Edelweiss - Ess Dee Aluminium (EDA IN, MCap INR 7.5 bn, CMP INR 287, Not Rated) - Visit Note

Sunil

Ess Dee Aluminium (EDA IN, MCap INR 7.5 bn, CMP INR 287, Not Rated)

We met the management of Ess Dee Aluminium (EDAL) yesterday. Key takeaways are:

Indian packaging industry – an overview

Size of the Indian packaging industry is estimated at USD 14.7 bn (INR 650 bn) and is growing at 15% p.a, which is twice the growth rate of the global packaging industry (Source: Company). The growth in the packaging industry in India is mainly driven by the FMCG, food, and the pharmaceutical packaging sectors. The domestic pharma packaging industry, dominated by the unorganized sector, is valued at INR 250 bn of which 4%, i.e. INR 10 bn is foil based packaging.

![]()

![]()

Plastic flexible packaging dominates the Indian packaging industry and is growing at 25% p.a.

About the company

Incorporated in 2004, EDAL started commercial production of aluminium strip pack foil and aluminium blister pack foil in November 2004. Having amalgamated Atlanta Vinyl Pvt. Ltd. with itself in 2005, the company branched out into manufacturing PVC film used in blister packaging. EDAL commands 10-15% of the INR 10 bn domestic foil based pharma packaging industry.

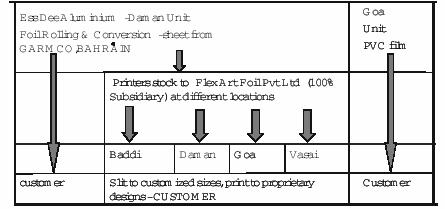

Business Model:

Source: Company

Having its printing facility around plants of major pharmaceutical players, EDAL's spoke & hub business model provides advantages like lower lead time and lower transportation cost. The company imports 100% of its aluminium foil stock from GARMCO (Gulf Aluminium Rolling Mill Co.), Bahrain. ~57% of its produce is sold to Flex Art Foil, its 100% subsidiary and printing arm. Major clients include Ranbaxy, Cipla, Wockhart, Cadilla

Deployment of IPO proceeds: The company raised INR 1.57 bn (6.96 mn shares at INR 225 per share) in the recently concluded IPO, the proceeds of which are to be deployed to double its current foil rolling capacity of ~9,100 TPA (3,600 TPA in FY06) to 18,000 TPA by Q2FY08, and its PVC film manufacturing capacity from 4,200 TPA to 5,800 TPA by Q2FY08. A total of INR 1.14 bn has been earmarked for this purpose.

Future plans: EDAL plans to introduce newer products such as:

· PVdC coated PVC film

· Cold form alu alu laminates

· Child resistant laminates

· Laminates for oral rehydration salts, cough lozenges and anti TB kits

It also plans to enter the foil based food and FMCG packaging segment.

Risks & concerns:

- Execution risk – considering its short history

- EDAL maintains debtor and inventory days of ~180 days and ~120 days respectively and no credit while purchasing raw materials. Thus huge working capital requirement results in negative cash flows. We believe increased capacities are likely to put more pressure on working capital.

- End user's resistance to change suppliers (local / imports)

- Venture into food & FMCG packaging – an area unexplored by the company so far

Financials & Outlook:

* post equity

Source: Company

At the CMP of INR 287 the stock trades at 31x H1FY07 annualized EPS of INR 9.2. The company expects to double from ~INR 1.6 bn in FY07 to ~ 3.2 bn in FY09. Although the prospects of the company look bright at a macro level, based on the above mentioned concerns we have a neutral view on the stock.

--

http://DEADPRESIDENT.BLOGSPOT.COM