FAT CATS OF PRICE RISE

1 view

Skip to first unread message

sarabjit grewal

Sep 20, 2018, 4:21:15 AM9/20/18

to

While high oil prices roil you, govt, oil companies are getting richer

TNN | Sep 20, 2018, 11.06 AM IST

NEW DELHI: In some cities, petrol prices have crossed Rs 90 to a litre. It’s going up because the rupee has depreciated sharply against the dollar, while crude prices have risen steadily for the past year. To make matters worse, the government has raised taxes repeatedly. But there’s another key factor — the way fuel is priced here. India imports almost no petrol or diesel, it imports crude. But the price you pay for your fuel is based largely on import parity price, or the price you would pay if India were to be actually importing petrol or diesel. This not only means you pay a very high price but also that oil companies and the government make more money as prices go up. Here’s a four-step explanation.

1. OUR PETROL, DIESEL IMPORTS ARE MINISCULE

2. YET FUEL IS PRICED AS IF IT IS IMPORTED

* Oil refiners, who make these products in India, are paid what is called a Refinery Gate Price (RGP) based on the Trade Parity Price or TPP

* TPP is a weighted average of the Import Parity Price (IPP) and the Export Parity Price (EPP)

* IPP is the price importers would pay if they actually imported the product at an Indian port. So, it includes not just the cost of the fuel itself, but also freight charges, insurance, customs duty and port charges

* EPP is what somebody actually exporting the product would get

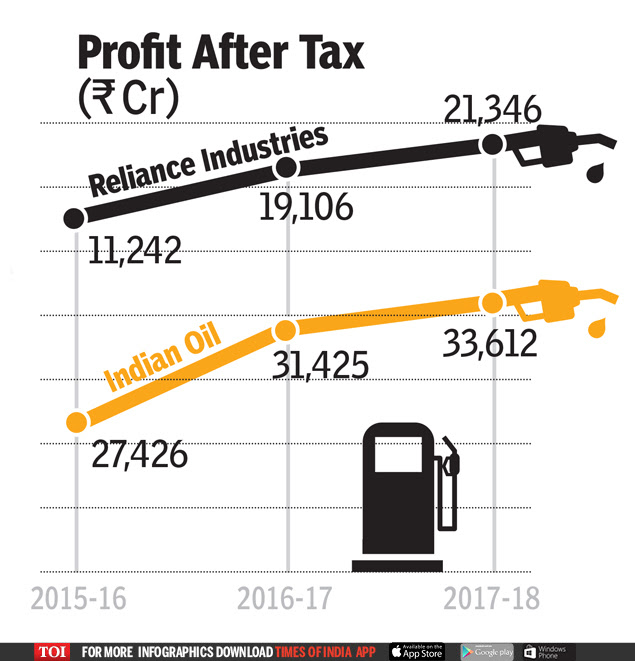

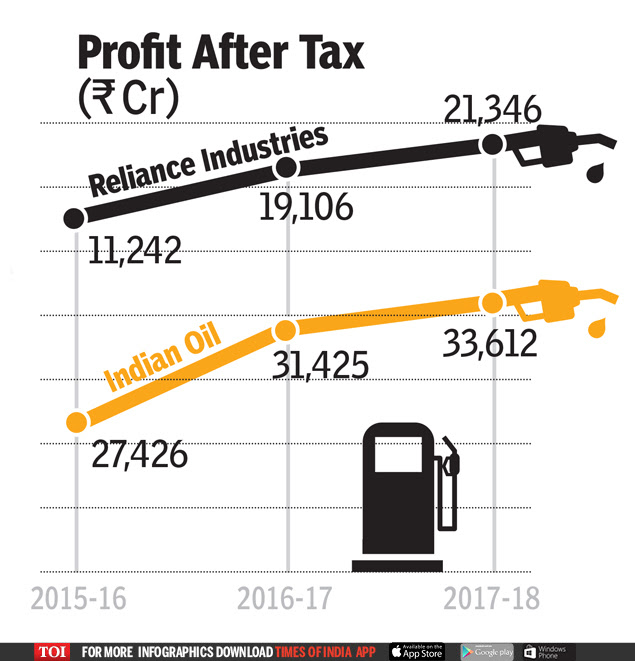

3. NOW ADD AD VALOREM TAX

This method of calculating the price to be paid to refiners means that whenever international oil prices rise (or customs duty on their products increase), they get a windfall. That’s because customs is an ‘ad valorem’ rate, or a percentage of the basic value, unlike a ‘specific’ duty, which would remain fixed irrespective of basic price. Since customs duty is 2.5% of the imported price, it goes up in absolute terms as the basic price does. So, at $100 per barrel, the duty on a barrel of petrol would be $2.5, at $200 per barrel it would be $5. Indian refiners would get this benefit without incurring the duty itself! This partly explains why they have actually become more profitable at a time when their raw material (crude oil) is becoming more expensive. Between 2015-16 and 2017-18, the average price of the crude India buys went from $46/barrel to $48/barrel and then $56/barrel. But check out what happened to the bottomlines of our two biggest refiners, state-owned Indian Oil and private sector giant Reliance Industries...

4. GOVT, TOO, MAKES A KILLING

Of course, the government also gained in terms of taxes over the last three years. To a small extent, this was because the amount it collects as customs duty goes up as the import price does. But customs duty accounted for a tiny part of the increased tax collections from petroleum. The bulk really came in the form of excise duty.

In January 2016 alone, govt hiked basic excise duty thrice. Taken with the Rs 6/litre additional excise duty (now replaced by a Rs 8/litre road and infrastructure cess), total excise duties reached close to Rs 17 per litre for petrol and Rs 19 per litre for diesel. This fuelled tax collections.

The govt gained in three other ways

➤ Higher profits for oil refiners meant higher tax on the profits

➤ Higher profits for state-owned refiners meant more dividend for government, their main shareholder

➤ Higher dividends distributed by public and private refiners meant more dividend distribution tax. All of these rose in the last three years

WHAT THE GOVT HAS TO SAY ABOUT THIS

The pricing issue was examined by a committee under C Rangarajan in 2006 after the cost-plus formula was done away with and petrol-diesel prices were deregulated in April 2002. The idea was to align domestic and international prices. India has to import 80% of raw material (crude oil), so export parity could not be an option. That’s why an 80:20 trade parity pricing was implemented in line with Rangarajan report. Customs on products is 2.5% but this is applicable only on 80% of the output, effectively making it 2%.

There are several taxes on domestic crude such as National Calamity Duty, VAT and state entry tax. These are absorbed by the refiners. So after adjusting these, the effective customs duty is minuscule. No state-run refiner exports products, barring in exceptional circumstances.Private refiners do. But they don’t use domestic crude and import oil at landed cost basis. Customs on the product thus ensures level field when private refiners sell products in the domestic market. Landed cost is a transparent way to arrive at pricing. Otherwise, it will have to be a cost-plus formula, which is opaque.

1. OUR PETROL, DIESEL IMPORTS ARE MINISCULE

2. YET FUEL IS PRICED AS IF IT IS IMPORTED

* Oil refiners, who make these products in India, are paid what is called a Refinery Gate Price (RGP) based on the Trade Parity Price or TPP

* TPP is a weighted average of the Import Parity Price (IPP) and the Export Parity Price (EPP)

* IPP is the price importers would pay if they actually imported the product at an Indian port. So, it includes not just the cost of the fuel itself, but also freight charges, insurance, customs duty and port charges

* EPP is what somebody actually exporting the product would get

3. NOW ADD AD VALOREM TAX

This method of calculating the price to be paid to refiners means that whenever international oil prices rise (or customs duty on their products increase), they get a windfall. That’s because customs is an ‘ad valorem’ rate, or a percentage of the basic value, unlike a ‘specific’ duty, which would remain fixed irrespective of basic price. Since customs duty is 2.5% of the imported price, it goes up in absolute terms as the basic price does. So, at $100 per barrel, the duty on a barrel of petrol would be $2.5, at $200 per barrel it would be $5. Indian refiners would get this benefit without incurring the duty itself! This partly explains why they have actually become more profitable at a time when their raw material (crude oil) is becoming more expensive. Between 2015-16 and 2017-18, the average price of the crude India buys went from $46/barrel to $48/barrel and then $56/barrel. But check out what happened to the bottomlines of our two biggest refiners, state-owned Indian Oil and private sector giant Reliance Industries...

4. GOVT, TOO, MAKES A KILLING

Of course, the government also gained in terms of taxes over the last three years. To a small extent, this was because the amount it collects as customs duty goes up as the import price does. But customs duty accounted for a tiny part of the increased tax collections from petroleum. The bulk really came in the form of excise duty.

In January 2016 alone, govt hiked basic excise duty thrice. Taken with the Rs 6/litre additional excise duty (now replaced by a Rs 8/litre road and infrastructure cess), total excise duties reached close to Rs 17 per litre for petrol and Rs 19 per litre for diesel. This fuelled tax collections.

The govt gained in three other ways

➤ Higher profits for oil refiners meant higher tax on the profits

➤ Higher profits for state-owned refiners meant more dividend for government, their main shareholder

➤ Higher dividends distributed by public and private refiners meant more dividend distribution tax. All of these rose in the last three years

WHAT THE GOVT HAS TO SAY ABOUT THIS

The pricing issue was examined by a committee under C Rangarajan in 2006 after the cost-plus formula was done away with and petrol-diesel prices were deregulated in April 2002. The idea was to align domestic and international prices. India has to import 80% of raw material (crude oil), so export parity could not be an option. That’s why an 80:20 trade parity pricing was implemented in line with Rangarajan report. Customs on products is 2.5% but this is applicable only on 80% of the output, effectively making it 2%.

There are several taxes on domestic crude such as National Calamity Duty, VAT and state entry tax. These are absorbed by the refiners. So after adjusting these, the effective customs duty is minuscule. No state-run refiner exports products, barring in exceptional circumstances.Private refiners do. But they don’t use domestic crude and import oil at landed cost basis. Customs on the product thus ensures level field when private refiners sell products in the domestic market. Landed cost is a transparent way to arrive at pricing. Otherwise, it will have to be a cost-plus formula, which is opaque.

YR Raghavan

Reply all

Reply to author

Forward

0 new messages