Market view & RELIANCE near major Break-out

Prabhakar A.K

Nifty (6317) - Nifty has closed highest ever on daily & weekly basis but still all time high 6357 is not breached while 2010 Diwali high of 6338 has been crossed making 6342 high of 5years. Today Nifty has to cross 6342 if the rally has to continue while 6280 holds very good support, while below 6280 then 6225 become possible. Nifty failing make high above 6342 in next 1-2days then correction of 150points on cards as Nifty nears overbought region.

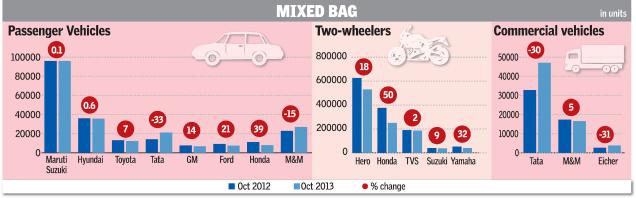

Auto Number Observation-

Good Monsoon, Festival season & Election in 5states has kept 2Wheeler and Tractor sales buoyant

HEROMOT making highest ever sales while HONDA growing @ 50% yoy which point to good Monsoon as key driver, festival season, election in 5state.

Car sales has shown divergent trend with Petrol car maker doing better than Diesel, as differential between Petrol & Diesel prices has narrowed down making Petrol cars more attractive.

MARUTI Rs.1636 can be major beneficiary, as Crude coming down, while any cut in interest rates or stabilization in economy will become key trigger as MARUTI maintains it leadership position.

MARUTI on technically is near all time high Rs.1777 made in May2013 so any good correction would give good entry for long term investor looking for 1-2years.

HEROMOT reported an 18.17 per cent rise in total sales at 6, 25,420 units for October this year, which is highest ever sales for any month previous recorded was May this year when it sold 5, 57,890 units.

Source Hindubusinessline

Source Hindubusinessline

Weekly Break-out in RELIANCE more confirmation needed

RELIANCE Rs.908- Stock has been trading below Rs.955 for nearly 125 weeks and if we connect May2009 high 1267 then sloping downtrend line is giving a break-out in weekly charts but closing above Rs.920 would give more confirmation Target 1200-1350 in next 12months.

RIL is interesting stock- RIL Get 78.5% of revenue from refining while EBIT Margins are 3.3% it contributes 52% to EBIT while PETCHEM has 20.1% share in revenue with EBIT Margins 10.4% as it contributes 41.2% while OIL & GAS contributes 1.2% revenue EBIT Margin 24.2% and Contributes 5.9% to EBIT, while in 2QFY13 with 2.1% revenue contribution 14% was EBIT and now many factors @ play in next 2-3Quaters which would push OIL & GAS revenues.

Source Company presentation

Source Company presentation

Inference---

OIL & GAS is high margin business in FY12 EBIT Margins were 40.7% and with drop in volumes EBIT margins have come down. Post April 2014 Gas prices will be revised and company is making lot of efforts to improve gas production which would happen in next 12month.

RIL Shale gas has 550wells from 3JV and in next 1-2Quaters the revenues can double and both these can be major trigger for the stock.

http://www.ril.com/html/investor/10_yearshighlight.html 10years of RIL where Net profit margin which averaged around 10% has dropped in last 4years to low of 5.7% in 2012-2013 and company has gone through major investment cycle which will benefit in next 3-4years and in my personnel view this stock could more double in next 3-4years.