Fwd: FW: South Sudan's fiscal policies risk hyperinflation/ Oxford Analytica 20.09.16

Elisabeth Janaina

South Sudan's fiscal policies risk hyperinflation/ Oxford Analytica 20.09.16

An expanded budget coupled with falling oil revenues has left South Sudan in a precarious economic position

The government of South Sudan on Friday rejected the findings of a US-based advocacy group alleging that government and rebel leaders have controlled and exploited large swaths of country's economy, especially during the recent conflict. The report has dominated the economic news in South Sudan as macroeconomic conditions in the country have deteriorated rapidly. Soaring inflation, low oil prices and a persistent, growing deficit portend more fiscal difficulties ahead in Juba.

What next

Juba will search for ways to fund the 2016-17 budget, including loans, but Western donors will resist providing support unless the government improves its fiscal conduct and demonstrates a commitment to the peace agreement. Although South Sudan has been renegotiating the terms of its oil export agreement with Sudan, the effect will be muted if oil prices stay low. With no other way to fund the budget, South Sudan will be forced to finance spending by printing money, leading to worsening macroeconomic imbalances and possibly hyperinflation.

Subsidiary Impacts

· Rapid inflation could encourage more dollarisation of the informal economy.

· Delays in public-sector payments are likely, including to the army.

· Financial strains and limited patronage opportunities could exacerbate violence.

· Donors and aid organisations will feel pressure to increase funding for humanitarian programmes.

· With nearly 5 million people facing acute food insecurity, rising prices could exacerbate a severe food crisis.

Analysis

Just as the post-civil war peace in South Sudan appears shaky, so are the macroeconomic fundamentals.

In late August, Juba presented a 2016-17 budget of over 29.6 billion South Sudanese pounds (SSP), equalling approximately 846 million dollars (based on the exchange rate of 35 SSP to the dollar when the budget was formulated).

While the proposed budget is nominally three times larger than last year's, the SSP has depreciated by at least 90% in 2016, rendering the new budget a reduction in real dollar terms.

Given persistent low oil prices and disruptions in production, as well as very limited budget support, it is unclear how Juba will fund the spending plan

Depreciating pound

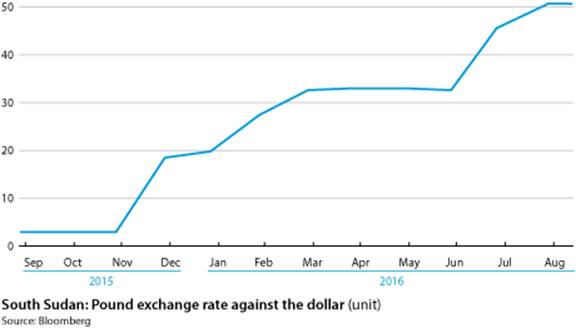

Since adopting a floating exchange rate in December 2015, the SSP has rapidly depreciated.

The official and black market exchange rates have moved toward convergence in recent months; both stand at around 50 SSP to the dollar. The depreciation will continue so long as the Bank of South Sudan (BoSS) prints money to finance the budget.

As a result of monetary expansion and subsequent currency depreciation, measured annualised inflation (highly volatile in recent years) grew to 661.3% in July and 729.7% in August 2016, driving up the prices of goods in the market. According to the government, food and non-alcoholic drink prices are driving inflation. For example, maize reached a record high of 30,000 SSP per sack during September in Abyei.

730%

Measured inflation during August in South Sudan

Fiscal demands

Several factors are pushing Juba to spend. Outside of the security sector (traditionally an area of high expenditure), other demands will add to the fiscal strain.

The recent peace agreement ending the civil war envisaged expanding and creating various institutions, both to fill existing gaps in government and create positions for personnel from the warring factions. A larger army and increases in pay to civil servants also add pressure to the budget.

Should the government follow through with a plan to increase the number of states in the country to 28, those will come with further administrative costs.

Funding the budget

The IMF has urged South Sudan to restore macroeconomic stability in part by reining in spending, especially as oil revenue has dropped.

To secure budget support from Western donors and international financial institutions, Juba would also need to present a credible plan for fiscal reform, as well as demonstrate commitment to the peace agreement. To date, neither of these courses of action seems likely due to the persistent failure to improve security in the oil producing regions of Upper Nile and Unity State, and an unresolved political crisis that has left the political future of the country uncertain.

International financial institutions and Western donors will look for fiscal reform and resolution of political tensions

Regional integration and support

On September 5, Juba deposited the instruments of ratification for accession to the East African Community As the bloc's newest member, South Sudan is hoping to win support from neighbours. Concurrent to the presentation of the budget, the new first vice president, Taban Deng Gai, travelled to regional capitals looking for funding to relieve the economic situation

The visits included meetings in Uganda to request support to pay an outstanding amount of approximately 35 million dollars owed by South Sudanese to Ugandan traders. Due to arrears, traders have stopped supplying essential items to their northern neighbour, crippling the local economy. Officially, Uganda has agreed to send a delegation for technical assistance to Juba to advise on aspects including improved revenue collection, banking and improving the agricultural sector.

The first vice president also lobbied the government of Kenya for money to pay for essential items, noting that Juba could no longer afford basic goods and service delivery. Local media report that Nairobi is weighing a possible 60-million-dollar loan for humanitarian and economic aid.

Neither Kenya or Uganda will be anxious to acquiesce to the request given South Sudan's current fiscal position; chances of repayment are low. Furthermore, domestic constituents may oppose a bailout of this kind. However, both neighbours have some vested interests in the peace of South Sudan due to trade relations, as well as from the perspective of regional stability.

Loans

Initially, South Sudan kept inflation in check through a large credit line provided by the government of Qatar on the basis of future oil sales, but this credit line has dried up.

Juba has also taken loans from the Chinese government. In August, Juba requested a 1.9-billion-dollar-loan from China to support infrastructure finance. China may continue to lend money and keep the South Sudanese economy afloat in the short term; however, notwithstanding unfavourable terms for Juba, repayment will rely on increases in oil prices and sustained productivity, as non-oil revenues are low

Hyperinflation

The release of the 2016-17 budget does not address the concerns of the growing fiscal deficit and, in light of the low oil price, South Sudan will struggle to find the funds needed to enact the budget. The most likely scenario, therefore, is that BoSS will print money, which will continue to fuel rapid depreciation of the SSP and this in turn will exacerbate the inflationary pressures. If not addressed, South Sudan could enter a period of hyperinflation leading to the collapse and abandonment of the SSP.