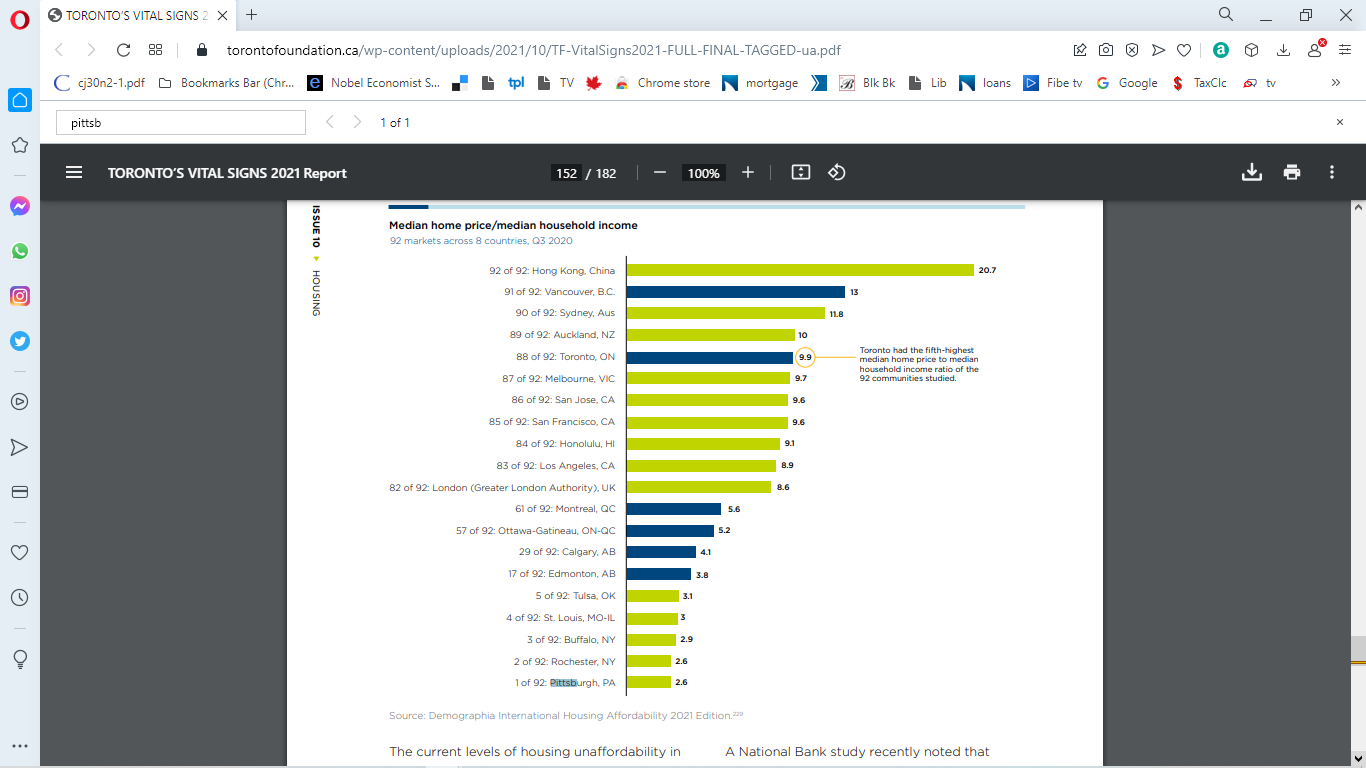

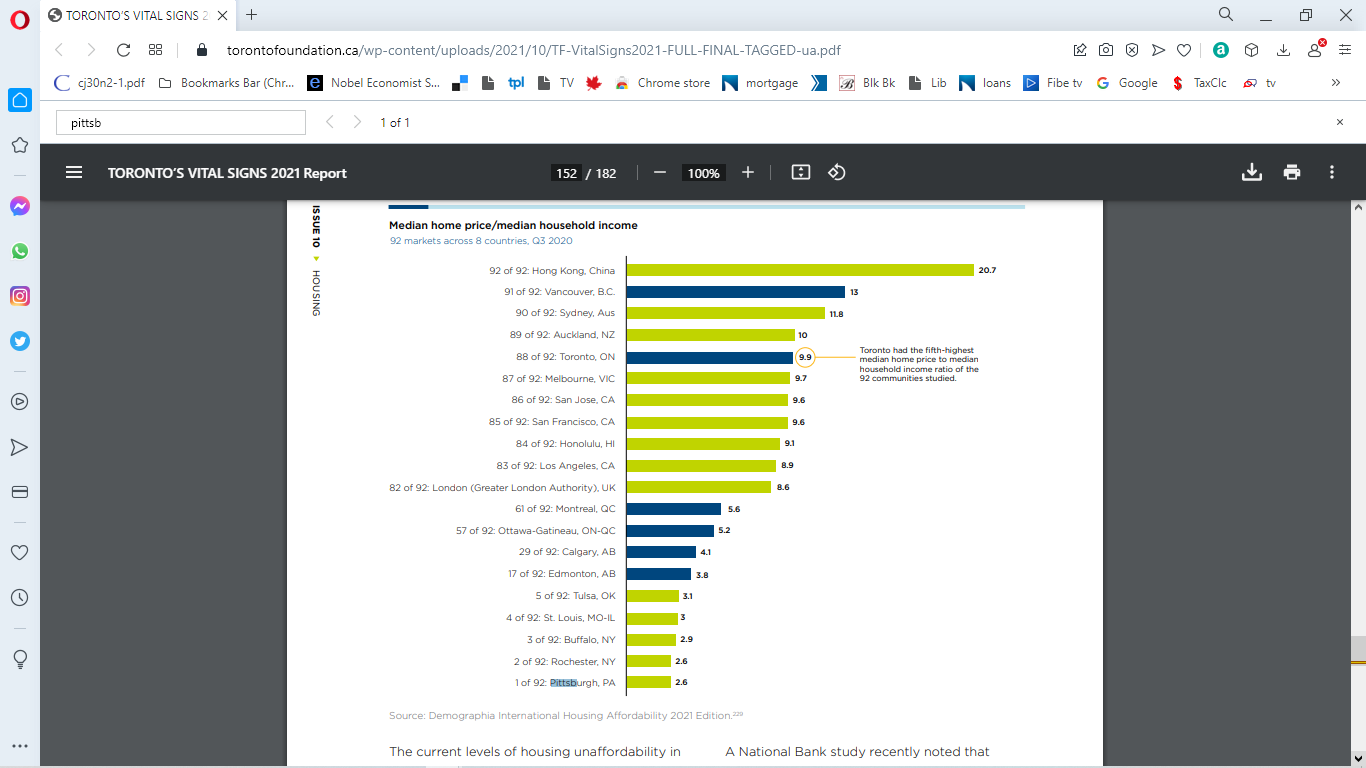

Frank can you explain this extraordinary range in this chart on income vs home prices?

4 views

Skip to first unread message

Polito

Oct 18, 2021, 12:14:54 AM10/18/21

to Frank de Jong, earthshar...@googlegroups.com

brendan hennigan

Oct 18, 2021, 12:39:51 PM10/18/21

to Frank de Jong, earthshar...@googlegroups.com

I quickly scanned the section on housing affordability.

I did not see any analysis on the increase in the price of land.

It is easy to say that housing is a human right, but what are the fundamental principles supporting this claim?

Promoting the Georgite proposition that you cannot have private property in land could support the idea that affordable housing (the land portion at least) is a human communal right.

Report's Solution recommendations are on page 162.

Will all the investment in so called affordable housing eventually go back to the landlord? In this case, the large property developers?

The range in the chart needs to be broken down differently - more variables could be included (not just median income and median housing price)- tax rates, transit costs, child care coasts, walkability-liveability factors, health costs, to name a few.

Low interest rates and an astronomical increase in household debt have helped to pushed house prices up.

Brendan

From: earthshar...@googlegroups.com <earthshar...@googlegroups.com> on behalf of Polito <goodsam...@gmail.com>

Sent: October 18, 2021 12:14 AM

To: Frank de Jong <fde...@earthsharing.ca>; earthshar...@googlegroups.com <earthshar...@googlegroups.com>

Subject: Frank can you explain this extraordinary range in this chart on income vs home prices?

Sent: October 18, 2021 12:14 AM

To: Frank de Jong <fde...@earthsharing.ca>; earthshar...@googlegroups.com <earthshar...@googlegroups.com>

Subject: Frank can you explain this extraordinary range in this chart on income vs home prices?

--

You received this message because you are subscribed to the Google Groups "Earthsharing Canada" group.

To unsubscribe from this group and stop receiving emails from it, send an email to earthsharing-ca...@googlegroups.com.

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAAoo3GwjO6ZgAn4OJ2FGudfnka4_dmN35186rp_MEoQjafLgeA%40mail.gmail.com.

You received this message because you are subscribed to the Google Groups "Earthsharing Canada" group.

To unsubscribe from this group and stop receiving emails from it, send an email to earthsharing-ca...@googlegroups.com.

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAAoo3GwjO6ZgAn4OJ2FGudfnka4_dmN35186rp_MEoQjafLgeA%40mail.gmail.com.

Frank de Jong

Oct 19, 2021, 12:02:37 PM10/19/21

to Earthsharing Canada Google Group

Toronto is booming, it's a very successful urban area, attracting businesses, it's a very safe city, good health care, social programs, and has many amenities, it attracts immigrants who help businesses interface with their home countries. Land is expensive in Toronto and hinterland because much of the extra wealth generated in Toronto migrates to land value. People with extra money bid up the price of land (housing). And presently wealth is maldistributed.

But LVT is no magic bullet that reduces housing costs, it just makes society more equitable, democratises land ownership and makes the economy more efficient.

Stage one of LVT is to shift the municipal tax off buildings and onto land. Individuals living on smaller lots would see municipal tax reductions, people living in multi-unit buildings on small lots would see dramatic municipal tax (rent) reductions.

Stage two of LVT is to offset income, sales and business taxes with charges on the rental value of land. Fully phased in, a person would no longer pay income or sales taxes but pay a land value tax to be shared by all levels of government. They would no longer require a bank loan for the land component of their properties.

f

Polito

Oct 19, 2021, 11:34:38 PM10/19/21

to earthshar...@googlegroups.com

The logic of land taxes should make land banking and monopoly and speculation less profitable. The Georgist

notion is that taxing the unearned income reduces the income and thus the value of the land. Ultimately value

is the income divided by a discount rate. If the net income after tax is $100,000 and the discount rate is 5% then

the asset is 100,000/.05 which is $2 million. If we reduce the profits with a land tax by half the asset would be

worth a million.

In this short clip of a long presentation I ask the question and it is answered by two notable Georgists. Ted signed

the famous letter to Gorbachev along with several elite economists, of whom there were several Nobel Prize

winners, ...

--

You received this message because you are subscribed to the Google Groups "Earthsharing Canada" group.

To unsubscribe from this group and stop receiving emails from it, send an email to earthsharing-ca...@googlegroups.com.

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CA%2BM9nn9vD4DLguPKrCj4r%3DRQJAB6LhzuH14qzZa0_1Qaq4euqg%40mail.gmail.com.

“Salus populi suprema lex - the welfare of the people shall be the supreme law"

Jassal Devpreet

Oct 20, 2021, 7:15:47 AM10/20/21

to Earthsharing

Dear Polito,

Please explain the discount rate.

Devpreet (Dave) Jassal

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAAoo3GzP9xzHt2yL4miisHNTvVHafn%2BWmDmFHV81dRtj1uPKwQ%40mail.gmail.com.

Frank de Jong

Oct 20, 2021, 10:23:30 AM10/20/21

to Earthsharing Canada Google Group

Just semantics, Joe, but LVT doesn't reduce the value of land, it just morphs the upfront cost into the monthly LVT.

If fully phased in, the land component of a property would have no upfront cost.

f

On Tue, Oct 19, 2021 at 11:34 PM Polito <goodsam...@gmail.com> wrote:

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAAoo3GzP9xzHt2yL4miisHNTvVHafn%2BWmDmFHV81dRtj1uPKwQ%40mail.gmail.com.

Polito

Oct 20, 2021, 9:46:05 PM10/20/21

to earthshar...@googlegroups.com

If interest rates are really low, we can borrow more money, we can afford to pay more for a house

or other asset. That rate would be the discount rate. The higher those rates, the less we can borrow

and the less we can pay for the asset. In the past few years interest rates have gone down so people

could afford to pay more for the house. The same is true for a profitable business. We can pay more

for it and still be a going concern.

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAG9eaWs-%3D62ZbFiQF2LDWT%2B5Be-Vujz3ykwfsNHic9ipLuzhcA%40mail.gmail.com.

Jassal Devpreet

Oct 21, 2021, 7:24:21 AM10/21/21

to Earthsharing

Thanks Polito

Devpreet Jassal

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAAoo3GzOwt6V4dnkCF9hVWaeRr64sMyxjZgNLGHzi4AwJxGLfQ%40mail.gmail.com.

Polito

Oct 27, 2021, 12:41:36 AM10/27/21

to earthshar...@googlegroups.com

Erich Jacoby-Hawkins

Oct 27, 2021, 10:42:58 AM10/27/21

to earthshar...@googlegroups.com

This seems to be a property mostly of the original BitCoin. The later cryptos, including BitCoin Cash, use less energy overall and less per transaction. The comment about purchasing a latte with BitCoin is a bit misleading, as I don't think many cafes accept BitCoin and I believe most BitCoin users either use it as a store of (speculative) value via buy/hold (or "HODL to the moon", as they call it) or for occasional illicit transactions. I would be surprised if there are any but a few crypto extremists who spend tiny bits of their precious crypto on minor inconsequential daily transactions. Most are all about maximizing their store, believing in an eventual Bitcoin dominance, or trying to profit by timing peaks & troughs of the wildly fluctuating crypto value.

All the later alt-coins use improved technology and have lower costs (by design), some of them extremely low compared to BC. I don't know, however, how the lower ones would compare to a standard credit or debit card transaction for the same amount. They might still have more transaction cost even in the best case.

Having read the originating report, it's not clear to me how much of the "transaction cost" is a marginal cost and how much of it derives from the huge (and growing) cost to mine (mint) each marginal BitCoin added to the overall supply. BitCoin was designed to make mining further coins exponentially more expensive as a way to cap supply at a set or asymptotic ceiling. So this high energy cost is, in a way, a "feature" rather than a bug, one that has run perhaps far beyond what was originally envisioned by the mysterious BitCoin creator. The idea perhaps was that cost would exceed rational desire to mine more coins, but underestimated the power of greed to ignore environmental (or financial) costs in search of gain. This mechanism then trickles down into the embedded cost of the resulting crypto, as well as (I think) making the transactions themselves highly consumptive of computing power due to their ever-growing chain of verification. I can only imagine this is worsened when a single BitCoin, now worth thousands of dollars, is spit into myriad tiny millibits or microbits or satoshis (currently at 17 to the US penny), each carrying the full blockchain or identity trail of the original BitCoin from which it was split.

The cost is indeed astonishing, although I have to wonder what the comparable cost is of various more traditional currency-based transactions, the vast majority of which are now done digitally, in the developed world. I wonder if there is analysis of the footprint of credit, debit, or PayPal/Venmo transactions. I'm sure it's far below BitCoin but where does it sit vs. Ethereum 2.0?

Erich.

On Wed, Oct 27, 2021 at 12:41 AM Polito <goodsam...@gmail.com> wrote:

BGHearns

Oct 30, 2021, 10:39:24 AM10/30/21

to earthshar...@googlegroups.com

Hi, All

Energy constraint is the main reason Bitcoin and cryptocurrencies are never going to exist beyond a brief period of time. Two salient facts become inescapable, once one pushes through the forest of waving hands by people who are still convinced that infinite growth is possible on a finite planet because "we're going to the stars" or some such nonsense, is that, first, we do not have any "green" energy source that is completely independent of oil or coal, and, second, both oil and coal have become increasingly dirty and expensive. In fact world oil production from all sources peaked in June 2020. (Conventional oil -- the classic drill rig type -- peaked way back in 2005.)

We simply do not have any energy source (no, not even nuclear, which is absolutely dependent on oil) that can match the energy kick that petroleum gives us, followed closely by coal. We can build hydro dams with concrete that does not require oil, but it does require a huge amount of human effort and a lot of trees to produce the concrete. We cannot build commercial wind turbines, since the blades are made of plastics (and not recyclable, so not really 'green', either). Solar panels can only provide a trickle of energy, relatively speaking, nowhere near enough to power a cryptocurrency operation. So as energy becomes increasingly constrained in the next couple of decades, as predicted so accurately back in 1973, this cryptocurrency fantasy will fade into memory.

Bruce Hearns

--

You received this message because you are subscribed to the Google Groups "Earthsharing Canada" group.

To unsubscribe from this group and stop receiving emails from it, send an email to earthsharing-ca...@googlegroups.com.

To view this discussion on the web visit https://groups.google.com/d/msgid/earthsharing-canada/CAF7jsiM7LnnR9g1SzXqPuth2q3du6RAUwNgjahzXRHYpx211ug%40mail.gmail.com.

Reply all

Reply to author

Forward

0 new messages