Monetary Policy Week in Review - 11 February 2012

4 views

Skip to first unread message

Central Bank News

Feb 10, 2012, 4:02:37 PM2/10/12

to central...@googlegroups.com

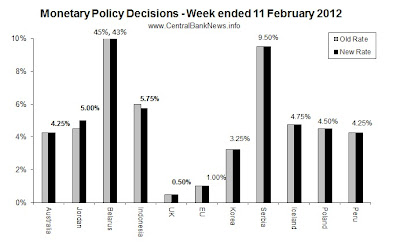

The past week in monetary policy saw just one bank lift rates; Jordan +50bps to 5.00%, and two banks cut rates; Belarus -200bps to 43.00%, and Indonesia -25bps to 5.75%. Meanwhile the banks that held rates unchanged were: Australia 4.25%, UK 0.50%, EU 1.00%, South Korea 3.25%, Serbia 9.50%, Iceland 4.75%, Poland 4.50%, and Peru 4.25%. Also making news was the Bank of England adding another GBP 50 billion to its quantitative easing program.

Some of the key quotes and comments from the central bankers that announced monetary policy decisions are listed below:

- Reserve Bank of Australia (held rate at 4.25%): "At today's meeting, the Board noted that interest rates for borrowers have declined to be close to their medium-term average, as a result of the actions at the Board's previous two meetings. With growth expected to be close to trend and inflation close to target, the Board judged that the setting of monetary policy was appropriate for the moment. Should demand conditions weaken materially, the inflation outlook would provide scope for easier monetary policy."

- Bank Indonesia (dropped rate 25bps to 5.75%): "This decision was made as a further step to boost Indonesia's economic growth amidst decreasing performance of the global economy, with the priority remains on achieving inflation target and exchange rate stability."

- Bank of England (held rate at 0.50%, added 50B to APP): "In the light of its most recent economic projections, the Committee judged that the weak near-term growth outlook and associated downward pressure from economic slack meant that, without further monetary stimulus, it was more likely than not that inflation would undershoot the 2% target in the medium term."

- European Central Bank (held rate at 1.00%): "Inflation is likely to stay above 2% for several months to come, before declining to below 2%. Available survey indicators confirm some tentative signs of a stabilisation in economic activity at a low level around the turn of the year, but the economic outlook remains subject to high uncertainty and downside risks.... A very thorough analysis of all incoming data and developments over the period ahead is warranted."

- Bank of Korea (held rate at 3.25%): "In Korea, economic growth has slowed, with domestic demand subdued overall and exports also decreasing. On the employment front, however, the uptrend in the number of persons employed is being sustained, led by the private sector. The Committee anticipates that the domestic economic growth rate will gradually return to its long-term trend level going forward, although viewing downside risks as likely to remain high for some time due mostly to the impact of external risk factors."

- Central Reserve Bank of Peru (held rate at 4.25%): "Some current and advanced indicators of activity show a moderation of growth in the economy. For example, even though sales of electricity continued to grow in January, they showed a lower pace of growth than in December. Moreover, indicators of global economic activity have shown a better-than-expected evolution, but uncertainty in international financial markets persists and growth in 2012 is expected to be lower than in the previous year."

- National Bank of Serbia (held rate at 9.50%): "The key risks to inflation projection stem from the international environment due to the still unresolved crisis in the euro area, as well as from fiscal policy at home. Keeping the budget deficit within the framework earlier agreed with the IMF would serve as an additional safeguard of macroeconomic stability and leave more scope for future relaxation of monetary policy."

Looking at the central bank calendar, the two main monetary policy meetings are the Bank of Japan and Sweden's central bank. Elsewhere the US Federal Reserve will release the minutes from its most recent FOMC meeting (Wednesday), and the European Central Bank will release its monthly bulletin (Thursday), and the Bank of England is scheduled to release its inflation report (Wednesday).

- JPY - Japan (Bank of Japan) expected to hold at 0.10% on the 14th of Feb

- SEK - Sweden (Riksbank) expected to hold at 1.75% on the 15th of Feb

Source: www.CentralBankNews.info

Reply all

Reply to author

Forward

0 new messages