January 25, 2011 Bob Brinker's Warns About Muni-Bonds But Brinker Tax-Exempt Porfolio is Losing Money

15 views

Skip to first unread message

honeybee

Jan 26, 2011, 4:31:44 PM1/26/11

to brinker-moneytalk-and-marketim...@googlegroups.com

January 26, 2011....On Moneytalk Sunday, Bob Brinker expressed very serious concerns about the future of the state, city and county muni-bond market. He offered evidence that congress is looking for a way to make it legal for states to go bankrupt, which would make it possible for bond debt to be restructured. (You can read some excerpts of what Brinker had to say about this topic in the January 23rd summary.)

(For the purpose of avoiding the identity confusion that results from both men being known by the same name, I will refer to the radio host as Bob Brinker#One. And I will refer to his son, the computer expert, as Bob Brinker#Two = BB#2. The Fixed Income Advisor co-editor is BB#2's wife, Lisa Brinker, who is a linguist.)

Bob Brinker's Marketimer does not have any tax-exempt bond funds, but according to the November 2011 issue, the newsletter that his son and daughter-in-law publish (BB#1 acts as consultant) has a "Tax-Exempt Portfolio." So the Brinker's subscribers are already suffering losses from tax-exempt bond funds.

In 2008, all of BB#2 and Lisa's model portfolios lost money. Since then, they have added a fund that contains stocks which has helped their performance over the past couple of years (Vanguard Wellesley Income Fund "VWINX" that is about 1/3 stocks.). Some might wonder how honest it is to claim your portfolios are fixed income while having them partially invested in stocks.

The following information and excerpts are from the November 2010 issue of Brinker Fixed Income Advisor which is available for free download on the website:

"Aggressive Portfolio seeks to maximize fixed income returns" -- Contains: Wellesley, FCVSX, LSBRX, RPIBX, VFIIX (10%), VWEHX (25%).

"Moderate Porfolio seeks higher fixed income returns" -- Contains: Wellesley, FCVSX, RPIBX, VFIIX (15%), VWEHX (25%), VIPSX, VFSTX.

"Conservative Portfolio invests in the safest investment vehicles. This portfolio is best suited for fixed income investors who wish to minimize risk." -- Contains: Wellesley, RPIBX, VCVSX, VFIIX (20%), VWEHX (15%), VIPSX, VFSTX.

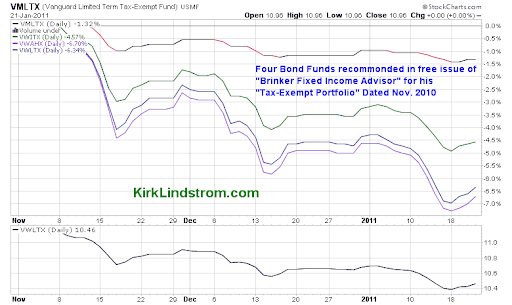

While Bob Brinker#1 is warning radio listeners about general obligation bonds, the Brinker Fixed Income Advisor Tax-Exempt Portfolio is losing money. Here is the Tax-Exempt Portfolio as of November 2011 (VMLTX, VWITX, VWAHX, VWLTX). Click to enlarge:

(For the purpose of avoiding the identity confusion that results from both men being known by the same name, I will refer to the radio host as Bob Brinker#One. And I will refer to his son, the computer expert, as Bob Brinker#Two = BB#2. The Fixed Income Advisor co-editor is BB#2's wife, Lisa Brinker, who is a linguist.)

Bob Brinker's Marketimer does not have any tax-exempt bond funds, but according to the November 2011 issue, the newsletter that his son and daughter-in-law publish (BB#1 acts as consultant) has a "Tax-Exempt Portfolio." So the Brinker's subscribers are already suffering losses from tax-exempt bond funds.

In 2008, all of BB#2 and Lisa's model portfolios lost money. Since then, they have added a fund that contains stocks which has helped their performance over the past couple of years (Vanguard Wellesley Income Fund "VWINX" that is about 1/3 stocks.). Some might wonder how honest it is to claim your portfolios are fixed income while having them partially invested in stocks.

The following information and excerpts are from the November 2010 issue of Brinker Fixed Income Advisor which is available for free download on the website:

"Aggressive Portfolio seeks to maximize fixed income returns" -- Contains: Wellesley, FCVSX, LSBRX, RPIBX, VFIIX (10%), VWEHX (25%).

"Moderate Porfolio seeks higher fixed income returns" -- Contains: Wellesley, FCVSX, RPIBX, VFIIX (15%), VWEHX (25%), VIPSX, VFSTX.

"Conservative Portfolio invests in the safest investment vehicles. This portfolio is best suited for fixed income investors who wish to minimize risk." -- Contains: Wellesley, RPIBX, VCVSX, VFIIX (20%), VWEHX (15%), VIPSX, VFSTX.

While Bob Brinker#1 is warning radio listeners about general obligation bonds, the Brinker Fixed Income Advisor Tax-Exempt Portfolio is losing money. Here is the Tax-Exempt Portfolio as of November 2011 (VMLTX, VWITX, VWAHX, VWLTX). Click to enlarge:

If you are interested in fixed income guidance, I suggest that you compare The Retirement Advisor to the Brinker Fixed Income Advisor. I think you will agree with me that The Retirement Advisor is greatly superior. While the Brinker's did not post their 2008 losing returns on their website, Kirk Lindstrom and David Korn have posted their returns every year.

honeybee

Jan 26, 2011, 4:34:51 PM1/26/11

to Bob Brinker Moneytalk and Marketimer discussions with The Beehive Buzz

To view charts and portfolio contained in this post, go to the "New

Google" link in right hand column.

> <https://lh4.googleusercontent.com/_Td9NhwukPQo/TUCSFbhKr1I/AAAAAAAAAE...>

>

> <https://lh4.googleusercontent.com/_Td9NhwukPQo/TUCScMeTegI/AAAAAAAAAE...>

>

> If you are interested in fixed income guidance, I suggest that you compareThe Retirement Advisor<http://david-korn.blogspot.com/>to the Brinker

> Fixed Income Adviso <http://www.fixedincomeadvisor.com/>r. I think you will

Google" link in right hand column.

>

> <https://lh4.googleusercontent.com/_Td9NhwukPQo/TUCScMeTegI/AAAAAAAAAE...>

>

> If you are interested in fixed income guidance, I suggest that you compareThe Retirement Advisor<http://david-korn.blogspot.com/>to the Brinker

> Fixed Income Adviso <http://www.fixedincomeadvisor.com/>r. I think you will

honeybee

Jan 27, 2011, 2:13:06 PM1/27/11

to Bob Brinker Moneytalk and Marketimer discussions with The Beehive Buzz

(My reply to a pack of lies posted elsewhere):

I don't think you have any friends, youknowhoo. You blew it long ago.

Personally, I wouldn't trust anything you say about anyone -- least of

all this person you call a "friend."

Apparently, you stalk her and keep files on her and when the truth

doesn't work for you, you just lie.

BTW, talking about not being too smart:

I know this "trusted financial advisor" who is slamming general

obligations muni bonds every Sunday, while at the same time, the

worthless rag he "consults" for is losing money on a fund of muni

bonds.

You can't make this stuff up, NOONE would believe it.

Whoa Nellie - Katy Bar the Door!

> >http://honeysbobbrinkerbeehivebuzz2.blogspot.com/- Hide quoted text -

>

> - Show quoted text -

I don't think you have any friends, youknowhoo. You blew it long ago.

Personally, I wouldn't trust anything you say about anyone -- least of

all this person you call a "friend."

Apparently, you stalk her and keep files on her and when the truth

doesn't work for you, you just lie.

BTW, talking about not being too smart:

I know this "trusted financial advisor" who is slamming general

obligations muni bonds every Sunday, while at the same time, the

worthless rag he "consults" for is losing money on a fund of muni

bonds.

You can't make this stuff up, NOONE would believe it.

Whoa Nellie - Katy Bar the Door!

>

> - Show quoted text -

Reply all

Reply to author

Forward

0 new messages