Premium Tax Credit

6 views

Skip to first unread message

scott jessup

Mar 22, 2023, 10:18:29 AM3/22/23

to via ClientWhysConnect

My client’s 2022 return was rejected because of health insurance market place despite being fully employed since mid 2021 with health insurance coverage (have 1095B for proof). Does he need to paper file?

Thanks

Scott

Sent from my iPhone

Thanks

Scott

Sent from my iPhone

Karen Klimkosky Lee

Mar 22, 2023, 11:47:01 AM3/22/23

to clientwh...@googlegroups.com

Ask your software provider.

> On Mar 22, 2023, at 7:18 AM, 'scott jessup' via ClientWhysConnect <clientwh...@googlegroups.com> wrote:

>

> My client’s 2022 return was rejected because of health insurance market place despite being fully employed since mid 2021 with health insurance coverage (have 1095B for proof). Does he need to paper file?

> You are subscribed to the ClientWhysConnect group.

> Post Address: clientwh...@googlegroups.com

> Unsubscribe Address: clientwhysconn...@googlegroups.com

> For more options, visit this group at

> http://groups.google.com/group/clientwhysconnect?hl=en?hl=en

>

> Disclaimer --- You use the information shared on ClientWhysConnect.com at your own risk. The information is based upon unsubstantiated member opinions and if you have concerns about the validity of the information you should research the issue thoroughly yourself and arrive at your own conclusions. We will never share any of the information you’ve provided to the ClientWhysConnect.com list with anyone.

> ---

> You received this message because you are subscribed to the Google Groups "ClientWhysConnect" group.

> To unsubscribe from this group and stop receiving emails from it, send an email to clientwhysconn...@googlegroups.com.

> To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/6ADAA02A-A32D-4010-8ED1-A90C24468090%40yahoo.com.

> On Mar 22, 2023, at 7:18 AM, 'scott jessup' via ClientWhysConnect <clientwh...@googlegroups.com> wrote:

>

> My client’s 2022 return was rejected because of health insurance market place despite being fully employed since mid 2021 with health insurance coverage (have 1095B for proof). Does he need to paper file?

> Thanks

> Scott

>

> Sent from my iPhone

>

> --

> Scott

>

> Sent from my iPhone

>

> You are subscribed to the ClientWhysConnect group.

> Post Address: clientwh...@googlegroups.com

> Unsubscribe Address: clientwhysconn...@googlegroups.com

> For more options, visit this group at

> http://groups.google.com/group/clientwhysconnect?hl=en?hl=en

>

> Disclaimer --- You use the information shared on ClientWhysConnect.com at your own risk. The information is based upon unsubstantiated member opinions and if you have concerns about the validity of the information you should research the issue thoroughly yourself and arrive at your own conclusions. We will never share any of the information you’ve provided to the ClientWhysConnect.com list with anyone.

> ---

> You received this message because you are subscribed to the Google Groups "ClientWhysConnect" group.

> To unsubscribe from this group and stop receiving emails from it, send an email to clientwhysconn...@googlegroups.com.

> To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/6ADAA02A-A32D-4010-8ED1-A90C24468090%40yahoo.com.

millerdbm

Mar 22, 2023, 3:03:49 PM3/22/23

to clientwh...@googlegroups.com

Had the same problem last year. Finally found out that the dependent older son was on Covered California for three months and dad wasn't told.

Sent with Proton Mail secure email.

------- Original Message -------

Sent with Proton Mail secure email.

------- Original Message -------

scott jessup

Mar 23, 2023, 8:21:34 PM3/23/23

to clientwh...@googlegroups.com

In 1969, Ray Charles recorded a song with the line, “if wasn’t for bad luck I’d have no luck at all.”

It turns out my client did not cancel his Covered California in 2021 so for 2022 he had workplace coverage and marketplace coverage. He now owes repayment of the premium advance. Any recommendations I can give my client?

Thanks

Scott

Sent from my iPhone

> On Mar 22, 2023, at 12:03 PM, 'millerdbm' via ClientWhysConnect <clientwh...@googlegroups.com> wrote:

>

> Had the same problem last year. Finally found out that the dependent older son was on Covered California for three months and dad wasn't told.

> To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/UjQombukfvHSjh9KiQqrDzxTJ8Vuca2cUxWBdgtYbjbsAvr9Yn-DjtKiadi5aKxF53Ji3fjoaNLUIy75ZdhUblgT6VZ4kRmPqbVIBj2f6vU%3D%40protonmail.com.

It turns out my client did not cancel his Covered California in 2021 so for 2022 he had workplace coverage and marketplace coverage. He now owes repayment of the premium advance. Any recommendations I can give my client?

Thanks

Scott

Sent from my iPhone

>

> Had the same problem last year. Finally found out that the dependent older son was on Covered California for three months and dad wasn't told.

Lee Reams

Mar 23, 2023, 8:26:39 PM3/23/23

to clientwh...@googlegroups.com

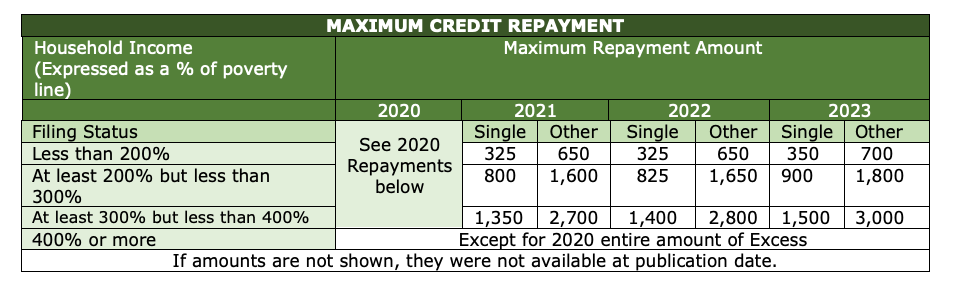

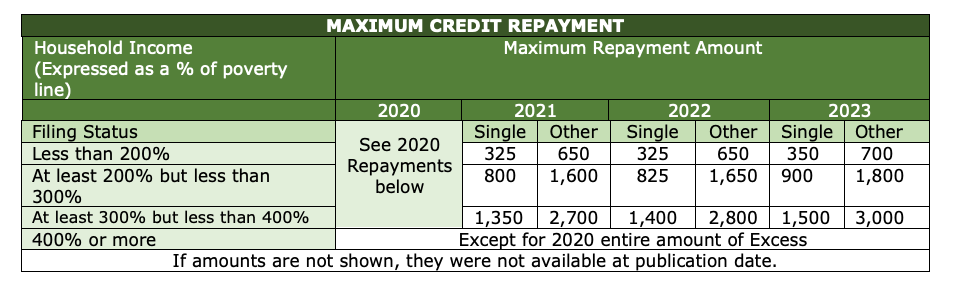

There is a maximum repayment amount for lower income taxpayers. Not sure if that will do client any good

.

To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/CD5121E2-D938-438B-A2A4-C14359393421%40yahoo.com.

|

| ||||||||||||

| |||||||||||||

scott jessup

Mar 23, 2023, 11:18:15 PM3/23/23

to clientwh...@googlegroups.com

No. Client makes $100k per year.

Sent from my iPhone

On Mar 23, 2023, at 5:26 PM, Lee Reams <lee....@clientwhys.com> wrote:

There is a maximum repayment amount for lower income taxpayers. Not sure if that will do client any good

<PastedGraphic-2.tiff>

Lee Reams Sr., BSME, EA Chief Content Officer CountingWorks Pro | CountingWorks | TaxBuzz | TaxCPE p: 1.800.442.2477 x240 w: www.countingworkspro.com/ e: lee....@countingworks.com

See how CountingWorks can grow your practice.

--

You are subscribed to the ClientWhysConnect group.

Post Address: clientwh...@googlegroups.com

Unsubscribe Address: clientwhysconn...@googlegroups.com

For more options, visit this group at

http://groups.google.com/group/clientwhysconnect?hl=en?hl=en

Disclaimer --- You use the information shared on ClientWhysConnect.com at your own risk. The information is based upon unsubstantiated member opinions and if you have concerns about the validity of the information you should research the issue thoroughly yourself and arrive at your own conclusions. We will never share any of the information you’ve provided to the ClientWhysConnect.com list with anyone.

---

You received this message because you are subscribed to the Google Groups "ClientWhysConnect" group.

To unsubscribe from this group and stop receiving emails from it, send an email to clientwhysconn...@googlegroups.com.

To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/5EC9246B-6EF7-4294-AC5F-42FA24C26CAB%40clientwhys.com.

ho...@mktaxpros.com

Mar 28, 2023, 6:58:43 PM3/28/23

to clientwh...@googlegroups.com

Hi Scott,

Is your client the only person listed on the 1095-A? If there is someone else on the 1095-A and they belong to a separate tax household (i.e. a kid that is no longer eligible to be a dependent), allocation between the 2 tax returns is an option.

Also for 2021, if your client had any unemployment, he would be eligible for the full subsidy.

Best of luck!

Holly

Holly Swanson

Martin, Ketterling & Associates

2299 E. Main St. Suite 8, Ventura, CA 93001

Phone (805) 653-7362

Fax (805) 653-1991

To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/DC8D9585-C1AC-4D45-8B2E-FF85CCB566DD%40yahoo.com.

scott jessup

Mar 28, 2023, 9:06:53 PM3/28/23

to clientwh...@googlegroups.com

Holly, My client is the only one and filed a dispute with Covered California

Sent from my iPhone

On Mar 28, 2023, at 3:58 PM, ho...@mktaxpros.com wrote:

To view this discussion on the web visit https://groups.google.com/d/msgid/clientwhysconnect/009201d961c8%24d6eadd10%2484c09730%24%40mktaxpros.com.

Reply all

Reply to author

Forward

0 new messages