Itaxsoftware.net

itaxsoftware.net

Itaxsoftware.net |

|

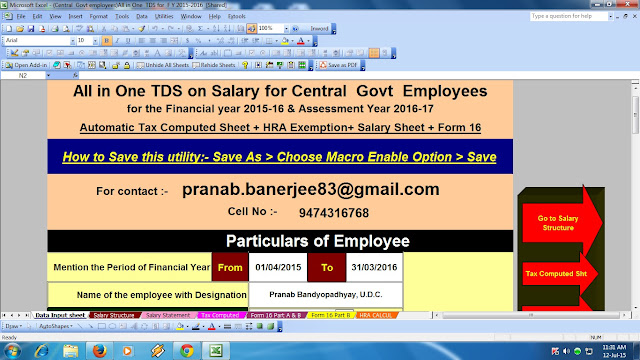

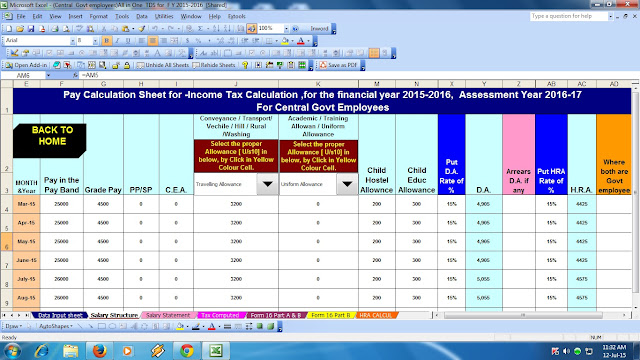

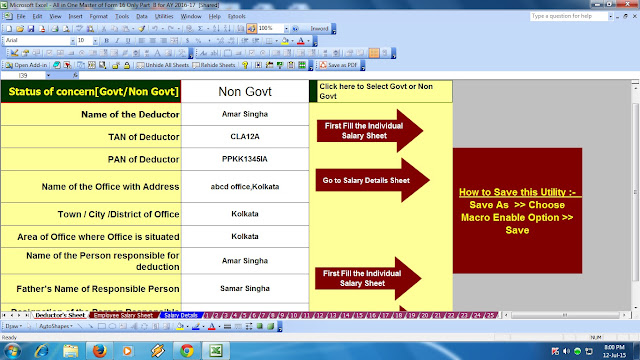

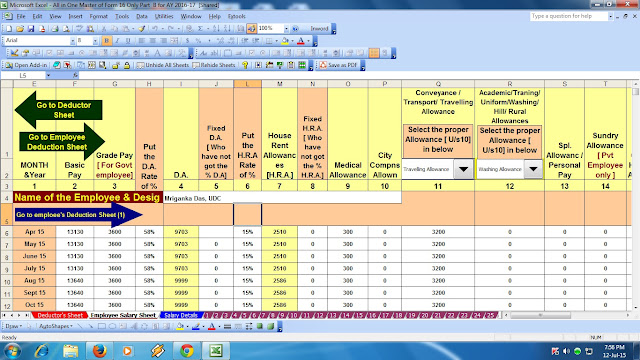

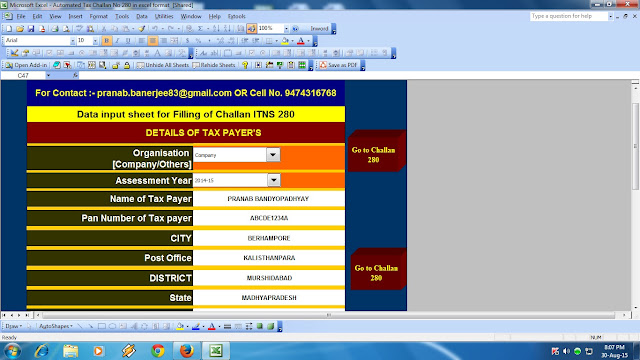

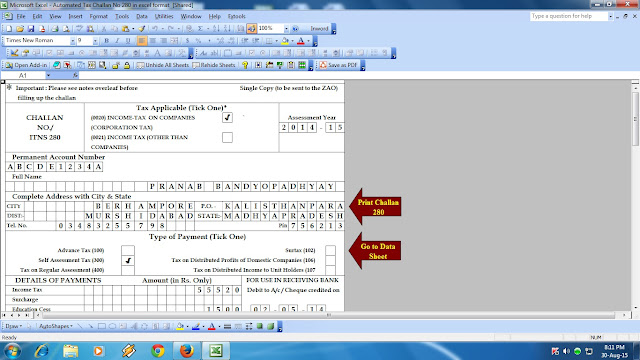

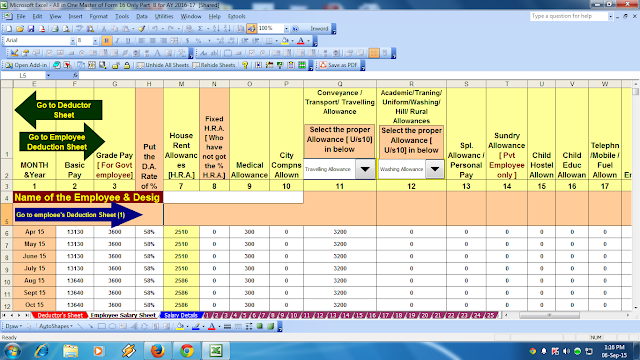

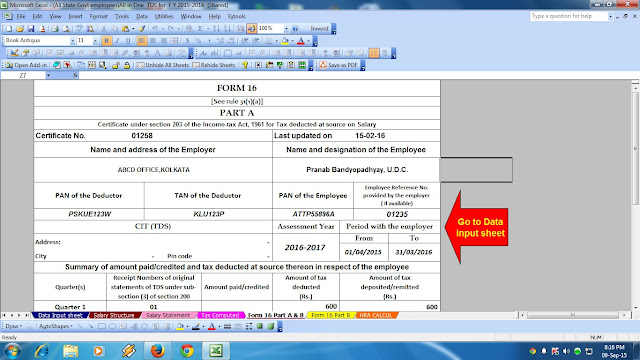

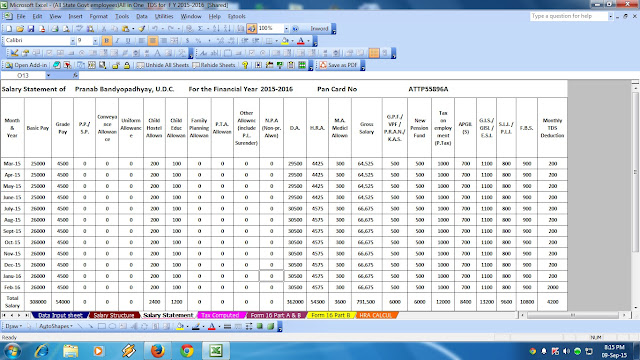

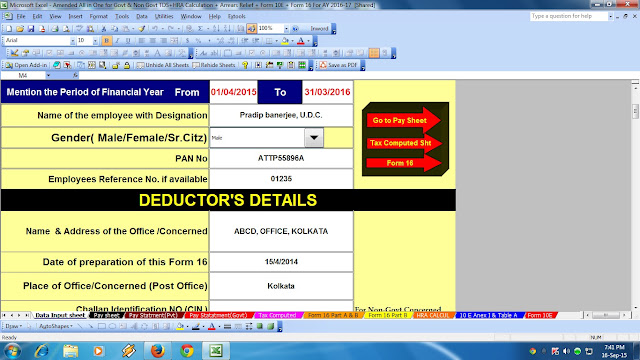

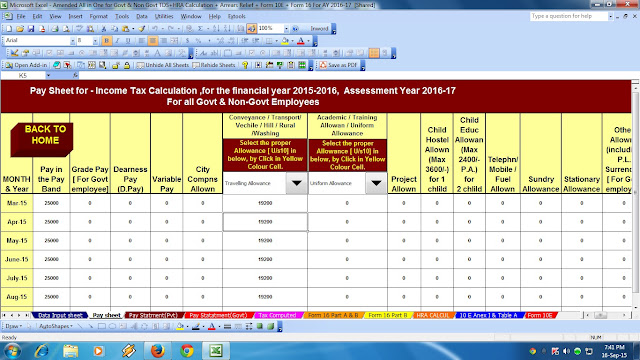

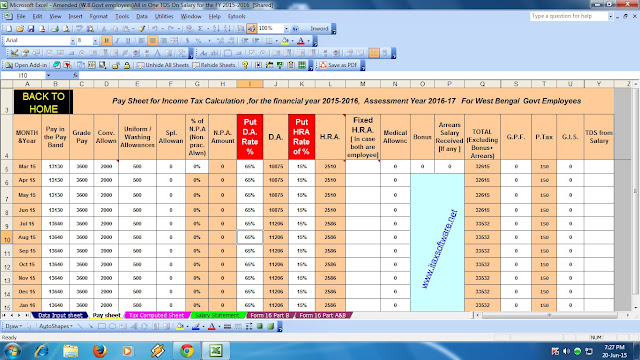

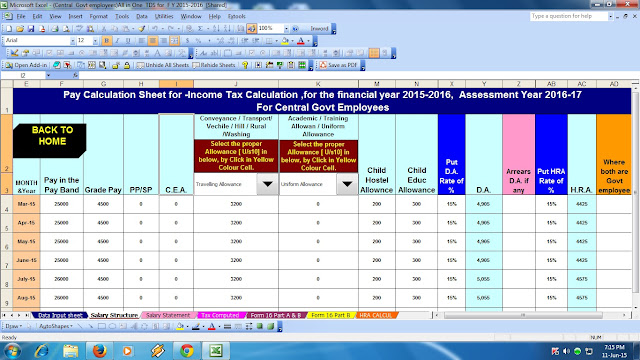

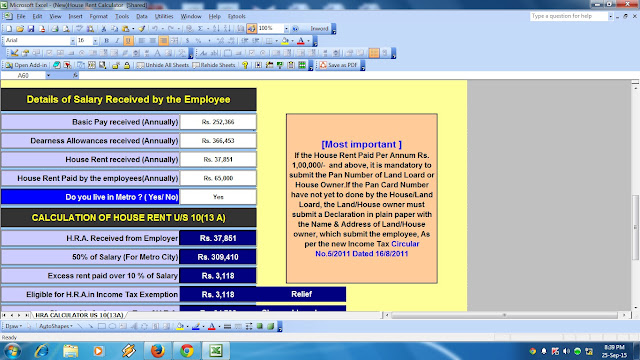

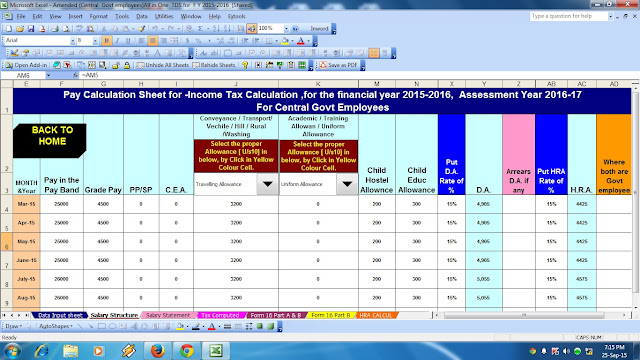

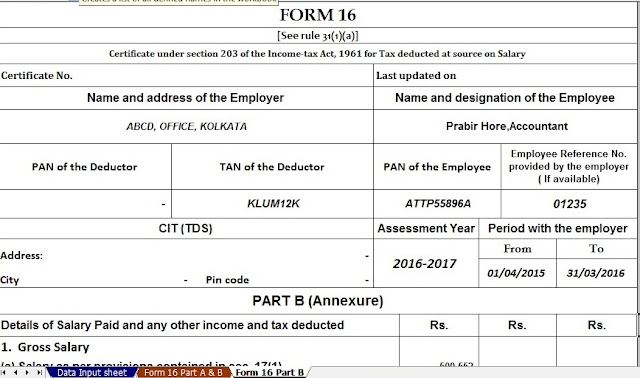

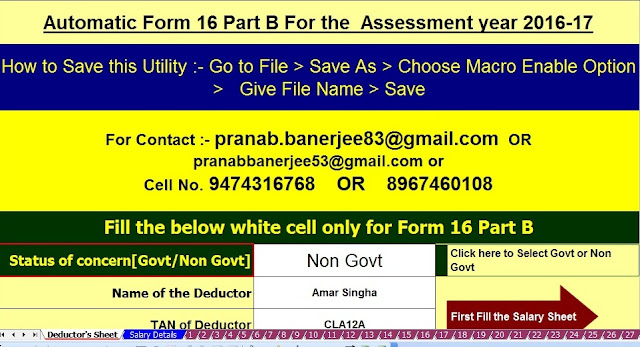

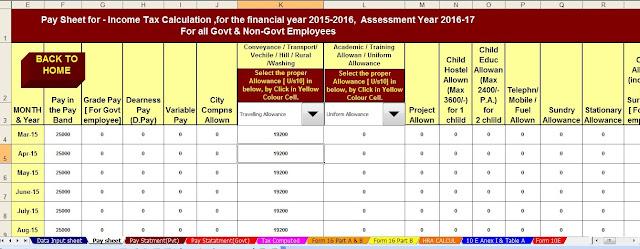

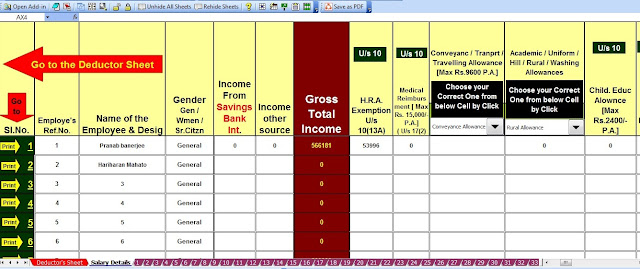

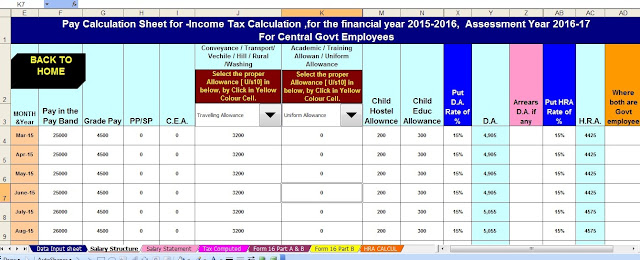

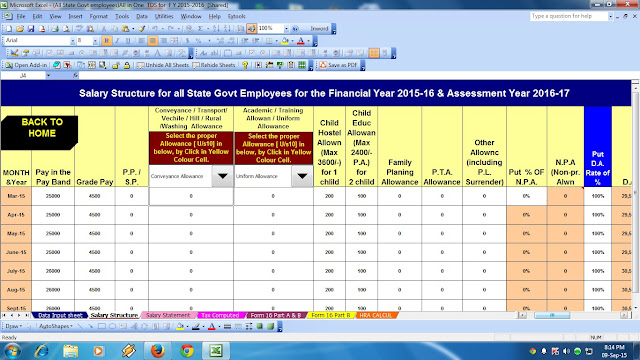

Posted: 14 Jul 2015 06:40 AM PDT Click here to Download the latest Income Tax Preparation Excel Based software which can prepare CENTRAL Govt employee’s For F.Y.2015-16 ( This Excel utility can prepare at a time Tax Computed Sheet + Individual Salary Sheet + Salary Structure for Central Govt Salary Pattern for calculating the Gross Salary Income + Automatic House Rent Exemption Calculation + Automatic Form 16 Part B and Form 16 Part A&B for the Financial Year 2015-16 and Assessment Year 2016-17.)

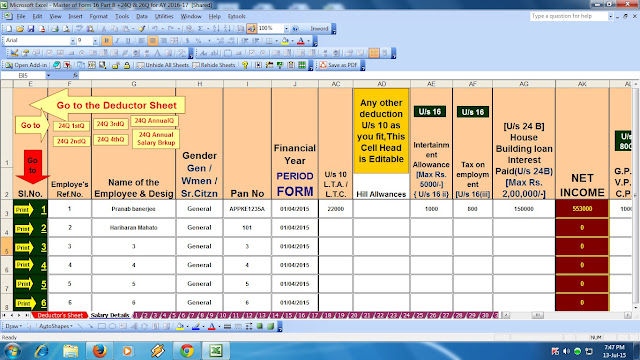

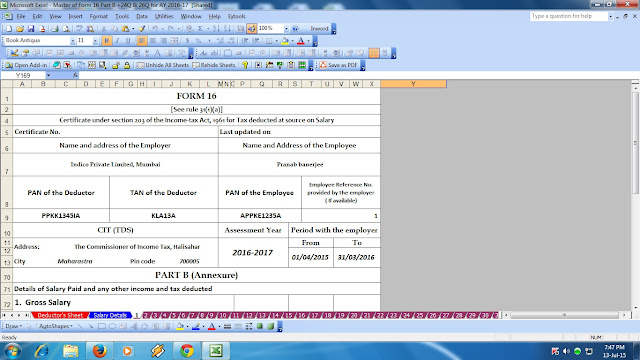

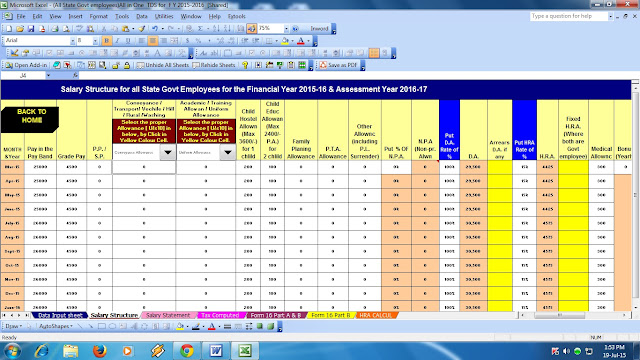

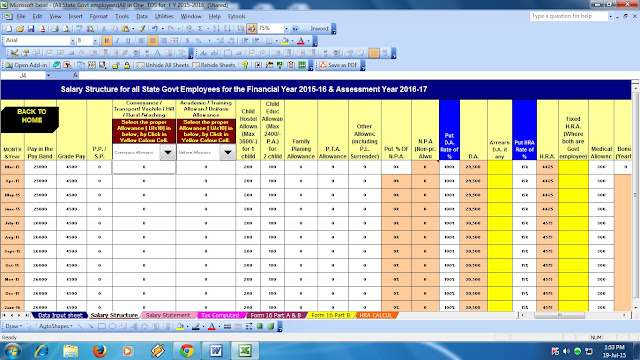

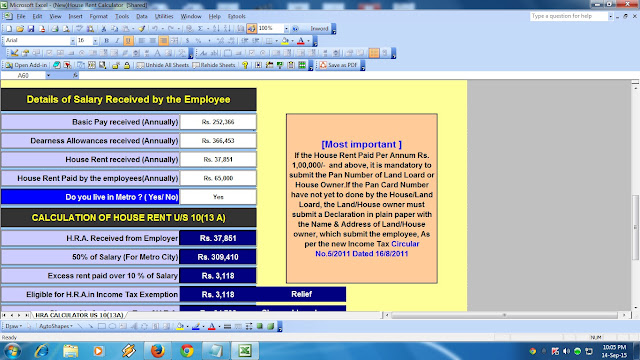

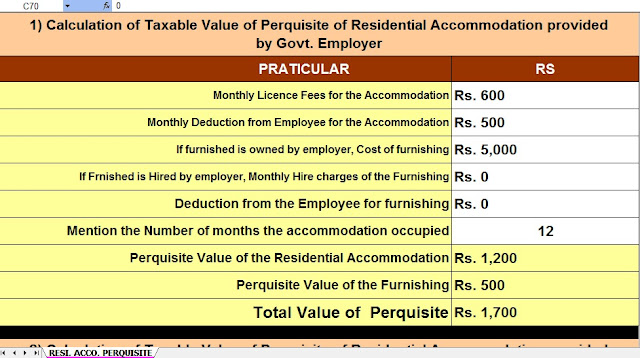

As per the Central Govt Salary Pattern and Central Govt employees Salary and Allowances made this Excel Utility and follow the Central Finance Budget 2015. All the Amended in Income Tax as per the Finance Budget have in this Software for the financial Year 2015-16 and Assessment year 2016-17. It seems that the various Central Govt Office calculate the Income Tax as manually which take time to calculate the Tax Liability.In this Excel Based Software can use Central Govt Employee. The Salary Structure of Central Govt Pattern have built in this utility and which can fit for Central Govt Employees Salary Structure. This Excel Based Software most easy to generate and easy to handle. You can prepare more than 100 employees TDS on Salary by this One software ( One by One). Feature this utility1. In build the Salary Structure for Calculating the Gross Salary with the all Benefits of Central Govt Salary Pattern. 2. All the Income Tax Section have in this Utility and you can view the section at a glance 3. Automatic Calculate your Income Tax Liability 4. Automatic Calculate the House Rent Exemption Calculation U/s 10(13A) 5. Automatic Prepare the Form 16 Part B and Form 16 Part A&B as you like to print 6. Print Facility of all the sheets Click here to Download the latest Income Tax Preparation Excel Based software which can prepare Central Govt employee’s ( This Excel Utility can prepare at a time the Tax Computed Sheet + Individual Salary Sheet + Salary Structure for any State Govt concerned Salary Pattern for calculating the Gross Salary Income + Automatic House Rent Exemption Calculation + Automatic Form 16 Part B and Form 16 Part A&B for the Financial Year 2015-16 and Assessment Year 2016-17.)This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from itaxsoftware.net

To stop receiving these emails, you may unsubscribe now. |

Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

itaxsoftware.net

Itaxsoftware.net |

|

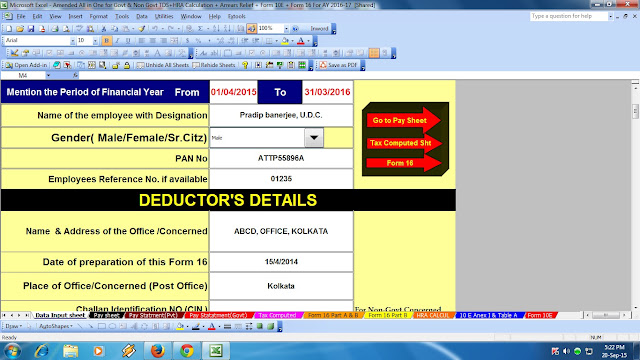

Posted: 15 Jul 2015 07:36 AM PDT Substitution of new section for section 80EQ. Who is eligible for deduction u/s 80E? A. Loan should be taken by individual for pursuing higher education of self, spouse or his /her Children’s. Hence parents are also eligible to claim deduction of interest paid by them on loan taken for their children’s education. This deduction is not available to HUF. Click to download the Automatic All in One for Govt and Non-Govt employees for FY 2015-16 [This Excel Utility can prepare at a time Tax Computed Sheet+Individual Salary Structure+Automatic Arrears Relief Calculation+Automatic House Rent Exemption Calculation + Form 16 Part A&B and Part B with the all Income Tax Section including New Income Tax Section and Automatic Tax Rebate U/s 87A ]Q. What is eligible amount? A. Only interest paid on an educational loan is allowed as deduction u/s. 80E of The Income Tax Act, 1961, out of his/her income chargeable to tax i.e. Deduction will be allowed only when actual interest is paid. Q. How much amount is deductible? A. There is no limit for amount of repayment of interest. Unlimited amount of interest can be deducted under this section. However there is no benefit available on the repayment of principal amount of the loan. The assesse can claim the amount of interest in the initial assessment year & carry forward up to 7 assessment years. Deduction is allowed for a continuous period of eight years, starting with initial assessment year in which the assessee starts paying the interest on the loan or until the interest is paid in full whichever is earlier. Q. Can loan be taken for any education? A. The loan should be taken for the purpose of higher education. Q. Can higher studies be pursued outside India? A. There is no condition that the course should be in India. Q. Can loan be taken from relatives? A. The loan should be taken from any financial institution or any approved charitable institution. Interest on Loan taken from relatives or friends will not be eligible for deduction under section 80E. Download All in One TDS on Salary for Only Non-Govt employees for F.Y.2015-16 [ This Excel Based Software can prepare your Tax Compute Sheet + Individual Salary Structure as per Non-Govt Concerned Salary pattern + Automatic HRA Calculator U/s 10(13A) + Form 16 Part A&B and Part B for A.Y.2016-17]Below given the actually says by the Income Tax Department about the U/S 80E25. For section 80E of the Income-tax Act, the following section shall be substituted with effect from the 1st day of April, 2006, namely:— ‘80E. Deduction in respect of interest on loan taken for higher education.— (1) In computing the total income of an assessee, being an individual, there shall be deducted, in accordance with and subject to the provisions of this section, any amount paid by him in the previous year, out of his income chargeable to tax, by way of interest on loan taken by him from any financial institution or any approved charitable institution for the purpose of pursuing his higher education. (2) The deduction specified in sub-section (1) shall be allowed in computing the total income in respect of the initial assessment year and seven assessment years immediately succeeding the initial assessment year or until the interest referred to in sub-section (1) is paid by the assessee in full, whichever is earlier. (3) For the purposes of this section,— (a) “approved charitable institution” means an institution specified in, or, as the case may be, an institution established for charitable purposes and notified by the Central Government under clause (23C) of section 10 or an institution referred to in clause (a) of sub-section (2) of section 80G; (b) “financial institution” means a banking company to which the Banking Regulation Act, 1949 (10 of 1949) applies (including any bank or banking institution referred to in section 51 of that Act); or any other financial institution which the Central Government may, by notification in the Official Gazette, specify in this behalf; (c) “higher education” means full-time studies for any graduate or post-graduate course in engineering, medicine, management or for post-graduate course in applied sciences or pure sciences including mathe-matics and statistics; (d) “initial assessment year” means the assessment year relevant to the previous year, in which the assessee starts paying the interest on the loan.’. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 16 Jul 2015 09:14 AM PDT As per the Finance Budget 2015 have some changes in the Tax Section and hike the limit of some Section other than the Tax Slab is the same as previous Financial Year 2014-15. Main Changes in this Budget and main effect to the Salaried Person for Financial Year 2015-16 as given below

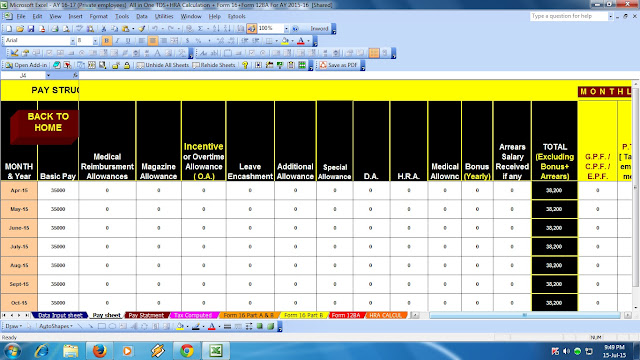

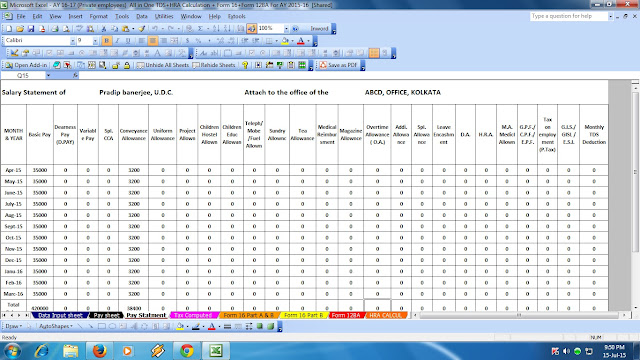

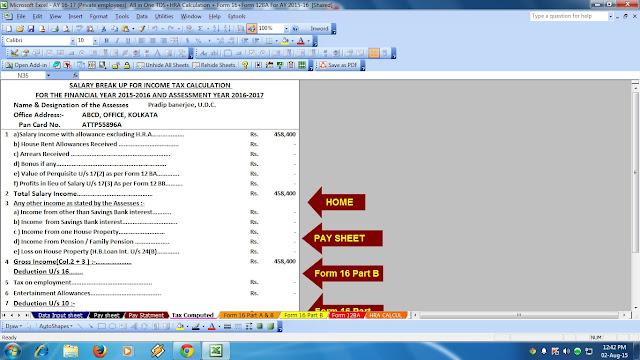

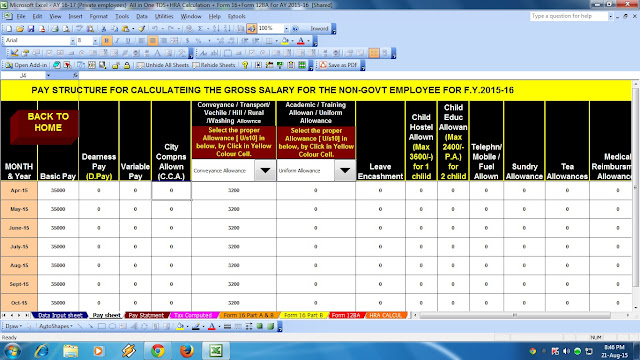

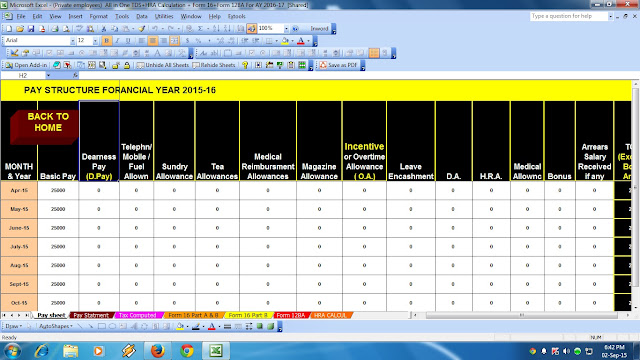

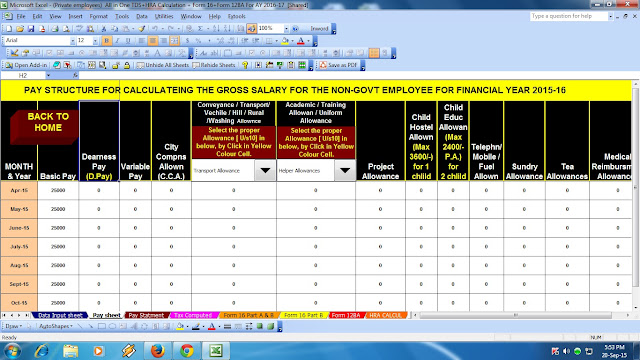

As per the Finance Budget 2015-16 have prepared the Excel Based All in One Income Tax Preparation Software for Only Private ( Non-Govt ) employees for Financial Year 2015-16. All in One Income Tax Preparation Excel Based Software for only the Non Govt employees for the Financial Year 2015-16 and Assessment Year 2016-17. This Excel Based Software can prepare at a time your Income Tax Compute Sheet + Automatic House Rent Exemption Calculation + Automated Form 16 Part B and Automated Form 16 Part A&B + Form 12 BA for the Financial Year 2015-16. This Excel Based Software can use only for the (Private Employees) Non Govt employees. The Salary Structure has prepared as per the Salary Pattern of any Non Govt Concerned which can fit for any Private Concerned Salary PatternFeature of this Excel Based Software :-

|

|

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

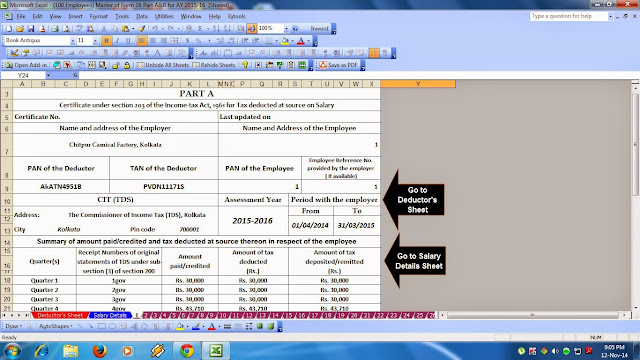

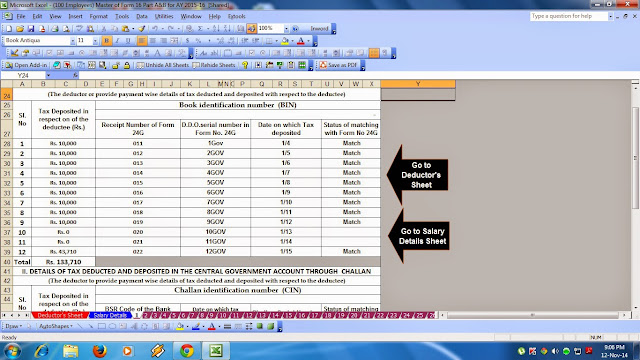

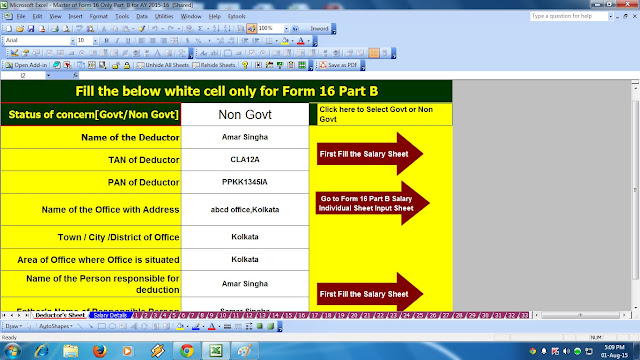

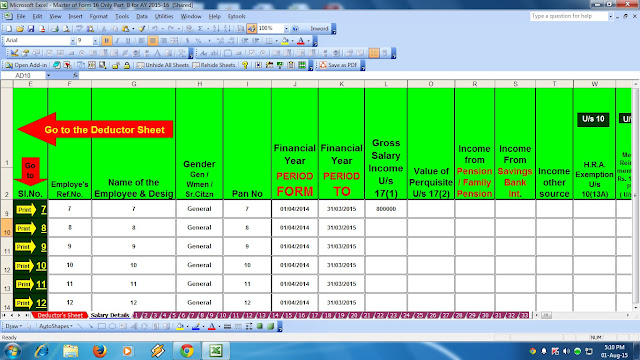

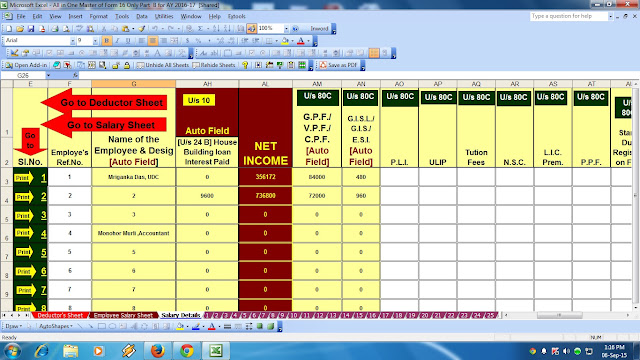

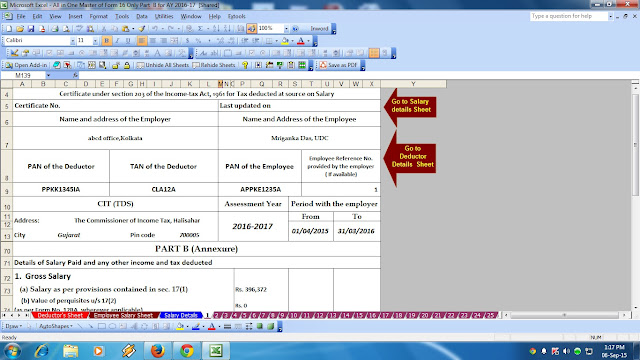

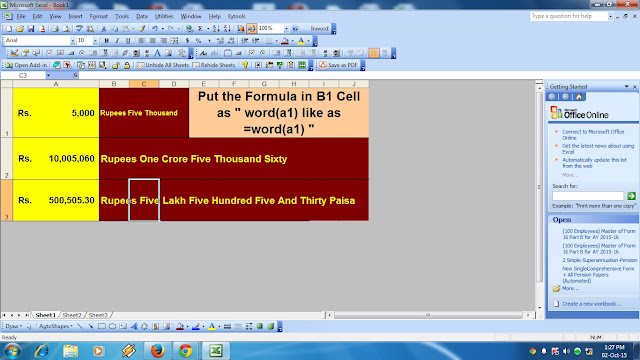

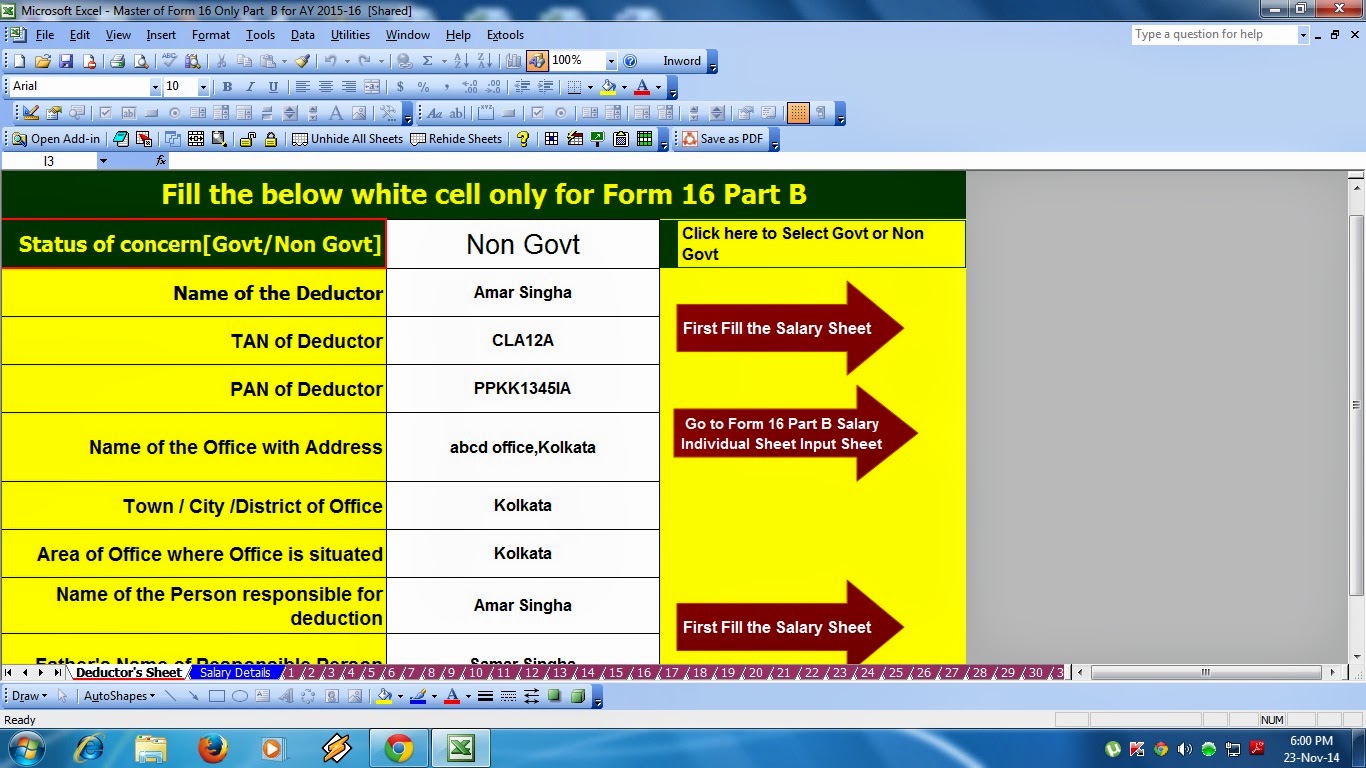

Posted: 17 Jul 2015 07:41 AM PDT Click here to Download the Master of Form 16 Part B with 24Q & 26Q for the Financial Year 2015-16 & Assessment Year 2016-17 ( This Excel Based Software can prepare at a time 50 employees Form 16 Part B with 24Q & 26Q[All Quarters] )As per the Income Tax Rules it is mandatory to submit the each quarter ended Income Tax Return to the Central Govt by the Govt and Non-Govt Concerned of their employees with the Challan 24 Q for Govt and 26Q for Non-Govt Concerned. In the One Financial Year have 4 (four) quarter 1st,2nd,3rd and 4th and final quarter.The CBDT has modified the Challan of 24Q and 26Q and published the new Amended Format of 24Q and 26Q. Most of the concerned have not prepare and submit the Challan in each quarter and it appears that they have submit only the 27A Challan where not found of each employees salary details as well as TDS deduction of each employees. Now it is Mandatory to submit the 24Q or 26Q by the CBDT in each quarter. The Final and 4th Quarter will be Total Income of the hole financial year of an employees with the details of TDS deduction with Annex A. It may help if you have already prepare the both of Form 16 Part B and 24Q or 26Q of each quarter for the Financial Year 2015-16 & Assessment Year 2016-17. If it is possible, then your time will be reduce and it will be advance to prepare the Form 16 Part B which can distribute to the employees after 31st Marc 2016. The itaxsoftware.net have prepared an Excel Based Software which can prepare at a time 50 employees Form 16 Part B with 24Q & 26Q ( for all quarters) for the financial year 2015-16 and Assessment Year 2016-17. Feature of this Utility :- 1) This Excel Based Utility can prepare at a time 50 employees Form 16 Part B 2) Prepare at a time 50 employees All Quarters 24Q & 26Q ( Amended Version) 3) Prevent the double entry of the Name of Employee and Pan Number 4) Automatic Calculate the Income Tax 5) Automatic Prepare the Form 16 Part B ( Amended Version) 6) Automatic Convert the Amount in to the In Words ( Without any Excel Formula) 7) Easy to install in any Computer 8) Easy to Generate as this file is simple Excel File 9) Both of Govt and Non-Govt Concerned can be used this utility 10) The Salary Structure have in built, so it will be easy to calculate Tax Liability Click here to Download the Master of Form 16 Part B with 24Q & 26Q for the Financial Year 2015-16 & Assessment Year 2016-17 ( This Excel Based Software can prepare at a time 50 employees Form 16 Part B with 24Q & 26Q[All Quarters] ) |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

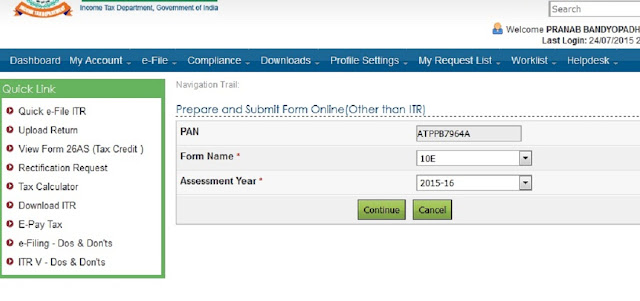

Posted: 18 Jul 2015 09:54 AM PDT Government is trying hard to go green but the necessity of sending signed ITR-V form to Bangalore was becoming an obstacle to make e-filing process completely paperless. Digital Signature has already been mandated for the companies to file and verify their returns but individuals were given an option to sign the physical copy of ITR-V and send it to CPC, Bangalore. Government has come out with the Electronic Verification Code for verifying the income tax return to get rid of this last piece of paper and make the e-filing process completely paperless. Now, you just have to put an EVC after filing your return and you are done with e-filing, no need to send signed ITR-V to CPC, Bangalorewithin 120 days’ time frame. What is Electronic Verification Code (EVC)?Electronic Verification Code (EVC) is a 10 digits alpha numeric code to verify your income tax return and can be generated via various methods. Let’s see the features and usage of Electronic Verification code to e-verify your income tax return. § EVC is a 10 digit alpha numeric code which would verify the identity of the person filing the income tax return. § The EVC could be used to verify ITR 1 (Sahaj) / ITR 2 / ITR 2A / ITR 3 / ITR 4 /ITR 4S (Sugam). § EVC would be unique and can be used only with the PAN of the person furnishing the income tax return. This means one EVC for one PAN. § One EVC can be used to validate only one ITR whether it is original or revised return. § The EVC remains valid for 72 hours but can be generated various times through various modes. § In case the tax returns are already filed or uploaded, the verification needs to be done within 120 days of filing of return. How to Generate Electronic Verification Code (EVC)?CBDT has notified four methods to generate Electronic Verification Code (EVC). Before proceeding to generate EVC please ensure that the mobile number and email address registered with the CBDT is accessible by you. 1. Generate EVC through e-filing websiteI consider this as the simplest method because you just need to click few buttons and you will get EVC on your mobile and registered email. But this method is only available if your salary income is up to Rs.5 lacs and you are not claiming any tax refunds. § Simply login to your account with PAN number as user id and your password. § Click on the e-file tab and select Generate EVC as shown in the image below: § You would then receive EVC on your registered mobile number as well on your registered email address.

2. Generate EVC through Linking Aadhaar Card with PANBefore generating EVC through Aadhaar Card, make sure that your mobile number should be registered with your aadhaar. (I faced this problem generating EVC). How to link your aadhaar with PAN?After login, you would see “Profile Settings” Tab besides downloads. Click on it and a drop-down menu would appear, select Link Aadhaar with PAN. You would then be presented with the image as shown below:  Fill in the required details and click on Link Now to complete the process. Next Step would be to generate EVC and for that you have to select “I would like to generate Aadhaar OTP to e-Verify my return” at the time of e-verifying your tax return. 3. Generate EVC through Bank ATM (Automatic Teller Machine)For this option you have to use the ATM card of the bank which is registered with the IT department. You can generate EVC by selecting “generate EVC for ITR filing” appears on the ATM Screen. The EVC would be sent to your registered mobile number with Bank. 4. Generate EVC through Net Banking FacilityGenerating EVC using Net Banking requires you to route your process of e-filing through the bank which is registered with IT Department. You would have to login into your net banking account and seek the redirection to income tax e-filing website where you can generate EVC. The EVC would be sent to your registered mobile number with Bank. This option requires a valid PAN to be linked with your Bank account as per KYC norms and ITR should be for same PAN number. How to use Electronic Verification Code (EVC) to verify Income Tax Return?Electronic Verification Code (EVC) for e-verification process of Income Tax Return can be used while:

1. In case you are Uploading Tax Return without using Net Banking than as soon as you are finished with uploading of return, a screen having following options would popup:

You can use any one of the above options (1 to 3) to e-verify your Income Tax Return and download the Acknowledgement (No Further action required). Option 1 requires you to put the EVC you have already generated and then download the Acknowledgement (No Further action required). Option 2 requires you to generate EVC either through AMT or E-filing website. Option 3 would use generating EVC through Aadhaar Card (As described above). Option 4 would means you don’t want to use the new method of EVC and would like to go with the old method of ITR-V signing and sending it to CPC Bangalore. 2. In case you have routed to e-filing website through net banking account then after you finish uploading tax return three options would be shown on your screen:

You can use any one of the above options (1 and 2) to e-verify your Income Tax Return and download the Acknowledgement (No Further action required). Option 1 would simply need you to confirm the verification of ITR by clicking on “Continue” button. Download the Acknowledgement (No further action is required). Option 2 remains same as in above case and ECV would be sent to your registered mobile number. Option 3 would be old method of ITR-V signing. 3. Verification of Already Uploaded Returns requires you to verify them within 120 days of submission or uploading by following below mentioned steps:

Remember: E-Verification of Income Tax Return through Electronic Verification Code (EVC) is available from the current assessment year i.e. 2015-16 (F.Y. 2014-15). If you are filing belated return of the last previous year u/s 139(4) or filing revised returns for past years u/s 139(5) than you would have to follow the old method of ITR-V signing and sending it to CPC, Bangalore within 120 days of filing of return. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 19 Jul 2015 08:56 AM PDT Click & Download Automated Master of Form 16 Part B for FY 2014-15 ( This Excel Utility can prepare at a time 100 employees Form 16 Part B for Financial Year 2014-15As per the CBDT Notification the Format of Form 16 have already changed and this Form 16 have divided in two part, One is Part A and Part B. The Part A is now mandatory to download from the TRACES Portal and the Part B is mandatory to prepare by the employer.Now the time of each and every Govt or Non Govt Concerned busy to prepare and supply the Income Tax Salary Certificate Form 16 for the Financial Year 2014-15 and Assessment Year 2015-16. The Excel Based Software for preparing the Form 16 is available in various Web Site. But this Excel based Software unique to other Software. New Tax Slab and Some Changes in Income Tax in Financial Year 2014-15 As per the new Finance Budget the Income Tax Slab has raised from 2 Lakh to 2.5 Lakh and the Tax Section 80C has also raised from 1 Lakh to 1.5 Lakh, it is the great news to the all salaried persons for the Financial Year 2014-15. The Income Tax Section 87A Tax Rebate Rs. 2,000/- will be continue in this Financial Year 2014-15.

|

|

Here is given below Two Type of Form 16 Preparation Excel Based Software, 1) One by One Preparation Form 16 Part A&B and Part B (2) Master of Form 16 Part B ( This utility can prepare at a time 50 employees Form 16 Part B) Download the utility from below link:-1) Click to download One by One Preparation Form 16 Part A&B and Part B for FY 2014-152) Click to download Master of Form 16 Part B for FY 2014-15 ( This utility can prepare at a time 50 employees Form 16) |

This posting includes an audio/video/photo media file: Download Now |

|

Joint Home Loan can entitled : Eligibility rules & Income Tax Benefits U/s 80C and U/s 24B Posted: 19 Jul 2015 04:53 AM PDT A joint home loan not only allows you to share your debt burden but also allows you to extract maximum benefits offered by the IT Act. As per the existing Income Tax Laws, both the individuals (loan applicants) can claim income tax deductions on the principal repayment under section 80c and on the interest amount under Section 24. The maximum amount that can be claimed as tax deduction depends on the use of the property ie whether it is a ‘Self occupied property’ or a ‘Let-out property’. What is a Joint Home Loan? – A joint home loan is a loan which is taken by more than one person. Who is a co-borrower? – A Co-borrower is a person with whom you take the home loan jointly. Who is a co-owner? – A Co-Owner is an individual that shares ownership in an asset with another individual / group. Joint Home Loan & Eligibility rules / ConditionsIf the loan applicants are married couples then it is a perfect arrangement for home loan providers. The couple is at liberty to decide if they want to be co-owners or if only one of them wants to be a co-borrower. If the loan applicants are Father & son or Father & unmarried daughter then Lenders generally insists on the son / daughter being the Primary Owner of the property. (This can be applicable when Mother & unmarried daughter are the borrowers)

|

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

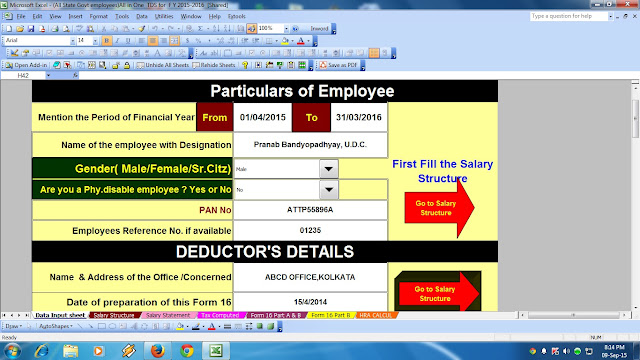

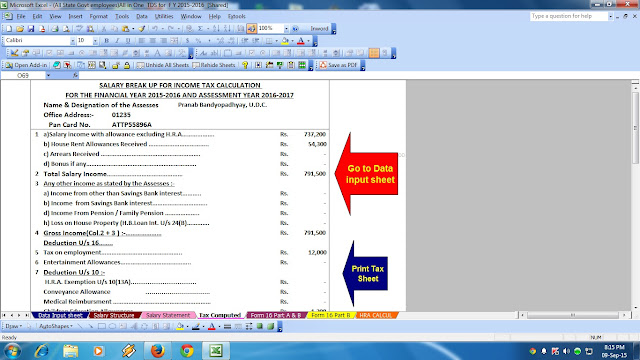

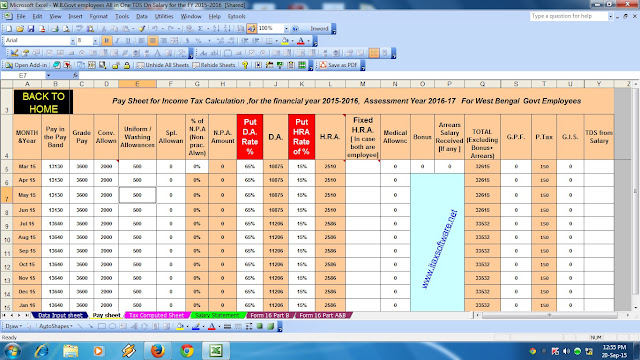

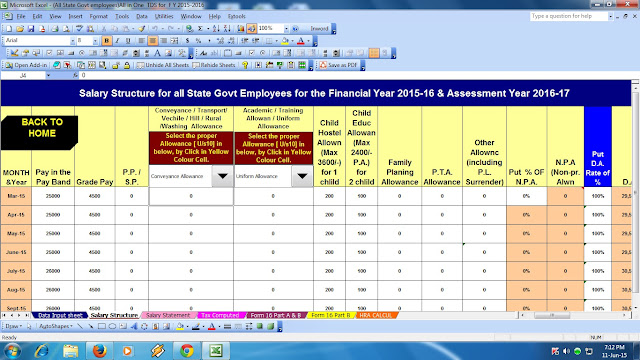

Posted: 20 Jul 2015 06:10 PM PDT Download the Excel Based Income Tax Software All in One for All State Govt employees for the Financial Year 2015-16 and Assessment Year 2016-17 with all new feature of Finance Budget 2015-16 [ This Excel Utility can prepare at a time the Tax Compute Sheet + As per Salary Structure of State Govt Employees the Salary Structure + Automatic House Rent Exemption Calculation + Form 16 Part A&B and Form 16 Part B for FY 2015-16]

Apart from increase in Income Tax exemption limit under Section 80 D for Health Insurance Premium and enhanced exemption limit for Transport Allowance, Salaried Employees coming under NPS will get additional Income Tax Exemption in the Financial Year 2015-16, if they contribute in excess of Rs. 1,00,000 in NPS. Section 80 CCD (1) : Provision meant for deduction of own contribution in NPS from total income. Limit provided under this Section has been increased from Rs.1,00,000/- to Rs. 1,50,000/- Finance Bill 2015-16 provides that a tax payer can avail Income Tax Exemption under Section 80 CCD(1) by way of deduction of contribution made by him/her in National Pension System (NPS) up to Rs. 1,50,000. This new change in Section 80CCD (1) by introducing an additional sub section in the form of sub section 1B to Section 80CCD and by deleting existing sub section 1A, provides for additional exemption / deduction from total income to extent of Rs. 50,000 over and above limit of Rs. 1.50 lakh imposed by Section 80CCE (for the purpose of allowing deduction under Section 80C, 80CCD(1) and Section 80CCC) But Who will really be benefited by this additional Deduction / Exemption under Section 80CCD (1B)?Individuals who are self employed and allowed to contribute 10% of their gross total income in NPS and tax payers who contribute up to Rs.1,50,000 in Tier 1 account in a year towards NPS by virtue of their higher salary will be benefited by this additional limit. In other words, those who earn less than Rs.15 lakh in a year and contribute in 10% of their salary in NPS Tier 1 account will be benefited under Section 80 CCD (1) only up to the value of the yearly contribution made by them in NPS and it would be less than Rs. 1.5 lakh Note on amendment / Omission relating to Section 80CCD in Finance Bill 2015Clause 17 of the Bill seeks to amend section 80CCD of the Income-tax Act relating to deduction in respect of contribution to pension scheme of Central Government. The existing provisions contained in sub-section (1) of section 80CCD, inter alia, provides that in the case of an individual, employed by the Central Government on or after 1st January, 2004, or being an individual employed by any other employer or any other assessee being an individual who has in the previous year paid or deposited any amount in his account under a pension scheme notified or as may be notified by the Central Government, a deduction of such amount not exceeding ten per cent. of his salary is allowed. It is proposed to omit sub-section (1A) and insert a new sub-section (1B) so as to provide that an assessee referred to in sub¬section (1), shall, be allowed an additional deduction in computation of his total income, of the whole of the amount paid or deposited in the previous year in his account under a pension scheme notified or as may be notified by the Central Government, which shall not exceed fifty thousand rupees. It is also propose to provide that no deduction under this sub-section shall be allowed in respect of the amount on whcih deduction has been claimed and allowed under sub-section (1). Consequential amendments have been proposed in sub-section (3) and sub-section (4) of section 80CCD. These amendments will take effect from 1st April, 2016 and will, accordingly, apply in relation to the assessment year 2016-17 and subsequent assessment years. Provisions of Finance Bill 2015 that seeks amendment / Omission relating to Section 80CCD17. Amendment of section 80CCD. In section 80CCD of the Income-tax Act, with effect from the 1st day of April, 2016,-— (a) sub-section (1A) shall be omitted; (b) after sub-section (1A), as so omitted the following sub-section shall be inserted, namely:— “(1B) An assesse referred to in sub-section (1), shall be allowed a deduction in computation of histotal income, [in addition to the deduction allowed under sub-section (1)], of the whole of the amount paid or deposited in the previous year in his account under a pension scheme notified or as may be notified by the Central Government, which shall not exceed fifty thousand rupees: Provided that no deduction under this sub-section shall be allowed in respect of the amount on which a deduction has been claimed and allowed under sub-section (1); (c) in sub-section (3),— (I) for the words, brackets and figure, “sub-section (1)”, wherever they occur, the words, brackets, figures and letter “sub-section (1) or sub-section (1B)” shall be substituted; (II) for the words “under that sub-section”, the words “under those sub-sections” shall be substituted; (d) in sub-section (4), for the words, brackets and figure, “sub-section (1)”, the words, brackets, figures and letter “sub-section (1) or sub-section (1B)” shall be substituted. Section 80 CCD (2) : Though there is no change as far as Section 80 CCD(2) this section finds mention here as this is an Income Tax Exemption that a NPS Employee gets for the contribution made by Govt / employer. It provides for Income Tax Exemption with no limit for 10% of Salary consisting of basic pay and Dearness Allowance if any contributed by an employer in NPS Tier 1 Account. The more attractive feature of this deduction provision is that it is not limited by overall exemption limit of Rs. 1.5 lakh under Section 80 CCE of Income Tax Act. In other words, deduction for contribution made by an employer towards NPS Tier 1 account will be allowed in addition to Rs. 1.5 lakh exemption limit under Section 80 CCE. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

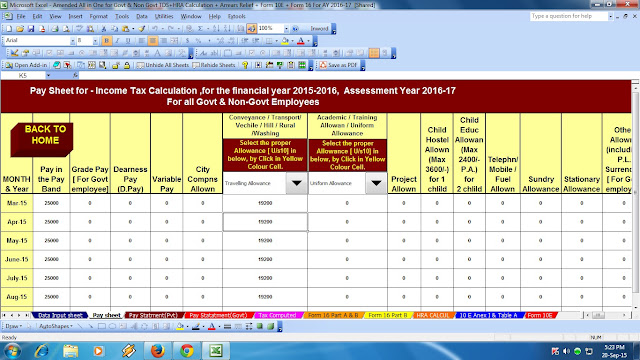

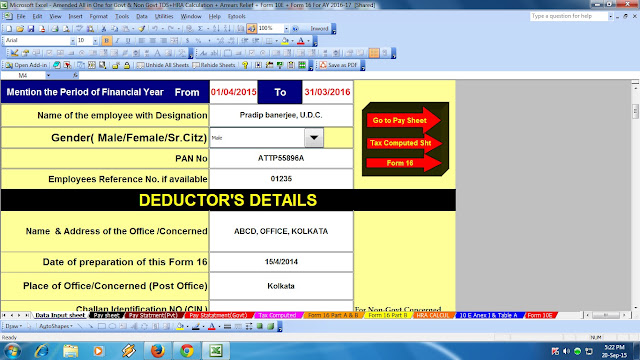

Posted: 21 Jul 2015 07:39 AM PDT Download All in One TDS on Salary for Govt and Non-Govt employees for F.Y.2015-16 and A.Y.2016-17[ This Excel Utility can use both of Govt and Non-Govt Concerned + Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automatic Arrears Relief Calculator with Form 10E + Automatic HRA Exemption Calculation + Form 16 Part A&B and Part B]

While Finance Minister termed Budget 2015-16 as a growth oriented one with due attention to common and poor in India, there were not much changes as far as Income Tax 2015-16 in respect of salaried employees concerned. Personal Income Tax Rates were untouched and as a result Salaried Class will have to pay same Income Tax that they paid last year. However, following changes have been effected with regard to deductions / exemption allowed from total income of Salaried Employees under various Sections Income Tax Act by which quantum of Income Taxpayable this year may get reduced if an employee is eligible for such deduction / exemption. Sukanaya Samriddhi Scheme made eligible for deduction under Section 80C Max Rs. 1.5 LakhIndividuals who are subjected to Personal Income Tax Provisions can now save Sukanaya Samriddhi Scheme, a newly started savings scheme with a view to encourage savings in the name of girl child’s education and marriage, for the purpose of claiming deduction under Section 80C Additional Income Tax Exemption in respect of Health Insurance Premium under Section 80 D:Medical expenditure is getting increased day by day and however awareness towards Health Insurance is very minimal in India. In order to make Health Insurance Schemes more attractive and to cover entire health insurance premium paid by an employee for the purpose of deduction under Section 80 D, limits of Health Insurance Premium for covering individual and a senior citizen for the Income Tax Exemption have been increased to Rs. 25,000 and Rs. 30,000 respectively. Moreover, as far as very senior citizens (aged 80 years or more) are concerned any payment made on account of medical expenditure up to Rs. 30,000 would be eligible for deduction under Section 80D. More Deduction under Section 80DD for very senior citizens (increased from Rs. 50,000 to Rs. 80,000)While an individual is eligible to deduct up Rs. 50,000 which was spent towards medical expenditure under Section 80DD, budget 2015 has brought out an additional provision under this section to allow deduction of Rs. 80,000 for very senior citizens. The condition of producing certificate from a medical doctor under Section 80DDB has been relaxed and it is enough the tax payer produces a prescription from a specialist doctor. Additional Income Tax Exemption for Persons with disability under Section 80U:In view of the rising cost of medical care and special needs of a disabled person, it is proposed to amend section 80DD and section 80U so as to raise the limit of deduction in respect of a person with a disability from Rs. 50,000 to Rs. 75,000. It is also to raise the limit of deduction in respect of a person with severe disability from Rs. 1 lakh to Rs. 1.25 lakhs. Limit under Section 80CCD and Section 80CCC for contribution in NPS and other pension funds raisedAn additional deduction under section 80CCD to the extent of Rs. 50,000 has been introduced for contributions under the National Pension Scheme. Deduction towards Transport Allowance increased Rs. 1600 per monthThe long due increment in the monthly travel allowance has now finally materialized. In order to commensurate with the increased costs of transportation, it is now proposed to be double the original transport allowance and it shall stand at Rs. 1,600 per month. And more than 80% Rs. 3200/- P.M. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 22 Jul 2015 10:00 AM PDT Downloadthe All in One Tax Preparation Excel Based Software for Central Govt employeesfor F.Y.2015-16 and A.Y.2016-17 [ This Excel Utility can prepare at a time your Tax Compute Sheet + Individual Salary Structure + Individual Salary Sheet + Automatic HRA Exemption Calculation + Automatic Form 16 Part A&B and Form 16 Part B including the latest amended by the Finance Budget 2015-16]Insurance Policies Tax BenefitsThe very first step of a successful tax or financial planning start with getting yourself adequately Insured. Let’s see how you can save tax through Insurance Policy in India. Life Insurance Tax BenefitTax benefit on Life Insurance Policy Premium Paid

Insurance Sum Received:In case the policy is surrendered before the maturity than the whole sum received from the Insurer will be taxable, if 5 premiums have not been paid. If you have surrendered the policy after paying 5 premiums than the amount received from the insurer would be tax-free. 2. On Maturity: Insurance Sum received on maturity is completely tax-free u/s 10 of the I-T Act. 3. On the Death of the Policy Holder: Insurance Sum received on the death of the assesse by his family or legal heirs is completely tax-free u/s 10 of the I-T Act. But a death certificate of the policy holder is required to be given to the insurer along with the other documents to claim the insurance amount. Health Insurance Tax Benefit or Mediclaim PolicyTax benefit on Health Medical InsurancePremium Paid:But to claim the deduction, few conditions have to be met:

Insurance Sum Received:Many of the Insurance Companies have started Cashless Health Insurance Schemes, under which you don’t need to pay any amount to the medical institutes. The medical bills are directly paid to the medical institute by TPA/Insurance Company. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 23 Jul 2015 08:53 AM PDT Click here to Download the All in One Master of Form 16 Part B with Individual Salary Structure for FY 2015-16 ( Prepare at a time 50 employees Individual Salary Sheet + Individual Salary Structure + Form 16 Part B for the Financial Year 2015-16)It is most laborious to calculate the individual Income Tax calculate without Salary Structure of an employee, but this Excel Utility in build the Individual Salary Structure for each employee, where you can easily calculate the Gross Salary Income and also automatic feed the calculation in the Form 16 Part B.The Salary Structure has build in the concept of every Govt and Non-Govt Salary Pattern and this Salary Structure may fit for each and every Concerned Salary and Benefits. You can also Print the Individual Salary Sheet for each employee and preserve the same for your office use. The all of new Income Tax Section have in this Excel Utility, no need to search for new Income Tax Section. This Section include as per the new Finance Budget 2014. The Tax Slab and Section 80 C has also include in this Utility as per the new Income Tax Slab. All the calculation have made automatically and all Income Tax Section as per the Income Tax Rules have calculate by this utility. First you should fill the employees Individual Salary Structure, then Fill the employees deduction Under Chapter VIA, after filling this two sheet the Individual Salary Sheet and the Form 16 Part B will be prepare automatically.This Excel Utility can use for both of Govt and Non-Govt Concerned employee. Click here to Download the All in One Master of Form 16 Part B for F.Y.2015-16 ( Prepare at a time your Individual Salary Sheet + Individual Salary Structure + Form 16 Part B for the Financial Year 2015-16) |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Check Your Form 26AS before filing Income tax return for Assessment Year 2015-16 Posted: 24 Jul 2015 09:04 AM PDT  Form 26AS is the important document issued by the IT department to the taxpayers. I have noticed that the majority of taxpayers are not aware of Form 26AS and its importance. In order to spread awareness about Form 26AS I am here with detail information about Form 26AS and its importance. What is Form 26AS?Form 26S is consolidated annual tax statement issued to the income tax payer by the IT department every year. You can download Form 26AS from Income tax filing website. Form 26AS shows how much tax is credited on your account from various sources like salary, pension, interest income etc. Apart from this Form 26AS contains following information. Part A: Details of Tax Deducted at Source (TDS)Part A1: Details of TDS for 15G/15H Part A2: Details of TDS on sale of immovable property Part B: Details of Tax Collected at Source (TCS) Part C: Details of Advance tax, self-assessment tax or regular assessment Part D: Details of paid Refunds Part E: Details of AIR transactions Why it is Important to check form 26AS before filing Income Tax return?You should cross check detail mentioned in form 26AS against TDS certificate. i.e Form 16 or Form 16AS before filing income tax return. This is to ensure that the TDS deducted on behalf of the taxpayer by deductor is actually deposited with the income tax department. E.g If you are a salaried person and your employer has deducted Rs 50,000 and you have also paid the advance tax of Rs 10,000, form 26AS should reflect these details. If your 26AS is not showing this detail and you are filing a income tax return without checking 26AS it will be misleading information in Income tax return and you may receive demand notice. How 26AS form is useful to you?

What is the reason of mismatch in Form 26AS? Sometimes Form 26AS contain information that is not matching with TDS certificate. The reason of mismatch in form 26AS is given below. Non Filing of TDS Return – Dedcutor has not filed TDS return which will result in non mapping of TDS deducted with form 26AS. Wrong Information in TDS Return– Deductor have punched wrong information in TDS written like PAN number, Amount of TDS deducted, Amount of TDS deposited or Assessment Year. Omission of Information in TDS Return – Mismatch Due to clerical mistake done by theWhat is to be done in case of mismatch in TDS and Form 26AS? In case you find a mismatch in TDS and form 26AS, you don’t have any option but to chase deductor of TDS (employer or bank) to correct the mistake. If the return is not filed you need to ask them to file TDS return. If the return is already filed you need to ask them to locate and correct the mistake. How to view/download Tax Credit Statement Form 26AS? You can view/download this form in 2 different ways. On Income tax site -

On Bank site using Net banking – You can use Net banking facility of the bank to view your Form 26 AS. This facility is available if PAN number is mapped with the respective account. This facility is available for free. Only authorized banks like SBI, ICICI, Axis Bank, Bank of Baroda, UCO Bank etc. are providing this facility. Conclusion – Check your form 26 AS before filing your income tax return. I have seen that many taxpayers are receiving demand notice asking them to pay tax although they have already paid taxes. So please verify your form 26AS against your TDS statement. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

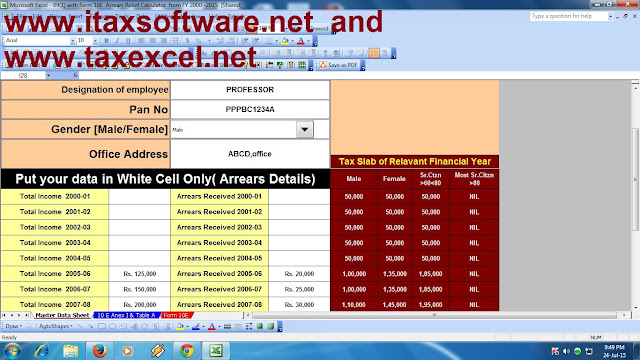

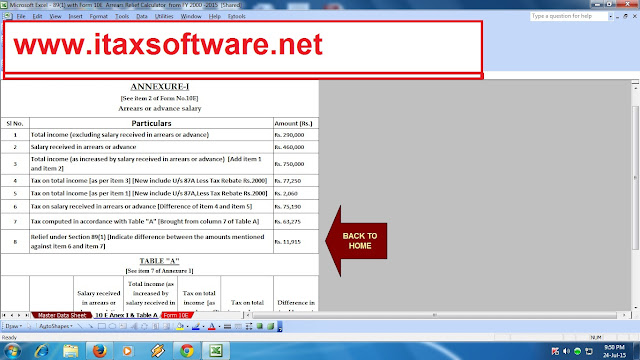

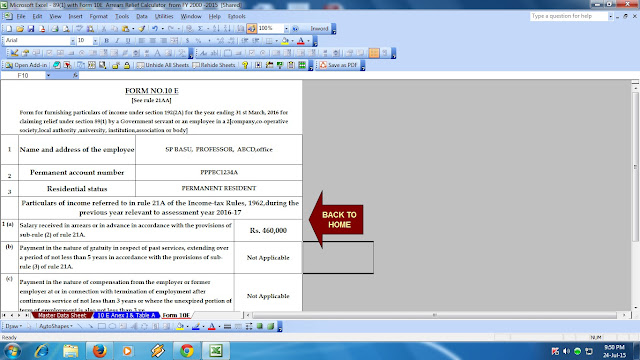

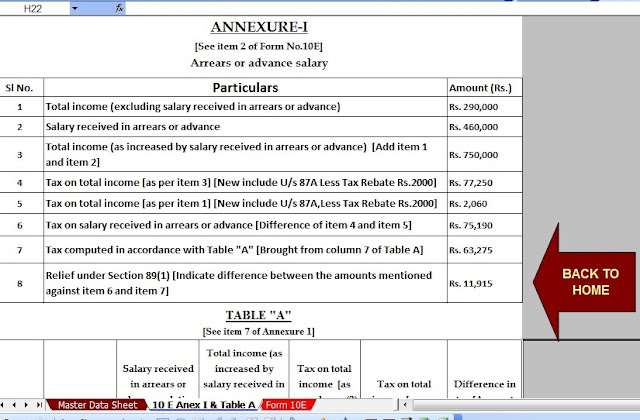

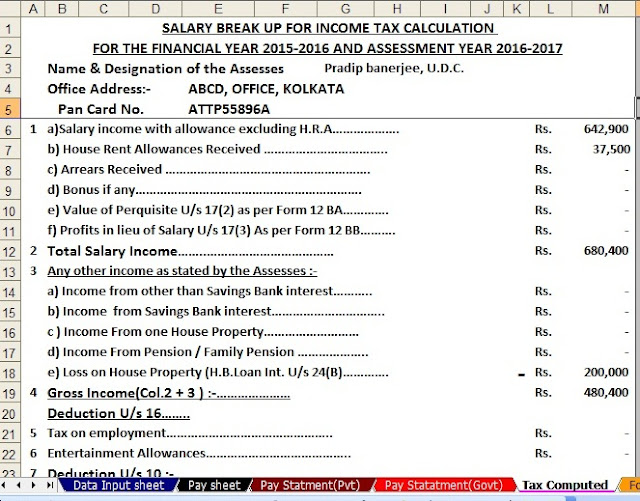

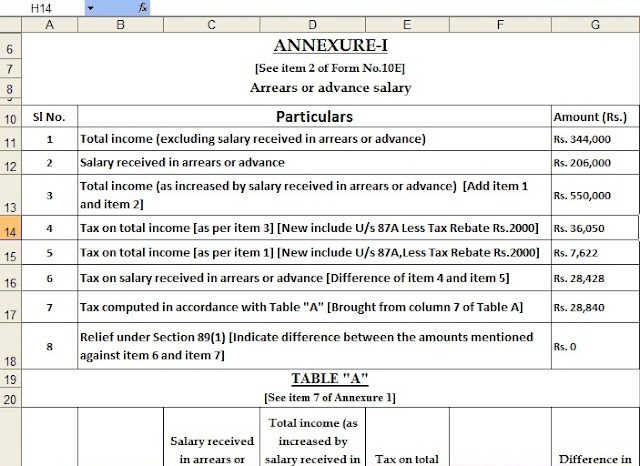

Posted: 26 Jul 2015 09:31 AM PDT WHAT IS THE ACTUAL CALCULATION OF ARREARS RELIEF U/S 89(1) AND WHAT'S THE PROCEDURE TO CALCULATE THE ARREARS RELIEF WHICH IS GET THE AMOUNT OF AN EMPLOYEE BEHIND HIS PREVIOUS YEARS.HERE IS GIVEN BELOW THE AUTOMATIC ARREARS RELIEF CALCULATOR SINCE THE FINANCIAL YEAR 2000-01 TO FY 2015-16 WITH FORM 10E.BELOW GIVEN THE METHOD OF CALCULATION U/S 89(1)AS PER THE INCOME TAX RULES. SECTION 89 l RELIEF WHEN SALARY ETC., IS PAID IN ARREARS OR IN ADVANCE Scope of relief under the section in five situations explained1. Section 89(1) authorises grant of relief in a case where an employee receives salary in arrears or in advance or has received in any financial year salary for more than twelve months, a payment which under the provisions of section 17(3)(ii) is a profit in lieu of salary. The effect of such increase is that the income will be assessed at a higher rate than it otherwise would have been assessed and it is for this reason that section 89(1) authorises relief to be allowed. The relief is to be allowed in terms of rule 21A of the Income-tax Rules, 1962. 2. Rule 21A(1) enumerates the following five different situations wherein the assessees will be entitled to relief (four of these are specific situations while the fifth is a residuary one) : a. salary being received in arrears or advance; b. where the payment is in the nature of gratuity in respect of past services extending over a period of not less than five years is received; c. where the payment is in the nature of compensation received by the employee from his employer or former employer at or in connection with termination of his employment after continuous service of not less than three years and where the unexpired portion of the term of employment is also not less than three years; d. where the payment is in the nature of commutation of pension; e. where the payment is not covered by the description given in (a) to (d) above. The relief is to be worked out in the first four situations in accordance with the specific modes described in rule 21A (2)(a) to (d). 3. The authority to grant relief in the four specific cases is the Income-tax Officer assessing the employee. In the residua case, it is Central Board of Direct Taxes. 4. The relief under section 89(1) is to be given in the assessment in which the extra payment by way of arrears, advance, etc., is taxed. The mode of granting relief spelt out in rule 21A(2) to 21A(5) would show that in all the four different cases the exercise of giving relief is initiated by bringing to tax the whole of the extra amount in the assessment for the assessment year relevant to the year of receipt. Basically, the relief under section 89(1) is arithmetical. It involves finding out of two rates of tax. The first is the rate of tax applicable to the total income including the extra amount in the year of receipt. The second is finding out the rate by adding the arrears to the total income of the years to which they relate. For this purpose the assessee should be asked for a true and authentic statement of the total income of the earlier years to which the arrears pertain There is no warrant for issuing a notice under section 148 or calling for returns of income of the earlier years. Click here to Download Automated Arrears Relief Calculator with Form 10E from the Financial Year 2000-01 to Financial Year 2015-16 |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

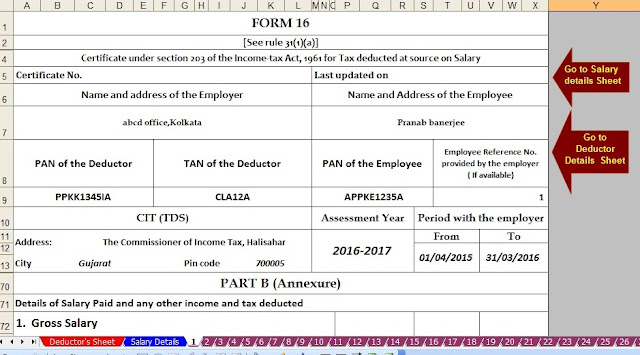

Posted: 27 Jul 2015 09:25 AM PDT In this fast moving world, young individuals switch job more often with an aim to get better opportunity and better increment. Form 16, is very vital for the salaried employee while filing tax returns. However, a situation may arise when they have to file returns and are left with multiple Form 16. Here are 10 things you must know on Form 16. Download the Automated Master of Form 16 Part B for FY 2014-15 [ This Excel Based Utility Can Prepare at a time 50 employees Form 16 Part B]Download the Automated Master of Form 16 Part A&B for FY 2014-15 [ This Excel Based Utility can prepare at a time 50 employees Form 16 Part A&B]1) Form 16 is issued by the employer to employee. This certificate provides all details of salary earned and tax deducted at source by the employer. 2) If a person has changed job, he needs to collect the Form 16 from both the employer at the year end, with the help of both forms only he would able to file his returns. 3) An individual can have multiple Form 16 in cases such as change in job or working with multiple employers simultaneously. 4) If your salary drawn is below the basic exemption limit, you may not be issued with this certificate by your employer as no TDS is deducted. 5) If your employer has not provided with Form 16, you can check the salary slip as it will mention the same. 6) Form 16 includes key information required such as gross salary, perquisites, various allowances and deductibles. 7) If you have changed the job in the same financial year, authorities require you to sum up the total income from both the employers and file income tax return. 8) If the previous employer has not issued form 16 on account of some reason such as no tax deduction at its end, employee can file the return taking into consideration the pay-slips plus the form 16 issued by the new employer. 9) If you do not wish to furnish form 16 issued by your previous employer to the new employer, you can file tax return taking cues from the two form 16 issued by the previous and new employer. 10) Form 16 will must mention the PAN Number of the employer. |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

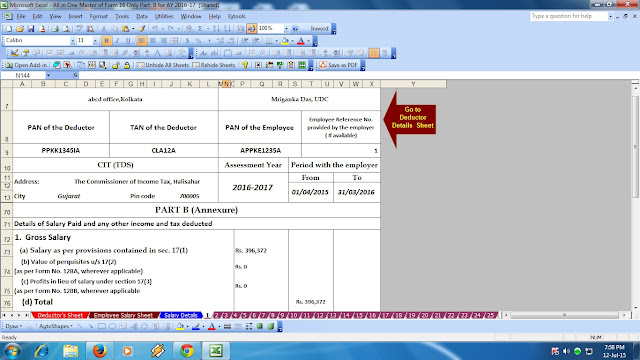

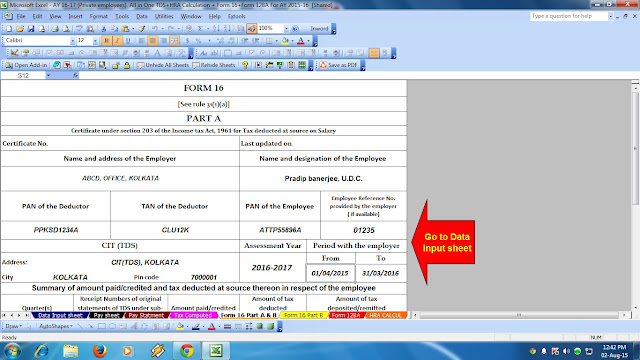

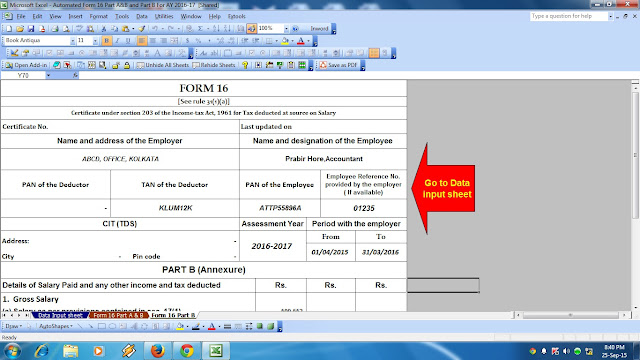

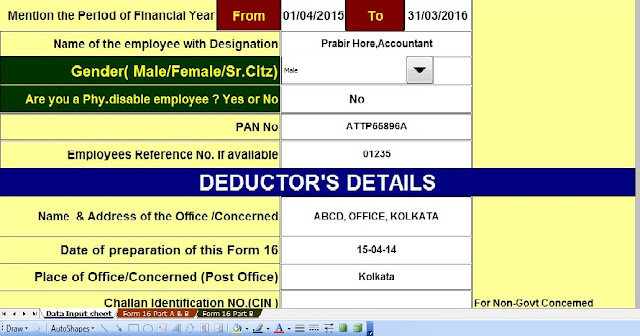

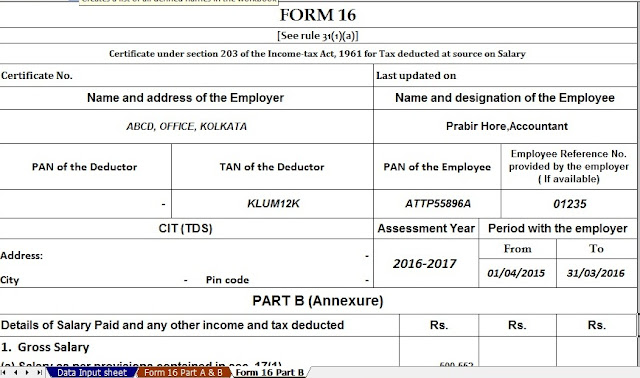

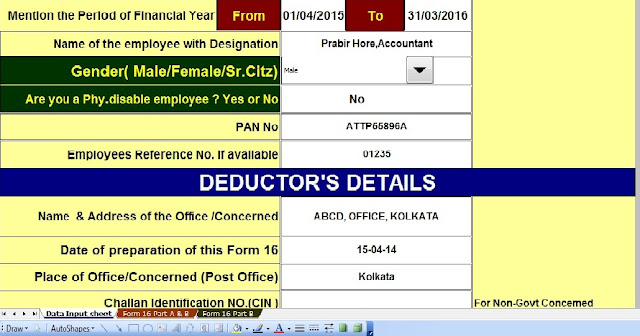

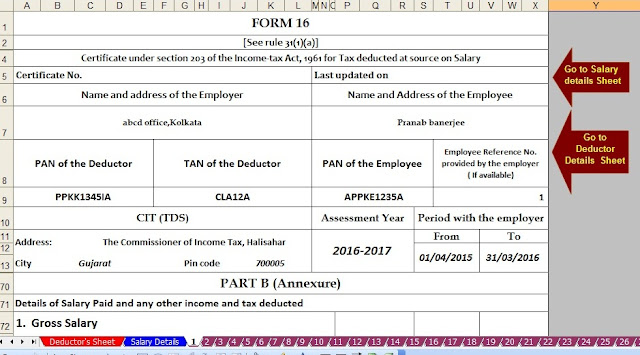

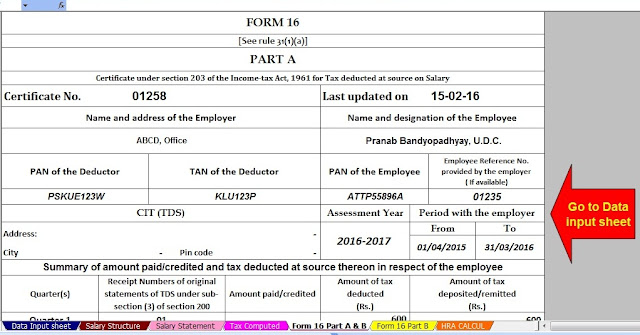

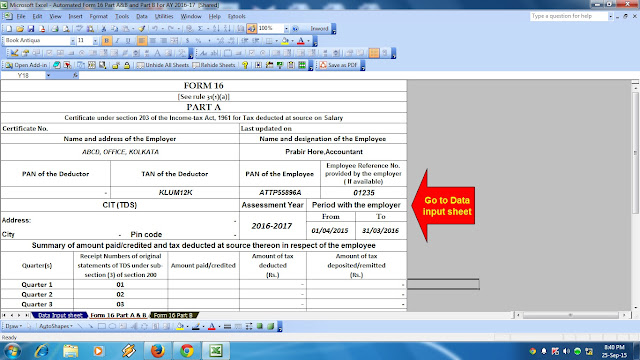

Posted: 28 Jul 2015 07:46 AM PDT The Financial Year 2014-15 have already gone and start the new Financial Year 2015-16 has start since 1st April 2015 and end will be March 2016. All the concerned have already calculate the Income Tax for their employees and also deducted Tax from their Salary and deposited the same to the Central Govt Account. Now it is necessary to prepare and distribute the Form 16 to the concern employee so they can fill the Income Tax Return in due time. As per the Income Tax time schedule it is mandatory to prepare and supply the Form 16 to the employees with April 2015. So you should ready to prepare the Form 16 for the Financial Year 2014-15 and Assessment Year 2015-16. As per the CBDT new Notification 11/2013 the format of Form 16 have already changed. In this New Format of Form 16 have two parts. One is Part A and another is Part B. In Form 16 Part A have the all details of Tax deducted and deposited to the Central Govt respective account, and Form 16 Part B have the all details of Salary of employee. It is also Notifies by the CBDT that the Form 16 Part A mandatory from the Income Tax New Web Site TRACES Portal (www.tdscpc.gov.in), and the Part B of Form 16 must be prepare by the Employer. If you have not known that how to Download the Form 16 Part A from the Tracess Portal, CLICK HERE to view "How to Download Form 16 Part A". But most of Concerned have not well known about this new Notification or they can not be able to download the Form 16 Part A from the Tracess Portal. In this regard they have need to prepare both of Form 16 Part A&B both. Here is given below the Automated Form 16 Part B and Automated Form 16 Part A&B for the Financial Year 2014-15 and Assessment Year 2015-16 which can prepare at a time 50,100 and One by One Form 16 Part A&B and Part B for the Financial Year 2015-16Feature of this Excel Based Form 16 Preparation Software :-

Download the Form 16 preparation Excel Based Software from the below given link :- 1) Master of Form 16 Part B for FY 2014-15 [ This Excel Utility can prepare at a time 50 employees Form 16 Part B for FY 2014-15]2) Master of Form 16 Part A&B for FY 2014-15 [This Excel Utility can prepare at a time 50 employees Form 16 Part A&B]3) Master of Form 16 Part B for FY 2014-15 [ This Excel Utility can prepare at a time 100 employees Form 16 Part B]4) Master of Form 16 Part A&B for FY 2014-15 [ This Excel Utility can prepare at a time 100 employees Form 16 Part B]5) One by One Prepare Automatic Form 16 Part A&B and Part B [This Excel Utility can prepare both Form 16 part A&B and Part B ] |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 29 Jul 2015 07:11 AM PDT Click to Download Income Tax Master of Form 16 Part B with 24Q and 26Q All Quarters for the Financial Year 2015-16 and Assessment Year 2016-17( This Utility can prepare at a time 50 employees Form 16 Part B with 24Q & 26Q for the Financial Year 2015-16 as per the New Income Tax Slab)The Financial Year 2014-15 and Assessment Year 2015-16 have already gone and the New Financial Year 2015-16 and Assessment Year 2016-17 have already started since 1st April 2014 to 31st March 2016. The CBDT have already changes the Format of Income Tax Form 16 and this Form 16 have in the two parts one is Form 16 Part A which is mandatory to download from the TRACES PORTAL(www.tdscpc.gov.in) and another Part of Form 16 Part B is must be prepared by the employer. In this Part B have the all details of employee's Salary and benefits. The Income Tax Challan 24Q (For Govt Concerned) and 26 Q(For Non Govt Concerned) also prepare for submitting the each Quarter end by this Challan this 24Q and 26Q by the employer. Now it comes the 1st Quarter Cahallan submit date in the June 2014 and you have to prepare and submit your employees Quarter wise return to the Income Tax Department for the Financial Year 2015-16. Below given Excel Based Automated Form 16 Part B with the Challan 24Q and 26Q for the all quarters for the Financial Year 2015-16 and Assessment Year 2016-17. This Utility can help and reduce your time for preparation of 24Q or 26Q with Form 16 Part B. Click here to Download Income Tax Master of Form 16 Part B with 24Q and 26Q All Quarters for the Financial Year 2015-16 and Assessment Year 2016-17( This Utility can prepare at a time 50 employees Form 16 Part B with 24Q & 26Q for the Financial Year 2015-16 as per the New Income Tax Slab) |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

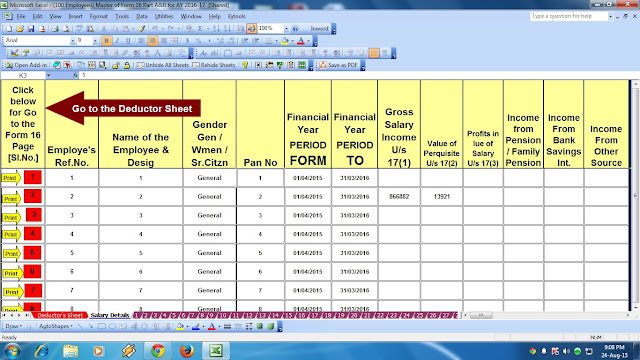

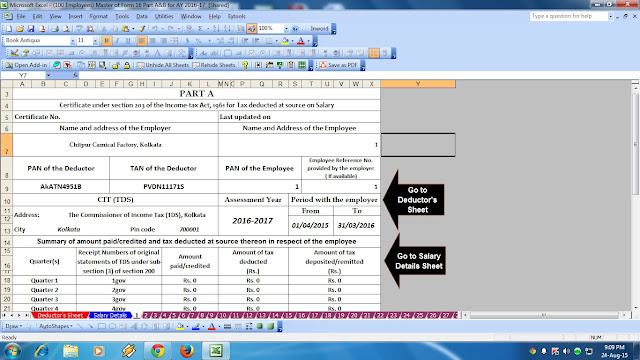

Posted: 30 Jul 2015 06:58 AM PDT Click here to Download Automated Form 16 Part A&B for the Financial Year 2014-15 & Assessment Year 2015-16 ( This Excel Utility can prepare at a time 100 employees form 16 Part A&B)The CBDT has already changed the Format of Form 16 dated on 19/2/2013. In this Format have two part. Part A which found the Tax Deducted At Source and deposited in to the Central Govt Account and another Part B which is found the details of employee's Salary. This Part B is mandatory to prepare by the employer. This Part A is mandatory to download form the Income Tax TRACES Portal. Most of the Employer or deductor yet not well known about this new Format of form 16. Also you most of employer could not able to download the Form 16 Part A from the TRACES portal. Who have not able to download the Form 16 Part A from the TRACES Portal, they can use this below given both in one file Form 16 Part A&B in New Format of Form 16. This Excel Based Software can prepare at a time 100 employees Form 16 Part A&B for the Financial Year 2014-15 and Assessment Year 2015-16. This Utility can use both of Govt and Non Govt Concerned. |

Feature of this Utility:- |

Click here to Download Automated Form 16 Part A&B for the Financial Year 2014-15 & Assessment Year 2015-16( This Excel Utility can prepare at a time 100 employees form 16 Part A&B) |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

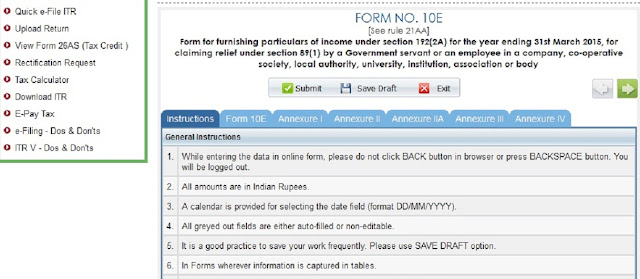

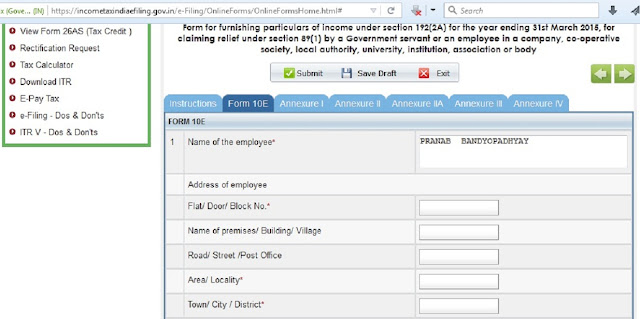

Posted: 31 Jul 2015 08:34 AM PDT Income Tax Department has come up with a New user friendly online Income Tax Return filing tool. Unlike the tools provided earlier in which we have to fill up an offline Excel sheet, the new Income Tax tool has a neat online interface for filling up and saving data at once. Undoubtedly, the new online Income Tax Return filing facility is user friendly and professional. We could see that presently this online tool is applicable only for ITR-1 and ITR-4S. We hope to Income Tax Department would extend this online tool to ITR-2 also in the near future.

Here is an intro to this useful tool 1. Go to this Income Tax Department’s Official online ITR filing Website. Register using your PAN and get user name and password, if you have not already registered.  2. Login in to New Income Tax E-filing tool  3. Once you have successfully logged in you will land in to following page  4. After you select the ITR type and relevant year for which ITR has to be filed, entry page of ITR will be shown. The first tab will be containing the instructions for filling the data  5. As you are in logged in session, it is adviceable to save the data entered after each tab is completed. However Submit Button has to be used only after entry of all the data. The following Screenshot is Personal Information entry tab. Once entry is completed save the data as draft and proceed to next tab.  6. Following Screenshots are relating to entry tabs for Income Tax details, Details of Income Tax Deducted by employer, and Bank Account details. After entry of data in all these tabs are completed, click Submit button to generate ITR-V Button. ITR-V is a document which contains the summary of your income, deductions and income tax paid. This document has to be signed and sent to the Income Tax Central Processing Centre at Bangalore. Address of this centre will be available in the mail sent to you attaching filled up ITR-V form. Please note that Online E-filing will get completed only after receipt of this ITR-V at Central Processing Centre at Bangalore.  As per the CBDT has mandatory to mention the Aadhar Card for the Assessment Year 2015-16 |

This posting includes an audio/video/photo media file: Download Now |

|

Posted: 31 Jul 2015 08:29 AM PDT Click here to download the Automatic Master of Form 16 Part B ( This Excel Utility can prepare at a time 100 employees Form 16 Part B for the Financial Year 2014-15)Updated list of deductions available Chapter VI-A while calculating Income Tax for Individual & also helpful for tax planning. Section 80C: Under this section deduction from total income in respect of various investments/ expenditures/payments in respect of which tax rebate u/s 88 was earlier available. The total deduction under this section (alongwith section 80CCC and 80CCD) is limited to Rs. 1.5 lakh only.( As per the Finance Budget 2014-15 the Max Limit of U/s 80 C HAS RAISED UP TO RS. 1.5 LAKH) 1. Life Insurance Premium For individual, policy must be in self or spouse's or any child's name. For HUF, it may be on life of any member of HUF. 2. Sum paid under contract for deferred annuity For individual, on life of self, spouse or any child . 3. Sum deducted from salary payable to Govt. Servant for securing deferred annuity for self-spouse or child Payment limited to 20% of salary. 4. Contribution made under Employee's Provident Fund Scheme. 5. Contribution to PPF For individual, can be in the name of self/spouse, any child & for HUF, it can be in the name of any member of the family. 6. Contribution by employee to a Recognised Provident Fund. 7. Sum deposited in 10 year/15 year account of Post Office Saving Bank 8. Subscription to any notified securities/notified deposits scheme. e.g. NSS 9. Subscription to any notified savings certificate, e.g. NSC VIII issue. 10. Unit Linked Savings certificates. 11. Contribution to notified deposit scheme/Pension fund set up by the National Housing Scheme. 12. Certain payment made by way of installment or part payment of loan taken for purchase/construction of residential house property. Condition has been laid that in case the property is transferred before the expiry of 5 years from the end of the financial year in which possession of such property is obtained by him, the aggregate amount of deduction of income so allowed for various years shall be liable to tax in that year. 13. Contribution to notified annuity Plan of LIC(e.g. Jeevan Dhara) or Units of UTI/notified Mutual Fund. If in respect of such contribution, deduction u/s 80CCC has been availed of rebate u/s 88 would not be allowable. 14. Subscription to units of a Mutual Fund notified u/s 10 (23D). 15. Subscription to deposit scheme of a public sector, company engaged in providing housing finance. 16. Subscription to equity shares/ debentures forming part of any approved eligible issue of capital made by a public company or public financial institutions. 17. Tuition fees paid at the time of admission or otherwise to any school, college, university or other educational institution situated within India for the purpose of full time education of any two children. Available in respect of any two children Section 80CCC: Deduction in respect of Premium Paid for Annuity Plan of LIC or Other Insurer Payment of premium for annuity plan of LIC or any other insurer Deduction is available upto a maximum of Rs. 150,000/-. The premium must be deposited to keep in force a contract for an annuity plan of the LIC or any other insurer for receiving pension from the fund. Section 80CCD: Deduction in respect of Contribution to Pension Account Deposit made by a Central government servant in his pension account to the extent of 10% of his salary. Where the Central Government makes any contribution to the pension account, deduction of such contribution to the extent of 10% of salary shall be allowed. Further, in any year where any amount is received from the pension account such amount shall be charged to tax as income of that previous year. 18. Section 80CCG: Rajiv Gandhi Equity Saving Scheme As per the Budget 2012 anouncements, a new scheme Rajiv Gandhi Equity Saving Scheme (RGESS) will be launched. Those investors whose annual income is less than Rs. 10 lakh can invest in this scheme up to Rs. 50,000 and get a deduction of 50% of the investment. So if you invest Rs. 50,000 (maximum amount eligible for income tax rebate is Rs. 50,000), you can claim a tax deduction of Rs. 25,000 (50% of Rs. 50,000). 19. Section 80D: Deduction in respect of Medical Insurance Deduction is available upto Rs. 20,000/- for senior citizens and upto Rs. 15,000/ in other cases for insurance of self, spouse and dependent children. Additionally, a deduction for insurance of parents (father or mother or both) is available to the extent of Rs. 20,000/- if parents are senior Citizen and Rs. 15,000/- in other cases. Therefore, the maximum deduction available under this section is to the extent of Rs. 40,000/-. From AY 2013-14, within the existing limit a deduction of upto Rs. 5,000 for preventive health check-up is available. Note:- By the Finance Budget 2015 has Raised the Limit up to Rs. 25,000/- for General below 60 years and Rs. 30,000/- for Sr.Citizen, apply since 1/4/2015 for the Financial Year 2015-16 20. Section 80DD: Deduction in respect of Rehabilitation of Handicapped Dependent Relative Deduction of Rs. 50,000/- w.e.f. 01.04.2004 in respect of ü Expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative. ü Payment or deposit to specified scheme for maintenance of dependent handicapped relative. Further, if the defendant is a person with severe disability a deduction of Rs. 100,000/- shall be available under this section. The handicapped dependent should be a dependent relative suffering from a permanent disability (including blindness) or mentally retarded, as certified by a specified physician or psychiatrist. Note: A person with 'severe disability' means a person with 80% or more of one or more disabilities as outlined in section 56(4) of the 'Persons with disabilities (Equal opportunities, protection of rights and full participation)' Act. 21. Section 80DDB: Deduction in respect of Medical Expenditure on Self or Dependent Relative A deduction to the extent of Rs. 40,000/- or the amount actually paid, whichever is less is available for expenditure actually incurred by resident assessee on himself or dependent relative for medical treatment of specified disease or ailment. The diseases have been specified in Rule 11DD. A certificate in form 10 I is to be furnished by the assessee from any Registered Doctor. Section 80E: Deduction in respect of Interest on Loan for Higher Studies Deduction in respect of interest on loan taken for pursuing higher education. The deduction is also available for the purpose of higher education of a relative w.e.f. A.Y. 2008-09. Section 80G: Deduction in respect of Various Donations The various donations specified in Sec. 80G are eligible for deduction upto either 100% or 50% with or without restriction as provided in Sec. 80G, Section 80GG: Deduction in respect of House Rent Paid Deduction available is the least of 1. Rent paid less 10% of total income 2. Rs. 2000/- per month 3. 25% of total income, provided of Assessee or his spouse or minor child should not own residential accommodation at the place of employment. of He should not be in receipt of house rent allowance. of He should not have self occupied residential premises in any other place. 22. Section 80U: Deduction in respect of Person suffering from Physical Disability Deduction of Rs. 50,000/- to an individual who suffers from a physical disability(including blindness) or mental retardation. Further, if the individual is a person with severe disability, deduction of Rs. 100,000/- shall be available u/s 80U. Certificate should be obtained from a Govt. Doctor. The relevant rule is Rule 11D. Section 80RRB: Deduction in respect of any Income by way of Royalty of a Patent Deduction in respect of any income by way of royalty is respect of a patent registered on or after 01.04.2003 under the Patents Act 1970 shall be available upto Rs. 3 lacs or the income received, whichever is less. The assessee must be an individual resident of India who is a patentee. The assessee must furnish a certificate in the prescribed form duly signed by the prescribed authority. NOTE THAT BY THE FINANCE BUDGET 2015 THIS LIMIT HAS RAISED UP TO Rs.75,000/- FROM 50,000/- SINCE 1/4/2015 FINANCIAL YEAR. 23. 80 TTA: Deduction from gross total income in respect of any Income by way of Interest on Savings account Deduction from gross total income of an individual or HUF, upto a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account ( not time deposits ) with a bank, co-operative society or post office, is allowable w.e.f. 01.04.2012 (Assessment Year 2013-14). 24. 80 EE. Additional House Building Loan Interest up to Rs. 1,00,000/- will be admissible who have paid the HBL Interest w.e.f. 1/4/2013 (Excluding the Section 24 B) |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

- IRCTC Updates: No ID Needed For Tatkal Bookings, IRCTC Requests to Banks For Providing OTPs

- All about Income Tax Salary Certificate Form 16 for Salaried persons for F.Y.2014-15 with Automatic Form 16 for F.Y.2014-15

- IRCTC Updates: No ID Needed For Tatkal Bookings, IRCTC Requests to Banks For Providing OTPs

|

IRCTC Updates: No ID Needed For Tatkal Bookings, IRCTC Requests to Banks For Providing OTPs Posted: 01 Aug 2015 06:49 PM PDT |

|

Posted: 01 Aug 2015 06:49 PM PDT |

|

IRCTC Updates: No ID Needed For Tatkal Bookings, IRCTC Requests to Banks For Providing OTPs Posted: 01 Aug 2015 04:49 PM PDT |

itaxsoftware.net

|

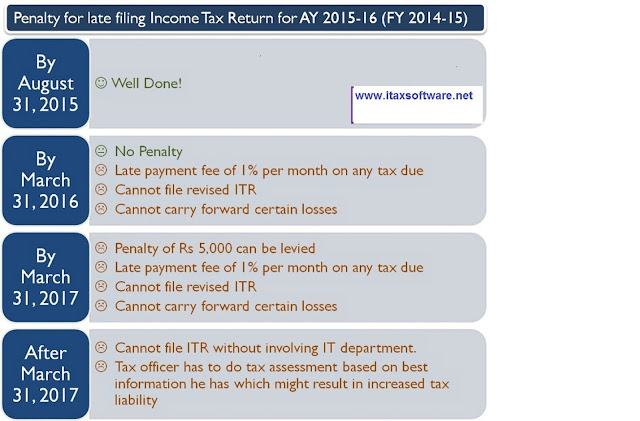

What is the benefits of Income Tax Return File, Who and Why need to File Income Tax Return Posted: 02 Aug 2015 05:53 AM PDT Who needs to mandatory to file ITR? As per Income tax laws; You need to file your income tax return if your gross taxable income (without any tax saving deduction) is more than the basic tax limit applicable for you. Gross Taxable Income is defined as Total Income for the financial year (Minus) Conveyance Allowance, LTA, HRA, Profession Tax, Home loan interest, etc. But before exemptions under Section 80C to 80U etc which includes investments such as ELSS, PPF, NPS, Insurance etc Below is the Basic Tax limit: § For citizens below 60 years of age – Rs 2.5 Lakhs § Between 60 and 80 years (Senior Citizens) – Rs 3 Lakhs § Above 80 years (Very Senior Citizens) – Rs 5 Lakhs Some Examples: 1. If you are 58 years of age and your income is Rs 3 lakhs, you need not necessarily pay tax as you can invest Rs 50,000 in Sec 80C (such as PPF, ELSS etc) and pay 0 taxes. But still you will need to file your tax returns.2. If you are 81 years of age and your income is Rs 4.5 Lakhs you need not necessarily file income tax return as the basic tax limit is Rs 5 lakhs for very senior citizens. Other than the above you still need to file your ITR if you satisfy any of the following conditions: 1. You have to claim any excess tax deposited 2. You have losses that you want to take forward to next financial years 3. If you have any foreign asset or income from sources outside India 4. If you have income from property held by a trust Why filing ITR is good idea? Other than the categories of people described above who needs to mandatory to file ITR, we encourage everyone with income to file their ITR because of following reasons: 1. ITR is required when you want to take any loan. This serves as valid income proof especially for the self employed. 2. Also it’s useful document when you apply for Visa for some countries 3. The filing of ITR is easy, free and can be done by self in 15 – 20 minutes especially if you income sources only from salary/pension, fixed deposit interests etc. Is e-filing ITR mandatory?You would need to e-file your income tax return in case 1. You have to claim refund of excess tax paid 2. Your gross income is more than Rs 5 lakhs 3. ITR forms 3, 4, 5, 6 & 7 have to e-file However for citizens above 80 years of age, they can still file their returns in paper format if they are using ITR forms 1, 2A or 2. Last date for Filing ITR?The last date for filing income tax return for AY 2015-16 (FY 2014-15) is August 31, 2015. However in case you are carrying on a business and your accounts are required to be audited, the due date gets extended till September 30, 2015. What if you miss the ITR deadline?In case you miss the deadline for filing your ITR for AY 2015-16, you can still do it by March 31, 2016 without any penalty and up to March 31, 2017 with penalty. But in either case you loose on following benefits: 1. You cannot revise your returns in case you find any error on a later date 2. You cannot carry forward your losses 3. In case you had tax due, you will need to pay penalty on that – 1% for every month of delay What’s the Penalty for non-filing ITR?In case you do not file your income tax return for AY 2015-16 by March 31, 2016 (but should have filed as per IT laws),the assessing officer can put a fine of up to Rs 5,000 under section 271F after hearing the credits of your case. Ideally everyone with income should file their IT return as it serves as valid proof of income. Paying taxes and filing returns are two different things and you should not default on either. So even if you paid all your taxes or have zero tax liability you must file your returns as per law. |

This posting includes an audio/video/photo media file: Download Now |

|

IRCTC Updates: No ID Needed For Tatkal Bookings, IRCTC Requests to Banks For Providing OTPs Posted: 01 Aug 2015 07:10 PM PDT Indian Railways has announced several new updates and programs this week. Here is a quick brief: No IDs Required For Tatkal TicketsIndian Railways has decided to stop the practice of asking identity proofs during booking –both online and offline. As per an official release, the ID proof would only be required to show during the journey. As of now, passengers are mandated to provide booking clerk an attested copy of their identity proof while booking from counter, and mention the ID number in online bookings. Stopping of this step will certainly benefit the passenger during tatkal bookings, as much time is lost in arranging such photocopies and providing them to the booking clerk. IRCTC Requests Banks For Providing OTPSAs of now, IRCTC has formally partnered with 50 banks for providing payment options during an online booking. However, only 24 banks have One Time Password (OTP) arrangement, which creates fraud possibilities and obstruct smooth flow for the Railways. IRCTC has formally requested all the remaining banks to initiate OTP procedure so that customers don’t face any hassle while booking tickets. In fact, these 26 banks without OTP system has been given a deadline of August 15th to implement the same. IRCTC GM (software) M Srinivas said, “We need to implement OTP system by all the banks with a view to checking fraudulent transactions on the IRCTC website. Railway crime branch has also put the IRCTC on alert about fraudulent transactions,” Out of these 50 banks, 28 banks provide net banking, six offer payment gateways, 10 provide debit card option, 4 offer cash cards while 1 each is EMI-based and IRCTC prepaid card system. |

This posting includes an audio/video/photo media file: Download Now |

|

Posted: 01 Aug 2015 07:09 PM PDT What is Form 16: If you are salaried employee in an organization, then you will get the salary after deducting tax by the employer. Therefore Form 16 is a certificate issued to you by your employer stating the Personal details of the Employee including Name, Permanent Account Number (PAN) etc , details of the salary you have earned, Perquisites that has been offered, allowances given , details of Chapter VIA deductions and the tax deducted on your salary by your Employer and paid to the government. It also has Employer details like Name, permanent account number PAN, TAN etc. This is the basic document which is required by the employee to file income tax returns because Form-16 contains income chargeable under the head “Salaries” which is the taxable salary. The same needs to be indicated in Income Tax Returns. Form 16 has 2 parts – Part A and Part B. Part A has TAN (tax deduction & collection account number) of the employer & PAN (permanent account number) details of both the employer and employee. The name and address of employer and employee is also mentioned. It also mentions the assessment year and provide summary of tax deducted from your income and deposited to the government as per the quarterly TDS return filed by the employer. A monthly detail of TDS deducted and deposited is also certified. Part B is an important part of your Form 16 since it has a consolidated detail of salary paid to you during the year. The breakup of your salary as well as detail of deduction claimed by you under section 80 of the income tax act is mentioned. Deductions under Chapter VIA include details of amounts claimed under Section 80C for EPF, PPF, NSC, life insurance premium or Section 80D for health insurance, Section 80G for donations made are all mentioned here. It also shows your total taxable income and tax deducted on such income. Necessity of Form 16 In Filing Income Tax Return: Form 16 is necessary to file an income tax return in Indiabecause Firstly, Form 16 acts as a checker for you to verify whether your employer has deposited the whole amount of TDS that he may have deducted from your salary. Secondly, it will enable you to file Income tax return disclosing the correct taxable salary income and various deductions from your salary like EPF, Profession tax and TDS. Download Amended Format of Form 16 Part B for the Financial Year 2014-15 ( This Excel based Software can prepare at a time 50 employees Form 16 Part B for F.Y.2014-15)Download Amended Format of Form 16 Part A&B for the Financial Year 2014-15 ( This Excel based Software can prepare at a time 50 employees Form 16 Part A & B for F.Y.2014-15)Employer Obligation to provide Form 16 :- Further, it is the obligation of the employer to provide a Form 16 to all employees by 31 May of the assessment year (AY), if TDS has been deducted , In case no TDS has been deducted by the employer they may not issue you a Form 16.The employer can be liable to pay a penalty of Rs. 100 for each day by which he delays issuance of this certificate, also if you have been employed under more than one employer during the year, each of your employers will provide you a Form 16. Filing of Income Tax Return without Form16:- Even if Form 16 has not been issued you cannot escape from the liability to file Income Tax Return , therefore to file income tax return without Form 16 you need to collect your monthly salary slip and compute total salary for the year. Note: The amount credited in your bank statement is after deducting the tax at source but for reporting in ITR you need to calculate Gross Salary. An employee receives many types of allowances in the form of salary while some allowances such as conveyance allowance, medical allowance, HRA, etc. are exempt from income tax while dearness allowance is completely taxable. Hence, the IT Department allows you to deduct the exempt allowances from salary to arrive at the figure of taxable salary. Since you have not received form 16 from your employer, you must verify Form 26AS to know about the TAN and TDS deducted by your Employer If you have other income as well apart from salary then sum up all the income like Income from renting of House property , capital gains from sale of assets , income from other sources like interest on bank deposits, RDs, FDs etc. Deduct tax benefit from the above computed income like investments made under NSC, LIC, tuition fees, PPF, and repayment of principal of housing loan under section 80C. Similarly, donations made to charitable institutions can be claimed under section 80G, and payment made towards premium of medical insurance policy can be claimed in section 80D. After summing up all income and deducting the tax benefits , the resultant computation will be taxable income. Now, calculate income tax on this taxable income using the IT slab rates for financial year 2014-15. Now you are all set for filing tax return. You can now visit the online tax filing site http://www.tdscpc.gov.into file your INCOME TAX RETURN. |

This posting includes an audio/video/photo media file: Download Now |

| You are subscribed to email updates from itaxsoftware.net

|

| To stop receiving these emails, you may unsubscribe now. |

| Email delivery powered by Google |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 03 Aug 2015 06:17 AM PDT Download Income Tax Calculator for Govt & Non Govt employees for Assessment Year 2016-17 with all amended Tax Limit as per New Finance Budget 2015-16* No change in tax slabs or minimum taxable limit for the Financial Year 2015-16 and Assessment Year 2016-17* The transport allowance exemption hiked to Rs 1,600 per month from Rs 800 per month U/s 10 * Limit of deduction of health insurance premium increased from Rs. 15000 to Rs. 25000. For senior citizens limit increased from Rs 20000 to Rs 30000. U/s 80D * Senior citizens above the age of 80 years, who are not covered by health insurance, to be allowed deduction of Rs 30000 towards medical expenditures. * Deduction limit of Rs 60000 with respect to specified decease of serious nature enhanced to Rs 80000 in case of senior citizen. U/s 80DDB *Additional deduction of Rs 25000 allowed for differently abled persons.U/s 80U *Limit on deduction on account of contribution to a pension fund and the new pension scheme increased from Rs 1 lakh to Rs 1.5 lakh.U/s 80CCC *Payments to the beneficiaries including interest payment on deposit in Sukanya Samriddhi scheme to be fully exempt. Max Rs.1.5 Lakh U/s 80C |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Posted: 04 Aug 2015 06:11 AM PDT The Financial Year 2015-16 has already started and as per the Finance Budget 2015, the Tax Slab have not changed, same as previous financial year 2014-15. But Limit of some Tax Section has Increased by this Finance Budget. The Section 80U have increased 75000/- P.A. and Rs. 125000/- P.A. for Blind persons. Traveling Allowances also raised up to 1600/- P.M. and Blind Person can avail Rs. 3200/- P.M. Section 80D Raised Rs. 25000/- and Sr.Citizen Rs. 30,000/-It is necessary to calculate your Tax Liability for the Financial Year 2015-16 as the D.A. has also increased to the Govt employees time to time.It is most hazard to calculate individually HRA Calculation separately another sheet and also it is hazard to calculate the Arrears Relief Calculation from the financial Year 2000-01 to 2015-16. This Excel Utility can prepare all the calculation just a moment. Thus your time may reduce for calculating the actual Income Tax of each employee. This Excel Based Software Can prepare more than 500 employees Tax Computed One by One for the Financial Year 2015-16 and Assessment Year 2016-17 |

Feature of this Utility:- |

· Automatic Calculate Income Tax with Tax Computed sheet individually· Individual Salary Structure for calculating the Gross Salary Income· Salary Structure have prepare on the Basis of Govt and Non Govt Salary Pattern· Automatic Calculate the House Rent Exemption Calculation U/s 10(13A)· Automatic Calculate the Arrears Relief Calculation with Form 10E since 2000-01 to 2014-15· Automated Form 16 Part A&B· Automated Form 16 Part B· Automatic Convert the Amount in to In WordsClick here to Download theExcel Based Software All in One Tax preparation Software for Govt and Non-Govt employees for F.Y.2015-16 and A.Y.2016-17[This Excel Utility can prepare at a time Income Tax Computed Sheet + Automatic Arrears Relief Calculator + Automatic House Rent Exemption calculation + In built Salary Structure for both Govt & Non Govt employees which prepared on the basis of Salary Pattern of each Govt and Non Govt concerned + Automated Form 16 Part A&B + Automated Form 16 Part B for the Financial Year 2015-16 and Assessment Year 2016-17.] |

This posting includes an audio/video/photo media file: Download Now |

itaxsoftware.net

Itaxsoftware.net |

|

Automated up to date Arrears Relief Calculator with Form 10E since FY 2000 to 2015-16 Posted: 05 Aug 2015 07:50 AM PDT Download the Arrears Relief Calculator U/s 89(1) Up to Date from FY 2000-01 to FY 2015-16]As the New Finance Budget 2015 has already declare the Income Tax Slab have not changed and same as past Financial Year, but some changes have been made and raised some maximum limit of some Tax Section in this Financial Year 2015-16.1) The Income Tax Section 80 D Raised up to Rs. 25,000/- for general and up to Rs. 30,000/- for Sr.Citizen. Read more in details 2) A new deduction U/s 80C have introduce in this Finance Budget 2015 in the name of Sukanya Samriddhi Scheme Account which is Max Limit Rs. 1,50,000/-.Read this deduction in details 3) The Section 80CC have also raised up to Rs. 1,50,000/- in this Finance Budget 2015 for Pension Account. 4) Transport/Conveyance Allowance is double up to Max Rs. 1600 P.M. 5) Tax Rebate Rs.2,000/- U/s 87A and Savings Bank Interest up to Rs. 10,000/- U/s 80TTA will be continue in the Financial Year 2015-16. In Future it will be indispensable the Arrears Relief Calculator, as the Central Govt and other some State Govt have already arrange to set the 7th Pay Commission to the Govt employees. In this Regard it may helpful to calculate the Arrears Relief of Salary which can calculate by the Income Tax Section 89(1) for Relief of Arrears. The itaxsoftware.net have already prepared the Up to Date Arrears Relief Calculator U/s 89(1) Since the financial year 2000-01 to Financial Year 2015-16 with Form 10E. Download the Arrears Relief Calculator U/s 89(1) Up to Date |

This posting includes an audio/video/photo media file: Download Now |

|

Posted: 05 Aug 2015 06:44 AM PDT Tax Treatment of Gratuity as per Income Tax Act,1961 is covered U/S 10(10) of the Act. In case of retirement, resignation or termination, you have to consider Income Tax liability on propose receipt of Gratuity. If Gratuity is received by employee himself, it will be taxable under head salary while if it is received by legal heir on death of employee, It will be taxable under “Income from other sources’ to the extent it is not chargeable to tax as per below mentioned provisionTax Treatment of Gratuity depends on type of employee viz;

Download Tax Calculator with Form 16 Part A&B and Part B for F.Y.2014-15