Infosys Q3 FY2013 Results - First Cut

Rajesh Desai

Dear Sir/Madam,

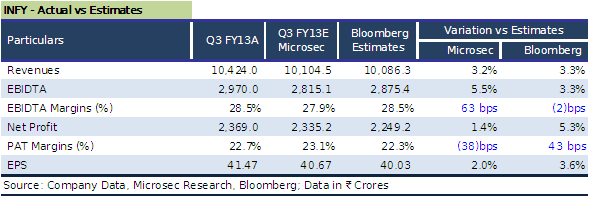

Infosys Ltd (INFY) announced its consolidated Q3 FY2013 results on 11 January 2013. Both the company’s top line and bottom line, on organic basis, were in line with our expectations. However, INFY beat street expectations during the quarter. A glimpse of the company’s performance vis-à-vis our and street expectations, and vis-à-vis Q2 FY2013 and Q3 FY2012, are as follows:

Ex-Lodestone numbers:

Performance (q-o-q and y-o-y):

While INFY’s top line, including Lodestone, increased 5.7% q-o-q to `10,424 Crores, its bottom line remained sequentially stable at `2,369 Crores in Q3 FY2013. However, the revenues included contribution of `214 Crores from Lodestone, except which, the revenues grew sequentially by 3.6%. Revenues came slightly above our estimates due to better than expected improvement in pricing that improved 1.8% during the quarter. The company reported a better than expected EBIDTA during the quarter, mainly by trimming on its Administrative Expenses. Among the components, reduced consultancy and professional charges and toned down provisions, with contraction of `74 Crores, remained key contributors for this decline.

Although INFY slightly upped its FY2013 dollar revenues guidance, ex-lodestone, to $7.346 Bn from $7.343 Bn, the company expects top line, including Lodestone to stand at $7.45 Bn during the year. However, INFY kept its $ EPS guidance unchanged at $2.97 for FY2013. Nevertheless, the company expanded its organic ` revenue and EPS guidance to `40,178 Crores and `162.80 per share respectively. A quarter earlier, INFY predicted revenues to stand at `39,582 Crores while it envisaged the EPS at `160.61 in FY2013. Including Lodestone the top line is expected to stand at `40,746 Crores during the year.

After several quarters of lower than expected performance, INFY cheered the street with slightly better than estimated numbers in Q3 FY2013. The current quarter performance may support the company’s stock in the near term. However, the company’s management continues to remain cautiously optimistic on the business environment. With this, advise investors to hold the stock at current juncture with a target of `2,722 per share.

Regards,

Team Microsec Research

Microsec Capital Limited

Tel: 91 33 30512100

Fax: 91 33 30512020

--

CA. Rajesh Desai