Best Gold IRAs in North Dakota

SEO Consulting Group

* Before investing, remember that this article does not provide financial advice. To ensure you make the best investment decision possible, it's always a smart move to consult with an experienced financial advisor first. We may receive a commission for purchases made in this article.

If you're looking to secure your retirement from inflation or diversify your investment portfolio, establishing a North Dakota gold IRA account is an option that should be taken into consideration.

Unlike traditional accounts, which only contain paper assets, this Precious Metals IRA is supported by genuine silver and gold.

Establishing a gold IRA account can be pretty intimidating, considering it requires finding an approved depository to store the gold and locating an experienced custodian qualified in IRS tax regulations. Many investors are leaning towards trustworthy companies that build such IRAs for them.

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

To help you find the perfect precious metals IRA, we have thoroughly reviewed some of the most reputable gold IRA companies. Our analysis was based on various criteria, such as user ratings and reviews, fees charged by each company, selection of available precious metals, experience level, and more.

Best Gold IRA Companies in North Dakota

• Goldco: Best gold ira company and most trusted overall

• Red Rock Secured (Only Home Delivery Gold IRA)

• Noble Gold: Best customer support

Why Trust Us?

We have personally tested and reviewed each of the gold IRA companies in North Dakota on our list. We have extensively researched the fees, customer service, selection of precious metals, IRAs offered, and security practices to ensure you find the best gold IRA company for your retirement investments.

We want you to know that we aim to provide you with a trusted source for finding a reputable gold IRA company.

How do we select the top gold investment companies?

Suppose you want to set up a gold IRA or alternative kinds of precious metals IRAs. In that case, you must use a reputable and dependable company.

Investing in gold IRAs can be pricey, and making the wrong decision with your provider could save you money.

We have compiled the highest quality list of gold IRA companies through extensive research to satisfy your needs. We considered a range of criteria while selecting our five favorites that demonstrate their trustworthiness, proficiency, and prominence.

To be exact, these were the factors we kept in mind:

Reviews and Reputation

It's no secret that some companies have better reputations than others, and the same principle applies when selecting a gold investment firm for your IRA needs.

Please pick one of the industry's best companies to ensure you get the best experience from start to finish.

When you want to understand a company's trustworthiness, head to the Better Business Bureau. This organization lets customers leave reviews and grievances about businesses on its website.

Moreover, it rates these firms from A+ down to F -, with A+ indicative of superior quality services.

Selecting our list of the five most reputable gold IRA companies entailed thoroughly surveying each firm's Better Business Bureau scores and reviews. Simultaneously, we ensured that all these companies received a B rating or higher from the BBB, with more positive customer testimonials than negative ones.

Ease of setup

Trustworthy gold IRA companies make it a priority to gain new customers by ensuring that the setup process is both effortless and stress-free. These businesses enable potential investors to establish their investment accounts in as little as several days, along with qualified advice from experienced financial advisors.

The gold IRA companies we've included have simplified setup procedures and will provide you with direct access to a specialist during your account-opening process. This makes obtaining the necessary guidance fast and straightforward!

Fees and Costs Involved

Gold IRA companies commonly charge fees for their assistance, which covers the expenses related to setting up your account, keeping it safe and secure over time, and safeguarding your valuable metals.

Although it may be tempting to go with a company that offers its services without charge, you should think twice before trusting them. Such companies are likely not investing the necessary resources and expertise into managing your gold IRA correctly. Moreover, they often need more support and guidance from other, higher-quality service providers.

On the other extreme, firms that request exorbitant fees may not be reliable either. These organizations could be more invested in getting significant returns than delivering excellent consumer services.

As we selected the gold IRA companies to include on this list, our main priority was finding organizations that offered reasonable fees for their services.

Gold and silver products are available.

A gold IRA is undoubtedly an attractive option if you want to expand your investment portfolio. That's why it's wise to work with a company that offers an array of precious metals, such as gold and silver.

You can then diversify your investments based on the different types of metal available to maximize your profits!

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

Our list of companies provides a range of investment possibilities, with some offering only silver and gold coins. In contrast, others allow investments in precious metals like platinum, palladium, and even cryptocurrencies.

With so many options for investing your money wisely, you will find the perfect fit!

You can be sure that all the businesses on our list stock various precious metal products.

Gold Buybacks

If you're in two minds about which precious metal to invest in for your IRA or apprehensive about the procedure, a company with buyback options may be the answer. These companies enable clients to sell their metals back without any additional cost.

For a seamless precious metal selling experience, the top gold IRA companies offer buyback guarantees and make the process as straightforward as possible. They may waive shipping costs if you buy your metals directly from them!

If you want to part ways with your precious metals, our list of companies will provide the perfect solution. They all offer quick and secure buybacks, which give you that extra assurance when selling back your investments.

Not in North Dakota? Check out the Best Gold IRAs in North Carolina.

What is a Gold IRA in North Dakota?

You might already know the 401(k) and traditional IRA accounts, which permit you to invest in index funds, stocks, and other paper assets in your retirement account. However, it's worth noting that most classic retirement investment opportunities don't offer gold as an option for investing.

If you're searching for a way to maximize your retirement savings, gold individual retirement accounts (IRAs) are the ideal option. Gold IRAs provide access to various precious metals, including gold, silver, platinum, and palladium – all investments that can be held in an IRA account with equal contribution and income limits as traditional IRAs. Investing in these assets allows for pre-tax contributions too!

Unlike traditional IRAs and 401(k)s that contain paper assets, gold IRAs include precious physical metals. Consequently, when you opt for a gold IRA investment plan, an accredited custodian must store the physical metal outside your home in a secure depository.

If you're considering buying gold for your IRA, working with a top-rated company from our list is the most reliable way to go about it. They can help guide you through all the steps of opening and maintaining an account that meets IRS rules and connect you with custodians specializing in retirement accounts. Investing in gold has never been simpler!

Gold IRA accounts can be an invaluable addition to your retirement strategy. Not only does the stability of gold often outpace paper assets, but diversifying your portfolio with it will help reduce volatility and maximize long-term growth potential.

Not to mention, gold IRAs offer substantial tax advantages. Your contributions and profits are generally exempt from taxation, while specific contributions may even be eligible for a tax deduction. If you want to secure your investments and diversify your portfolio, investing in a gold IRA is an intelligent choice!

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

You can also opt for a gold IRA rollover to diversify your retirement portfolio. This transfer of funds from an existing IRA to a new one with gold investments is easy and secure--and we'll discuss it in further detail below.

Best North Dakota Gold IRAs Reviewed

#1. Goldco: Best Gold IRA Company in North Dakota

Goldco is a trusted company that specializes in safeguarding your wealth and assets. They provide expert guidance to transfer retirement funds from an IRA, 401(k), or 403(b) to a precious metals account.

Furthermore, if you want to purchase gold and silver directly, this certified company can assist!

When investing in a gold IRA from Goldco, you can source several quality coins backed by reputable mints. These eligible coins for retirement accounts include:

• Gold American Eagle gold coins

• Gold Maple Leaf coins

• Gold Freedom and Hope coins

• Gold bars

• etc

If you would instead acquire silver coins, these are some of the choices available:

• Silver American Eagle coins

• Silver Maple Leaf coins

• Silver Lucky Dragon coins

• Silver bars

With Goldco, you can start investing in a North Dakota gold IRA without stress. You can begin by signing the agreement on their website and take advantage of their knowledgeable representatives, who will help make sure you understand every step. Making this process as effortless as possible is what they do best!

Subsequently, you must fund your IRA by transferring assets from an existing 401(k) or any other eligible account. Gold rollovers are generally tax-free, thus allowing you to avoid pesky penalties. You can even create a new precious metals IRA if you still need to get an initial retirement plan to draw funds from!

Now that you have invested in a precious metals IRA, it is time to decide to select your gold or silver pieces.

For those who choose to invest in their retirement savings without a middleman, Goldco offers the perfect solution.

On the Goldco website, you can purchase physical gold and coins to be shipped directly to your home or one of their approved safety depositories – plus, some investors may qualify for complimentary storage services with us!

Goldco offers an extensive selection of premium gold and silver coins to purchase directly. Sign the agreement on their website, then fund your account with a bank wire or mail-in check - it's that easy!

With Goldco, you know you're getting quality products at unbeatable prices.

Are you considering working with Goldco? Then request your complimentary kit today!

This fantastic package includes a printed guide, audio guide, and video tutorial on the company's offerings to help answer any questions. These include:

• How to invest in precious metals

• How to grow your retirement account

• How precious metals can give you more control over your assets

When you purchase a qualifying item, Goldco rewards you with 10% back in free silver!

Ultimately, Goldco is the perfect gold IRA company for your retirement needs; they offer an array of investments, including gold and silver, to ensure all your goals are met.

Why Goldco stands out:

• They offer a free gold IRA information kit

• Excellent inventory of gold coins, silver bullion, and other precious metals

• Many Years of experience in setting up precious metals IRAs

• Most reputable gold IRA company with an A+ BBB rating

• Get $10,000+ in free silver with qualified accounts

• Best buy-back guarantee

Click here to discover more about Goldco.

#2 Red Rock Secured (Only Home Delivery Gold IRA)

Red Rock Secured is a well-respected gold bullion and precious metal investing firm. This company offers an exclusive home delivery Gold IRA, allowing investors to buy physical gold for retirement without leaving the comfort of their homes.

Red Rock Secured also offers competitive gold IRA fees and has a knowledgeable customer service team that can answer any investor questions. If you’re looking for a precious metal investing firm specializing in home delivery of gold IRAs, Red Rock Secured is a perfect choice.

The company provides a wide selection of investment-grade gold bars and coins, including American Eagle gold coins and popular bullion bars like the 1 oz Credit Suisse Gold Bar. Red Rock Secured also offers special storage insurance coverage to protect your IRA investments while in their secure vaults.

With Red Rock Secured, investors can add gold and other precious metals to their retirement portfolios securely and straightforwardly. They use a combination of physical gold, silver, platinum, and palladium investment options for individuals who want to maximize their return on investment. This online broker also offers tools like IRA Rollover Kit to help investors maximize their gold and silver IRA investments. They also provide customer service around the clock to answer investors' questions.

Finally, Red Rock Secured also provides an online storage option for storing their precious metals safely and securely.

Here’s what we like most about Red Rock Secured:

Expertise: Red Rock Secured has a team of experts with extensive experience in the precious metals market. This allows them to offer sound advice and help investors make the right decision.

Low-Cost Storage: With Red Rock Secured, investors can store their gold and silver in a low-cost, secure facility. They provide options for both at-home and off-site storage, so investors can choose the option that best suits their needs.

Security: Red Rock Secured takes security seriously. Their facility has state-of-the-art security systems to protect your precious metals investments.

Customer Service: The customer service team at Red Rock Secured is highly experienced and knowledgeable in the precious metals market. They are dedicated to providing sound advice and helping investors make the right investment decisions. The team can answer questions or concerns via phone, email, or online chat.

Tax Benefits: Depending on your situation, investing in gold and silver can provide tax benefits. Red Rock Secured’s team of experts can help you navigate the process and maximize your returns.

Investment Education: Red Rock Secured provides education on various topics related to precious metals investments, such as buying and selling, storage solutions, market trends, and portfolio protection strategies. They have an extensive library of resources, including informative guides and webinars.

Red Rock Secured is the only gold IRA company on our list offering home delivery for precious metals investments in North Dakota. You can physically take delivery of your assets instead of storing them in a secure vault somewhere. They offer a wide selection of coins, rounds, and bars, with competitive pricing and excellent customer service.

Of course, there are requirements for doing this, but we highly recommend you contact them to find out more!

Click here to learn more about Red Rock Secured.

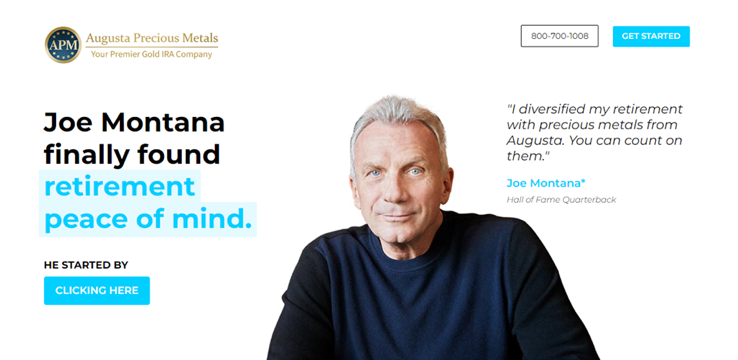

Since 2012, Augusta Precious Metals has led the gold IRA industry. Founded by hall-of-fame quarterback Joe Montana and his team of financial advisors, they have received thousands upon 1000s of 5-star rankings and multiple awards for their outstanding service.

Augusta Precious Metals offers extraordinary opportunities to invest in gold IRAs and cash purchases. Like the other companies mentioned, you must possess a qualifying IRA before initiating your new silver or gold retirement account with Augusta Precious Metals. Roll over your funds from your existing IRA into it and reap the benefits of investing in precious metals!

You can start your gold or silver purchase experience by speaking with a live agent who can give you personalized direction.

Additionally, they will arm you with educational insights about investing in precious metals for an IRA.

Now, your live agent can help you establish your new IRA. To obtain an Augusta Precious Metals IRA account, you must have a minimum of $50,000 available for investing.

After registering an account with us, the next step is to fund it using your current retirement savings.

Now that everything's ready submit a request through Augusta's order desk to purchase the gold or silver of your choice!

With Augusta, you can buy physical gold and silver beyond an IRA. Not only that, but they provide free professional guidance with their gold and silver specialists to aid in your buying decisions.

Once purchased, secure delivery of your assets is guaranteed, so you have complete control over them.

To buy silver or gold directly, follow these easy steps:

• Fund your account.

• Select your gold or silver options.

• Sign for delivery.

Augusta offers a diverse selection of gold and silver bullion, coins, and other products that can be procured directly or utilized to finance an IRA. Examples of these uniquely crafted assets include:

• Canadian Maple Leaf coins

• American Eagle coins

• America the Beautiful coins

Augusta hand-selects reliable custodians such as Equity Trust, Gold Star Trust Company, and Kingdom Trust to manage your new IRA. Furthermore, they offer additional convenience by liaising between you and the custodian to simplify communication anytime.

Augusta Precious Metals provides an expansive video library curated by Delvyn Steele, a Harvard-educated economist. His videos offer valuable insight into the state of our economy and are essential for those seeking to stay current on financial trends.

In conclusion, Augusta Precious Metals is an excellent choice for anyone looking to open an IRA in precious metals with a reliable company.

Click Here to Learn More About Augusta Precious Metals

American Hartford Gold, specializing in selling precious metals and IRAs that involve them, is viewed as a reliable source. After all, it has been an established business since 2015, with an A+ rating from the Better Business Bureau and stellar ratings on both Trustpilot (4.9) and Google (4.8). They have earned their credibility!

The Los Angeles-based company allows individuals to invest in valuable metals through a direct purchase or an individual retirement account. These investments include:

• Gold and silver coins

• Platinum

• Collectors coins

• Gold bars

• Silver bars

Investing in precious metals through American Hartford Gold allows investors to receive their goods right home. Still, regarding IRAs, they must store the assets with a third party like North Dakota Depository Service or Brinks Global Services - though only with additional storage fees.

Complete the three-step process to acquire your desired precious metal from American Hartford Gold!

1) Request help with filling out the new investor account forms.

2) If you want to transfer funds into your new account, consider rolling over money from an existing IRA. It's a smart and easy way to start growing your savings!

3) American Hartford Gold has you covered when selecting and purchasing IRA-eligible precious metals.

They offer price matching for their products and a buyback commitment program - allowing you to sell your gold bullion back to them (or another company) without facing liquidation fees.

Get started with investing in a Gold IRA today!

At American Hartford Gold, jumpstarting your gold IRA is easy and free of charge. Shipping to the depository? Covered by them too!

Insurance and tracking are standard services without additional fees; however, you may be subject to annual maintenance costs or storage expenses if stored at a third-party facility.

Unfortunately, prices for metals aren't available online, so it's best to consult with one of their representatives directly before investing in any precious metal products.

Pros

• Family-owned and operated business

• BBB-accredited company with an A+ rating

• A buyback commitment and a price-match guarantee

• A company that donates to charitable community organizations

Cons

• It does not reveal the exact fee structure or current metal values

• annual maintenance fees

• no international shipping

Ultimately, this American Hartford Gold review reveals why it is an appealing option for investors. The company has built a strong reputation, offers various gold and silver investment choices, and guarantees buyback commitment. All in all, there's no doubt that this brand stands out from the competition.

Invest in gold with American Hartford Gold and diversify your wealth portfolio! All you need to do is contact their customer service for the current gold prices and pay a small depository fee. With this company, you can trust that your money will be well-invested.

Click Here to Learn More About the American Hartford Group

#5 Noble Gold

Investing in precious metals has never been easier with Noble Gold. Whether you buy gold, silver, palladium, platinum coins, or rare collectibles through your IRA or directly from the website, Noble Gold provides an unparalleled selection of luxuries and valuables.

At Noble Gold, they make the gold IRA process easy. If you're ready to get started, fill out their quick online form - it'll only take a few minutes of your time! And if any of the questions have you stumped? Don't worry; call them and one of their friendly team members will be happy to assist in finding what's needed. Investing with Noble Gold is that simple!

Subsequently, the Noble Gold IRA team will be in contact with your new custodian to create your account and provide you with any additional paperwork that may require completion. For added convenience, they'll also email your self-directed IRA account number.

With Noble Gold, you have the flexibility to smoothly transfer assets from one custodian directly into your new IRA or rollover funds in a tax-free manner. So, don't worry about incurring any taxes when transitioning between accounts!

Funding your Noble Gold account and acquiring precious metals has never been easier!

With Equity Institutional, their trusted custodian, you can monitor the status of your investments at any time with 24/7/365 online access. Feel free to check in anytime—your funds are secure.

If you'd instead invest in precious metals without the help of a middleman, take advantage of Noble Gold's Royal Survival Packs. Hand-picked selections specifically composed to ensure maximum liquidity and recognizability have been included in these packs. They are especially beneficial for those who aren't sure which metal would be best suited to their needs.

Stand out from the rest with Noble Gold's outstanding features! This gold IRA company provides unbeatable prices on gold so that you can get more for your money.

Additionally, their secure and swift shipping will ensure you receive your items quickly without hiccups. Numerous customers have left glowing five-star reviews of this service - giving you an extra layer of assurance in trusting them to manage your investments.

Even more beneficial is that Noble Gold offers an unbeatable buyback program to all clients. If your retirement plans or savings goals suddenly change, you can be confident that the company will repurchase any gold or other precious metals you have bought from them previously.

Noble Gold is a great gold IRA firm that goes the extra mile to help its customers make profitable investments.

Click here to visit the Noble Gold Site.

Finding the proper custodian for your North Dakota gold-based IRA

As the owner of a precious metal IRA in North Dakota, you are responsible for safely storing your assets.

Unfortunately, storing gold IRAs at home is against IRS regulations - but don't worry! Your best option is to partner with an experienced gold IRA custodian who will securely safeguard and manage your investments.

When it comes to the safekeeping of your valuable assets, you can trust several federally approved financial institutions such as banks, credit unions, and brokerage firms.

Gold IRA companies may suggest particular custodians; however, their customers have complete freedom in deciding which reliable custodian they wish to store their metals with.

Picking the correct custodian for your gold IRA storage can appear daunting. To ensure secure and reliable services, it's essential to take time to assess multiple custodians while focusing on their credentials. Required qualifications include licenses, insurance policies, and registrations that guarantee the safety of your assets.

Uncover the dependability of a custodian by exploring its reputation. Peruse customer reviews on the Better Business Bureau website to gain insight into others' encounters with guardians, consequently providing you an estimation of what your journey may be like.

Unlike conventional IRA options, investing in a gold IRA requires working with an experienced broker. Thankfully, the companies on our list take care of all the steps to purchasing precious metal IRAs and act as brokers for you.

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

Floridians can store a wide variety of gold in their precious metals IRA, from minted coins to bars and bullion.

The IRS has precisely defined the kind of gold, silver, platinum, and palladium that can be held in IRAs. All must meet a purity standard of 99.5% or higher; silver must reach up to 99.9%.

Furthermore, when purchasing metals for your IRA account, you can pick coins that come in one-ounce denominations and more fractional amounts such as one-half an ounce, one-quarter an ounce, or even just one-tenth!

Working with a respected gold IRA firm is essential to guarantee that the gold you acquire for your IRA meets IRS requirements.

Still, it's always beneficial to ensure your planned purchase aligns with the regulations outlined by the Internal Revenue Service before making any investment decisions.

Top reasons to invest in gold for retirement

Are you questioning whether it is worth putting resources into gold for your retirement funds instead of preserving a traditional IRA or 401(k)? Is transferring assets to a gold IRA worth the effort?

Investing in gold is a smart financial move for several reasons. Here are some of the most persuasive arguments for adding gold to your retirement portfolio.

Gold remains valuable and coveted, retaining its worth through the ages.

Gold has remained an enduring investment vehicle, maintaining its worth throughout the ages. Consumers recognize gold's prestigious title as one of the most valuable materials, a standing that hasn't shifted much in hundreds of years. Furthermore, this precious metal is also resilient; it retains its color and never corrodes over time.

Gold is an excellent hedge against inflation.

Inflation is an unavoidable truth; the value of a dollar diminishes with time. Consider, for instance, that it takes many more dollars to purchase a 1,000-square-foot house today than fifty years ago.

In this context, making money—and avoiding losses—from your paper investments requires them to rise at rates higher than the inflation rate itself.

Gold is an excellent safeguard against inflation. Prices of gold can rise and fall based on factors such as supply, demand, bank reserves, and investor tendencies. Thus, when the worth of the dollar drops, it is often accompanied by a surge in gold prices.

Gold acts as a safeguard against financial deflation.

By investing in gold, you can safeguard your assets from inflation and guard them against deflation. When supply drops drastically due to a decrease in demand—like the Great Depression--people tend to look for ways to protect their money.

Gold is a steady option which leads its purchasing power to rise during deflation like this one and other vital periods too.

Investing in gold can be an intelligent way to diversify your portfolio and manage risk.

Are you familiar with the adage, "Don't put all your eggs in one basket?" This advice has considerable relevance when it comes to stock market investments. If you place all of your funds into a single area, then any unforeseen risks can do significant damage to its value and leave you exposed.

Diversifying your portfolio is a great way to manage risk and reduce the volatility of your asset prices. A wise strategy for achieving this goal is investing in traditional retirement assets and a gold IRA. This will ensure that you have various options available, so no matter what happens to one type of investment, you'll still be covered with others!

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

Understanding a North Dakota gold IRA rollover

Most gold IRA firms we list do not let you open a new gold Individual Retirement Account. Alternatively, they ask that you move funds from an existing account or withdraw money and deposit them in a brand-new IRA, known as a gold IRA rollover.

The IRS requires that IRA rollovers adhere to specific rules and regulations. Say you decide to move funds from an IRA, the period in your account must not exceed 60 days before investing them into a different account. Alternatively, with an IRA transfer, the money never passes through your hands as it is sent directly to the new institution.

Rolling over a traditional IRA is more complex than just shifting funds from one account to another. Yet, it can be quicker since the transaction typically happens within 60 days or less. The companies on our list are reliable and experienced; they will ensure you navigate the gold IRA rollover process smoothly without any additional fines due to wrong advice.

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

Precious Metals IRAs FAQs

How much is the least amount of money needed to invest in a gold IRA?

There is no lowest threshold to open a gold IRA - the IRS does not impose any specific requirement.

Even though gold IRAs are a secure investment, several companies have certain requirements to open an account. For example, clients must invest at least $50,000 with Augusta Precious Metals if they want to buy gold or other metals.

If your retirement accounts have not grown much since you opened them, you may want to consider a gold IRA company with more lenient minimum investment requirements. Compared to others in the market, their entry amounts are usually quite low.

Is it possible to store a gold IRA in the comfort of your own home?

Consumers often ask if they can store the gold bought through a Gold IRA in their homes, but unfortunately, this is impossible. When you invest in a Gold IRA, the physical gold bullion must remain offsite and securely stored by your custodian.

Alternatively, according to IRS regulations, gold IRA investors must keep their assets with an entity approved by and registered with the US Internal Revenue Service. Such entities may include banks, credit unions, or other financial institutions. Red Rock is the only company that offers home delivery. If that is something you are interested in, you should definitely check them out.

Ignoring this rule and storing your gold at home could be costly. Not abiding by the regulation would turn your gold into a 'distribution,' resulting in a 10% tax penalty and income taxes on the distribution that will lower its overall value to you.

Even worse, hoarding your gold investment at home could trigger a tax audit from the IRS that may result in unwanted penalties.

If you'd rather own gold and keep it wherever you please, purchasing gold bullion directly from one of the recommended IRA providers might be an ideal choice. These companies will ship your valuable assets straight to where they need to go while offering insurance coverage for that extra protection during transit. After receiving your items, storing them with a custodian or simply keeping them home is entirely up to you!

Do you know which IRS-approved coins can be held in a gold IRA?

To ensure compliance with IRS regulations, the metals you acquire for an IRA investment must adhere to explicit criteria regarding quality and purity. Gold, platinum, and palladium must hold a 99.5% pure rating, whereas silver needs to have at least a 99.9% pure score to qualify as good investments under this classification.

Do you know that the IRS certifies certain gold bullions and coins as meeting their requirements?

Well, if not, here's what to expect: for example, qualifying for a Gold IRA could include any of these pieces--the American Eagle Coin Series (American Buffalo / Gold Eagles), Canadian Maple Leaf Coins, Austrian Philharmonic Coins or even South African Krugerrand.

• American Gold Eagle bullion and proof coins

• American Gold Buffalo uncirculated coins

• Chinese Gold Panda coins

• Australian Kangaroo/Nugget coins

• Canadian Gold Maple Leaf coins

• Austrian Gold Philharmonic coins

When you collaborate with a reputable gold IRA provider, you can be sure that the investment will adhere to IRS regulations.

Are there any costs for establishing a gold IRA account in Kentuky?

Three fees will likely come when you get into gold IRA investing.

Firstly, most IRAs have an initial setup fee which generally falls somewhere between $50 and $150 - though this can be waived in some instances if the investment amount is large enough.

Subsequently, numerous IRA companies pay an annual administrative fee to keep your account active. This charge can span between $50 and $150, usually depending on the size of your portfolio.

Ultimately, a custodian must be paid for the storage of your investment. The amount owed varies among companies; some charge an annual flat fee, while others base their fees on the total value of gold within the account.

In addition to the basic fees, IRA providers may add a commission fee for purchasing gold on behalf of their clientele.

Although gold IRA fees may be higher than those of traditional IRAs and 401(k)s, many investors find that the benefits of investing in gold outweigh these costs.

Where are the precious metals inside your gold IRA stored?

Opening a gold IRA account requires selecting a custodian, such as a bank or trust company, to keep your investment securely. Fortunately, the choice of where the gold is kept is yours alone.

A few gold IRA companies cooperate with particular depositories, thus making it easy to move your investment into those facilities. Yet, if you prefer, you can still opt for other custodians instead.

Whichever depository you entrust with your gold investment, verifying their licenses and registrations is highly recommended before proceeding. Neglecting these precautionary measures can have dire consequences, potentially causing the loss of your entire investment.

>>Start Protecting Your Hard-Earned Wealth With This FREE GUIDE<<

Our Conclusion on Gold-Backed IRAs in Minesota

Diversifying your retirement portfolio is critical for protecting yourself from the volatility of assets, and a gold IRA is an excellent way to do just that. Our reputable list of providers makes it easy; they offer advisors with extensive knowledge of gold IRAs and provide a variety of coins and bullion options. Investing in a gold IRA now can guarantee safety in the future - so don't hesitate any longer!

Need help determining which gold IRA provider is the best suited to handle your North Dakota investment needs?

Request a free booklet from each company and review the benefits and downsides offered by each.

Though all these providers provide similar services, you can rest assured that none are wrong with your decision - whichever choice you make will be beneficial!

If you're concerned about your retirement savings, investing in a gold IRA could be your solution.

Explore the companies listed today and begin rolling over funds from your current retirement account to one backed by a more secure asset like gold.

Summary of the Top Gold IRAs in Arkansas

• Goldco: Best gold ira company and most trusted overall

• Red Rock Secured (Only Home Delivery Gold IRA)

• Noble Gold: Best customer support

*Before investing money, please do your due diligence and contact a certified financial advisor. It's also important to remember that foreign companies may not come with the same safeguards as those offered by U.S.-based firms; results will vary from person to person too! An advertiser has created this article - it is not necessarily written for or endorsed by a financial expert, so proceed with caution when assessing its accuracy and content. Before engaging with a business, be sure to research the regulations and laws about that service. To learn more about U.S. investments and financial rules, visit Investor.gov from the Securities and Exchange Commission (SEC). Please make sure you understand what is required of your company so that it remains compliant.

Resources:

https://www.kstatecollegian.com/2022/11/05/goldco-precious-metals-reviews/

https://www.villagevoice.com/2023/01/02/best-gold-ira-companies/

https://www.outlookindia.com/outlook-spotlight/how-to-convert-your-401k-to-physical-gold-news-261715