Online transactions now even safer

1 view

Skip to first unread message

Chawanni Advice

Feb 26, 2009, 12:44:25 AM2/26/09

to chaw...@googlegroups.com

Traditionally, to transact with a credit card ( either online or over

the phone ) all the info required for processing the payment is present

on the card.

The info that is usually needed for transacting is:

1. The 16-digit card number

2. Expiry date of the card

3. The CVV ( Credit Verfification Value ) found on the back of the card

4. The card holder's name

Since, all this info is present on the card, the customers always had security concerns related to credit card usage online. To address customers' security concerns Visa and MasterCard came up with initiatives like Verified by Visa and MasterCard SecureCode. Basically both of them worked on the same principle.A separate password, apart from the info already found on the card is required to complete a credit card transaction.

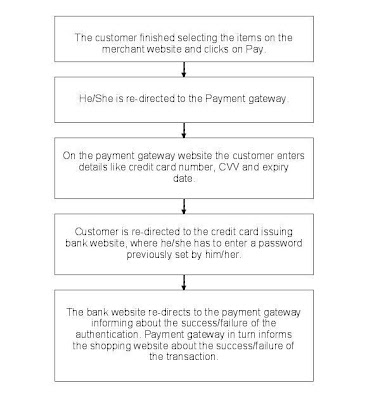

The diagram attached will help you understand the "Verified by Visa" or "MasterCard SecureCode" better.

But there are 2 limitations to "Verified by Visa" or "MasterCard SecureCode" which might have hampered its popularity in India.

1. The merchant ( i.e. merchant's payment gateway ) must support these features.

2. Also, the credit card issuing bank must support these security features. Although most large private banks ( like ICICI, HDFC ) support these security features, most of the PSU Banks still do not support "Verified by Visa" or "MasterCard SecureCode" for online transactions.

If either the payment gateway or the bank does not support them, the customer cannot use "Verified by Visa" or "MasterCard SecureCode" for online transactions.

Now RBI has made such authentication, based on info not found on the card( i.e. with a separate password ), mandatory for all online transactions. Also it is mandatory to send SMS and online alerts for online transactions exceeding Rs. 5000. What this means is that all payment gateways and card-issuing banks will have to support authentication by a separate password. Please note that these regulations are applicable only from August 2009.

As per this report, RBI is also working on security features to be employed for credit card transactions over the telephone. These regulations will go a long way in ensuring the safety of your online & IVR transactions. Thanks, RBI.

The original article can be found here:

http://chawanni.blogspot.com/2009/02/online-transactions-now-even-safer.html

The info that is usually needed for transacting is:

1. The 16-digit card number

2. Expiry date of the card

3. The CVV ( Credit Verfification Value ) found on the back of the card

4. The card holder's name

Since, all this info is present on the card, the customers always had security concerns related to credit card usage online. To address customers' security concerns Visa and MasterCard came up with initiatives like Verified by Visa and MasterCard SecureCode. Basically both of them worked on the same principle.A separate password, apart from the info already found on the card is required to complete a credit card transaction.

The diagram attached will help you understand the "Verified by Visa" or "MasterCard SecureCode" better.

But there are 2 limitations to "Verified by Visa" or "MasterCard SecureCode" which might have hampered its popularity in India.

1. The merchant ( i.e. merchant's payment gateway ) must support these features.

2. Also, the credit card issuing bank must support these security features. Although most large private banks ( like ICICI, HDFC ) support these security features, most of the PSU Banks still do not support "Verified by Visa" or "MasterCard SecureCode" for online transactions.

If either the payment gateway or the bank does not support them, the customer cannot use "Verified by Visa" or "MasterCard SecureCode" for online transactions.

Now RBI has made such authentication, based on info not found on the card( i.e. with a separate password ), mandatory for all online transactions. Also it is mandatory to send SMS and online alerts for online transactions exceeding Rs. 5000. What this means is that all payment gateways and card-issuing banks will have to support authentication by a separate password. Please note that these regulations are applicable only from August 2009.

As per this report, RBI is also working on security features to be employed for credit card transactions over the telephone. These regulations will go a long way in ensuring the safety of your online & IVR transactions. Thanks, RBI.

The original article can be found here:

http://chawanni.blogspot.com/2009/02/online-transactions-now-even-safer.html

Reply all

Reply to author

Forward

0 new messages