Fwd: CENTRAL GOVERNMENT EMPLOYEES NEWS

G R Bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 9 Jan 2017 6:16 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

CENTRAL GOVERNMENT EMPLOYEES NEWS

DoPT launches revamped website

Posted: 08 Jan 2017 10:28 AM PST

DoPT launches revamped website"The Department of Personnel & Training is the coordinating agency of the Central Government in personnel matters, specially in respect of issues concerning recruitment, training, career development and staff welfare."The Department of Personnel & Training, under the Ministry of Personnel, Public Grievances and Pensions is the coordinating agency of the Central Government in personnel matters, specially in respect of issues concerning recruitment, training, career development and employees welfare. The 'DoPT', is known by almost all the Central Government employees. There is probably any employee who hasn’t seen its website.Among the DoPT’s important powers are the task of appointing officers of the Indian Administrative Services, laying down the terms and conditions of the duties of all officials and employees, and publishing the government orders that are issued from time to time.The transition of the DoPT website in the past few years has been remarkable. In addition to publishing the latest Government Orders every day. The growth of the website’s popularity can be gauged by the fact that the page hits have been steadily increasing.The DoPT website has now been relaunched with brand new features.FOUNDER OF 'CENTRAL GOVERNMENT EMPLOYEES NEWS' TITLE AND KEYWORD... "90PAISA" - No.1 BLOG FOR CENTRAL GOVT EMPLOYEES AND PENSIONERS...!

You are subscribed to email updates from CENTRAL GOVERNMENT EMPLOYEES NEWS.

To stop receiving these emails, you may unsubscribe now.Email delivery powered by Google Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 10 January 2017 18:16:44 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

- Pongal Holiday is not in the List of Compulsory Holidays 2017

- Pan or Form No 60 mandatory for all bank accounts – Submit to the bank by 28.2.2017

- Notice for the meeting of the NJCA

- 2nd Anomaly Committee Meeting to be held on 11.1.2017

- Admissibility of HRA in case of residing in Govt. Guest House / Transit Facility – CGDA Orders

- CBSE Class XII Date Sheet 2017 – Download pdf

- CBSE Class X Date Sheet 2017 – Download pdf

Pongal Holiday is not in the List of Compulsory Holidays 2017

Posted: 10 Jan 2017 03:54 AM PST

Pongal Holiday is not in the List of Compulsory Holidays 2017In Tamil Nadu, agitation Programme is being organised against the government decision of not including the Pongal Holiday in the list of Compulsory Holidays for the year 2017 for central government offices.It is quite a surprise that some Political parties and Tamil Media are telling that Central Government has removed the Pongal holidays from the List of Compulsory Holidays for the year 2017.Since 2009, there is no such order issued by DoPT (A Nodal Ministry for Central government employees) that includes Pongal festival in the List of Compulsory Holidays. The Orders for Central Government Holidays from the year 2009 are available in DOPT websiteThe Holiday for the Festivals which are celebrated in States shall be decided by the Central Government Employees Welfare Coordination Committee in the State Capitals, if necessary, in consultation with Coordination Committees at other places in the State from the list of restricted Holidays declared by central government. There are three such Holidays can be decided by State Coordination committees or Co Ordination committees in Departments for Central Governments offices functioning in States.Raed more at http://www.gservants.com/

Pan or Form No 60 mandatory for all bank accounts – Submit to the bank by 28.2.2017

Posted: 10 Jan 2017 03:52 AM PST

Pan or Form No 60 mandatory for all bank accounts – Submit to the bank by 28.2.2017

Press Information BureauGovernment of IndiaMinistry of Finance08-January-2017 18:17 IST

Income-tax Rules amended to provide that bank shall obtain and link PAN or Form No. 60 (where PAN is not available) in all existing bank accounts (other than BSBDA) by 28.02.2017.

Income-tax Rules have been amended to provide that bank shall obtain and link PAN or Form No. 60 (where PAN is not available) in all existing bank accounts (other than BSBDA) by 28.02.2017, if not already done. In this connection, it may be mentioned that RBI vide circular dated 15.12.2016 has mandated that no withdrawal shall be allowed from the accounts having substantial credit balance/deposits if PAN or Form No.60 is not provided in respect of such accounts. Therefore, persons who are having bank account but have not submitted PAN or Form No.60 are advised to submit the PAN or Form No. 60 to the bank by 28.2.2017.

The banks and post offices have also been mandated to submit information in respect of cash deposits from 1.4.2016 to 8.11.2016 in accounts where the cash deposits during the period 9.11.2016 to 30.12.2016 exceeds the specified limits.

It has also been provided that person who is required to obtain PAN or Form No.60 shall record the PAN/Form.No.60 in all the documents and quote the same in all the reports submitted to the Income-tax Department.

The notification amending the relevant rules is available on the official website of the Income-tax Department i.e. www.incometaxindia.gov.in

Notice for the meeting of the NJCA

Posted: 10 Jan 2017 03:51 AM PST

Notice for the meeting of the NJCANJCANational Joint Council of Action4, State Entry Road, New Delhi – 110055No.NJCA/2017Dated: January 6, 2017All Constituents of NJCADear Comrades!Sub: Notice for the meeting of the NJCATo review the situation and consider the developments and taking appropriate decision, the National Joint Council of Action will meet on 17th January, 2017 at 16.00 hrs, in JCM Office, 13-C, Ferozshah Road, New Delhi.You are requested to make it convenient to attend the above cited meeting of the NJCA.With Frateranl Greetings!Comradely Yours,(Shiva Gopal Mishra)General SecretarySource: Confederation

2nd Anomaly Committee Meeting to be held on 11.1.2017

Posted: 10 Jan 2017 03:49 AM PST

Second Meeting of the Anomaly Committee on the calculation methodology of the Disability Pension for Defence forces personnel as per the recommendations of the 7th Central Pay CommissionIMMEDIATEMEETING NOTICEF.No.11/2/2016-JCA(Pt)Government of IndiaMinistry of Personnel, PG & Pensions

Admissibility of HRA in case of residing in Govt. Guest House / Transit Facility – CGDA Orders

Posted: 10 Jan 2017 03:46 AM PST

Admissibility of HRA in case of residing in Govt. Guest House / Transit Facility – CGDA OrdersCONTROLLER GENERAL OF DEFENCE ACCOUNTSULAN BATAR ROAD, PALAM, DELHI CANIT-10No.AN/XII/18001/1/GHDated: 5th Jan 2017ToAll PCDA,CDA, PCA (FYS) KolkataSubject: Admissibility of HRA in case of residing in Govt. Guest House / Transit FacilityReference: HQrs Office Important Circulars Xo.AX/XVIII/1/18001/GH dated 21.11.200 and AN/XIV/14153/III/HRA/CCA/Vol.-X dated 18.03.2011Comprehensive guidelines have been issued on the subject vide HQrs Office Important Circular dated 21.11.2000, to regulate the stay of officials at Guest Houses/transit accommodations. Further, HQrs Office Circular dated 18.03.2011 clearly stipulates that those occupying Government accommodation are not eligible for HRA and that the officers staying in the Inspection Quarters/Bungalow etc. in the Headquarters of their posting will not be entitled to draw HRA for the penod during which they stay in the Inspection Quarters/Bungalow etc.2. Despite this, HQrs office is in receipt of reference from PCDA/CDA asking for clarification on the subject matter.3. It is therefore, reiterated that those residing in Government accommodation be it Inspection Quarter or Transit Facility or Guest House shall not be granted HRA as stipulated vide GOI, Ministry of Communications, in consultation with Ministry of Finance, vide their letter No.14-4/85-NB dated 26.11.1985. Action may be taken accordingly.(Mustaq Ahmad)Dy. CGDA (Admin)Authority: www.cgda.nic.in

This posting includes an audio/video/photo media file: Download Now

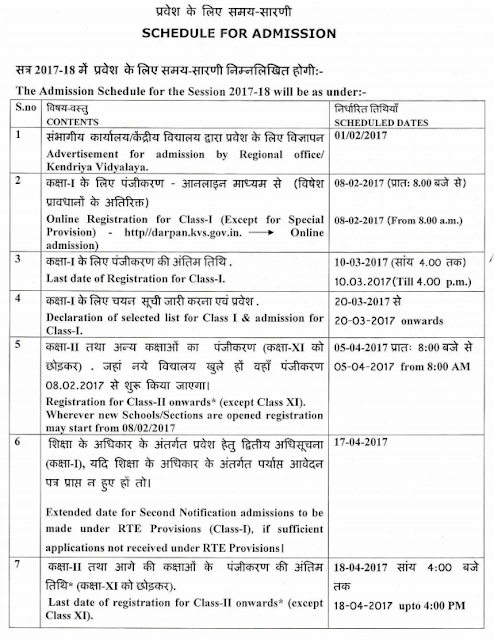

CBSE Class XII Date Sheet 2017 – Download pdf

Posted: 10 Jan 2017 03:44 AM PST

CBSE Class XII Date Sheet 2017 – Download pdfCENTRAL BOARD OF SECONDARY EDUCATIONSENIOR SCHOOL CERTIFICATE EXAMINATION 2017(CLASS XII)DATE SHEET

This posting includes an audio/video/photo media file: Download Now

CBSE Class X Date Sheet 2017 – Download pdf

Posted: 10 Jan 2017 03:43 AM PST

CBSE Class X Date Sheet 2017 – Download pdfCENTRAL BOARD OF SECONDARY EDUCATIONSENIOR SCHOOL CERTIFICATE EXAMINATION 2017(CLASS X)DATE SHEET

This posting includes an audio/video/photo media file: Download Now

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 8 January 2017 18:17:56 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

Demonetization versus Seventh Pay Commission: Tax-paying government servants among the worst hit!

Posted: 07 Jan 2017 08:28 AM PST

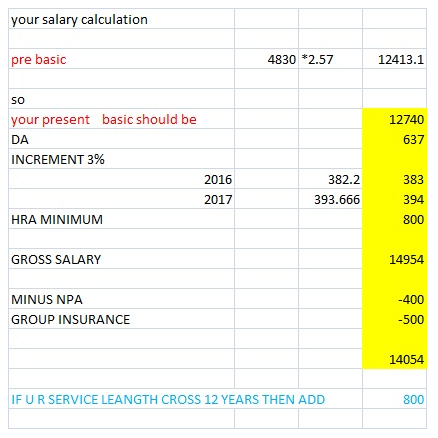

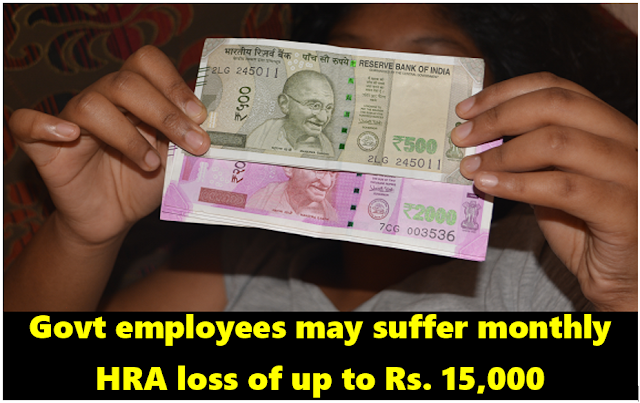

Demonetization Vs 7th Pay Commission: Tax-paying government servants among the worst hit!“Government employees, who pay regular taxes for up to the last Rupee that they earn as salaries and bonuses, are the ones who were most affected – directly and indirectly – by demonetization.”As part of its proclaimed drive to eradicate black money, counterfeit notes, and terrorism, the Government, on November 8, announced the abolishing of Rs. 500 and 1000 notes. The acute shortage of cash, that began on November 9, continues until this day. The masses are faced with hardship in one form or the other – medical expenses, marriages, house construction, outstation and foreign travels, celebrations, last rites, school fees, and everyday expenses… An advance of Rs. 10,000 as cash was given from the salary for the month of November only.News sources claim that the Ministry of Finance and officials of all departments are working hard to streamline the announcement and handle its after effects.The Central Government, which has implemented only the hike in the basic pay, as recommended by the Seventh Pay Commission and has been giving it with effect from January 1, 2016 onwards and has constituted a high-level special committee under the chairmanship of Finance Secretary Ashok Lavasa, to look into the recommendations regarding various allowances.The meeting of the high-level committee must be constituted in order to decide on important allowances being given to the Central Government employees, including House Rent Allowance. Although sources claim that seven such meetings had been held until now, no decision has been reached yet.The Seventh Pay Commission had compiled its entire report within 18 months. Four months have passed, but the committee has not been able to make its mind up about one aspect of it, the allowances. This has caused tremendous irritation and frustration among Central Government employees.Confusions and hurdles continue to plague in constituting the meeting of the high-level committee, which must decide on the issue of allowances to the Railways, Postal, defence, and armed forces. This can be deduced from the recent letter that the Secretary of National Council (JCM) had written to the Central Government. The most recent high-level committee meeting with the NC JCM Staff Side was held on September 1, last year.The Seventh Pay Commission had listed 196 kinds of allowances (51 allowances have been recommended to delete from the list). It must be mentioned here that, of these, the committee was constituted to look into all the allowances, except the dearness allowance. No decisions have been made yet on any of the allowances. In fact, there is no official information on the next meeting date.

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 6 January 2017 18:26:54 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

Reply-To: CENTRAL GOVERNMENT EMPLOYEES NEWS <ushanan...@gmail.com>

CG Staff are not yet given the full Benefit of 7th CPC Recommendation

Posted: 05 Jan 2017 09:17 AM PST

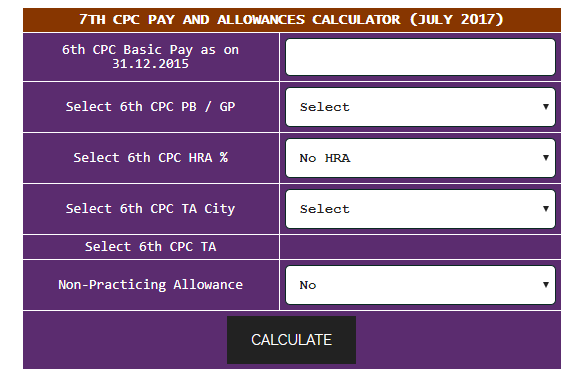

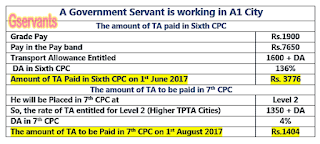

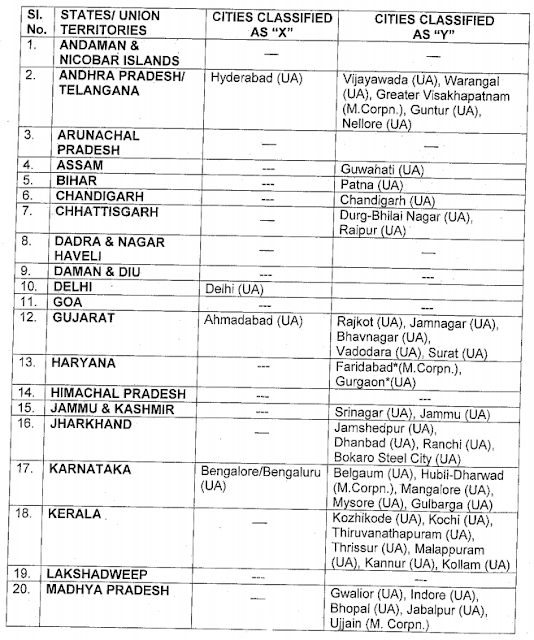

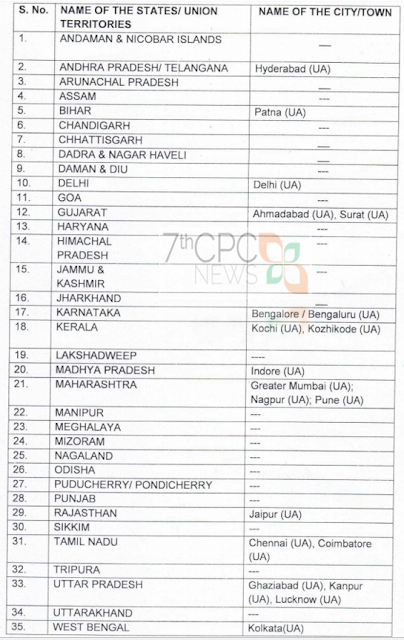

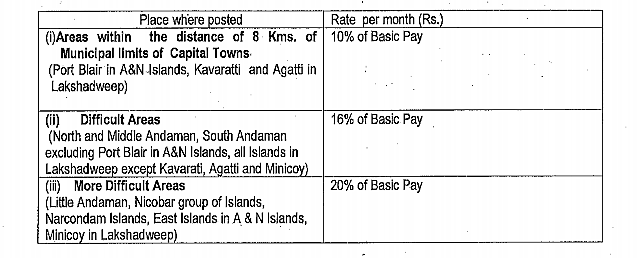

The CG Staff are not yet given the full Benefit of 7th CPC RecommendationThe actual increase on account of implementation of 7th CPC recommendation is still not fully available to Central govt Staffs.The recommendation of 7th Pay Commission has been implemented with effect from 1.1.2016 and the revised salary is being paid from this effective date. The Central Government, after implementing the Pay Panel report, hasn’t announce any decision about Allowances even after 12 months, created frustration among central government employees.The Pay Commission is constituted once in Ten Years to revise the Pay and Allowances and Pension for Govt Servants and Pensioners. Accordingly, the 7th Pay Commission was formed and it submitted its report to the Government on 19-11-2015. The Government Accepted the Report without any major changes and announced on 29.6.2016 that it would be implemented with effect from 1.1.2016.Since the increase in salary which is paid from 1.1.2016 was very less, it has demolished the expectations of CG Staffs.Very important aspect in revising Pay and Allowance is House Rent Allowance. The rates of HRA is determined based on the Population of the Cities in which the Govt Servants are working. Accordingly, 10,20 and 30% of Basic Pay is paid as HRA in Sixth CPC. The 7th CPC has recommended to revise it as 8%, 16% and 24%.

G R Bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 16 Jan 2017 6:17 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

- 7th Pay Commission Pay Revision for Autonomous bodies – Finmin issued orders

- FAQ on Central Staffing Scheme

- 88 percent of pension accounts have been linked to Aadhaar: Dr Jitendra Singh

- Option 1 for 7th CPC Pension is Mercilessly Rejected – Confederation

- Extension CGHS facilities to P&T pensioners

|

7th Pay Commission Pay Revision for Autonomous bodies – Finmin issued orders Posted: 15 Jan 2017 11:33 PM PST

7th Pay Commission Pay Revision for Autonomous bodies – Finmin Orders

AUTONOMOUS BODY’S PAY REVISION ORDERS ISSUED

Pay revision of employees of Quasi-Government Organizations, Autonomous Organizations, Statutory Bodies etc. set up by and funded/controlled by the Central Government – Guidelines

F.No.1/1/2016-E.III(A) |

Government of India

Ministry of Finance

|

Department of Expenditure

New Delhi, 13th January, 2017

Office Memorandum

Subject: Pay revision of employees of Quasi-Government Organizations, Autonomous Organizations, Statutory Bodies etc. set up by and funded/controlled by the Central Government – Guidelines

The employees working in the Quasi-government Organizations, Autonomous Organizations, Statutory Bodies etc. set up and funded/controlled by the Central Government, are not Central Government employees and, therefore, the benefits implemented by Central Government in respect of Central Government employees as part of their service conditions, are not directly applicable to the employees working in such autonomous organizations. The application of such benefits as given to Central Government employees in respect of employees of such autonomous organizations as well as the manner and conditions governing such application, including sharing of the additional financial implications arising thereon, requires specific approval of the Central Government. The autonomous organizations are expected to manage their affairs in such a fashion that their dependence on Central Government for financial support to meet the extra financial implications is minimal, as such autonomous organizations are expected to be financially Self-sufficient So as not to cause any extra burden on the Central Exchequer.

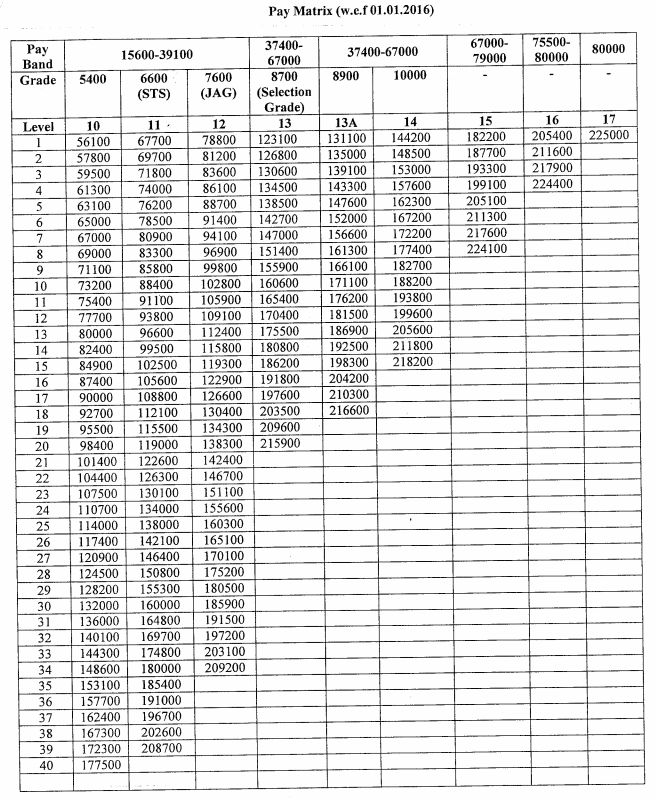

2. In the above background, the question of extension of the revised pay scales in terms of the CCS (RP) Rules, 2016 as notified on 25.7.2016 in respect of Central Government employees based on the recommendations of the 7th Central Pay Commission, to the employees of the Quasi-government Organizations, Autonomous Organizations, Statutory Bodies, etc., Set up and funded/controlled by the Central Government, where pattern of emolument structure, i.e. pay scales and allowances, in particular Dearness Allowance, House Rent Allowance and Transport Allowance, are identical to those in case of the Central Government employees, has been considered by the Government and it has been decided that the revised pay scales as per the Pay Matrix, as contained in Part-A of the Schedule of the CCS(RP) Rules, 2016 as well as the principle of pay fixation as contained in the said rules, may be extended to the employees of such organizations, subject to the following stipulations:-

(i) The conditions of service of employees of these organizations, especially those relating to hours of work, payment of OTA etc. are exactly Similar to those in Case of the Central Government employees.

(ii) The revised pay structure shall be admissible to those employees who opt for the same in accordance with the extant Rules.

(iii) Deductions on account of Provident Fund, Contributory Provident Fund or National Pension System, as may be applicable, will have to be made on the basis of the revised pay w.e.f. the date an employee opts to elect the revised pay structure.

3. The revised pay scales contained in Parts B & part C of the Schedule of the CCS(RP) Rules, 2016, shall not be automatically applicable to the employees Of Autonomous Organizations. The concerned Administrative Ministry shall consider such cases keeping in view whether these pay scales are justified for the category of staff of Autonomous Organizations based on functional considerations, recruitment qualifications, as well as the applicable pre-revised pay scales. Based on such an examination by the concerned Administrative Ministry, appropriate proposals, if justified, would be submitted to the Ministry of Finance, Department of Expenditure, through their Integrated Finance.

4. In case of those categories of employees whose pattern of emoluments structure, i.e., pay scales and allowances and conditions of service are not similar to those of the Central Government employees, a separate ‘Group of Officers’ in respect of each of the Autonomous Bodies may be constituted in the respective Ministry/Department. The Financial Adviser of the respective Ministry/Department will represent the Ministry of Finance on this Group. The Group would examine the proposals for revision of pay scales etc. taking into account the views, if any, expressed by the Staff representatives of the concerned organizations. It would be necessary to ensure that the final package of benefits proposed to be extended to the employees of these Autonomous Organizations etc. is not more beneficial than that admissible to the corresponding categories of the Central Government employees. The final package recommended by the ‘Group of Officers’ will require the concurrence of the Ministry of Finance.

5. In regard to the additional financial impact arising out of the implementation of the revised pay Scales, as provided above, the following parameters shall be kept in view:-

(i) In respect of those Autonomous Organizations, which have not been depending upon the Government Grants for their operations or for meeting the cost of salary, including those autonomous organisations which are in a position to meet the additional financial impact from their Own internal resources, the additional financial impact shall be met by the concerned autonomous organizations without any financial support whatsoever from the Government, No financial Support shall be given by the Central Government in Such cases.

(ii) In respect of the other Autonomous Organizations. which are not in a position to meet the additional financial impact, either fully or partly, on account Of the implementation of the revised pay scales, the concerned autonomous organization will take up the proposals with the Advisers of the respective Administrative Financial Ministry/Department, bringing out the extent to which the additional cost could be met internally, the shortfall to be made up and the reasons for the shortfall. While giving concurrence to the implementation of the revised pay scales, the Financial Advisers shall ensure that the extent of Government support is kept at the minimum, and in no case the Government support shall be more than 70% (seventy percent) of the additional financial impact.

(iii) In respect of Autonomous organisations set up under a specific Act of Parliament, not generating adequate internal resources to meet the additional financial impact, the extent of Government support may be more than 70% of the additional impact, provided in the opinion of the concerned Financial Adviser the nature of functions and the fund position of the organisations so warrant.

(iv) The mode of payment of arrears, as laid down in Rule 14 of the CCS(RP) Rules, 2016 shall be followed, subject to the overall financial impact and the capacity of the concerned autonomous organization to absorb the cost without putting any avoidable burden on the Governments finances, provided the conditions mentioned above are met.

6. The Central Government has not taken any decision so far in regard to various allowances based on the 7th Central Pay Commission in respect of Central Government employees and, therefore, until further orders the existing allowances in the autonomous organizations shall continue to be admissible as per the existing terms and conditions, irrespective of the revised pay Scales having been adopted.

(Amar Shth Singh)

Director

Authority: www.finmin.nic.in

|

This posting includes an audio/video/photo media file: Download Now |

|

FAQ on Central Staffing Scheme Posted: 15 Jan 2017 11:31 PM PST

FAQ on Central Staffing Scheme |

Department of Personnel & Training

|

Central Staffing Scheme 2016

Frequently Asked Questions

1. Who are eligible to apply for Central Staffing Scheme?

Officers from 36 participating services and fulfilling the eligibility conditions as given in the circular are eligible to apply.

2. If a particular Service is not listed in the Participating Services, can it be included?

No. The participating services are duly approved by Appointments Committee of Cabinet (ACC).

3. Whether this online application is also for Posts of Chief Vigilance Officers (CVOs).

No. the online application is only for Posts under Central Staffing Scheme.

4. How an IAS officer will apply for Central Staffing Scheme.

IAS officers will apply through IntraIAS Website (http://intraias.nic.in). For IntraIAS Portal an IAS Officer needs UserName and Password.

5. In case, if an IAS Officer is not having the Username / Password, how to get it?

The Officer needs to send an e-mail communication mandatorily with full particulars (Name, Cadre and Allotment Year) to ‘persin...@nic.in’. The username and password will be sent by reply e-mail.

6. IAS officer’s data are available in ER Sheet maintained by DOPT. Whether the officer needs to enter all those details again in the CSS online application.

No. All the information available in ER Sheet of the officer will be automatically populated in the application form. If the officer desires, the officer can modify the details in the online application form. It may be noted that editing of these data is permitted but it will not be automatically reflected in their respective ER Sheet.

7. Is it necessary for an officer to complete the application form at once?

No. Only the identity Number, Password and Password hint needs to be created in the first instance. With the identity number and password, the Personal, Qualification, Experience and Training details may be entered into the system at a later date and time. The details about the Identity No. will also be e-mailed to the e-mail id provided by the officer in the Personal details. Once the officer has completed entering all the details, the officer can finalise the application and take the print out. Once the application is finalized, it cannot be edited, only printout can be taken.

8. An Officer has applied for the Central Staffing Scheme for the Year 2010 and the officer was not retained / not selected. Does the officer need to apply again for the year 2011?

Yes, the officer needs to apply again.

9. Is there any User Manual available?

Yes. A document titled “Help to apply online” is available in the Website.

10. In case of Query or Suggestion whom to contact?

For rules related to Central Staffing Scheme / Status:

DS / Director Level: Director (MM), DOPT, North Block, New Delhi.

JS Level: Deputy Secretary(SM), DOPT, North Block, New Delhi.

Related to Software:

Senior Technical Director / Technical Director

NIC Computer Centre, DOPT, North Block, New Delhi.

E-Mail : persin...@nic.in

Authority: http://centralstaffing.gov.in/faq.pdf

|

|

88 percent of pension accounts have been linked to Aadhaar: Dr Jitendra Singh Posted: 15 Jan 2017 11:30 PM PST

88 percent of pension accounts have been linked to Aadhaar: Dr Jitendra Singh |

Press Information Bureau

Government of India

|

Ministry of Personnel, Public Grievances & Pensions

12-January-2017 18:15 IST

Dr. Jitendra Singh chairs 29th meeting of SCOVA

88 percent of pension accounts have been linked to Aadhaar: Dr Jitendra Singh

Make Pensioners part of nation building process, says Minister

The Union Minister of State (Independent Charge) for Development of North Eastern Region (DoNER), MoS PMO, Personnel, Public Grievances, Pensions, Atomic Energy and Space, Dr. Jitendra Singh chaired the 29th meeting of the Standing Committee of Voluntary Agencies (SCOVA) here today. The SCOVA meeting is organised by the Department of Pensions & Pensioners’ Welfare (DoP&PW), Ministry of Personnel, Public Grievances & Pensions and the last such meeting was held on June 27, 2016.

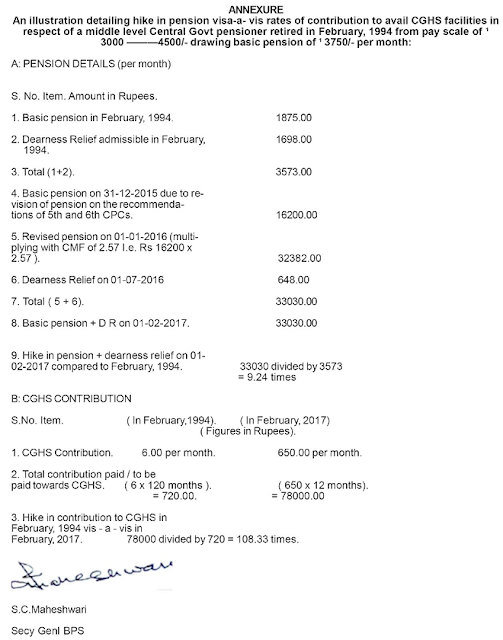

During the meeting, Dr. Jitendra Singh said that today’s interaction was very meaningful and stimulating, thus reflecting on the working of DoP&PW. The Minister said that there are about 50-55 lakh pensioners in the country and almost 88 percent of pension accounts have been seeded to Aadhaar. He further said that minimum pension has been increased to Rs. 9000 per person and ex-gratia amount has been increased from Rs. 10-15 lakh to Rs. 25-35 lakh.

Dr. Jitendra Singh said that we need to put in place an institutionalized mechanism to make good use of the knowledge, experience and efforts of the retired employees which can help in the value addition to the current scenario. Dr. Jitendra Singh said the retired employees are a healthy and productive workforce for India and we need to streamline and channelize their energies in a productive direction. We should learn from the pensioners’ experience, he added. The Minister also said that the DoP&PW should be reoriented in such a way that pensioners become a part of nation building process.

In the meeting, discussions were held on the action taken report of the 28th SCOVA meeting. Further many issues related to pensioners were discussed threadbare, such as revision of PPOs of pre-2006 pensioners, Health Insurance Scheme for pensioners including those residing in non-CGHS area, Special “Higher” Family Pension for widows of the war disabled invalidated out of service, Extension of CGHS facilities to P&T pensioners, issue relating to CGHS Wellness Centre, Dehradun etc. The Minister directed for the prompt and time bound redressal of the grievances of the pensioners and said that we should have sympathetic attitude towards them.

The Secretary, DoP&PW, Shri C. Viswanath and other senior officers of the department were also present on the occasion. The meeting was also attended by the member Pensioners Associations and senior officers of the important Ministries/Departments of Government of India.

|

|

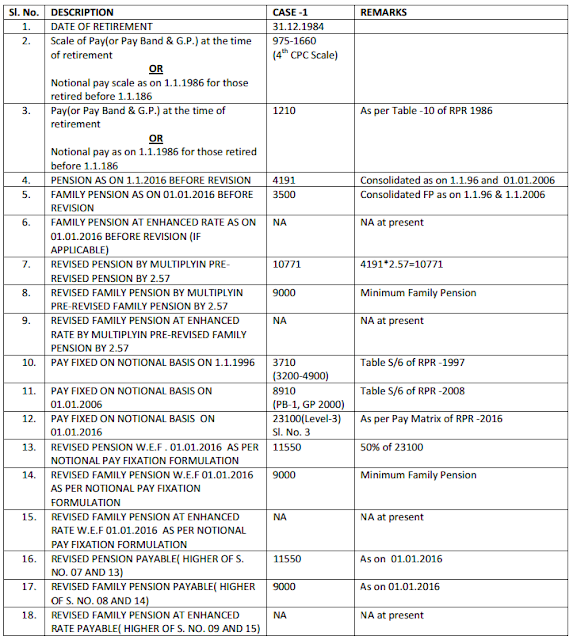

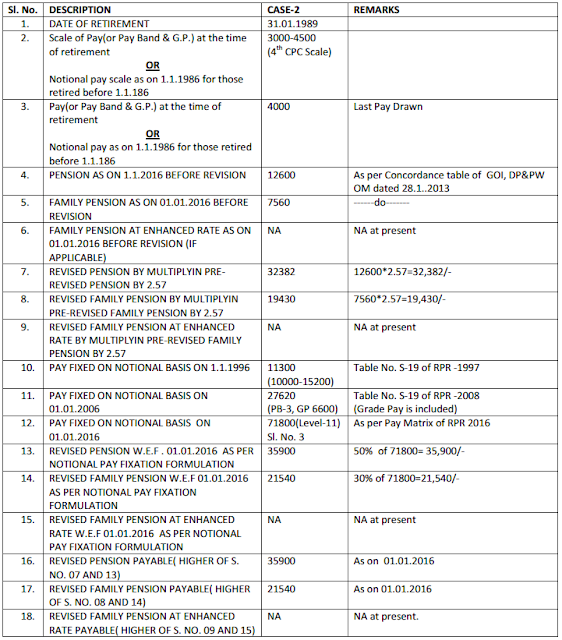

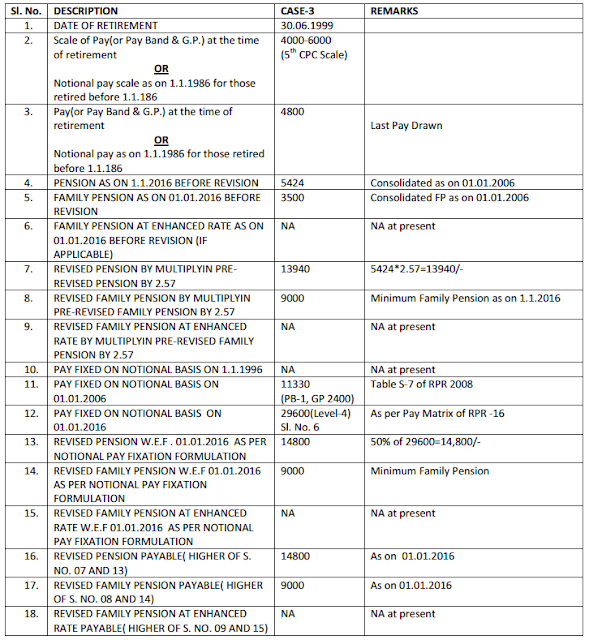

Option 1 for 7th CPC Pension is Mercilessly Rejected – Confederation Posted: 15 Jan 2017 11:29 PM PST

Option 1 for 7th CPC Pension is Mercilessly Rejected – Confederation

MOST UNKINDEST CUT OF ALL

PENSIONER’S OPTION – 1 MERCILESSLY REJECTED

It is learnt that the Committee chaired by Secretary (Pension) has NOT recommended the Option Number – 1 recommended by 7th Central Pay Commission for fixation of pension of pre -2016 Pensioners. Instead it has recommended extension of the benefit of pension determination recommended by 5th CPC ie ; arriving at notional pay in 7th CPC by applying formula for pay revision for serving employees in each Pay Commission revision and consequent pension fixation. Now the Implementation Cell of 7th CPC is studying the recommendations of Pension Committee for processing for submission for approval of Cabinet. Thus , the one and the only favourable recommendation of 7th CPC ie; the real parity in Pension which is also approved by Cabinet with a rider “subject to feasibility” is going to be mercilessly rejected by Government , inspite of repeated requests and demands from NJCA, Confederation and Pensioners Associations .

M. KRISHNAN

Secretary General

Confederation of Central Government Employees & Workers

Mob & WhatsApp: 09447068125

Source: Confederation

|

|

Extension CGHS facilities to P&T pensioners Posted: 15 Jan 2017 11:27 PM PST

Extension CGHS facilities to P&T pensioners

29th SCOVA meeting under the chairmanship of Hon’ble MOS(PP) – Action Taken Report on the Minutes of the 28th SCOV A meeting held under the Chairmanshipof Hon’ble MOS(PP) on 27.06.2016

Mini try of Personnel, Public Grievances and Pensions (Department of Pension & Pensioners Welfare)

Para 4(iv) of the minutes:- Extension CGHS facilities to P&T pensioners

The representatives of Ministry of Health and Family Welfare informed that the 7th CPC has recommended that all Postal Dispensaries should be covered with CGHS. It was decided to await the decision of the Government within a month.

(Action:- Ministry of Health and Family Welfare)

Ministry of Health and Family Welfare

The decision of the Government on the recommendations of 7th CPC is still awaited.

DoPPW

Ministry of Health & Family Welfare to indicate latest status during the meeting a to where the matter is pending. The Ministry of Health and Family Welfare has also been reminded on the same vide DoPPW OM dated 04.01.2017 to expedite the matter.

Authority: www.pensionersportal.gov.in

|

G R Bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 17 Jan 2017 6:16 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

|

LTC to J&K by Private Airlines travelled from 28.11.2015 to 31.05.2016 – Dopt Orders on 13.1.2017 Posted: 17 Jan 2017 03:03 AM PST

LTC to J&K by Private Airlines travelled from 28.11.2015 to 31.05.2016 – Dopt Orders on 13.1.2017

“It has been decided to allow the claims of those Government employees who had travelled by private airlines to Jammu & Kashmir on LTC during the gap period of 28.11.2015 – 31.05.2016.”

No.31011/7/2014-Estt.(A-IV)

Government of India

Ministry of Personnel, Public Grievances and Pensions

Department of Personnel and Training

Establishment A-IV Desk

North Block, New Delhi-110 001

Dated: January 13, 2017

OFFICE MEMORANDUM

Subject:- Central Civil Services (Leave Travel Concession) Rules, 1988 — Relaxation to travel by private airlines to visit Jammu & Kashmir.

The undersigned is directed to refer to this Ministry’s O.M. of even no. dated 28.11.2014 on the subject noted above and to say that vide aforesaid O.M., facility to travel on LTC by private airlines to Jammu & Kashmir (J&K) under the special dispensation scheme was allowed for a period of one year. This facility ended w.e.f. 28.11.2015 and was re-introduced on 01.06.2016.

2. Many references have been received about Govt. employees who had inadvertently travelled by private airlines to J&K during the gap period i.e. from 28.11.2015 to 31.05.2016, under the impression that the facility was still operational and were later facing difficulties in settlement of their LTC claims.

3. The issue has been examined in consultation with Department of Expenditure and Ministry of Civil Aviation. In relaxation to this Department’s O.M. of even no. dated 28.11.2014, it has been decided to allow the claims of those Government employees who had travelled by private airlines to Jammu & Kashmir on LTC during the gap period of 28.11.2015 – 31.05.2016. This shall be subject to the condition that tickets have been booked through the authorised modes and at LTC-80 fare or less and other conditions prescribed in DoPT’s O.M. No. 31011/7/2014-Estt.A-IV dated 28.11.2014.

(Surya Narayan Jha)

Under Secretary to the Government of India

Authority: http://dopt.gov.in/

|

FOUNDER OF 'CENTRAL GOVERNMENT EMPLOYEES NEWS' TITLE AND KEYWORD...

"90PAISA" - No.1 BLOG FOR CENTRAL GOVT EMPLOYEES AND PENSIONERS...! This posting includes an audio/video/photo media file: Download Now |

|

GDS COMMITTEE REPORT - INDEFINITE HUNGER FAST DEFERRED Posted: 17 Jan 2017 03:03 AM PST

NATIONAL FEDERATION OF POSTAL EMPLOYYEES

ALL INDIA POSTAL EMPLOYEES UNION-GDS

1st FLOOR NORTH AVENUE PO BUILDING

NEW DLEHI - 110001

Ref: NFPE/AIPEU-GDS/AGTN/2017

Dated – 17.01.2017

GDS COMMITTEE REPORT

DEPARTMENT OF POST SOUGHT PERMISSION FROM ELECTION COMMISSION FOR PUBLISHING THE REPORT - DISCUSSION HELD WITH NFPE & FNPO - ASSURED TO PUBLISH THE REPORT IMMEDIATELY AFTER GETTING APPROVAL

INDEFINITE HUNGER FAST DEFERRED

Dear Comrades,

As you are aware, the GDS Committee headed by Shri Kamlesh Chandra, Retired Postal Board Member, has submitted its report to Government on 24th November 2016. Secretary, Posts, informed us that the report will be published only after getting approval of the Minister, Communications. Earlier, GDS Committee Report was published on the very same date of submission. 7th Pay Commission Report was also published immediately on submission to Government.

Protesting against the unjustified stand of the Department, NFPE & AIPEU-GDS conducted nationwide agitational programmes like protest demonstration, dharna etc. Finally we have given notice for indefinite hunger fast in front of the Directorate from 18.01.2017, by Secretary General, NFPE and all General Secretaries of affiliated Unions including AIPEU-GDS. After our hunger fast notice things started moving. Secretary, Department of Posts deputed a Senior Officer to the Minister’s office to get the approval of the Minister. Minister granted permission to publish the Report with a condition that Election Commission’s approval should be obtained before publishing the Report, as Election Commission has already declared election to five State Assemblies.

On 16.01.2017, the Department called us for discussion with Member (Technology). In the discussion Member (T) informed that “a reference has been made to the Election Commission of India (ECI) and a response is expected shortly”. We recorded our strong protest against the unjustified delay in publishing the report. The Member (T) expressed “the difficulty in hosting the report in the Department’s website on account of the enforcement of the Model Code of Conduct in view of assembly elections having been announce in five states”. The appeal given by the Department to call off the indefinite hunger fast is published below.

In view of the above, the Federal Secretariat of NFPE and AIPEU-GDS has reviewed the situation based on the written assurance given by the Department and has decided to postpone the indefinite hunger fast to be commenced from 18th January 2017. Even if we go on indefinite fast or strike, Department cannot publish it without the permission of Election Commission, as the Department has already submitted it to Election Commission for permission.

We hope that the Election Commission will grant permission shortly to publish the Report.

NFPE & AIPEU-GDS has made sincere effort for compelling the Department to publish the GDS Committee Report and conducted nationwide agitational programmes. It is only because of our agitational programmes and indefinite hunger faster notice, the Department was compelled to get permission and also submitted it for Election Commission’s approval.

NFPE & AIPEU-GDS always stand with the three lakhs Gramin Dak Sevaks and we assure our GDS employees that if GDS Committee Report is against the interest of the GDS NFPE & AIPEU-GDS will declare serious agitational programmes including strike.

Fraternally yours,

R. N. Parashar P. Panduranga Rao

Secretary General, NFPE General Secretary, AIPEU-GDS

Source: Confederation

|

Gurdev Ram Bains

Gurdev Ram Bains

Begin forwarded message:

From: CENTRAL GOVERNMENT EMPLOYEES NEWS <noreply+...@google.com>

Date: 19 January 2017 18:16:57 GMT+05:30

To: bains.g...@gmail.com

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

- 7th CPC Revision of Pay Scales – Gazette Notification of Amendment of Service Rules / Recruitment Rules

- Seventh Central Pay Commission’s recommendations — revision of pay scales — amendment of Service Rules/Recruitment Rules

- Seventh Central Pay Commission’s recommendations – amendment of Service Rules/Recruitment Rules

- List of ECHS Hospitals, Nursing Homes and Diagnostic Centres

- NPS Committee Meeting to be held on 20.1.2017 – NC JCM Staff Side

- Measures for streamlining the implementation of the National Pension System for Central Government employees

- Early Closure of Offices in connection with Republic Day Parade and Beating Retreat Ceremony during 2017

- Grant of Transport Allowance at double the normal to deaf and dumb employees of Central Government – Finmin Orders

Posted: 19 Jan 2017 01:23 AM PST

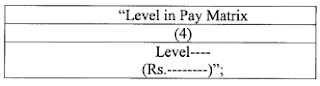

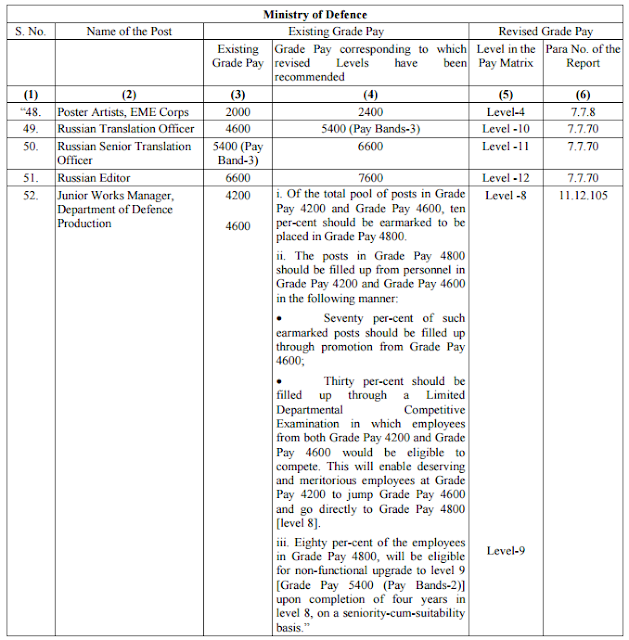

7th CPC Revision of Pay Scales – Gazette Notification of Amendment of Service Rules / Recruitment Rules7th CPC Recommendations – Revision of Pay Scales – Amendment of Service Rules / Recruitment Rules[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-Section (i)]Government of IndiaMinistry of ———-(Department of ——-)New Delhi, dated the , 2017NotificationG.S.R In exercise of the powers conferred by the proviso to article 309 of the Constitution, the President hereby makes the following rules to amend/ further to amend”the (short title of the principal rules with year, as it appears in the Gazette notification), namely:-“In case of first amendment to the principal rules, use the words “to amend” and in case of second or subsequent amendments, use the words “further to amend”.1. (1) These rules may be called the (the portion of the name of the principal rules occurring before the word “Recruitment”, followed by the words “Recruitment (Amendment) Rules, 2016 *2 .*2 the year shall be the year of amendment.(2) They shall come into force on the date of their publication in the Official Gazette.2. For rule 2 *3 of the (short title of the principal rules with year, as it appears in the Gazette notification), the following rule shall be substituted, namely:-“2. Number of posts, classification and Level in Pay Matrix.— The number of said post(s), its (their) classification and the Level in the Pay Matrix attached thereto, shall be as specified in columns (2) to (4) of the Schedule annexed to these rules”.”*3 Rule 2 relates to “Number of posts, classification and Pay Band and Grade Pay or Pay Scale”. In some rules where number of posts is more than one, this rule could be numbered as rule 3. Please quote the correct rule number as in the principal rules.*4 • in case the underlined words are differently worded in the principal rules, the same words may be used in place of the underlined words.3. ** In the Schedule to the (short title of the principal rules with year, as it appears in the Gazette notification),—(a) in column (4), for the column heading and the entries relating thereto, the following column heading and entries shall be substituted, namely:—(b) in column (11), for thewords, brackets and figures “Pay Band — ( Rs. ) plus (and) Grade Pay of Rs. “, *5 the words “Level—-(Rs.—-) in the Pay Matrix” shall be substituted.“*5 In case the underlined words occur only once in that column, then exactly as above;in case the underlined words occur twice in that column, then the words “at both the places they occur,” may be inserted at the place marked 5 ;in case the underlined words occur more than two times, then the words “wherever they occur,” may be inserted at the place marked *5.————————————————————————————**In case where the principal rules contain two posts or more, then, rule 3 shall be formulated as under:-3. In the Schedule to the (short title of the principal rules with year, as it appears in the Gazette notification),—(a) against serial number 1, relating to the post of(i) in column (4), for the column heading and the entries relating thereto, the following column heading and entries shall be substituted, namely:—(ii) in column (11), for the words, brackets and figures “Pay Band — ( Rs. ) plus (and) Grade Pay of Rs. “, *5 the words “Level—-(Rs.—-) in the Pay Matrix” shall be substituted;(b) against serial number 2, relating to the post of______,(i) in column (4), (as above);(ii) in column (11), (as above)”;(c) against serial number 3, relating to the post of———Please note that the amendments in columns (4) and (11) are to be repeated for each of the posts as shown above]______________________________________________________________________________[F.No.——](Name and designation of the Authorised SignatoryFootnote.—The principal rules were published vide notification number G.S.R. , dated the — in the Gazette of India, Part II, Section 3,Sub-section (i) dated —- .“The above footnote is used when the the principal rules are being amended for the first time.In case of second amendment to the principal rules, footnote shall be as under—“The principal rules were published vide notification number G.S.R. , dated the —- in the Gazette of India, Part II, Section 3, Sub-section (i) dated —- and was subsequently amended vide notification number G.S.R. , dated the —-.”In case of subsequent amendments to the principal rules, footnote shall be as under—“The principal rules were published vide notification number G.S.R. , dated the —- in the Gazette of India, Part II, Section 3, Sub-section (i) dated —- and was subsequently amended vide notifications number G.S.R. , dated the —-, G.S.R. , dated the —-, number G.S.R. , dated the —-.” (mention all amendments)In case of large number of amendments, instead of mentioning G.S.R. number and dates of all amendments, the following formulation may be used—“The principal rules were published vide notification number G.S.R. , dated the —- in the Gazette of India, Part II, Section 3, Sub-section (i) dated —- and was last amended vide notification number G.S.R. , dated the .” (mention only the last amendment).—————————————————————————————-Please note that in case where the principal rules are to be superseded and fresh rules are to be made, or where the rules are to be made for the first time, the Legislative Department shall be consulted.**in case where theprincipal rules contained note under the subheading‘Promotion’ or sub-heading ‘Deputation’ or both as the case may be, then, rule (c) and (d) under rule 3, as may be relevant shall be formulated as under:-(c) the following note as per Sixth Central Pay Commission recommendations below Column(11) under sub-heading ‘Promotion’ may be omitted:-“Note: For the purpose of computing minimum qualifying service for promotion, the service rendered on a regular basis by an officer prior to the 1 st January, 2006 or the date from which the revised pay structure based on the recommendations of the Sixth Central Pay Commission has been extended, shall be deemed to be service rendered in the corresponding grade pay or pay scale extended based on the recommendations of the said Pay Commission.”(d) the following note as per Sixth Central Pay Commission recommendations below Column(11) under sub-heading ‘Deputation’ may be omitted:-“Note: For purposes of appointment on deputation/absorption basis, the service rendered on a regular basis by an officer prior to the 1 St January, 2006 or the date from which the revised pay structure based on the recommendations of the Sixth Central Pay Commission has been extended, shall be deemed to be service rendered in the corresponding grade pay or pay scale extended based on the recommendations of the said Pay Commission except where there has been merger of more than one pre-revised scale of pay into one grade with a common grade pay or pay scale, and where this benefit will extend only for the post(s) for vvhich that grade pay or pay scale is the normal replacement grade without any upgradation.”

This posting includes an audio/video/photo media file: Download Now

Posted: 19 Jan 2017 01:22 AM PST

This posting includes an audio/video/photo media file: Download Now

Seventh Central Pay Commission’s recommendations – amendment of Service Rules/Recruitment Rules

Posted: 19 Jan 2017 01:22 AM PST

This posting includes an audio/video/photo media file: Download Now

List of ECHS Hospitals, Nursing Homes and Diagnostic Centres

Posted: 19 Jan 2017 01:04 AM PST

EMPANELMENT OF HOSPITALS/NURSING HOMES AND DIAGNOSTIC CENTRES1. Refer Govt of India, Min of Def letter No 22B(01)/2011-WE/D(Res)Part-II dated 10 Nov 2016 (Copy enclosed and soft copy is also uploaded in ECHS website on www.echs.gov.in)2. Regional centres will initiate action to complete the formalities required for empanelling hospitals approved for empanelment vide letter under reference. A Memorandum of Agreement (MoA) will be signed with each of the Hospital by the Director, Regional Centre ECHS concerned. The MoA will be made on Rs.100/- (Rupees one hundred only) non judicial stamp paper and will be valid for two years from the date of signing of the agreement. The payment for the stamp paper will be made by the empanelled facility. The following documents will be attached to MoA as Annexures:-(a) Health facilities for which recognised. (copy of Annexure of Govt letter pertaining to hospitals).(b) Negotiated Rates (Only one rate per code No. as applicable to the medical facility will be mentioned and negotiated rated would be lower than CGHS rates & indicated by asterix.)Rates applicable will be as per prevalent CGHS rates/negotiated rates whichever is lower.Disposal of Application Forms and MoAApplication forms in respect of the Hospitals approved for empanelment by the Empowered Committee of MoD will be returned by the Central Organisation, ECHS to the Regional Centres concerned from where they originated.The application forms will be stored in safe custody of Regional Centres. The application form will NOT be destroyed for two years after termination of the period of validity of the MoA.The original and duplicate copies of MoA will be retained by the Regional centres and the empanelled facility respectively. Additional photocopies of MoA alongwith Annexures including rates will be forwarded/distributed as under:-(a) Central Organisation ECHS.(b) Concerned Area/Sub Area/Independent Sub Area.(c) Concerned SEMOs.(d) Concerned Polyclinics.(e) Concerned CDAs.ReferralsFormal referrals to empanelled facilities as per laid down procedures can commence after signing of the MoA.(P.Srinivas)ColJt Dir (Med)For MDClick to view the hospital list

NPS Committee Meeting to be held on 20.1.2017 – NC JCM Staff Side

Posted: 19 Jan 2017 01:02 AM PST

NPS Committee Meeting to be held on 20.1.2017 – NC JCM Staff SideMeeting of the Committee constituted to suggest measures for streamlining the implementation for the National Pension System for Central Government employeesNo.57/1/2016-P&PW(B)Government of IndiaMinistry of Personnel,Public Grievances & PensionsDepartment of Pension & Pensioners’ Welfare3rd Floor, Lok Nayak Bhavan, Khan Market,New Delhi-110003, Dated the 16th January, 2017To,(I) The Secretary,National Conucil (Staff Side).JCM for Central Government Employees,13C, Finrozshah Road,New Delhi-110001(2) Shri Snjay Bhoosreddy,Honoary Secretary,Indian Civil & Administration Service (Central) Association,190A, F Wing,Krishi Bhawan, New Delhi – 110001,(3) Shri P.V.Rama Sastry, IPS,Secretary/JS(Department of Consumer Affairs),Krish Bhawan, New Delhi-110001,Subject: Meeting of the Committee constituted to suggest measures for streamlining the implementation for the National Pension System for Central Government employees – reg.Sir,I am directed to say that a Committee under the Chairmanship of Secretary (Pension) has been constituted to suggest measures for streamlining the implementation of the National Pension System.2. A meeting of the Committee with the JCM (Staff Side) and a few other Association is proposed to be held on 20.01.2017 at 11.00 a.m. at Conference Hall, 5th floor, Sardar Patel Bhawan, New Delhi. The members nominated to atted the said meeting should be well versed with the issue and include a fair mix of NPS beneficiaries.3. In view of the paucity of time, Associations are requested to limit their presentation to not more than 20 minutes each.4. This Department looks forward to your participation in the meeting.Yours faithfully,sd/-Director(Pension Policy)Source: www.ncjsmstaffside.com

Posted: 18 Jan 2017 08:21 AM PST

Measures for streamlining the implementation of the National Pension System for Central Government employees – reg.No.57/112016-P&PW(B)Government of IndiaMinistry of Personnel, PG and PensionsDepartment of Pension and Pensioners Welfare3rd Floor, Lok Nayak Bhawan,Khan Market, New DelhiDated the 16th January, 2017NoticeSubject: Measures for streamlining the implementation of the National Pension System for Central Government employees- reg.A Committee has been constituted to suggest measures for streamlining the implementation of the National Pension System for Central Government employees. Accordingly, suggestions / views are invited for streamlining the implementation of the National Pension System for Central Government employees for consideration by the Committee. Suggestions may be sent through email on the harjit....@nic.in and chakra...@gov.in(Harjit Singh)Director (Pension Policy)Authority: http://www.pensionersportal.gov.in/

Posted: 18 Jan 2017 08:19 AM PST

Early Closure of Offices in connection with Republic Day Parade and Beating Retreat Ceremony during 2017No.16/1/2016-JCA 2Government of IndiaMinistry of Personnel Public Grievances and Pensions(Department of Personnel and Training)North Block, New DelhiDated the 16th January, 2017OFFICE MEMORANDUMSub: Early Closure of Offices in connection with Republic Day Parade and Beating Retreat Ceremony during 2017In connection with arrangements for the Republic Day/ At Home Function/Beating Retreat Ceremony, 2017, it has been decided that the Government offices located in the buildings indicated in Annexure-A would be closed at 1300 hours on 25.01.2017 till 1300 hours on 26.01.2017. These buildings would also be closed at 1830 hours on 22.01.2017 till 1300 hours on 23.01.2017 for the full dress rehearsal.2. The buildings indicated in Annexure-B would be closed on 26.01.2017 till 1930 hours for ‘At Home Function’. The buildings indicated in Annexure-C would be closed at 1200 noon on 29.01.2017 till 1930 hours on 29.01.2017. The buildings indicated in Annexure-D would be closed on 28.01.2017 from 1600 hours till 1930 hours for the full dress rehearsal for Beating Retreat Ceremony.3. The above arrangements may please be brought to the notice of all concerned.4. Hindi version will follow.(D.K.Sengupta)Deputy Secretary (JCA)Authority: http://dopt.gov.in/

This posting includes an audio/video/photo media file: Download Now

Posted: 18 Jan 2017 08:15 AM PST

Grant of Transport Allowance at double the normal to deaf and dumb employees of Central Government – Finmin Orders“Transport Allowance at double normal rates would be admissible to the ‘Hearing Impaired employees having loss of sixty decibels or more in the better ear in the conversation range of frequencies’ as per Persons With Disabilities (Equal Opportunities, Protection of Rights and Fun Participation) Act, 1995”No.20/2/2016-E-II(B)Governmént of India

This posting includes an audio/video/photo media file: Download Now

You are subscribed to email updates from CENTRAL GOVERNMENT EMPLOYEES NEWS.

To stop receiving these emails, you may unsubscribe now.

Email delivery powered by Google

G R Bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 20 Jan 2017 6:20 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

|

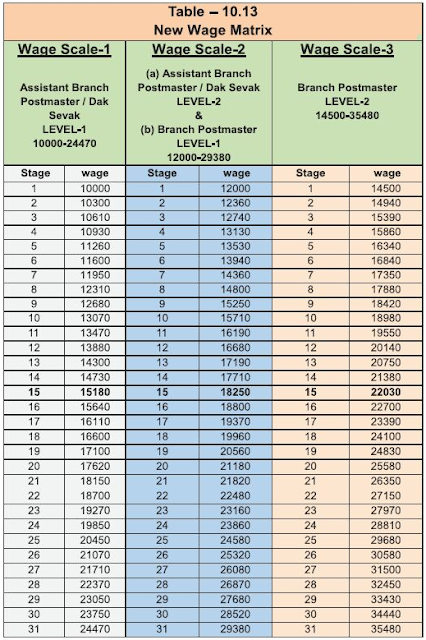

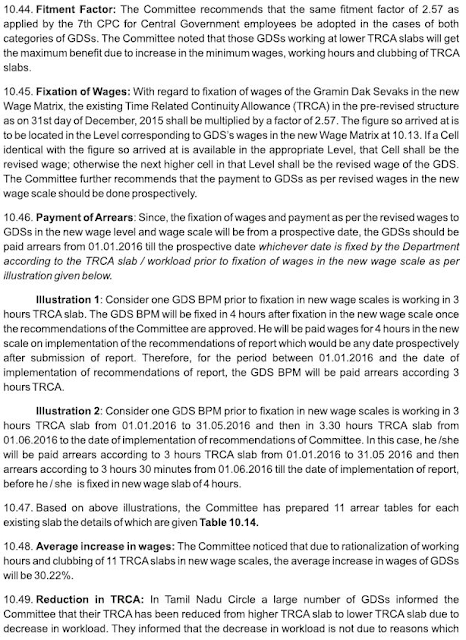

GDS Committee Report – Pay Scale, Fitment Factor and Arrears Posted: 19 Jan 2017 05:17 AM PST |

G R Bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 24 Jan 2017 6:16 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

- TRUST SHALL NOT BE BETRAYED - CONFEDERATION

- Income Tax Rates FY 2016-17 (AY 2017-18) - Finmin Orders

- Benefits of Debit Card Activation - FAQ

|

TRUST SHALL NOT BE BETRAYED - CONFEDERATION Posted: 24 Jan 2017 01:10 AM PST

TRUST SHALL NOT BE BETRAYED - CONFEDERATION

"Unfortunately, the NDA Government and the Group of Ministers consisting of Sri Rajnath Singh, Hon'ble Home Minister, Sri Arun Jaitley, Hon'ble Finance Minister, Sri Suresh Prabhu, Hon'ble Railway Minister who gave assurance on 30th June 2016 that Minimum wage and Fitment formula will be increased and a High Level Committee will be Constituted with a time - frame of four months, have given least concern for the above observations of the Apex Court. Now seven months are almost over. Further there is no guarantee that Allowance Committee will increase the percentage of HRA recommended by 7th CPC."

"TRUST SHALL NOT BE BETRAYED"

7th Central Pay Commission has quoted in para - 1.29 of " Foreword ", the following observations of the Supreme Court in the case of Bhupendranath Hazarika and another Vs State of Assam and others (reported in 2013 (2) Sec 516).

"It should always be borne in mind that legitimate aspirations of the employees are not guillotined and a situation is not created where hopes end in despair. A sense of calm sensibility and concerned sincerity should be reflected in every step. An atmosphere of trust has to prevail and when the employees are absolutely sure that their trust shall not be betrayed and they shall be treated with dignified fairness ; then only the concept of good governance can be concretized. We say no more."

Unfortunately, the NDA Government and the Group of Ministers consisting of Sri Rajnath Singh, Hon'ble Home Minister, Sri Arun Jaitley, Hon'ble Finance Minister, Sri Suresh Prabhu, Hon'ble Railway Minister who gave assurance on 30th June 2016 that Minimum wage and Fitment formula will be increased and a High Level Committee will be Constituted with a time - frame of four months , have given least concern for the above observations of the Apex Court. Now seven months are almost over. Further there is no guarantee that Allowance Committee will increase the percentage of HRA recommended by 7th CPC. Instead there is every chance, to deny retrospective effect from 01.01.2016 to the revised allowances and it may be implemented prospectively from 01.01.2017 or 01.04.2017, thus denying the eligible arrears for one year or more. It has become certain that the Option-1 for pensioners recommended by 7th CPC, which is the one and only favourable recommendation, stands rejected. Orders on abolition of Advances including Festival advance and imposing "very good " condition for MACP are issued unilaterally .

Request of the JCM National Council Staff side Secretary to give one more opportunity to present it's case before the Allowance Committee is not conceded by the Finance Secretary, who is the Chairman of the Committee. The request of the JCM Staff side to modify the Terms of Reference of Anomaly Committee is also not yet considered by the Department of Personnel and Training. The Committee constituted for New Pension Scheme is only for streamlining the NPS by making some cosmetic changes as recommended by 7th CPC and not for considering the demand of the JCM Staff side to scrap NPS. Not even a single demand of the staff side submitted to Cabinet Secretary on 10th December 2016, requesting modifications in the recommendations of 7th CPC is settled by the Government.

The All India Conference of the Confederation of Central Government Employees & Workers held in August 2016 at Chennai had taken a decision to request all constituents of NJCA to revive the indefinite strike , if Government is not ready to honour it's commitment before 30th October 2016. The AIC had further decided that, in case NJCA is not ready to revive the deferred indefinite strike, then Confederation should organise independent trade union action including strike. Confederation strongly feels that there in no meaning in waiting indefinitely for Government's decision. We cannot cheat the employees like NDA Government. As no consensus decision could be taken in NJCA, Confederation had decided to go for one day strike and organised country wide demonstrations, mass dharnas and massive Parliament March. Strike notice for one day strike on 15th February 2017 was served on 28th December 2016. Due to announcement of assembly elections in five states by Election Commission of India and 15th February being a polling day, the strike was postponed to 16th March 2017.

Intensive campaign and mobilisation is going on in full swing all over the country. About 13 to 15 lakhs Central Government employees will participate in the strike, with the full support and solidarity of about 34 lakhs pensioners, Central Trade Unions, independent Federations of State Government employees, Bank and Insurance employees and other public sector employees.

After reviewing the participation of employees in the one day strike, Confederation shall explore the possibility of declaring higher form of trade union action including indefinite strike . |

M. KRISHNAN

Secretary General

Confederation

|

|

Income Tax Rates FY 2016-17 (AY 2017-18) - Finmin Orders Posted: 23 Jan 2017 10:21 PM PST

Income Tax Rates FY 2016-17 (AY 2017-18) - Finmin Orders

CIRCULAR NO : 01/2017

F.No.275/192/2016-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

North Block, New Delhi

Dated the 2nd January, 2017

SUBJECT: INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2016-17 UNDER SECTION 192 OF THE INCOME-TAX ACT, 1961.

Reference is invited to Circular No.20/2015 dated 02.12.2015 whereby the rates of deduction of income-tax from the payment of income under the head "Salaries" under Section 192 of the Income-tax Act, 1961 (hereinafter ‘the Act’), during the financial year 2015-16, were intimated. The present Circular contains the rates of deduction of income-tax from the payment of income chargeable under the head "Salaries" during the financial year 2016-17 and explains certain related provisions of the Act and Income-tax Rules, 1962 (hereinafter the Rules). The relevant Acts, Rules, Forms and Notifications are available at the website of the Income Tax Department- www.incometaxindia.gov.in.

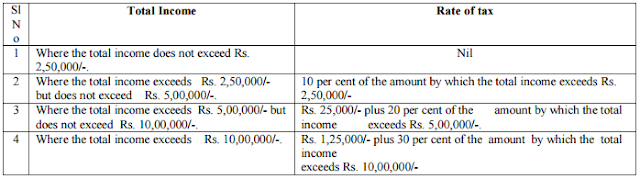

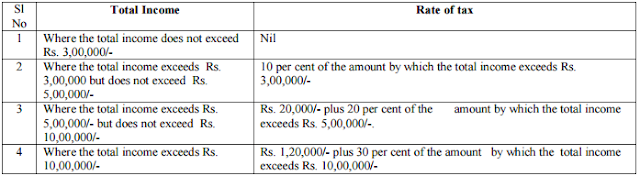

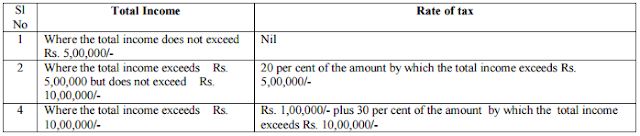

2. RATES OF INCOME-TAX AS PER FINANCE ACT, 2016:

As per the Finance Act, 2016, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head "Salaries" for the financial year 2016-17 (i.e. Assessment Year 2017-18) at the following rates:

2.1 Rates of tax

A. Normal Rates of tax:

B. Rates of tax for every individual, resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

C. In case of every individual being a resident in India, who is of the age of eighty years or more at any time during the financial year:

|

|

Benefits of Debit Card Activation - FAQ Posted: 23 Jan 2017 10:18 PM PST

Benefits of Debit Card Activation - FAQ

QUESTION 1. Why it is important to have active debit cards?

ANSWER: Debit Card makes your payments much more convenient and secure through an electronic payment facility directly from your bank account. Debit card can be used for purchases online or at shops by directly debiting your Bank account. Debit cards can also be used to withdraw cash from an ATM.

QUESTION 2: How is a customer benefited by debit cards?

ANSWER: Major benefits to customers are

Insurance: National Payment Corporation of India has introduced Insurance cover in case of accidental death or permanent disablement of Rs 1 Lac for Non-Premium cards (RuPay Classic) and Rs 2 Lac for Premium cards (RuPay Platinum) to eligible RuPay card holders. The RuPay Insurance programme will continue for financial year 2016-17, i.e. from April 01, 2016 to March 31, 2017.

QUESTION 3: Can I use my debit card if I have not used it for long?

ANSWER: Yes. It may however require activation. Please check the forwarding letter that came with your debit card. Please check your Bank website.

QUESTION 4: How do I generate a PIN ?

ANSWER: Banks provide PIN by mail, which is either dispatched by bank to the cardholder address. Some banks also offer Green Pin facility online. Banks also facilitate change of PIN to suit your requirements.

QUESTION 5: What are the recent steps taken for promoting debit card payments?

ANSWER: Some of the recent initiatives towards popularizing Debit card usage are:

QUESTION 6: What should you do if a shop asks you for an additional amount for use of your debit card?

ANSWER:As per the norms prescribed by card networks, shops should not ask for any additional amount called surcharge or convenience fee. You can refuse to pay an additional amount for use of your card and register complaint to your bank on its website or otherwise.

QUESTION 7: Can one refuse to pay additional amount as banks have waived their chargeson one of debit cards till 31st December 2016.

Answer: Although all banks have waived MDR up to Dec 31, 2016, customers are not required to pay additional amount even after that if demanded by the shopkeeper, as this is to be paid by the shopkeeper.

QUESTION 8: Why should Merchant encourage card use?

ANSWER: Merchant are benefitted to encourage debit card transaction as:

|

G R Bains

From: "CENTRAL GOVERNMENT EMPLOYEES NEWS" <noreply+...@google.com>

Date: 27 Jan 2017 6:18 pm

Subject: CENTRAL GOVERNMENT EMPLOYEES NEWS

To: <bains.g...@gmail.com>

Cc:

- Interest Rate of General Provident Fund w.e.f. 1.1.2017 – Finmin Orders

- Loans and Advances by the Central Government – Interest rates and other terms and conditions

- Streamlining the implementation of the NPS tor Central Govt Employees – NC JCM Staff Side

- Instructions on sealed cover procedure – where Government servant has been acquitted but appeal is contemplated/pending – Dopt

- Ceiling on IT for salaried persons should be raised to Rs.7.5 lakh: AIBEA to Jaitley

- Secretary staff side/JCM writes to Shri Rajnath Singh about the demands of Central Government Employees

- General Budget 2017-18 – NFIR’s proposals for consideration

|

Interest Rate of General Provident Fund w.e.f. 1.1.2017 – Finmin Orders Posted: 26 Jan 2017 08:04 PM PST

Interest Rate of General Provident Fund w.e.f. 1.1.2017 – Finmin Orders

Resolution – accumulations at the credit of subscribers to the GPF and other similar funds – 2017, w.e.f. 1st January, 2017

(PUBLISHED IN PART I SECTION OF GAZETTE OF INDIA)

F.No.5(1)-B(PD)/2016 |

Government of India

Ministry of Finance

|

Department of Economic Affairs

(Budget Division)

New Delhi, Dated the 18th January, 2017

RESOLUTION

It is announced for general information that during the year 2016-2017, accumulations at the credit of subscribers to the General Provident Fund and other similar funds shall carry interest at the rate of 8.0% (Eight per cent) w.e.f. 1st January, 2017 to 31st March, 2017. This rate will be in force w.e.f. 1st January, 2017. The funds concerned are:-

1. The General Provident Fund (Central Services)

2. The Contributory Provident Fund (India)

3. The All India Services Provident Fund

4. The State Railway Provident Fund

5. The General Provident Fund (Defence Services)

6. The Indian Ordnance Department Provident Fund

7. The Indian Ordnance Factories Workmen’s Provident Fund.

8. The Indian Naval Dockyard Workmen’s Provident Fund

9. The Defence Services Officers Provident Fund

10. The Armed Forces Personnel Provident Fund.

2. Ordered that the Resolution be published in Gazette of India.

sd/-

(Vyasan R.)

Deputy Secretary (Budget) |

This posting includes an audio/video/photo media file: Download Now |

|

Loans and Advances by the Central Government – Interest rates and other terms and conditions Posted: 26 Jan 2017 06:26 PM PST

Loans and Advances by the Central Government – Interest rates and other terms and conditions

F.No.5(3)-B(PD)/2016 |

Government of India

Ministry of Finance

|

Department of Economic Affairs

New Delhi, the 6th January, 2017

OFFICE MEMORANDUM

Subject:- Loans and Advances by the Central Government – Interest rates and other terms and conditions.

Reference this Ministry’s Office Memorandum F.No.5(3)-B(PD)2015 dated 3rd February, 2016 on the captioned subject.

2. The lending rates, categories and conditions prescribed in the aforesaid Office Memorandum have been reviewed. The revised rates of interest, categories and conditions as given in the Table below, would be applicable from 1st April, 2016 and till the time these are reviewed:

TABLE

The terms and condition and conditions regarding eligibility of loan would remain the same as that of last year. If any specific request comes in future from any other financial institution/CPSE/Autonomous Body/Cooperative, it would be examined by the Budget Division, DEA on merits of that case.

3. The terms, including interest rate of loans to Foreign Governments may be settled in consultation with Budget Division. Terms for on-lending of funds under externally aided projects should be in accordance with the prescribed pattern. In case, deviation is considered necessary, Budget Division should be consulted.

4. The interest rates prescribed above assume timely repayments and interest payments and hence no further rebate in rates is to be allowed for timely payments.

5. OTHER TERMS AND CONDITIONS

(a) The loan sanctioning authority should meticulously follow the instructions contained in General Financial Rules, 2005 (GFR 2005), particularly, rules framed under Chapter 9 (II-LOANS) of

GFR, 2005, while sanctioning loans to various entities as stipulated therein.

(b) The instructions issued from time to time have been reviewed and are set out in the following paragraphs for facility of reference.

6. STATE GOVERNMENTS

In the case of loans to State Governments, the arrangements for payment of annual instalment of principal and interest will be as under:-

(a) Block loans for State Plan Schemes and other Plan loans for Centrally Sponsored Schemes:- These loans when drawn in instalments, will be consolidated and deemed to have been drawn as on 1st October in each year. The maturity period of the loans sanctioned for State Plans is 20 years, repayments being made in 20 annual equal instalments together with interest on the outstanding balance commencing from the following year, subject to consolidation under the award of Twelfth Finance Commission (TFC).

However, fifty per cent of these loans will enjoy a five year initial grace period, after which repayments of these loans will be effected in 15 annual equal instalments. The amounts annually payable(by way of principal and interest) would be recovered in 10 equal monthly instalments commencing 15th June, subject to debt waiver under the award of TFC.

(b) Other Loans:- The terms of repayment of these loans will be as laid down from time to time.

7. PUBLIC SECTOR PROJECTS

(A) For new installations or expansion of existing institutions:

(a) The terms and conditions of loans should be fixed with reference to the financial picture presented in the approved Project Report. (Once the pattern is settled, there should be no change except with the specific concurrence of this Department for reasons to be stated in writing).(b) The capital requirements of a project should include adequate provisions for interest payment on borrowings during the period of construction (as specified in the Project Report). The interest on loans due during the period of construction will be allowed to be capitalised to the extent of the provisions made for this purpose in the approved Project Report. In other words, while interest on loans advanced to an undertaking during the period of construction will be notionally recovered by allowing its capitalisation, the payment of interest should effectively commence after the construction period is over.

(c) The repayment of principal should ordinarily commence one year after the project commences production, the number of instalments being determined with reference to the financial projections and repaying capacity specified in the Project Report. Requests for further moratorium will be considered only in exceptional cases where the Project Report has specified any special circumstances that may necessitate a longer period of moratorium and has indicated clearly what staggering of repayment would be needed over the necessary break period. The period of loans sanctioned against capitalised interest during the period of construction may also be on the same terms and conditions as are applicable to loans provided for financing the project costs.

(d) A suitable period of moratorium subject to a maximum of five years from the date of drawal of the loans may be allowed for the repayment of instalments of principal, having regard to the nature of the project, the stage of construction etc. The period of moratorium should not, however, extend in any case, beyond two years from the date of project going into production, or in the case of programmes of expansion, beyond two years from the date of expanded project coming into operation.

(B) For meeting working capital requirements: The undertakings are expected to obtain their cash credit requirements from the State Bank of India/Nationalised Banks by hypothecating their current assets (such as stock of stores, raw materials, finished goods, work in progress, etc.) and where the entire working capital requirements cannot be raised in this manner by seeking a guarantee from Government. Accordingly, requests from Public Sector Undertakings for funds for meeting working capital requirements should be considered only to the extent the same cannot be had from the State Bank of India/Nationalised Banks.

8. GENERAL REPAYMENT PERIOD

(A) (i) The period for repayment of loans for all parties other than State Governments should be fixed with due regard to the purpose for which they are advanced and it should be restricted to the minimum possible. Normally, no loan should be granted for a period exceeding 10 years. Where a longer period for repayment is sought, prior concurrence of the Budget Division in this Department will be necessary for fixing the period.

(ii) The repayment of a loan should normally commence from the first anniversary date of its drawal or on expiry of the period of moratorium, as the case may be. The recovery should ordinarily be effected in annual equal instalments of principal.

(iii) The period of repayment of working capital loans should preferably be restricted to two or three years. In no case, however, the period of these loans should exceed 5 years.

(B) Moratorium: Subject to exceptions made in respect of pubic sector projects, a suitable period of moratorium towards repayment might be agreed to in individual cases having regard to the project for which the loans are to be utilised. However, no moratorium shouldordinarily be allowed in respect of interest payment on loans. Ministries/Departments may with the approval of their Financial Advisers allow moratorium on repayment of principal wherever considered necessary upto a maximum period of 2 years.

(C) (i) Repayment before due date: Any instalment paid before its due date may be taken entirely towards the principal provided it is accompanied by payment towards interest due upto date of actual payment of instalment; if not, the amount of the instalment will first be adjusted towards the interest due for the preceding and current periods and the balance, if any, will alone be applied towards the principal. Where the payment of the instalment is in advance of the due date by 14 days or less, interest for the full period (half year or full year as the case may be) will be payable. If any State Government repays an instalment of a loan which is consolidated as on 1st October, in advance of the due date by more than 14 days the interest

(ii) Pre-payment premium: Prepayment premium of 0.25% on the loans with residual maturity of less than 10 years and 0.50% for the loans with residual maturity of 10 years and above, shall be charged. The provision does not apply to the loans to State/UT Governments.

(D) Penalty Clause: The loan sanctions/agreements should invariably include a penalty clause providing for levy of a penal rate of interest in the event of default in repayment of instalment(s) of principal and/or interest. The penal rate of interest should not be less than 2.50% above the normal rate of interest at which a loan is sanctioned.

(E) Defaults in repayment/interest payment:

(i) In the event of a default in repayment of loan/interest payment, the recovery of interest at penal rate may not be waived unless there are special reasons justifying a waiver. However, a decision in this regard will be taken by the Ministry of Finance (Budget Division) on the advise of Financial Adviser. Even in such cases, a minimum of 0.25% should be recovered from the defaulting party as penalty.

(ii) The penal rate of interest is chargeable on the overdue instalments of principal and/or interest from the due date of their payment to the date preceding the date of actual payment.

(iii) Whenever a fresh loan is to be sanctioned to a borrower who has earlier defaulted, the loan sanctioning authority must consider the question of recovery of defaulted dues. All releases to Public Sector Undertakings against budgeted outlays should be made only after adjusting the defaults, if any, pertaining to repayment of loans and interest. If for special and exceptional reasons such adjustments are not possible, specific orders of Secretary (Expenditure) should be obtained through Budget Division, before release of fresh loans, in relaxation of extant orders, in conformity

with this Division circular No.F.2 (190)-B(SD)/91, dated 15.10.1991.

(iv) Any defaults should ab-initio serve as a warning signal to the Ministries/ Departments for which curative action has to be taken immediately.

(v) Ministries/Departments need to critically review the financial position of the borrower, including defaulting CPSUs and wherever possible, should take immediate action to recover the money due to the Government.

(vi) In the case of defaulting CPSUs, there has to be a clear road map for restructuring of these CPSUs, as prolonged approval results in burgeoning of defaults.

(vii)Ministries/Departments are to ensure that these defaults do not become fiscally unsustainable.

(viii) Wherever Ministries/Departments are considering restructuring of a CPSU, it must be ensured that besides equity infusion, funds mobilisation, rescheduling of loans/interest payments, write off of dues, etc. should be formulated holistically. However, no request for waiver/postponement of instalments on any ground whatsoever will be accepted, except in cases of companies referred to BIFR or in respect of those companies which have incurred cash losses for last three years, in conformity with this Division circular No.F.2(165)-B(SD)/94, dated 06.10.1994.

(F) Requests for modification of terms of loans:

(i) Borrowers are required to adhere strictly to the terms settled for loans made to them and modifications of these terms in their favour can be made subsequently only for very special reasons. Requests for modification of terms may relate to increase in the period of a loan or of initial moratorium period towards repayment, or waiver of penal interest or reduction in or waiver of normal rate of interest. The procedure of dealing with requests for waiver of penal interest has already been dealt with in paragraph 8. Cases involving other modifications in repayment terms should be considered in consultation with the Budget Division in this Ministry. In referring such cases, the impact of the modifications on the estimates of repayment/interest which have gone into the Budget and Government’s resources position should be succinctly brought out by the administrative Ministry.