Cost of mis-management of PF fund - 2.5 Cr:

1 view

Skip to first unread message

Gaurav Singhal

Apr 30, 2012, 3:20:08 AM4/30/12

to Gaurav Singhal

It is usual practice by IT professional to withdraw of PF fund while switching company. Since IT professional switch company more frequently than other industry professional, so they are not able to accumulate the PF fund till retirement.

It is always option to withdraw or transfer PF fund while switching the job. So which option is better for IT professional and why?

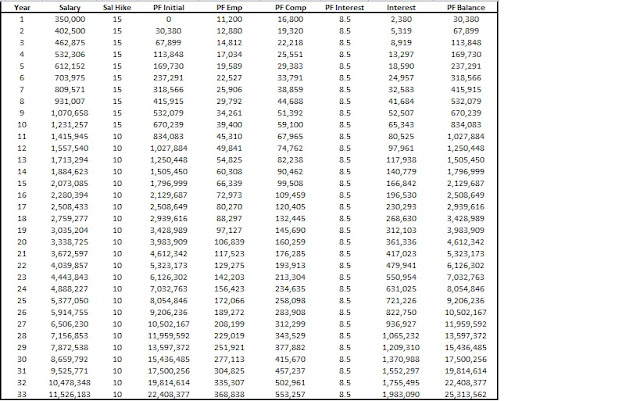

Lets take a sample case study of IT professional if he / she continue their PF fund till their retirement. followings are key assumption on this case study.

1. IT professional will have higher growth in initial career either in company or switch of company

2. Will get decent on average hike during their service

3. Consider PF interest would be stable

4. Will start his / her job on at age of 25th

As per simple PF accumulator calculator, IT professional will have total saving ~ 2.5 Cr. which is very decent amount for while he / she will retire and live retirement life.

Since IT professional does not manage their PF fund, it will notion loss of 2.5 Cr at retirement fund.

I would strongly recommend to give serious thought on PF fund management for decent retirement life...

--

It is always option to withdraw or transfer PF fund while switching the job. So which option is better for IT professional and why?

Lets take a sample case study of IT professional if he / she continue their PF fund till their retirement. followings are key assumption on this case study.

1. IT professional will have higher growth in initial career either in company or switch of company

2. Will get decent on average hike during their service

3. Consider PF interest would be stable

4. Will start his / her job on at age of 25th

|

| Simple PF Calculator |

Since IT professional does not manage their PF fund, it will notion loss of 2.5 Cr at retirement fund.

I would strongly recommend to give serious thought on PF fund management for decent retirement life...

--

GAURAV SINGHAL

B.Tech, PMP, PGDFA*

Contact Info: *Financial Advisor Certification

Email: ggsi...@gmail.com from

Cell: 09986-997274 Indian Institute of Banking & Finance

B.Tech, PMP, PGDFA*

Contact Info: *Financial Advisor Certification

Email: ggsi...@gmail.com from

Cell: 09986-997274 Indian Institute of Banking & Finance

Financial Planning: http://gaurav-pfk.blogspot.in/

Gaurav Singhal

May 2, 2012, 1:47:33 AM5/2/12

to Gaurav Singhal

Cost of mis-management of PF fund - 2.5 Cr:

Reply all

Reply to author

Forward

0 new messages