In case you had not realized that drug prices going up

Joel Clemmer

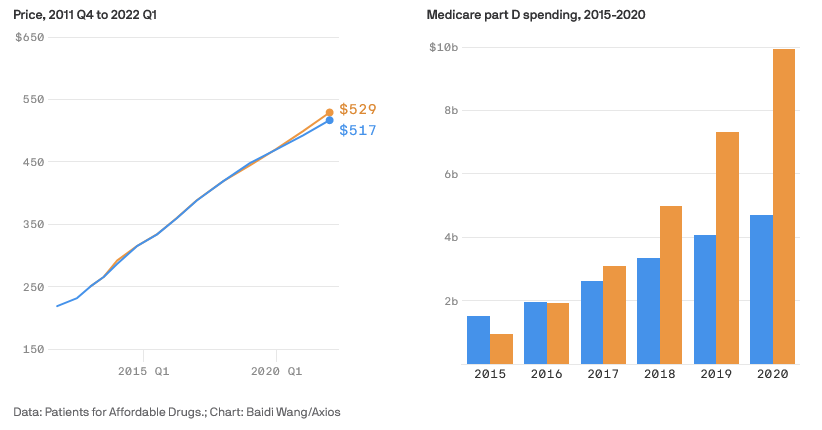

Medicare blockbusters' list prices more than doubled since launch

Two blood thinners that Medicare spent a collective $46 billion on between 2015 and 2020 have more than doubled their list prices since entering the market, according to a new analysis by Patients for Affordable Drugs.

Why it matters: List prices don't reflect the rebates negotiated between drug manufacturers and payers, but they are often used to determine Medicare Part D cost sharing — meaning as prices go up, patients pay more out of pocket.

The big picture: More than 8 million Americans regularly take blood thinners. Until 2010, the standard of care was warfarin, which was cheap but carried the risk of heavy bleeding.

- In 2011, Johnson & Johnson's Xarelto entered the market, and Bristol Myers Squibb and Pfizer's Eliquis followed it in 2013. Both are much less risky but had list prices of more than $200 for a month's supply — much higher than warfarin.

- Those list prices have increased in tandem over time, and both are now more than $500 for a month's supply.

- Eliquis was Medicare's top-spending drug in 2020, and Xarelto was the third most costly. In 2020, nearly 4 million Medicare beneficiaries took one of the two drugs.

The other side: Drug companies say health plans are responsible for the higher costs patients are seeing.

- “People should have affordable access to the medicines they need, yet many do not, in part because of the growing affordability gap between the lower net prices for insurers and the higher costs insurers charge patients,” said a Johnson & Johnson spokesperson.

Between the lines: It's unclear how much health plans pay for the drugs once rebates are taken into account, making it impossible to compare net prices over time.

- Drugmakers argue that they've had to give insurers and pharmacy benefit managers increasingly large rebates, which are reflected in drugs' rising list prices. After taking rebates into account, Xarelto's net price is 40% of its list price — a 60% discount, according to one estimate.

- But some patients' out-of-pocket drug costs are determined based on list prices, including those who are still in their deductible phase, the uninsured and those with cost-sharing requirements.

Shadow pricing occurs when a company

consistently follows the price increases of a

competitor in order to maintain high and

rising prices. The failure of drug companies

to compete on price demonstrates the

mutual benefit gained by companies that

choose to reject competition in favor of

sharing a market with high and ever-rising

profits.

Joel Clemmer