYC’, which may cause problem in future. . Yes, once DIN (Director Identification Number) is allotted, it is, IMMATERIAL WHETHER DIRECTOR IS HOLDING A DIRECTORSHIP OR NOT, MUST HAVE TO FILE DIR – 3 KYC FORM EVERY YEAR. e-form DIR-3 KYC clearly specify that,PERSONAL MOBILE NUMBER AND PERSONAL EMAIL ID IS MANDATORY FOR FILING.Therefore, Director have to use their own personal Mobile Number and Email ID. . . 16. By this practice what MCA want to Prove ? . TO CLEAN UP THE REGISTRY WILL CREATE A TRANSPARENT AND COMPLIANT CORPORATE ECOSYSTEM PROMOTE THE CAUSE OF ‘EASE OF DOING BUSINESS’ AND ENHANCE THE TRUST OF THE PUBLIC. In a drive carried out under the supervision of the Ministry of Corporate Affairs in the Financial Year 2017-18 the Registrars of Companies (ROCs) identified and removed from the register of companies under Section 248 of the Companies Act, 2013 the names of 2,26,166 companies, which had not filed their Financial Statements or Annual Returns for a continuous period of two or more financial years. As many as 3,09,619 directors were also disqualified u/s.164(2)(a) read with Section 167(1) of the Companies Act, 2013 for non-filing of Financial Statements or Annual Returns for a continuous period of immediately preceding 3 financial years (2013-14, 2014-15 & 2015-16). For the 2nd drive to be launched during the current Financial Year 2018-19 a total of 2,25,910 companies have been further identified for being struck-off under section 248 of the Companies Act, 2013 along with 7191 LLPs for action under section 75 of the LLP Act, 2008 due to non-filing of financial statements for the years 2015-16 and 2016-17. An opportunity of being heard will be given to these identified companies and LLPs by way of notices regarding their default and the proposed action. Appropriate action will be taken after considering their response. . . 17. By using DIR – 3 eKYC what MCA Gain ? . The Government expects that its EFFORTS TO CLEAN UP THE REGISTRY WILL CREATE A TRANSPARENT AND COMPLIANT CORPORATE ECOSYSTEM in India, promote the cause of ‘ease of doing business’ and enhance the trust of the public. The existence of black money creates imbalances in the economy, finances terror and crimes like money laundering etc., puts the honest at a disadvantage, deprives the State of the much needed revenues and ultimately adversely affects the poor of the country.The mechanism for sharing of documents and information amongst all the Law Enforcement Agencies has been put in place. Standard Operating Procedure regarding ‘SHARING OF DOCUMENTS’ has been finalised andCIRCULATED AMONGST ALL THE LAW ENFORCEMENT AGENCIES for compliance. The Task Force is the appellate authority for this purpose. The Standard Operating Procedure for sharing of information amongst the various Law Enforcement Agencies has also been finalized and circulated by Central Economic Intelligence Bureau, which is the Nodal Agency for this purpose. . . 18. ADVICE FOR PROFESSIONAL . Before certifying the forms by professional have to collect information’s and documents. . . 19. CERTIFICATION . I declare that I have been duly engaged for the purpose of certification/verification of this form. It is hereby certified that: Ä · I have satisfied myself about the identity of the applicant and his address based in the perusal of the original of the attached document, . Note: In case where the applicant is residing outside India the particular have to be verified from the documents duly attested by the attesting authority as prescribed Ä All required attachments have been completely attached to this application. Ä I have gone through the provision of The Companies Act, 2013 and rules thereunder for the subject matter of this form and matters incidental thereto and I have verified the above particulars (Including attachment (s)) from the original records maintained by the Company/applicant which is subject matter to this form and found them to be true, correct and complete and no information material to this form has been suppressed.

o All the required attachments have been completely and legibly attached to this form. o I have kept the copy of this form and attachments thereto, in my records for the further reference. o It is understood that I shall be liable for the action under section 448 of The Companies Act, 2013 for wrong certification, if found at my stage.. . . NOTE: . As per certification column of form (mentioned above also) - following are the important points for concerned: à Mobile no. and Email ID belong to the applicant/director signing the form. à I have verified the above particulars (Including attachment (s)) from the original records maintained by the applicant à I have satisfied myself about the identity of the applicant and his address à *** I declare that I have been duly engaged for the purpose of certification/verification of this form . .

Professionals must take a Declaration Form the Individual, whose eForm DIR – 3 KYC Filed. . .

From, (Name of Individual) Address: City : State : Date: _________ To (Name of Professional) (Firm Name) Practicing Company Secretary, Charted Accountant, Cost Accountant, COP No. Address: City : State : Subject: Declaration for certification e-forms DIR-3 KYC Ref: DIN – Directorship in Company : Name of Company in Which, appointed as Director Company Name :

. Dear Sir/Mam, . I hereby Declare that, the information is provided in connection with your certification/verification of e-form DIR-3 KYC under provisions of Companies Act, 2013, and as per Rule 12 of Companies (Appointment and Qualification of Directors) Rules, 2014. . I hereby, declare that, for certification of e-form DIR-3 KYC and verification of details mentioned in the form are true. . Further, kindly consider the below information/document required by your good self to verify details mentioned in e-form DIR-3 KYC:

. ___________________ (Name of Individual) DIN: . .

Ø Professional has to give declaration that he/she are engaged for Certification/verification of this form only i.e. eForm DIR – 3 KYC. Following should be course of action for the professional if he certified the e-form DIR-3 KYC. à Collect Declaration Form from every Individual and mentioned all the details as per Declaration. à Must ensure that, the Mobile No. and Email ID belongs to Director only. à Must Preserve copy of all attachments and form in his record, which may be helpful for future reference, if any show-cause notice issued by Ministry against such form. . . Thanks & Regards, ACA SOURAV BAGARIA . . Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. I assume no responsibility therefore. In no event, I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information. |

|||

|

KYC of Directors, Form DIR-3 KYC Under Companies Act, 2013 By CS POOJA AGARWAL Posted: 15 Jul 2018 12:00 AM PDT KYC of Directors, Form DIR-3 KYC Under Companies Act, 2013 By CS POOJA AGARWAL.Dear Professional Colleagues, . The Ministry of Corporate Affairs by its notification dated 5th July 2018 has notified the “Companies (Appointment and Qualification of Directors) fourth Amendment Rules, 2018”. The rules require that . "EVERY PERSON HOLDING DIN MUST GET HIS KYC UPDATED WITH THE MINISTRY OF CORPORATE AFFAIRS WITHIN DUE DATES PROVIDED IN THE RULES.". This Article deals with the practical aspects of the said rules and tries to clarify the requirements in a simplified form. .

. Time Limit:.

. Features of the FORM: .

. ATTACHMENTS:.

The document must have Applicant and his Father’s full name along with Photograph of the Applicant and his Date of Birth. .

. SIGNATURE:. The Form has TO BE DIGITALLY SIGNED by the APPLICANT himselfusing his CLASS 2 – DIGITAL SIGNATURE. It should be noted that before filing the form the DSC should be registered via ROLE CHECK with MCA. . NOTE: Any discrepancy may lead an action against the person u/s 448 of the Companies Act, 2013 under relevant provisions of the Indian Penal Code, 1860. . CERTIFICATION: This form should be CERTIFIED AFTER VERIFICATION OF THE DOCUMENTS IN ORIGINAL by the CA/CS/CMA in practice. . NOTE: Both the Applicant and Professional are advised to keep a copy of the forms and documents file with MCA permanently. . DOWNLOAD in PDF Format here: . DOWNLOAD NOW. Disclaimer :The entire contents of this article are solely for information purpose and have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation by the Author. CA GROUPS and the Author of this Article do not constitute any sort of professional advice or a formal recommendation. The author has undertaken utmost care to disseminate the true and correct view and doesn’t accept liability for any errors or omissions. You are kindly requested to verify and confirm the updates from the genuine sources before acting on any of the information’s provided hereinabove. CA GROUPS shall not be responsible for any loss or damage in any circumstances whatsoever. |

WELCOME TO CA GROUPS

CA GROUPS |

- Recommendations made during the 28th GST Council Meet

- GST council approves Simplified GST Return

- GST Council Approves Quarterly Returns for Taxpayers having Turnover upto 5 Cr

- GST Council approved Tax Exemption on Sanitary Napkins

- Key Takeaways from the 28th GST Council Meeting

- GST PENALTY SUMMARY

- No Due Date Extension for Income Tax Return Filing: CBDT

|

Recommendations made during the 28th GST Council Meet Posted: 21 Jul 2018 09:57 AM PDT Recommendations made during the 28th GST Council Meet.The GST Council in its 28thmeeting held here today has recommended certain amendments in the CGST Act, IGST Act, UTGST Act and the GST (Compensation to States) Act. . . The major recommendations are as detailed below:

. These amendments will now be placed before the Parliament and the legislature of State and Union territories with legislatures for carrying out the amendments in the respective GST Acts. |

|

GST council approves Simplified GST Return Posted: 21 Jul 2018 09:51 AM PDT GST council approves Simplified GST Return.The GST Council in its 28th meeting held here today under the Chairmanship of Shri PiyushGoyal , Union Minister for Railways , Coal , Finance & Corporate Affairs has approved the new return formats and associated changes in law. It may be recalled that in the 27thmeeting held on 4thof May, 2018 the Council had approved the basic principles of GST return design and directed the law committee to finalize the return formats and changes in law. The formats and business process approved today were in line with the basic principles with one major change i.ethe option of filing quarterly return with monthly payment of tax in a simplified return format by the small tax payers.All taxpayers excluding small taxpayers and a few exceptions like ISD etc. shall file one monthly return. The return is simple with two main tables. One for reporting outward supplies and one for availing input tax credit based on invoices uploaded by the supplier. Invoices can be uploaded continuously by the seller and can be continuously viewed and locked by the buyer for availing input tax credit. This process would ensure that very large part of the return is automatically filled based on the invoices uploaded by the buyer and the seller. Simply put, the process would be “UPLOAD – LOCK – PAY” for most tax payers.Taxpayers would have facility to create his profile based on nature of supplies made and received. The fields of information which a taxpayer would be shown and would be required to fill in the return would depend on his profile. . . NIL return filers (no purchase and no sale) shall be given facility to file return by sending SMS. . . The Council approved quarterly filing of return for the small taxpayers having turnover below Rs. 5 Cr as an optional facility. Quarterly return shall be similar to main return with monthly payment facility but for two kinds of registered persons – small traders making only B2C supply or making B2B + B2C supply. For such taxpayers, simplified returns have been designed called Sahaj and Sugam. In these returns details of information required to be filled is lesser than that in the regular return. . . The new return design provides facility for amendment of invoice and also other details filed in the return. Amendment shall be carried out by filing of a return called amendment return. Payment would be allowed to be made through the amendment return as it will help save interest liability for the taxpayers. . . 93% of the taxpayers have a turnover of less than Rs 5 Cr and these taxpayers would benefit substantially from the simplification measures proposed improving their ease of doing business. Even the large taxpayers would find the design of new return quite user friendly. |

|

GST Council Approves Quarterly Returns for Taxpayers having Turnover upto 5 Cr Posted: 21 Jul 2018 09:47 AM PDT GST Council Approves Quarterly Returns for Taxpayers having Turnover upto 5 Cr.The GST Council’s 28th meeting has approved the quarterly returns for traders having turnover of upto Rs 5cr annually, said Delhi Finance Minister Manish Sisodia. . This would be a major relief to the small traders across the country. . Presently, registered persons with aggregate turnover up to Rs. 1.50 Crores are eligible to file quarterly returns under the new tax regime. . The GST Council has now widened the relief to the traders having turnover up to 5 crore rupees. Traders with turnover up to Rs 5 crore will deposit GST monthly but they don’t have to file the returns quarterly, said Finance Minister Piyush Goyal while addressing the media today. . This is to facilitate the ease of payment and return filing for small and medium businesses with an annual aggregate turnover up to Rs. 5 crores. . Currently, the registered buyers from small taxpayers having turnover up to 1.5 crores are eligible to avail ITC on a monthly basis. . . |

|

GST Council approved Tax Exemption on Sanitary Napkins Posted: 21 Jul 2018 09:42 AM PDT GST Council approved Tax Exemption on Sanitary Napkins. Union Finance Minister Piyush Goyal chaired 28th Goods and Service Tax (GST) Council meeting in the national capital on Saturday. Some crucial changes in GST, were discussed during the meeting. One of the Major decision taken was on Sanitary Napkins. . After the rollout of GST from 1st July last year, several petitions were filed before various High Courts seeking tax exemption to sanitary napkins. . In last January, the Supreme Court had stayed all the petitions relating to exempting sanitary napkins from the current 12 per cent levy of tax from the ambit of Goods and Services Tax which are pending before the Delhi and Bombay High Courts. . The Apex Court was about to examine whether this is a fit case and see if all the matters pertaining to it should be heard by the Court itself. . Delhi FM Manish Sisodia after GST council meeting said Sanitary Napkins exempted from GST and no decision taken on sugar cess. |

|

Key Takeaways from the 28th GST Council Meeting Posted: 21 Jul 2018 09:13 AM PDT Key Takeaways from the 28th GST Council Meeting.The 28th meeting of the GST Council has introduced several changes in the present Goods and Services Tax (GST) system. Some of the key decisions taken by the Council after a nine-hour meeting is summarized below. .

|

. . REGARDS ACA SOURAV BAGARIA |

|

Posted: 21 Jul 2018 05:19 AM PDT GST PENALTY SUMMARY.GST PENALTY SUMMARY .

|

. .DOWNLOAD in PDF Format here |

. REGARDS ACA SOURAV BAGARIA |

|

No Due Date Extension for Income Tax Return Filing: CBDT Posted: 21 Jul 2018 03:24 AM PDT No Due Date Extension for Income Tax Return Filing: CBDT.The Central Board of Direct Taxes (CBDT), today clarified that the rumors spreading across in social media regarding extension in due date for non-tax audit cases is fake. The Income Tax department further clarified that there are no such plans to extend this deadline beyond 31st July, 2018. . The CBDT missive said that the department has already received over 1 crore returns filed electronically. . As per Section 234F of the Income Tax Act, from 1st April 2018, the penalty for late filing income tax return would be as follows: (a) five thousand rupees, if the return is furnished on or before the 31st day of December of the assessment year; (b) ten thousand rupees in any other case: Provided further that if the total income of the person does not exceed five lakh rupees, the fee payable under this section shall not exceed one thousand rupees. . “Therefore, the assessees are hereby asked to file their ITRs before the above due date to avoid the penalty,” the circular said. . The Board had notified the new Income Tax Return forms for the assessment year 2018-19 on April 5. The income Tax department has launched all the income tax forms for e-filing after more than a month of them being notified. . The present circular is not a happy news for taxpayers and the tax professionals as they did not get sufficient time to prepare the returns. . . DOWNLOAD FULL CIRCULAR BELOW . DOWNLOAD NOWREGARDS ACA SOURAV BAGARIA |

WELCOME TO CA GROUPS

CA GROUPS |

- Major Changes in revised form 3CD for FY 17-18 | AY 18-19

- CBDT releases revised Form 3CD for FY 17-18 | AY 18-19

- GST Migration Window to be opened till 31st August

|

Major Changes in revised form 3CD for FY 17-18 | AY 18-19 Posted: 23 Jul 2018 11:36 AM PDT Major Changes in revised form 3CD for FY 17-18 | AY 18-19.Some of the major changes in revised form 3CD are given below for reference. . Major Changes in revised form 3CD for FY 17-18 | AY 18-19.

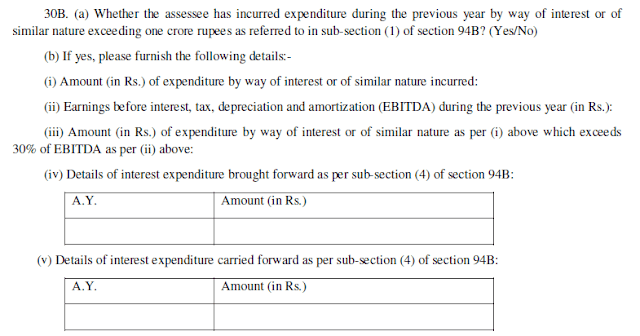

5. The new form 3CD will incorporate further reporting requirement related to Transfer pricing as per Section 92 CE and 94 B of Income Tax Act inserted vide Finance Act 2017 . . 6. Further the assessee is required to inform that whether he is required to furnish Statement of Financial Transactions i.e. Form No.61 or Form No. 61A or Form No. 61B as per Income Tax Act. . 7. Also the assessee is now required to inform if he has received any deemed dividend as per sub-clause (e) of clause (22) of section 2 of Income Tax Act 1961 . 8. The form has further added a reporting requirement of Investment in new plant or machinery in notified backward areas in certain States as per Section 32AD of Income Tax Act 1961 . . You May Also Like: Click here to read the complete notification revising form 3CD of Income Tax |

|

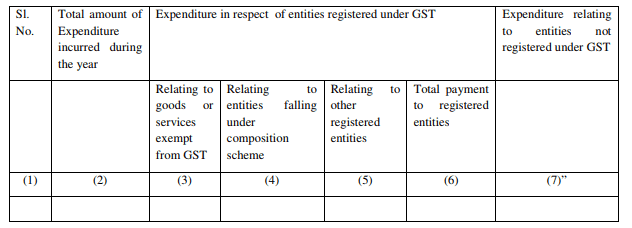

CBDT releases revised Form 3CD for FY 17-18 | AY 18-19 Posted: 23 Jul 2018 11:28 AM PDT CBDT releases revised Form 3CD for FY 17-18 | AY 18-19.The Central Board of Direct Taxes ( CBDT ) has revised the Form No. 3CD, an audit report under section 44AB of the Income-tax Act, 1961 in a case where the accounts of the business or profession of a person have been audited under any other law. . Earlier there were reports that the Income Tax Department wants to mine the GST payments data of businesses to ensure that no income goes untaxed. . With the rollout of GST, which is comparatively more transparent than the old the tax regime, the Board wants firms availing presumptive taxation facility and also certain companies (not subjected to tax audit) to furnish GST-related payments information in their income tax returns. . Tax Auditors of a certain classes of Assessees shall file Form 3CD in the prescribed format. A tax audit is mandatory if the turnover of a business exceeds Rs. 1 crore or exceeds Rs. 25 Lacs in case of Professionals. . Presently, the companies that are not subjected to tax audits are required to furnish GST details. With this amendment, this will be extended to tax audit cases. . Form 3CD is a Form in accordance with Rule 6G(2) and Section 44AB of the Indian Income Tax Act, 1961. The Form is a part of the process of filing Income Tax Returns in India and is an Annexure to the Audit Report. Form 3CD contains 32 Clauses. It is required to be attached with Forms 3CA or 3CB, as applicable. . The amendment further inserts a new provision, Rule 29A, to prescribe the details of any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to in section 56(2)(ix) of the Income Tax Rules. . . DOWNLOAD Full Notification Below DOWNLOAD NOTIFICATION |

|

GST Migration Window to be opened till 31st August Posted: 23 Jul 2018 03:11 AM PDT GST Migration Window to be opened till 31st August.The GST Council in its 28th meeting held here today has approved the proposal to open the GST migration window for taxpayers, who received provisional IDs but could not complete the migration process. . The taxpayers who filed Part A of FORM GST REG-26, but not Part B of the said FORM are requested to approach the jurisdictional Central Tax/State Tax nodal officers with the necessary details on or before 31st August, 2018. . The nodal officer would then forward the details to GSTN for enabling migration of such taxpayers. It has also been decided to waive the late fee payable for delayed filing of return in such cases.Such taxpayers are required to first file the returns on payment of late fees, and the waiver will be effected by way of reversal of the amount paid as late fees in the cash ledger under the tax head. . Taxpayers who intend to complete the migration process are requested to approach their jurisdictional Central Tax/State Tax nodal officers in this regard. . . DOWNLOAD Notification Below DOWNLOAD NOW |

WELCOME TO CA GROUPS

CA GROUPS |

|

Income Tax Return Filing Date Extended from 31.07.2018 to 31.08.2018 Posted: 26 Jul 2018 11:10 AM PDT Income Tax Return Filing Date Extended from 31.07.2018 to 31.08.2018.The Central Board of Direct Taxes (CBDT) has extended the due date for filing income tax returns to 31st August 2018 from this July 31st. . As the due date has been coming closer, the Board had received several requests from the tax practitioners body and the Institute of Chartered Accountants of India (ICAI) requesting a due date extension due to several reasons. . “For certain categories of taxpayers, the ‘due-date’ of filing income-tax return for assessment-year 2018-2019 is 31.07.2018. Upon consideration of the matter, the Central Board of Direct Taxes, in exercise of its powers under section 119 of the Income-tax Act, 1961 (‘Act’), hereby, extends the ‘due-date’ of filing income-tax return, as prescribed in section 139(1) of the Act, from 31st July, 2018 to 31st August, 2018,” the CBDT said in an order. . From the current Assessment Year onwards, non-filing of ITR before due date will invite late fee of Rs. 1,000/5,000/1-0,000 as the case may be, under section 234F of the Income Tax Act. |

The Board had notified the new Income Tax Return forms for the assessment year 2018-19 on April 5. The income Tax department has launched all the income tax forms for e-filing after more than a month of them being notified. . |

Further, due to GST and the over burden of compliance procedure, the tax practitioners were unable to finish their IT works. It is in this background, the people urged the Board to extend due date. . . DOWNLOAD FULL NOTIFICATION FROM BELOW . DOWNLOAD NOTIFICATION |

WELCOME TO CA GROUPS

CA GROUPS |

|

Govt. extends Due Date for filing GSTR-6 by Input Service Distributors Posted: 30 Jul 2018 07:33 PM PDT Govt. extends Due Date for filing GSTR-6 by Input Service Distributors.The Central Board of Indirect Taxes and Customs ( CBIC ) today extended the last date for filing GSTR-6 by Input Service Distributors for the months of July 2017 to August 2018 until the 3oth day of September 2018. . Earlier, the due date notified was 31st May 2018. . Input Service Distributor under GST Model includes an office of the supplier of goods and / or services which receives tax invoices issued by supplier towards receipt of input services and/or goods and issues a prescribed document for the purposes of distributing the credit of CGST (SGST in State Acts) and / or IGST paid on the said services to a supplier of taxable goods and / or services having same PAN. . A separate registration number is required for this application. An ISD is required to furnish details of invoices in form GSTR-6 through the GST portal. Every Input Service Distributor shall, after adding, correcting or deleting the details contained in FORM GSTR-6A, furnish electronically a return in FORM GSTR-6. . This return will contain details of tax invoices on which credit has been received. GSTR-6 needs to be furnished by 15th of the month succeeding the tax period. . Download Notification here Download Notification |

WELCOME TO CA GROUPS

CA GROUPS |

|

CBIC releases draft on New Simplified GST Returns Posted: 30 Jul 2018 10:13 PM PDT CBIC releases draft on New Simplified GST Returns.The Central Board of Indirect Taxes and Customs ( CBIC ) has released draft on New Simplified GST Returns as approved by 28th GST Council Meeting. . In the 27th GST Council, It had approved the basic principles of GST return design and directed the law committee to finalize the return formats and changes in law. . Last Council meeting in line with the basic principles with one major change i.e the option of filing quarterly return with monthly payment of tax in a simplified return format by the small tax payers. |

All taxpayers excluding small taxpayers and a few exceptions like ISD etc. shall file one monthly return. The return is simple with two main tables. One for reporting outward supplies and one for availing input tax credit based on invoices uploaded by the supplier. Invoices can be uploaded continuously by the seller and can be continuously viewed and locked by the buyer for availing input tax credit. |

. |

Taxpayers would have facility to create his profile based on nature of supplies made and received. The fields of information which a taxpayer would be shown and would be required to fill in the return would depend on his profile. . |

NIL return filers (no purchase and no sale) shall be given facility to file return by sending SMS. . |

In cases where no return is filed after uploading of the invoices by the supplier, it shall be treated as self-admitted liability by the supplier and recovery proceedings shall be initiated against him after allowing for a reasonable time for filing of the return and payment of tax. . Liability declared in the return shall be discharged in full at the time of filing of the return by the supplier as is being done at present in the present return FORM GSTR 3B. . There shall not be any automatic reversal of input tax credit at the recipient’s end where tax has not been paid by the supplier. In case of default in payment of tax by the supplier, recovery shall be first made from the supplier and in some exceptional circumstances like missing taxpayer, closure of business by the supplier or supplier not having adequate assets or in cases of connivance between recipient and the supplier, etc. recovery of input tax credit from the recipient shall be made through a due process of service of notice and issue of order. . . Download Notification here . Download Notification |

WELCOME TO CA GROUPS

CA GROUPS |

|

MCA amends Companies (Accounts) Rules 2014 Posted: 01 Aug 2018 06:06 AM PDT MCA amends Companies (Accounts) Rules 2014.The Ministry of Corporate Affairs (MCA) has amended the Companies (Accounts) Rules, 2014 wherein the provision related to the matter disclosure in board report has been amended. Now, the companies are required to disclose in their report about the maintenance of cost records, internal complaints committee under sexual harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013. . . DOWNLOAD FULL NOTIFICATION BELOW . DOWNLOAD NOTIFICATION |

.REGARDS ACA SOURAV BAGARIA |

WELCOME TO CA GROUPS

CA GROUPS |

|

29th GST Council Meeting: Key Highlights and Decisions Posted: 05 Aug 2018 02:38 AM PDT 29th GST Council Meeting: Key Highlights and Decisions.29th Meeting of GST Council has been conducted at New Delhi (dt. 4 August 2018) at a very short interval, specially to deliberate and discuss upon the issues relating to Simplification and Rationalization of GST Laws from the perspective of MSMEs and Small Taxpayers. . 157 issues were submitted before the Council. While addressing the media after the meeting, the Finance Minister Piyush Goyal said that several issues related to small businessmen and retailers were discussed in the meeting. . . Below are the Key Highlight of 29th GST Council Meeting:

. |

|

GST Council Special Meet approves Cashback for Digital Payments Posted: 05 Aug 2018 02:42 AM PDT GST Council Special Meet approves Cashback for Digital Payments.The 29th GST Council meeting held at New Delhi Today has approved the decision to give incentives on digital payments using BHIM app. The move aims at encouraging digital transactions which the Government promotes. The Council approved 20% cashback for the transaction via BHIM app. . The Special meeting was aimed to discuss the issues of the Micro, Small and Medium Enterprises (MSMEs). 157 issues were submitted before the Council. . While addressing the media after the meeting, the Finance Minister Piyush Goyal said that several issues related to small businessmen and retailers were discussed in the meeting. He said that the GST council has decided to form a sub-committee under the leadership of Shiv Pratap Shukla, Minister of State for Finance. Delhi Minister Manish Sisodia, Finance Minister of Punjab & Finance Minister of Kerala will be a part of this committee. The committee will study the issues and make recommendations to ease the issues of MSMEs. . The Law Committee will take decisions related to law. Fitment Committee will take decisions related to rates, Piyush Goyal said. . The next GST Council meeting is scheduled end of September at Goa. |

WELCOME TO CA GROUPS

CA GROUPS |

|

Govt notifies Due Dates for Filing GSTR-1 from July '18 to March '19 Posted: 11 Aug 2018 05:25 AM PDT Govt notifies Due Dates for Filing GSTR-1 from July '18 to March '19.The Central Board of Indirect Tax and Customs (CBIC) has notified the due dates for filing GSTR-1 for the taxpayers with the aggregate turnover of upto Rs.1.5 crores and with an aggregate turnover of more than Rs. 1.5 crores for the months of July 2018 to March 2019. . As per a notification issued by the Board Today, the due dates for quarterly furnishing of FORM GSTR-1 for those taxpayers with aggregate turnover of up to Rs.1.5 crores for the periods July – September 2018, October – December 2018 and January – March 2019 shall be filed within 31st October, 31st January and 31st March respectively. . The due dates for the furnishing of FORM GSTR-1 for those taxpayers with an aggregate turnover of more than Rs. 1.5 crores for the months from July 2018 to March 2019 is till the eleventh day of the month succeeding such month. . To Download the full text of the Notification CLICK Below . DOWNLOAD NOTIFICATIONDOWNLOAD NOTIFICATION |

|